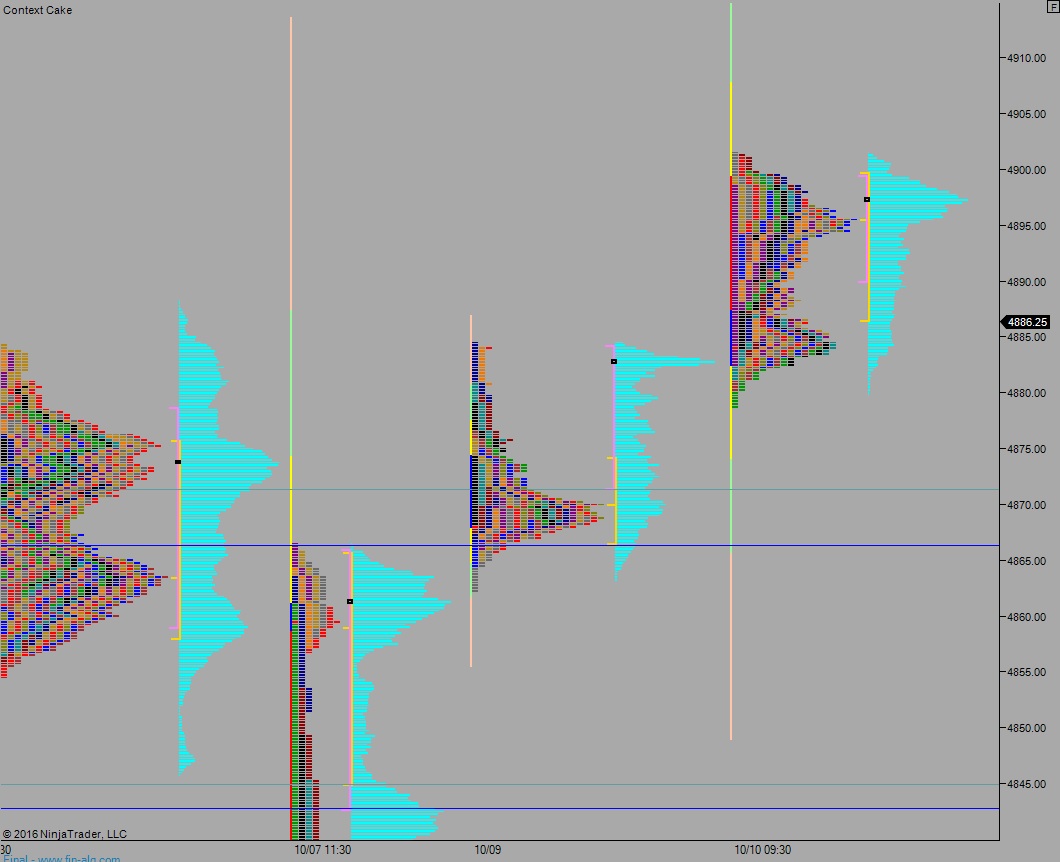

NASDAQ futures are coming into Tuesday gap down after an overnight session featuring normal range and volume. Price worked lower overnight, briefly exceeding the Monday low before bids showed up and pushed us back to yesterday’s midpoint.

On the economic calendar today we have the 3- and 6-month T-Bills as well as 4- and 52-week T-Bills going to auction at 11:30am. The performance of these auctions is the only scheduled event that may jostle an otherwise calm tape.

Yesterday we printed a normal variation up. Monday kicked off with a gap up and drive higher to new swing high. The morning excitement carried on briefly into late-morning, long enough to press the market range extension up before two-way trade ensued. The weak high from 9/22 was taken out, but we managed to form another, slightly less-weak, but still weak swing high on Monday.

Heading into today my primary expectation is for buyers to work into the overnight inventory and close the gap up to 4893.50. From here we work up through overnight high 4897.25 and tag 4902.25 before two way trade ensues.

Hypo 2 stronger buyers push up to 4907 then 4915.50 before two way trade ensues.

Hypo 3 sellers work down through overnight low 4878.75 and tag 4871.25.

Hypo 4 sellers push down through 4866.50 setting up a move to close the weekly gap down to 4859.50.

Levels:

Volume profiles, gaps, and measured moves:

crash baby, unwind time. fuck with numbers and they will fuck with you. leverage is gambling and gamblers lose in the end.