NASDAQ futures are coming into the week gap up after a Globex session featuring normal volume despite printing an extreme range. Price made a brief probe lower before holding the Friday mid then pushing up above last week’s high.

On the economic calendar we have Markit Manufacturing PMI at 9:45am, 3- and 6-month T-Bill auctions at 11:30am.

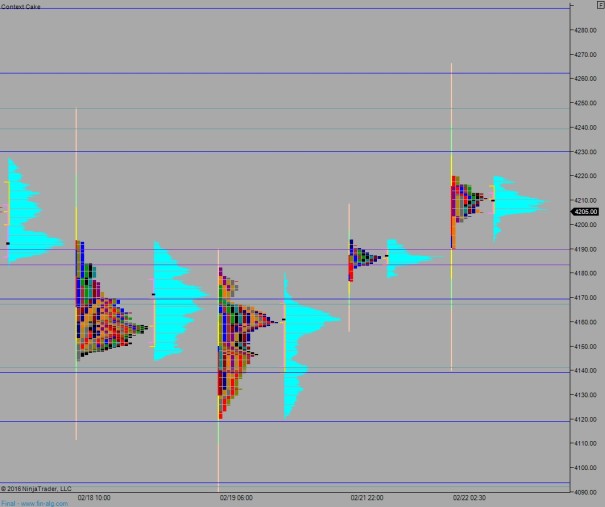

Last week began gap up also and the holiday shortened week saw buyers bidding price higher atop the gap. After Wednesday’s trend day, the market spent the rest of the week consolidating/retracing the gains.

Last Friday was a normal variation up day with a P-shaped structure, suggesting a short squeeze took place.

Heading into today my primary expectation is for sellers to work into the overnight inventory and trade down to 4183.25. Look for responsive buyers here (responsive relative to the open, initiative relative to last week’s close) who step in and work price up through overnight high 4220. Look for sellers up at 4230 and two way trade ensues.

Hypo 2 sellers aggressive off the open, buying attempt at 4183.25 is overrun setting up a move down to 4169.50. After a brief battle here, sellers continue lower to close the gap down to 4161. Sellers work lower to target overnight low 4146.50 before finding responsive buyers down at 4141.25 and going into two-way trade.

Hypo 3 gap and go higher. Buyers take out overnight high 4220 and then 4230 early, sustaining trade above the latter level to set up a secondary leg up to 4239 before two way trade ensues.

Levels:

Volume Profile, measured moves, and gaps:

face ripping rally

this can’t last much longer