Nasdaq futures are set to gap higher to start the week after a delayed start to the globex session. Chicago Mercantile Exchange futures, of which the E-Mini Nasdaq is, usually open for trade at 6pm eastern on Sunday. Yesterday the globex market did not open for trade until 10pm.

Just a bit after the open we have Markit reporting Composite and Services PMI. We also have New Home sales at 10am and Dallas Fed Manufacturing Activtiy at 10:30. Looking at the week ahead, we have Durable Goods Orders Tomorrow morning premarket as well has the House Price Index. Consumer Confidence Tuesday at 10am as well. Perhaps the biggest economic event of the week occurs Thursday when we have GDP numbers out for the USA.

On a big picture chart like the weekly composite chart below, we can see that we are currently participating in a price zone with very limited price history. Back in the year 2000, we started the second quarter with a big gap down. Before it could receive any resolution the dot com bubble burst. Thus a price gap remained open for the last 14 years. Now that we have finally reentered the gap, it only took one week to capture the “half gap” or midpoint of the open void. This week I will be monitoring the progress of the auction and whether we are likely to fill the entire gap or stall out. Either way, be aware of this big picture environment and how it could result in some accelerated moves:

The intermediate time frame is buyer controlled. After gapping higher outside of prior day range for five sessions in a row, the auction began to slow a bit Wednesday-Friday. The slowing tape allow a semblance of balance to begin to form. On Friday we attempted an early move from balance which at first found some responsive selling. Later in the session however we negated that selling and ended the session near the highs. Thus, although we saw the early signs of balance beginning on the intermediate time frame, it still has a bullish skew. See below:

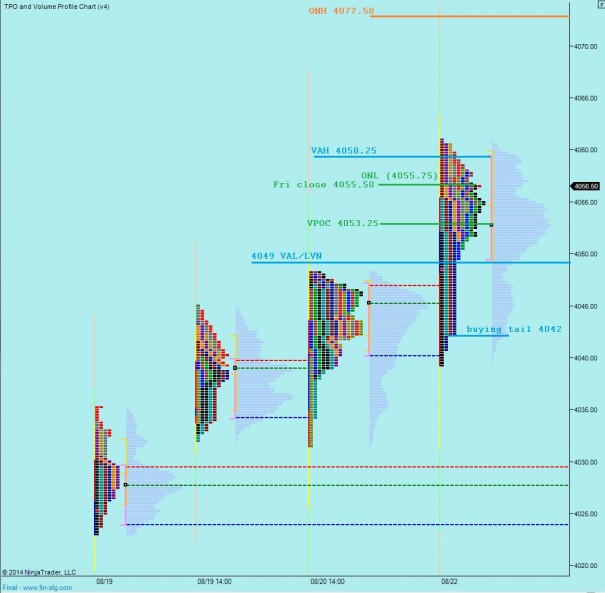

On a short term time frame we can also see the buyers in control. Value continues to migrate higher, not just price. This can be seen most clearly via the value area range relative to prior sessions. I have highlighted the key levels I will be observing early in the session using the following market profile chart:

If you enjoy the content at iBankCoin, please follow us on Twitter

Primary Hypothesis – sellers push off the open to test 4065.50 where responsive buying occurs and takes us up to test overnight high at 4077.50 and then balancing ensues

Hypo 2 – open drive higher, take out overnight high 4077.50 early and press higher for duration of the session

Hypo 3 – open rejection reversal, market pushes lower hard off open, recaptures Friday range and closes the overnight gap to 4055.50 before continuing to test the VAL at 4049, if no responsive buying then continue lower to test buying tail at 4042

pretty much hypo 1

so far, yep, here comes a test of overnight high 4077.50