During the week long Market Profile webinar I hosted for the After Hours with Option Addict crew, I defined and discussed initial balance (IB) quite extensively. This simple concept of noting the price range printed during the first hour of trade can be a huge help in determining market conditions early in the day. The same can be said for the opening swing, only the opening swing interprets market activity even sooner, sometimes being established in less than 5 minutes.

One of the primary reasons for tracking the initial balance is its use in determining what sort of “day type” is occurring. Another primary reason, the reason which is more actionable intraday, is that we rarely see a full day of trade without breaking either IB price extreme. Therefore, if we manage to enter a trade inside of initial balance which is working in our favor, we can press that day trade and ride that winner a bit further. Traders always emphasize the importance of letting your winners run because those few extra ticks you gain from a well managed trade can make a huge difference to your overall expectancy.

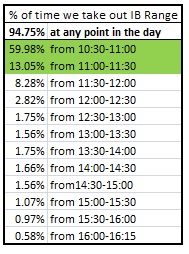

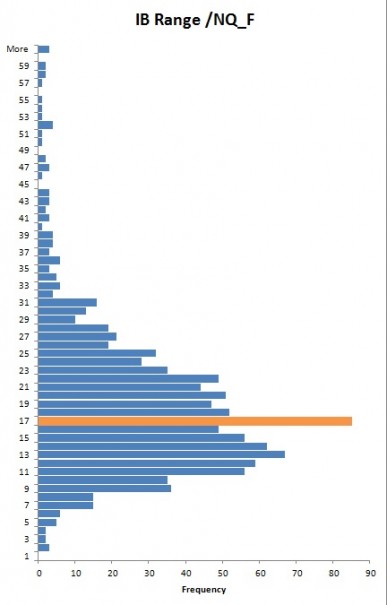

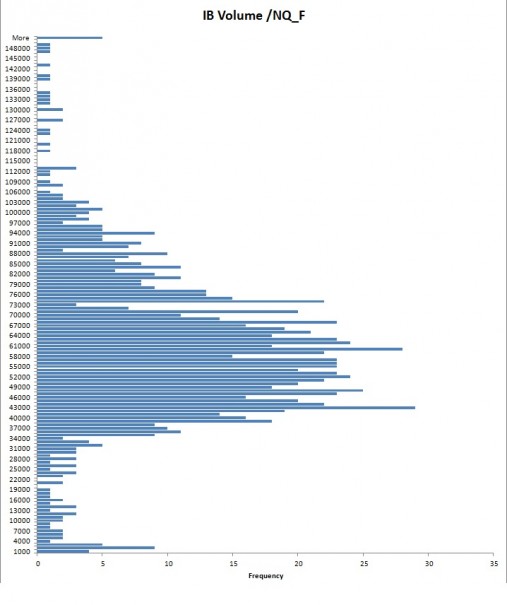

Nothing builds confidence in an idea like statistics and probabilities. Therefore as an addendum to the weekly course, I have built out the relevant IB statistics for my product, the Nasdaq E-mini future contract. I used five years of pure IQ Feed data to compile the following stats. Some highlights:

- We break initial balance 94.75% of the time

- By 11:30 – 73.03% of the time

- By 12:00 – 81.13% of the time

- Normal IB range (69.87% frequency) is 11 – 24 points

- Normal IB volume (66% frequency) is 40k – 75k contracts

And without further adieu, I present the data (looks familiar, yes?) in its entirety below. Enjoy:

If you enjoy the content at iBankCoin, please follow us on Twitter