Futures are up down a bit overnight after a busy night. S&P futures printed over seven handles in range while the NASDAQ printed an eighteen handle range. The action was fast at times and the resulting market profile print shows no signs of balance.

We have a busy economic calendar today including some premarket data. However, as we approach US trade markets are set to open in range and in value presenting us with a lowered risk reward environment. This condition could be favorable for individual stocks since the mild climate will not exert macro forces on these plays.

It will be important today to see who is in control of trade. Yesterday the action was predominately controlled by the local time frame (LTF) and this could be seen as value area highs and lows being faded back to the VPOC all day. These choppy conditions lack the order flow of other time frame who push us out of short term balance.

The /ES futures representing the S&P 500 are still trading within intermediate term balance. I will be watching a micro composite volume profile spanning back to 12/20/2013 which describes this intermediate term balance. The two closest levels in play are 1834.25 and 1840.50. I have highlighted these key levels on the following /ES chart:

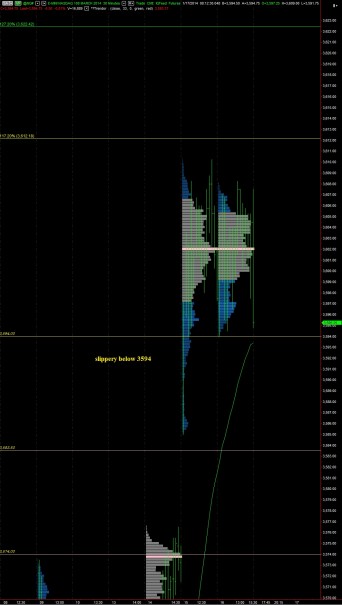

Turning to the NASDAQ futures, yesterday the action was contained entirely within the range of the prior day and we traversed most of the daily range in the last half hour of trade. The action is nearly identical to the prior day and printed matching VPOCs. This inside day print can sometimes occur near infection points. In this tape, it would demonstrate a time based correction at the highs which erodes at short sellers. Price is slippery below 3594 and opens to door to a gap fill. If instead we hold 3583.50 we may be successfully leaving intermediate term balance and exploring higher. Otherwise, the naked VPOC at 3574 becomes a target. I have highlighted these levels on the following market profile chart:

If you enjoy the content at iBankCoin, please follow us on Twitter