A Pastel Outlook on Things

We’ve reached an accord with the good people of Iran. They’ve agreed to cease making weapons that will annihilate large swaths of earthling population; and in return, we’ve agreed to let them make more money. Those centrifuges got awfully expensive. I am sure the Ayatollah was sick and tired of all the “nuke Jerusalem” rhetoric and simply wished to live out his days near the coast of Monaco.

You were tricked earlier today, when the markets gave it up, weren’t you? I was delighted to see that you were 200% retarded, instead of merely 100%. It makes for a much greater demonstration of entertainment for yours truly.

The weather is beautiful and I have no reason, whatsoever, to be here talking with the lot of you. My money management business is at fresh highs, the web business is as depraved as ever, and I am aggressively expanding, not to mention that I am also roasting the stomachs of my enemies in hell.

Exodus is coming, gentlemen. You needn’t have to worry about the future of your digital lives any longer. Go out and knock on your neighbors doors, call your friends and family, have them email me at [email protected] for a beta trial. We have one hurdle left to complete and then you’re in, for a limited time of course. After which, I intend to lunge at you and evict you from the premises of gentlemen.

Enjoy the extended weekend. I’ll be doing my Saturday cinema, as scheduled.

Comments »TIME FOR AGGRESSIVE EXPANSION

I kicked out MUSA for a small gain. With the proceeds, I rolled (no Humpty) into AMGN, GTN and YY.

GTN is my oversized position out of the three. I’d load up heavy on YY here, if it weren’t for the fact that is domiciled in a ruggedly corrupt nation of liars and dog eaters.

What can I say? I like television and feel we’re in the golden era of content, super bullish on NFLX, AMCX and GTN.

Comments »JUDGEMENT IS HERE

Your pencil dicks are being snapped in half right now. Do you hear that sound? It is the reverberations of your own demise.

Crucifixion is too good a sentence for you. Instead, you get to sit there, nailed to your bullshit pleather chair from staples, watching your net worth drift…away.

The jobs numbers are tomorrow, an off day for Wall Street. So get ahead of those numbers now. The winter winds have subsided. Very soon, you will be at the beach, spastic retarded drunk, gawking at women while your wife isn’t looking. These dark days of indecisiveness will end. With its end goes Joe into the middle of the flaming volcano.

This is it. This is your time. Get out there and start chopping some dicks off (no homo)!!!

Top pick: YY

Comments »The Resurrection Looms

Gimps fashioned in leather clothing, hidden in boxes, awaiting to be unleashed onto the world to short stocks and drive down the prices of fine American companies. We, as a people, must manage these gimps, contain them at all costs, and make sure they never see the light of day.

Imagine a world filled with Bluestars. We’d all be lost, flaming in volcano lava, completely fucked forked radish.

Tomorrow being the last day of the trading week, make it a good one. Get out there and swing the bat, son, and stop throwing like a girl.

Just a little FYI on The PPT Exodus beta trials: we have hit a minor delay due to external forces beyond our control. We should be in touch with you lads soon. In the interim, it’s important that we get it right and we really need your feedback and the opinions of those in the asset management field. If you happen to know anyone who might be interested in trying out the software in about a week or so, please have them email me right way at [email protected].

I am limiting the trials to 500 people, so email me as soon as you can–else be fucked for eternity.

Comments »Biotech Setting Up For a Sharp Upside Bounce

About two weeks ago I told you biotech needed to be slaughtered. Lo and behold, ever since then, the sector has been under pressure–with some names down more than 25%. The overall industry is off by almost 8%, led to the downside with names like ISIS, AMGN and SGEN.

Truth be told, there isn’t value in the biotech space, as the vast majority of these stocks are trading at absurd levels. But, judging by the risk appetite of traders, they’ll probably circle back to the industry soon, especially since the human species is a depraved one.

I like ISIS, ICPT, SGEN, JAZZ, AMGN and GILD here.

Today’s big story wasn’t the sell off. It was oil trading higher and yields dropping lower. Names like SLCA and FMSA, both current longs of mine, are raging to the upside. I do not like the underlying fundamentals of the oil trade. It’s too soon to believe the pain in the industry is over.

In summary, you should expect a bounce in biotech, book profits in oil, and prepare for general strength to combat this bullshit we’ve been getting the past two days–kicking the monsters who’ve working against you right into the fucking center of the active volcano.

Comments »Bill Gross’s Opinion on the Current Sell-Off

HAPPY NEW YEAR’S DAY!

I haven’t discussed it here on the blog, but Twitter just changed the game with their Periscope app. The ability to livestream is here and the possibilities are endless. When I am liquid and looking to reallocate, I am definitely buying TWTR for the long term. Another stock that has been basing out and might be ready to move is PNRA. Although I am disappointed by the offerings on their menu, at the present, I am sure by summertime they will get their shit in order.

If any of you are bewildered by the title of the post, that is because you’re an idiot.

Back in the middle ages, New Year’s Day was celebrated around March 25th. People were utterly retarded back then, so the dates shifted with the winds. By the late 16th century, the sophisticates in France adopted January 1st as New Year’s Day. From that time on, an era of unparalleled snobbery began.

Townspeople who celebrated on 1/1 would walk about the square in an air of dignity and would condescend down to anyone who still celebrated in March-April 1st. There are tales of idle rock throwing and burnings at the stake–pertaining to the persecution of those who opted to celebrate New Year’s Day, in the olde traditional manner. Remember, back then everyone was a member of ISIS and had zero regard for human life.

As time went on, April 1st was officially designated as a “Fool’s Day”, specifically because some jackasses had the audacity to celebrate New Year’s Day on that day, and not on the obvious choice of January 1st. Families would cower in shame, celebrating the new year in secrecy, all the while January firsters rampaged throughout the town pulling pranks on people who didn’t conform to their style of calendar.

History class is over. Go make a barrel of money.

Comments »The Chimes at Midnight

We’re being made to look like fools, coming here and pretending to know what course the Fed should take, regarding monetary policy. Hell, the Fed doesn’t even know what is right from wrong. Should we “get in front” of prospective inflation through rate hikes? Isn’t it all so artificial, after all? If rates want higher, the market will send them higher.

In a world where the donkey punchers from Romania, a country filled from top to bottom with criminality, get to borrow at the obscene rate of just 2%, one must think to oneself that something is amiss here. Maybe all of the bearshitters around the active volcano are right and this economy is being held together with the scotched tape of the Fed and other central banks. Now if you knew that to be a fact, would you, knowingly, precipitate actions that would lead to its eventual unraveling?

Any sane person answered no to that question.

The truth is, all of the talk about Fed rate hikes are utter horseshit, as TLT prints above $130. The market will see your rate hikes, and raise you, by lowering them for you, whether you like it or not. The market is in control of rates; and for now, they want lower.

While all of this is happening, the market is bidding up obfuscation: biotech stocks.

No one can argue with words like “imagine”, “potentially”, and “forecasted profits” etc. The great biotech run is the sleight of hand, the proverbial parlour trick, to keep you entertained, all the while carnage wreaks havoc on the industrials. At the vanguard of this dismantling is America’s cherished oil and gas industry, gone by the horizontal wayside–courtesy of Saudi Arabia.

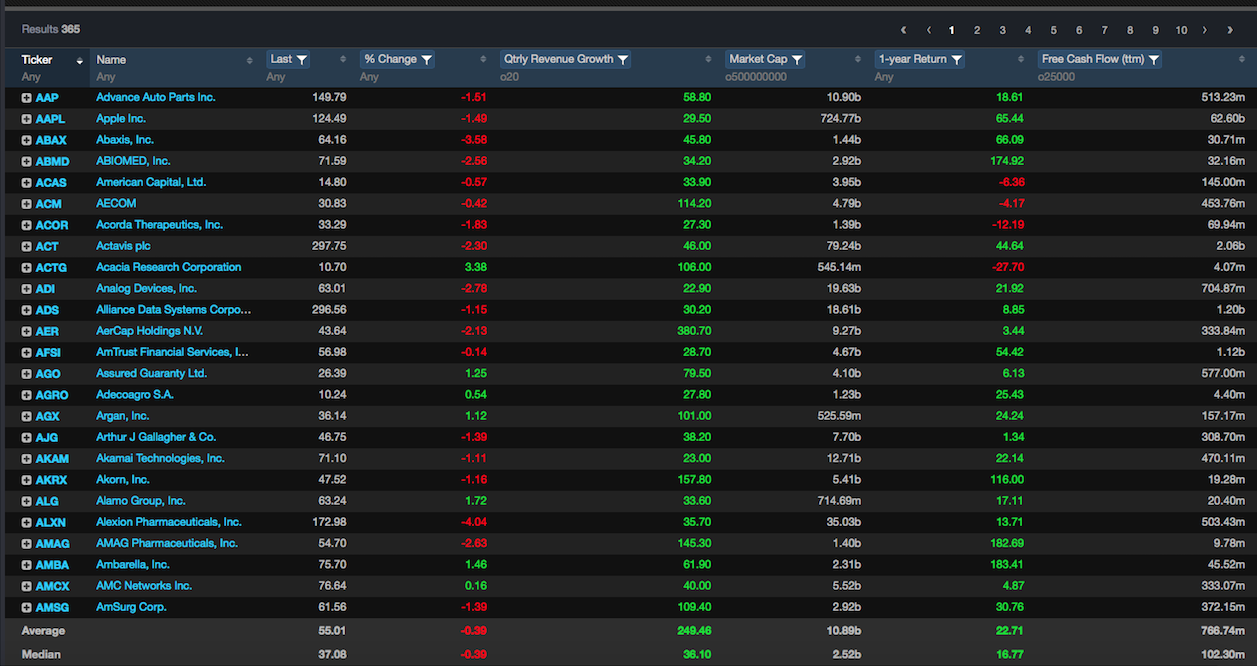

This is why non-profitable, non-health care related, stocks are underperforming. We are late in the bull cycle and if you haven’t got a company that is generating free cash flow, in any significant magnitude, there are sellers who will correct your ways in short order.

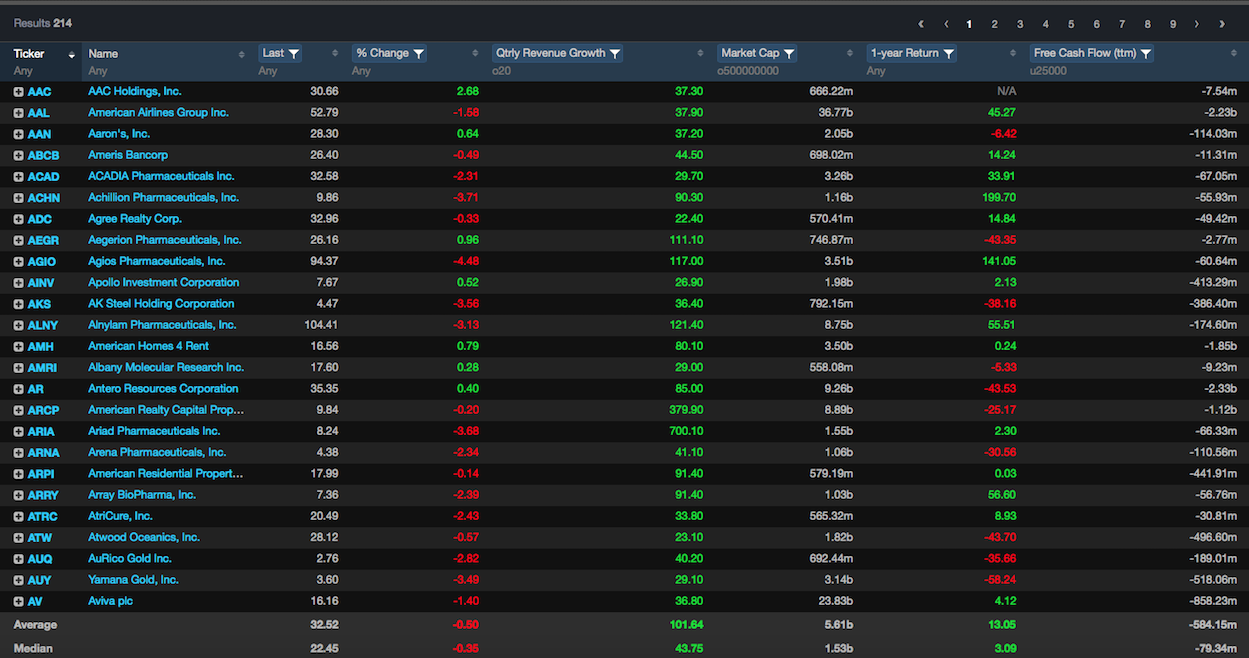

You want proof? How’s this for proof?

I ran two screens in Exodus, both identical except for one thing. In the first screen I asked for stocks with positive FCF, the second negative.

The free cash flow positive list netted more than 5x the percentage gains– over the past year.

Bear in mind, the latter screen of money losers includes all of the high flying biotechs, some stocks up 2,3, 500% over the past year. The results cannot be negotiated or glossed over any longer. Momentum is dead; long live free cash flow.

I suggest you start learning about the fundamentals of the market, on your own accord, else the forces of the market will make you do it under less agreeable terms.

Comments »A Quarter That Will Go Down In Infamy

Seeing this market give up yesterday’s gains is like watching a terrorist event unfold. We are destined, by the grace of God, to enjoy the spoils of QE. The first quarter of 2015 is officially over, and it was one giant circle jerk. I want MOAR spoils. Who would’ve known oil and gas stocks would lead the way, as everything else languished in flaccid hell, sans biotech?

I did.

My +15% gains for the quarter were built upon the backs of oil men, men who worked diligently in the fields of fossil to procure elements at horrifically low prices. For me, the biggest disappointment was HABT, which proved to be a waste of my time. I would’ve been better off with any other eatery, as retail and restaurant related names faired well.

Heading into Q2, I am expecting things to heat up a bit. As a matter of fact, I imagine Q2 to be a Tsar Bomba inside of a Jack in the Box, readying to pop out at any moment.

With regard to today’s trading action, I deeply regret buying BABA. It is a stupid stock and on the road to oblivion. It would’ve been nice to sell a little GRUB this morning, before its appalling reversal and subsequent disappointment.

Bottom line: I cannot complain, as I am up more than most for the year. Nevertheless, the obtuse demeanor of the tape persists, something that has been in abundance for more than a year. With the effervescent melody of frustration, marked with periods of inelegant horror, one must wade through these times of relentless upheaval–the black mirror of opportunity. This is a stock pickers market, one built to destroy amateurs. The path to success is finding companies with robust free cash flow. Any other method of research is simply a waste of time.

Comments »