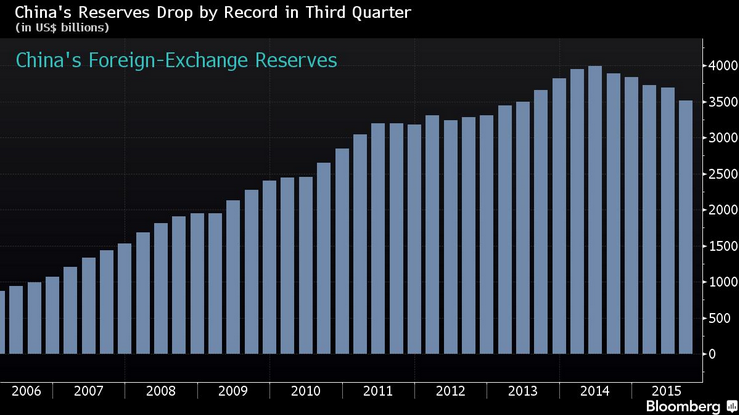

The market halved its gains following oil inventory numbers. Is that where we are now, dependent upon meaningless data to embolden us to be brave?

Russia is sending war ships to Syria, firing off missiles, and I hear people call Obama a coward. So what exactly would you have him do, engage the Russians or send ground troops to rout out ISIS?

We’ve been at war since 2001, carrying the mantle of freedom and honor to a savage people in a barbaric land. Let the Russians have their fill. We’ve dropped 14 years worth of ordinance on those bastards. Russia does it for 1 week and the internet is back to cradling Putin’s balls again. Please.

If you haven’t noticed, the content is flowing out of iBC these days. It’s part of a new strategy to completely annihilate whatever finance blogs are left in the fray. Also, be on the look out for a total redesign of the site, sometime this week.

Back to stocks. It looks like my call for a crazy faced rally was a bit pre-mature, with the NASDAQ negative now. Still, I am doing fine in CLX, UNFI, FCX, TWTR and recently sold out of AMCX.

Should we close lower, I will concede that might bode very poorly for tomorrow’s tape. The day is young. Let’s see if the bulls have it in them.

Comments »