Let’s have a look at some of the key players.

AAPL is trading 12x earnings, a 26% discount to its 10 year historical median. They are also trading at a 22% discount on a price to sales basis too. Their FPE is 11x. Based on the high estimates, it’s trading at 9x.

GOOGL is trading 29x earnings, a 6% discount to its 10 year historical median. They are also trading at a 5% discount on a price to sales basis too. Their FPE is 21x. Based on the high estimates, it’s trading at 18x.

MSFT is trading 29x earnings, a 74% premium to its 10 year historical median. But I think that number is screwy. On a price to sales basis, it’s trading at a 7% discount. Their FPE is 16x. Based on the high estimates, it’s trading at 11x. The 10 year historical median PE is 17.

WFC is trading 12x earnings, a 9% discount to its 10 year historical median. Because it’s a bank, we’ll be looking at its p/b ratio, which is 1.53, a discount of 4%. FPE is 12, based on high estimates 11.

AMZN isn’t interested in making money. Therefore, its PE is negligible. On a p/s basis, it is trading at 2.46, in line with its 10 year historical median. I haven’t the slightest idea how to value AMZN.

DIS is trading at 20x earnings, a 12% premium to 10 year historical median. On a price to sales basis, it’s retardo expensive, more than a 70% premium based on a 10 year median. It is, however, in line with the new valuation that Wall Street assigned it the past 3 years. FPE is 17, a slight discount to the 10 year median.

I can do this all day, using the Exodus platform. I’ll end it with WMT, which is trading at 13x earnings, a 13% discount to its 10 year historical average. Based on p/s, it is trading at a 16% discount. And, finally, they have a FPE of around 13x.

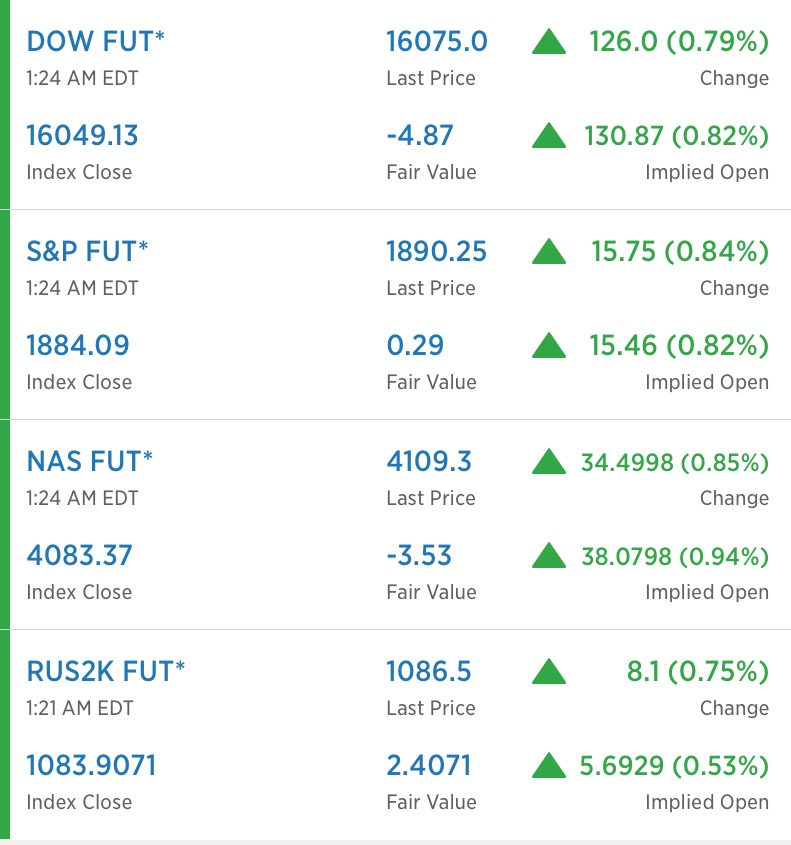

The overall market is trading at 18x earnings, the lowest since 2012. On a price to sales basis, stocks are cheap at 1.78x, the cheapest since 2012. The p/b is at 1.87, again the lowest since 2012.

In short, stocks are only cheap if the earnings aspect of the PE remains constant. If earnings are to be drastically cut back, stocks might have a rough ride over the next 6 months. By all measures, stocks are moderately priced, not even remotely close to the excessive valuations of 2000.

Comments »