I bet you thought I was fucking with you.

Comments »By the Way, We’re Super-Extended

The data in Exodus is mixed.

If current trends prevail, you will promptly regret being born tomorrow. Markets will plunge. Life will suck. And whatever clients you have left will fire you. On the other hand, if we push the timeframe back a bit, the market loves momentum and tends to rip to new highs when overheated.

Make no mistake, buying here is risky. You risk having egg placed all over your face, your pockets stripped from your pants, and your dignity soiled. But, if my hunches are correct, we are about to commence on an epic run to the upside, one that will abrasively leave skid marks on the hunched backs of short sellers, and slap the faces of those who cower in cash with paddles.

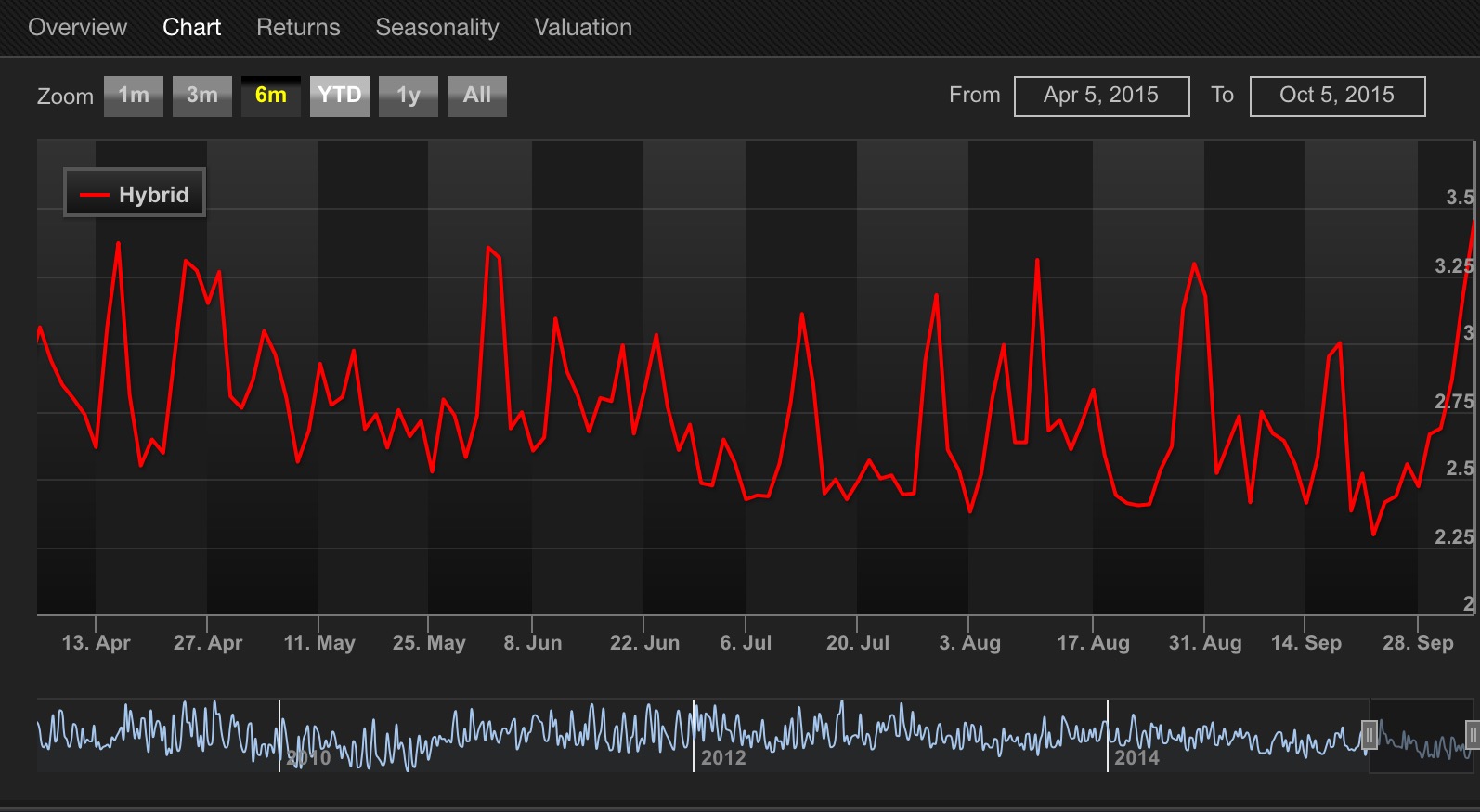

Here is the Hybrid oscillator for the steel and iron industry in Exodus.

That shit is super-extended. You’d have to be a mad-man to buy that shit, which is why I like it. Costanza trading 101: do the opposite.

Comments »I’M LONG THE MOST HATED SUBSTANCE IN ALL OF EXISTENCE

I’m a liberals worst nightmare. They hate this stuff more than serial killers. Maybe it’s because this shit causes earthquakes and tsunamis, causes clean water to become flammable, and enriches those who’d like to put handguns in every child’s hands in America.

I bought me some frac sand, or what I like to call Dracula Sand, via SLCA.

I also added to my GG position–because everyone hates that shit too.

I am now fully invested, for all intents and purposes.

Comments »What Was Hated, Now is Loved

All China related names are loved, commodities and all. Everything you were taught to hate about this market, now is loved. Like virgin snow on a mountain slope, this is exactly what you want to see on this snap back.

This is like February of 2008, only it’s October of 2011. The most hated market in all of mankind will rise up from its slumber to slay its enemies. Men who rise up against it will be tossed into a woodchipper and fired out as small particles into the adjacent wilderness.

Let’s keep this simple. I like banks, commodities and anything that has been reduced by half.

I have some funds to allocate. Bear with me.

Comments »LET THE BIOTECH RALLY COMMENCE

The poster child for gene therapy and beating pole for short sellers, Spark Therapeutics, just kicked all of its haters in the nuts.

Spark Therapeutics announces positive top-line results from the Phase 3 pivotal trial of SPK-RPE65, for the treatment of RPE65-mediated inherited retinal dystrophies; primary and first two secondary endpoints met (43.93) The pivotal trial met its primary endpoint (p = 0.001), demonstrating improvement of functional vision in the intervention group compared to the control group, as measured by the change in bilateral mobility testing between baseline and one year. There were no serious adverse events related to SPK-RPE65 or deleterious immune responses observed in the trial. Overall, adverse events related to the administration procedure were consistent with observations in earlier studies of SPK-RPE65. In addition, subjects who received SPK-RPE65 outperformed control subjects across the first two secondary endpoints: full-field light sensitivity threshold testing (p < 0.001) and the mobility test change score for the first injected eye (p = 0.001). The third secondary endpoint, visual acuity, did not show statistically significant evidence of benefit (p = 0.17). All reported p-values reflect results from the intent-to-treat (ITT) population, the most stringent efficacy analysis population described in the statistical analysis plan (SAP). Based on these results, Spark intends to file a Biologics License Application with the U.S. Food and Drug Administration in 2016 as the first step in executing its global regulatory and commercialization strategy.

Let there be light. Shares of ONCE are now up 67% in pre-market trading.

Comments »The ‘Lehman’ of Our Time is Now Ripping to the Upside

Glencore is now +12% in London on takeover rumors. The metal giant has now made up all of its one day -28% losses from two weeks ago–which spurred all of the bears, from every orifice of the world, to declare it “the Lehman Event’ of our time.

In related news, European markets are up more than 2%, led by the CAC, which is higher by 3.2%.

NASDAQ futs are +32.

Comments »We’re in a Small Capped Bear Market

Back in 2011, all of you thought the market was going back to the 2009 lows. I know this because I was here, dealing with the comments from crazy men typing furiously into keyboards. The market was unhinged heading into October of 2011, just like now. Then the rally happened.

I was 70% cash heading into October and had successfully navigated the correction. Then I stepped in.

I allocated 35% of my cash today, buying WNR, CLF, DECK and TEX. This is what I call “buying the blood” and it never feels right until it does.

Shortly thereafter, PANDEMONIUM BROKE LOOSE (extra Hulk Hogan)

Today over 500 stocks gapped higher by 10% or more. That’s ridiculous. 99% of those gains occurred in the final hour of trade. It’s not possible for this to occur, unless the buying was automated by some magical genie in a server rack. If you are short stocks here or long FAZ, you stand the chance to go from up nicely to negative $1 billion within minutes.

How negative was the mood just a week prior? Have a look.

INSANE S&P LOSING STREAK

Ever since May, the S&P has been down. With September’s 5.5% decline, followed by the 5.5% decline in August, we are now down for 5 consecutive months. The last time we had losing streaks like this was in 2002 and 2008 to 2009. In both cases, it led to a monstrous rally. Although I am bearish as a hairy human living alone in the woods, I need to be on guard (no Jerry) for an 8% rally in October.

The market has been grinding lower, led by the absolute destruction of basic materials, financials and tech shares. The leaders have been killed and people have pigeon holed themselves inside 80 year old man stocks. Coupled with the glaring fact that everyone is bearish, Zerohedge’s popularity is at an all-time high and I am 90% out of the market, something is astray, if I might so bold as to say so.

This just dawned on me, as I was doing some reading, thinking about the future. When thinking about stocks, I always lay out scenarios that might play out, then try to support them with historical precedence or hard facts.

The reality is, we are down 5 straight months and the news is as bad as it gets. Despite the bad news, we haven’t cracked lower. Instead, we are meandering around, grinding swing/momo traders into dust.

The real negative developments, aside from Europe, is the deterioration of China and the rise of Chinese CDS. What the fuck is that all about?

What to do, what to do?

Sound familiar?

Now let’s examine the internals of this bad market.

37.8% of stocks are down 20% for the year (1,629 of 4,306). That sounds really awful. But let’s dig deeper than a headline number.

18.1% of stocks with market caps over $10 bill are down 20%, YTD (107 of 590).

19.4% of stocks with market caps over $5 bill are down 20%, YTD (180 of 925).

51.3% of stocks with market caps under $1 bill are down 20%, YTD (1,133 of 2,206).

56.5% of stocks with market caps under $500 mill are down 20%, YTD (944 of 1,670).

60.5% of stocks with market caps under $250 mill are down 20%, YTD (714 of 1,180).

67.2% of stocks with market caps under $100 mill are down 20%, YTD (466 of 693).

72.4% of stocks with market caps under $50 mill are down 20%, YTD (302 of 417).

Do you see what’s going on here? Buying smaller cap stocks is inherently riskier than large capped. But these numbers are staggering. The vast majority of large cap stocks are holding up well, especially in comparison to small caps. For the most part, small caps do not have large institutional holders, lose a bunch of money, and have a weak, retail, oriented shareholder bases. The pain is always felt the worst here.

Were these small caps bought on Friday? Let’s have a look.

Friday’s rally, average and median returns

(sorted by market cap)

Over $10 bill: +1.54%/ +1.18%

Over $5 bill: +1.56%/ +1.18%

Under $1 bill: +1.83%/ +1.04%

Under $500 mill: +1.90%/ +1.03%

Under $250 mill: +1.74%/ +0.80%

Under $100 mill: +1.55%/ 0.67%

Under $50 mill: +1.24%/ 0.00%

Data provided by Exodus

Notice how the lower the market cap went, the lesser the gains? The higher average returns with market caps under $1 bill were coupled with a lesser number for the median, indicative of poor breadth and a few outliers that made up for the higher average returns. Looking at these numbers, I think it’s fair to say the best way to position for a bounce is with a portfolio of stocks between market caps of $5-10 bill, with maybe one or two small cap stocks for dicerolls.

Comments »Dr. Benjamin Bernanke Reflects on Saving the World in 2008

“I think there was a reasonably good chance that, barring stabilization of the financial system, that we could have gone into a 1930s-style depression,” he says now in an interview with USA TODAY. “The panic that hit us was enormous — I think the worst in U.S. history.”

Comments »Saturday Cinema with Le Fly: Gangs of New York

Is there a better actor than Daniel Day Lewis? Gangs of New York is a classic tale about a great city maturing and expanding outside of the old guard.

Immigrants were viewed as free loading vagrants, tossed back onto ships to fight our insane civil war. Politicans would encourage people to vote 4,5 even 20 times per election. And then there was the important matter of irish migrants vs the anglo-saxon gangs who hated them.

In many ways, the immigration issues in Gangs of NY are similar to what we face today with Mexico. The big difference was that we encouraged lots of immigration back then, for the war, for settlements, and for growth. Now we just need dish washers and people to man the lawn mowers.

This is an epic film, one of the best ever made.

THERE ARE 399 NASDAQS OF UPSIDE REMAINING

Greetings and salutations,

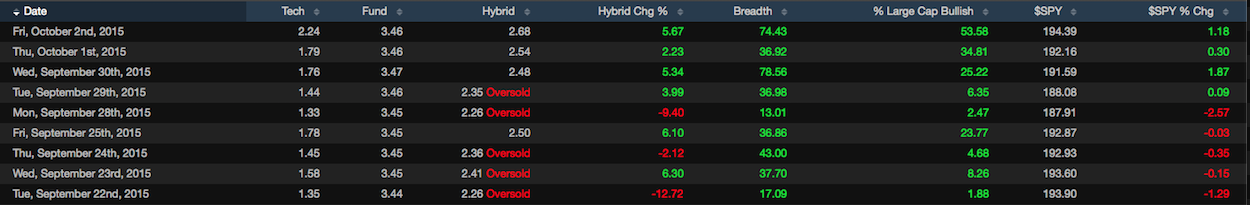

I hope you enjoyed today’s trading session. It’s especially significant to me because it marks an epic upside call for Exodus. As I was telling you earlier this week, the last time Exodus enjoyed so many consecutive OS signals was during the market rout of 2011. That resulted in a 10% move to the upside, rather immediately.

As it stands now, every single oversold signal has been validated and successful.

LISTEN TO ME NOW. There are precisely 399 NASDAQS left in the tape, for the month of October alone. It will culminate to the point of extreme perversion, capstone and buzz-saw all of the bears to clown dust.

We will take it to the bears with extra vigor and tenacity, to repay them for all of their trespasses over the course of the past 3 months. Full compliment.

Finally and in closing, I am here to remind you that the iBC Conference is happening this October 24th, a date which shall live in infamy for centuries to come. Don’t miss it. As a reminder, if you upgrade any of our premium services to annual, you will be admitted for free. The VIP ticket, however, is not up for negotiation.

Good day to you.

NOTE: Fuck Carl Icahn.

Comments »