Let’s be real. Taking losses when you are trading and/or investing is as normal as taking a dump. Yes, that is right. It is an essential part of investing and speculating.

So what is stopping most of us from taking loss when it is clear as day that our investment/trading thesis is not working?

Hope.

Oh dear!

Hope, my dear friends, is a loaded word in the stock market. So loaded that it can blow up on your face.

We should have faith!

I have heard that one before…

ok ok… you can’t discount faith entirely since, after all, I do have faith in my AMRN, LRAD, & SZYM investments.

However, there is one thing I also hold closer to my chest more than faith, an open mind when it comes to reviewing evidence or circumstantial facts that can debunk the faith I’ve in my investments. Even price action, when the direction is opposite to my thesis, is a kind of fact that I’ve to take into consideration. When you think about it, if price action collapses severely in absence of news, usually that means some big holders are unloading pronto based on information we don’t have; otherwise, any bear program will be countered by big players waiting for an opportunity to buy cheap at support level.

Keeping an open mind when you are deep in your hope and faith is not an easy task since you are in danger of being infatuated with the stock. In other words, you are in danger of being possessed. Yes, you heard me. Possessed by a strong feeling that your stock can do no wrong. I’ll revisit this topic in another post.

So how do we get ourselves out of this stranglehold of not being able to take loss when you know you should?

By changing your thought pattern regarding taking loss.

Instead of worrying about missing the boat by getting out to take your loss, you can focus on one (or several) of the followings:

1) get out now so you can buy back cheaper (I use this thought most of the times)

2) get out now before you spill more blood (I use this thought on my $USU position)

3) get out now so you can use the cash to buy another stock that is going up (I use this from time to time)

4) get out now to take a break from the stress (I use this one recently when I had a minor panic attack)

5) get out now because you have a planned vacation to take (don’t let this losing trade ruin your holiday)

If you can shift your thought to one or several of the above instead of focusing on your fear of missing the bounce after you are out, you are already ahead of the crowd.

Since taking loss is very much part of the trading/investing process, learn to be the one to take control of the process instead of being forced on you at your maximum pain level. In other words, take that loss when it is still small.

If you don’t mind my using this analogy, you control when you take a dump (otherwise, it will be an ugly accident!); then why not control when you take a loss when it hurts the least? Remember, how you hurt is personal, my small hurt may be your giant hurt or vice versa; therefore, you get to set YOUR small hurt loss-taking level.

Btw, your definition of small loss can also vary depend on whether it is a scalper, a swing trade, or a position trade.

Believe me, from my experience, once you are used to taking small losses, you will love it and will not think twice taking them as time passes. Yes, even in the face of seeing some bounce without you on board, you won’t be faded. You know why? That is because you will also have witnessed multiple times how taking small losses have saved you from much bigger losses, probably more times than you see price takes off without you after you’ve sold.

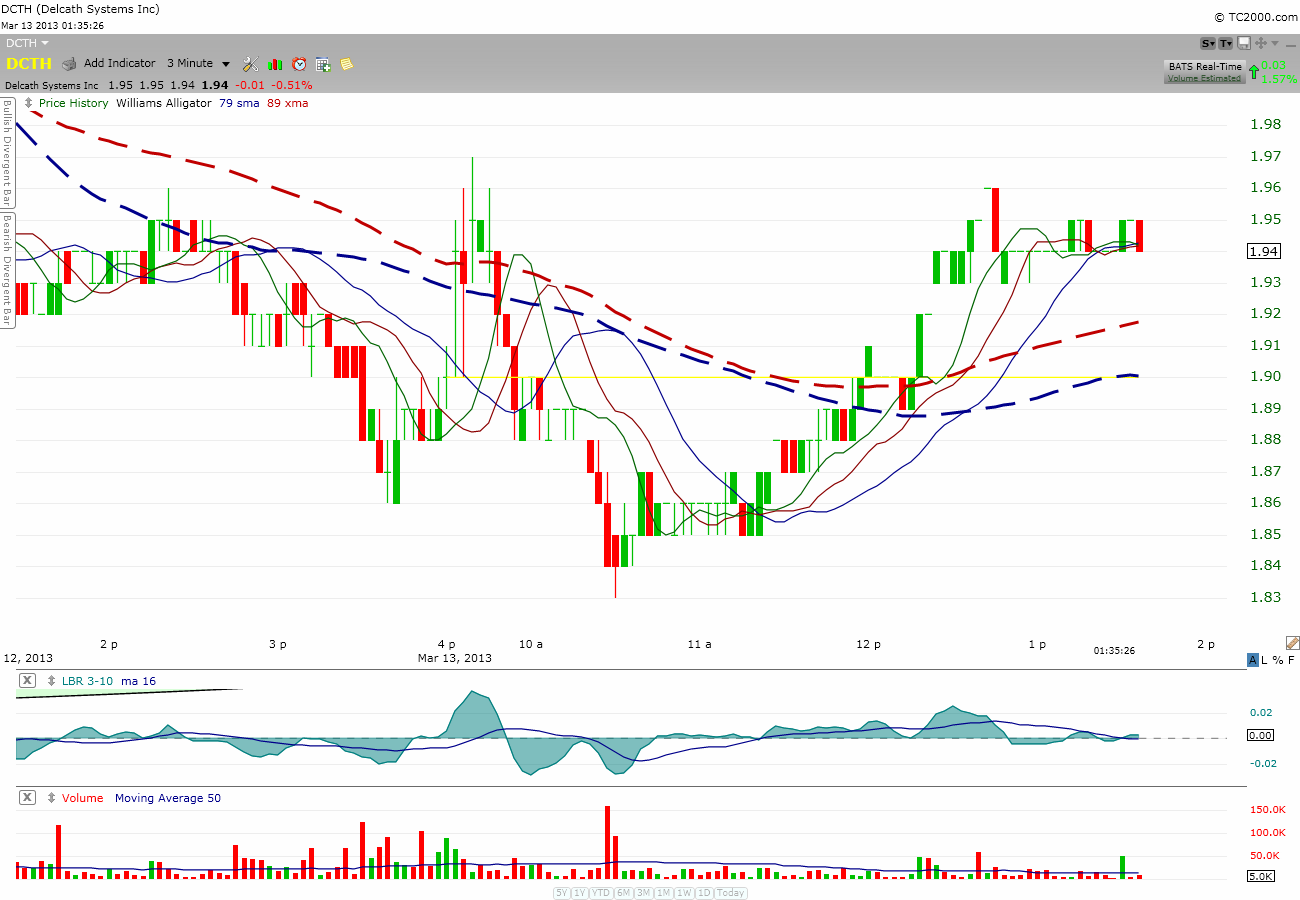

My witness of the $DCTH and $USU continuing downtrend last week after I’ve taken my losses proves my point.

My 2 cents.

Comments »