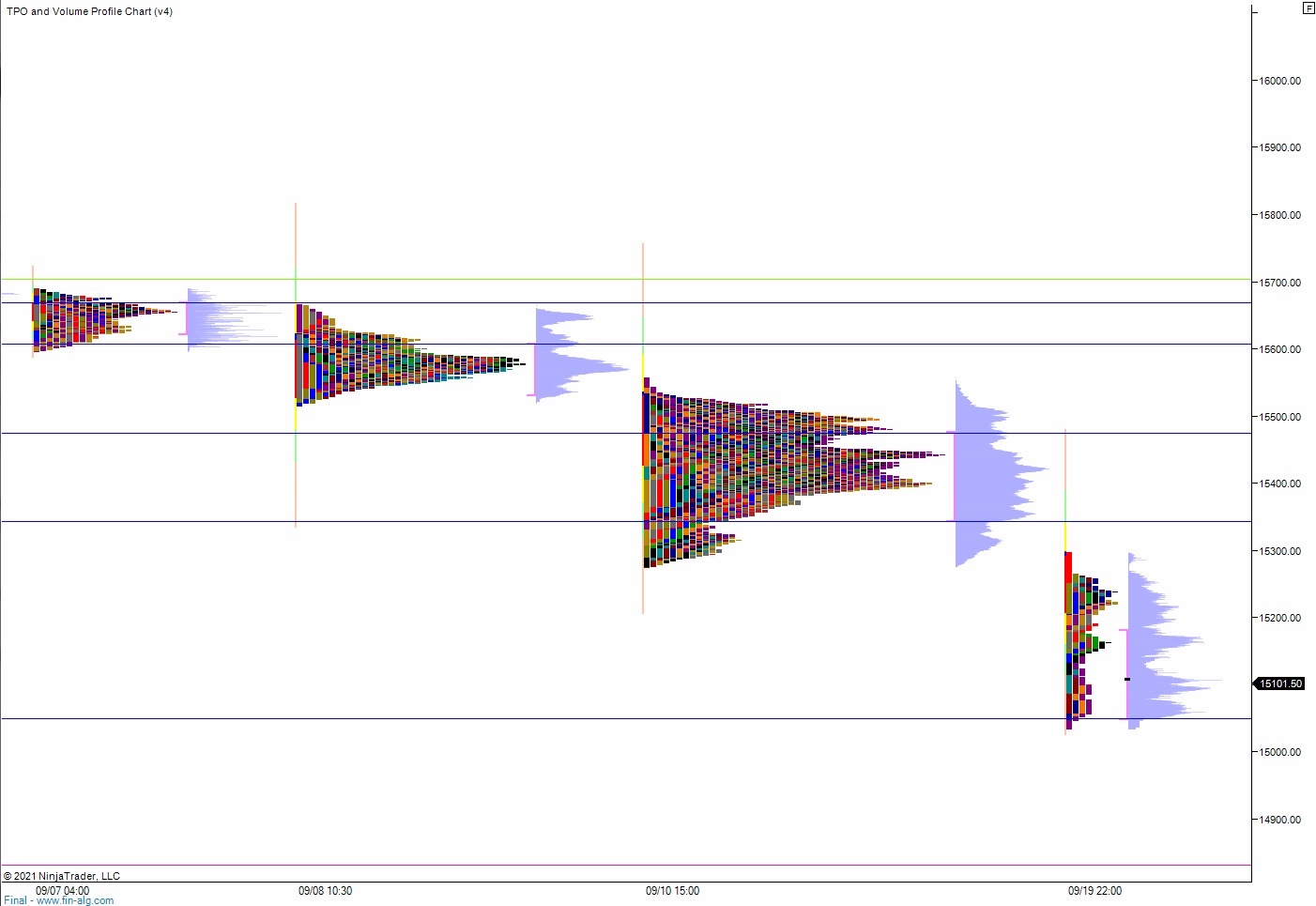

NASDAQ futures are coming into the week pro gap down after an overnight session featuring extreme range and volume. Price was balanced overnight, balancing along the lower quadrant of Friday range until about 9pm New York when sellers stepped in and began driving price lower. There was a bit of a two-way battle around 15,200 until about 4am when sellers continued to dominate the tape. And as we approach cash open price is hovering down below 15,100, levels unseen since August 20th.

On the economic calendar today we have housing market index at 10am followed by 3- and 6-month T-bill auctions at 11:30am.

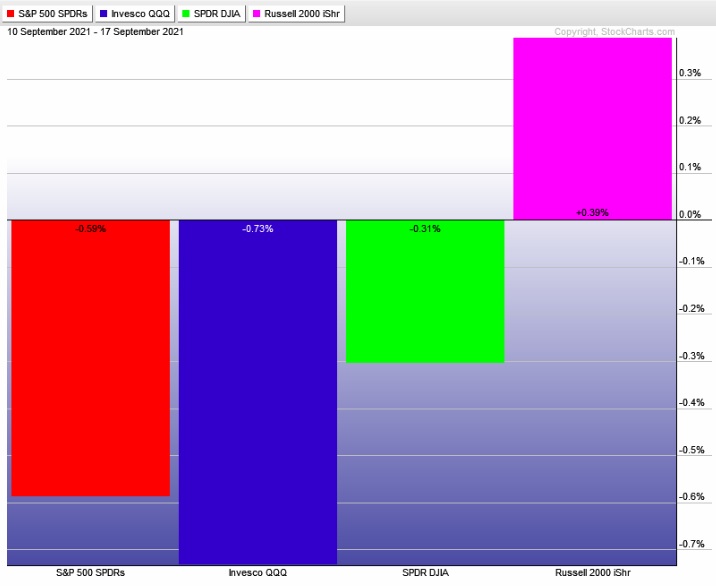

Last week we had choppy volatility that gradually drifted lower while chopping along. Then strong selling action into the weekend. The Russell 2000 was bullish divergent.

The last week performance of each major index is shown below:

On Friday the NASDAQ printed a double distribution trend down. The day began with a gap down in range that sellers drove down into, effectively taking out the the weekly low early in the session and defending attempts back into the Thursday range a bit later in the day. There was a bit of a bounce late in the session but it hardly managed to push through the lower quadrant. Sellers were still active into settlement.

Heading into today my primary expectation is for buyers to work into the overnight inventory, trading up to 15,226.75 before two way trade ensues.

Hypo 2 press down through overnight low 15,048.25 and tag 15,000.

Hypo 3 stronger buyers work up to 15,341.50 before two way trade ensues.

Levels:

Volume profiles, gaps and measured moves: