NASDAQ futures are coming into Wednesday with a slight gap down after an overnight session featuring extreme volume on elevated range. Price was balanced overnight, balancing along the upper half of Tuesday’s range. As we approach cash open price is hovering above the Tuesday midpoint.

On the economic calendar today we have crude oil inventories at 10:30am followed by a 20-year bond auction at 1pm.

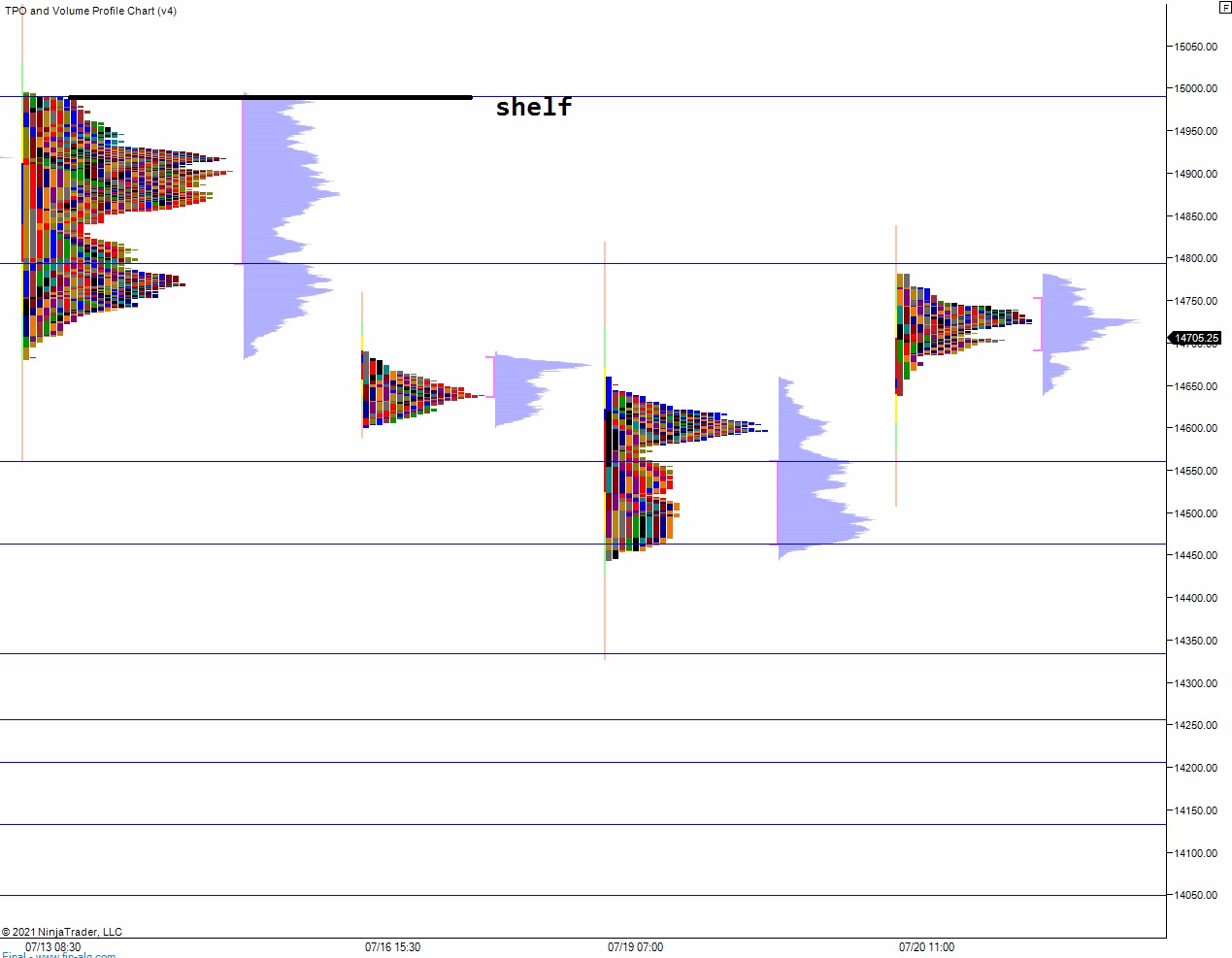

Yesterday we printed a double distribution trend up. The day began with a slight gap up beyond the Monday high. Sellers quickly resolved the overnight gap with a drive down off the open. Said sellers made their way down past the gap fill and tagged the Monday midpoint before the auction reversed. Responsive buyers formed a sharp excess low and after a tight battle along the daily mid buyers began a steady campaign higher that would unidirectional rotate higher until about 4pm and take price back up to last Friday’s naked volume point of control. Price was sort of choppy during settlement, and sellers faded a bit of the move into the close.

Heading into today my primary expectation is for buyers to work into the overnight inventory and close the gap up to 14,724.50. Buyers continue higher, taking out overnight high 14,765.75 and tagging 14,793.50 before two way trade ensues.

Hypo 2 stronger buyers trade up to 14,900 before two way trade ensues.

Hypo 3 sellers press down through overnight low 14,688.25 setting up a move down to 14,600.

Levels:

Volume profiles, gaps and measured moves: