I come from a long line of angry men. It is no excuse. I can do better. So many of the ways I usually channel all this physical rage vibrating in my body are gone from my life. The weights. The pools. The all-night raves. The 120 degree yoga rooms. Digging holes.

I’ve been on the computer since 8am after I triggered on some nice feller from Ohio after he dunked on me over on the Twitter. I felt like a real dumbass after that.

Anyhow I did all the weekend research. I am pretty spent, intellectually. I wish I could go empty my physical tank in the same manner.

Exercising at home is not the same. The great outdoors of Detroit are flat and bleak. Maybe I’ve just rip the damn cabinets off the walls.

It took five months to get everything I need for a new kitchen. It’s all sitting in the garage of Mothership. Should be pretty bitchin’ when it’s done.

Anyhow. Yeah. I need brainless work.

We slayed the NASDAQ last week. It took way too long maybe that has me ornery also. I sort of chopped wood Wednesday through early Friday. Then had to stick around all heckin’ day Friday to finally capture the move up to 13,800. I know, first world problems.

I’m telling you—I need to be hooked to a plow and made to work the land. Otherwise I end up a dull boy.

Happy Valentine’s Day.

Raul Santos, February 14th, 2021

And now the 325th edition of Strategy Session. Enjoy:

Stocklabs Strategy Session: 02/15/21 – 02/19/21

I. Executive Summary

Raul’s bias score 3.58, medium bull. Prices work higher Tuesday and through to Wednesday afternoon. Then look for the third reaction to Wednesday afternoon’s FOMC minutes to dictate direction into the second half of the week.

Wal-Mart reports earnings Thursday before-market-open. This major retailer/employer’s earnings could turn the whole market.

U.S. markets will be close Monday in observation of President’s Day.

II. RECAP OF THE ACTION

Gap up and slow rally through Tuesday. Fast selling Wednesday morning ultimately erased by early Thursday. Choppy along the highs until a late Friday ramp higher.

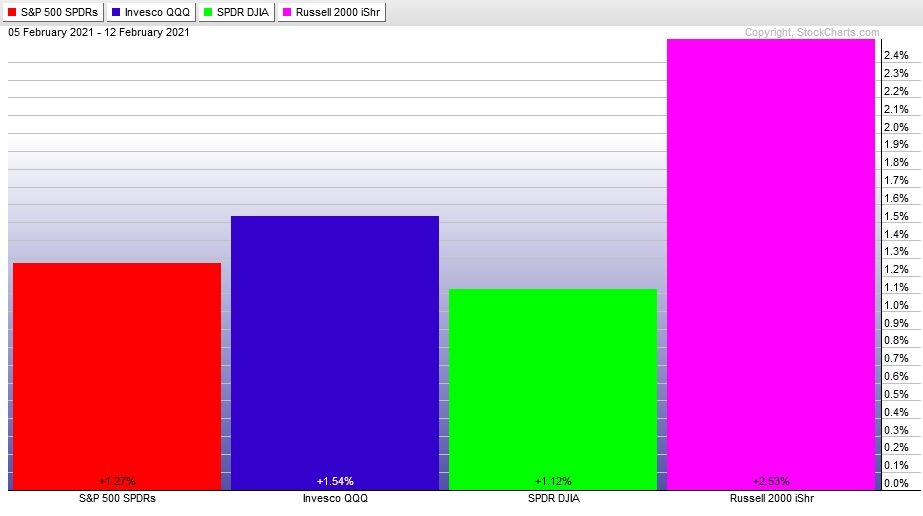

The last week performance of each major index is shown below:

Rotational Report:

Mixed rotations, predominantly higher. Tech strong but discretionary soft. Risk tolerance remains elevated.

slightly bullish

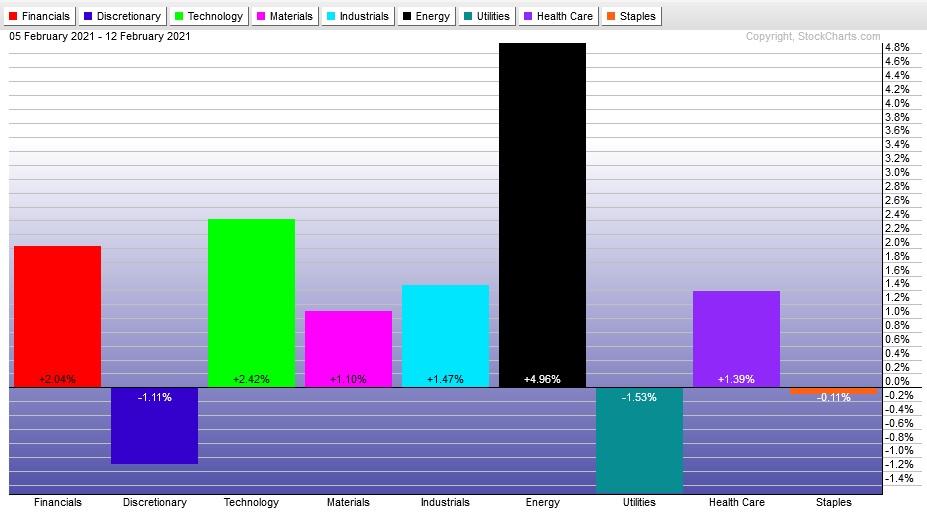

For the week, the performance of each sector can be seen below:

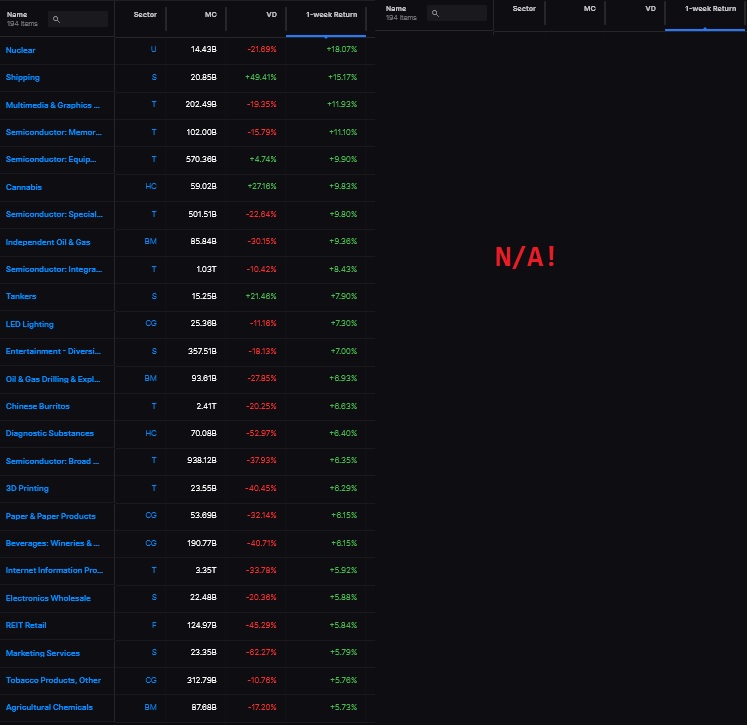

Concentrated Money Flows:

Industry flows not quite as heavily skewed as last week’s report, but still skewed bullish. Median return up over +2% after being greater than +4% the week prior. Key semiconductor industry groups populating the positive side of the ledger. No industry has a median return below -3%.

bullish

Here are this week’s results:

III. Stocklabs ACADEMY

No news is good news

The News tool inside Stocklabs can be especially powerful when a position I own makes an abnormal move. One of my favorite themes of this decade is the movement away from consuming animal flesh. Beyond the obvious technology plays like $BYND is mushrooms.

One of my long term holdings, Farmmi INC (ticker FAMI) saw its price move +40% last week. I like to know if a re-pricing of this scale is due to new information becoming public or a simple supply/demand based discovery process because it tells me how to treat the behavior.

A news driven move I will be skeptical of. I need to dig into any releases and check sources, and determine whether there is merit to the move. Then, my most likely expectation is for price to “return to the scene of the crime” meaning check back to the prices before the move happened.

I am quickly able to determine no news is associated with the movement by screening the News feed inside Stocklabs for “Farmmi”. Notice: If I attempt to screen using the ticker symbol a ton of useless noise feeds in because the software cannot differentiate between FAMI and “family”.

Knowing how to query large data sets is one of the skills most millennials take for granted. However, done correctly, on Google or in Stocklabs or elsewhere, and the world is your oyster.

There is no news behind the big move in Farmmi, therefore I shall continue to maintain my holding and perhaps add to it.

Due diligence complete in two minutes using the Stocklabs News tool.

Note: The next two sections are auction theory.

What is The Market Trying To Do?

Week ended searching for sellers.

IV. THE WEEK AHEAD

What is The Market Likely To Do from Here?

Weekly forecast:

Prices work higher Tuesday and through to Wednesday afternoon. Then look for the third reaction to Wednesday afternoon’s FOMC minutes to dictate direction into the second half of the week.

Wal-Mart reports earnings Thursday before-market-open. This major retailer/employer’s earnings could turn the whole market.

U.S. markets will be close Monday in observation of President’s Day.

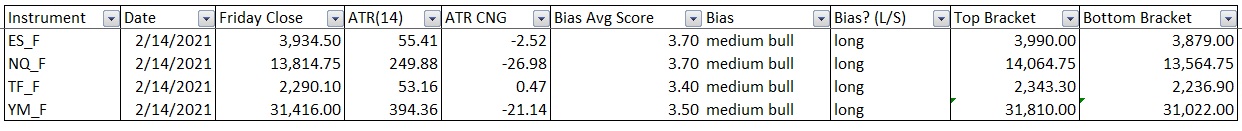

Bias Book:

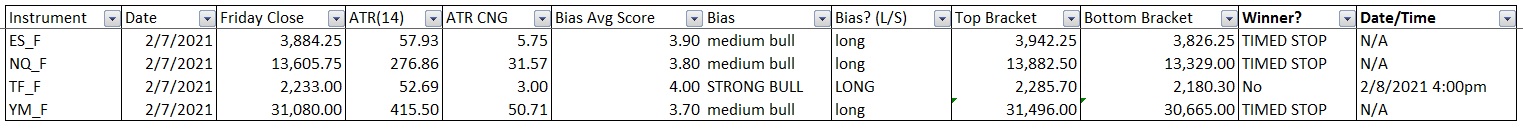

Here are the bias trades and price levels for this week:

Here are last week’s bias trade results:

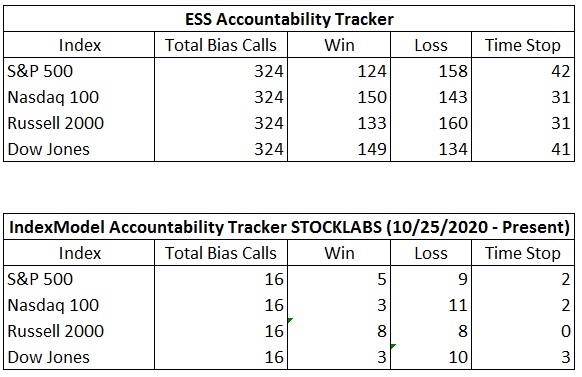

Bias Book Performance [11/17/2014-Present]:

All systems are up

Markets fluctuate between two states—balance and discovery. Discovery is an explosive directional move and can last for months. In theory, the longer the compression leading up to a break, the more order flow energy to push the discovery phase.

We are monitoring two instruments, the Nasdaq Transportation Index and the PHLX Semiconductor Index.

Transports continued their discovery up phase.

bullish

See below:

Semiconductors broke higher out of a mini balance on news of a chip shortage. Discovery up.

bullish

See below:

V. INDEX MODEL

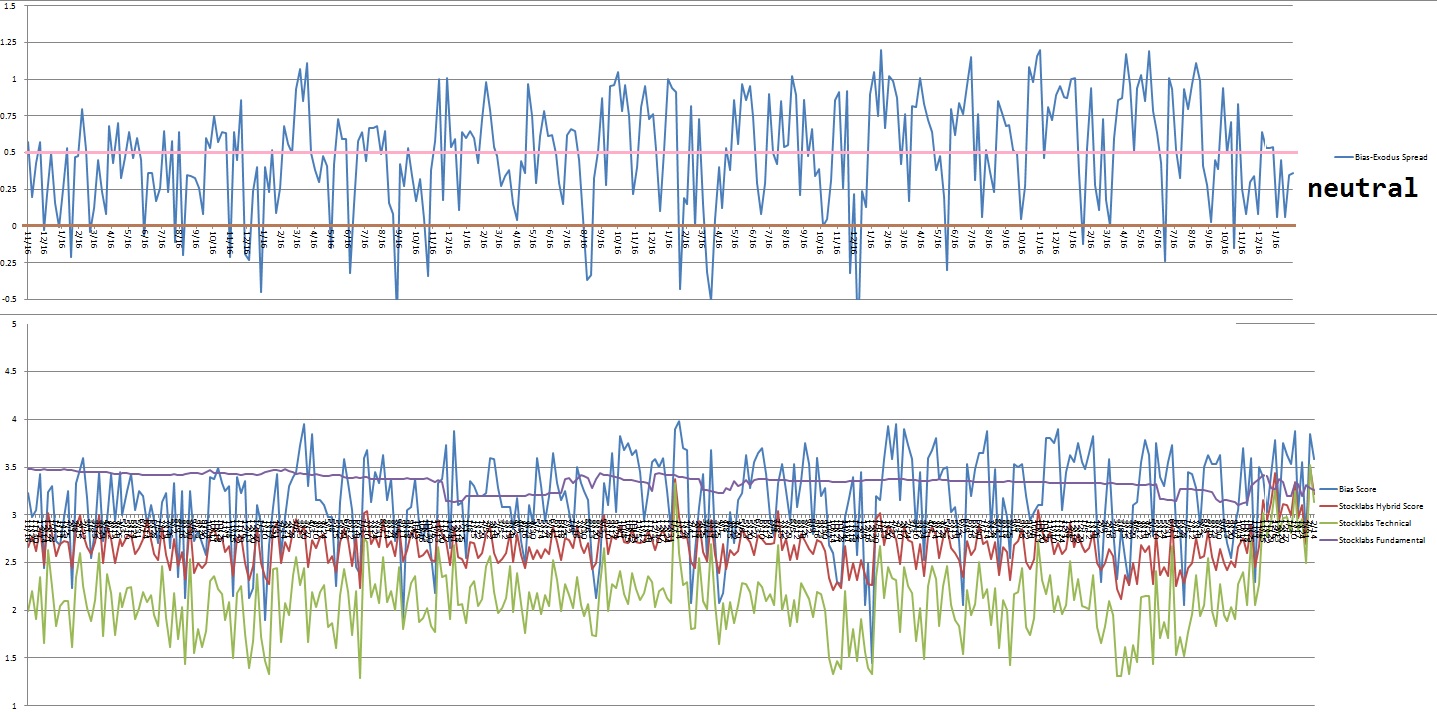

Bias model is neutral for an twelfth consecutive week. No bias.

VI. Stocklabs Hybrid Overbought.

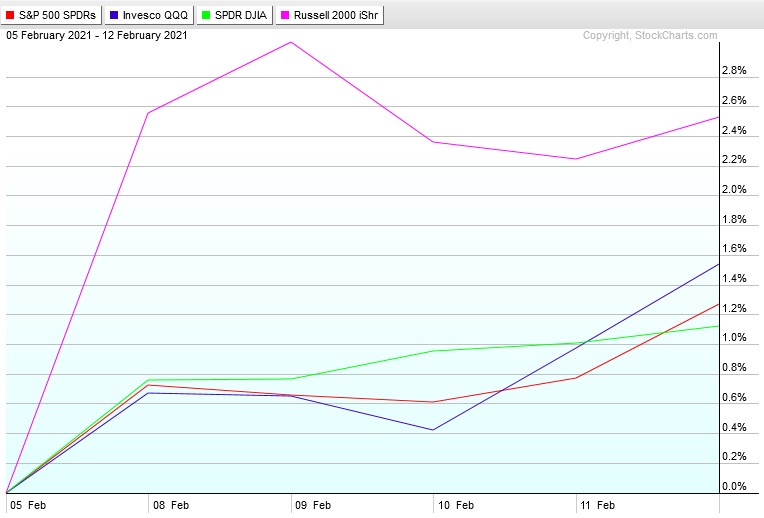

On Friday, February 5th Exodus flagged hybrid (and technical) overbought on the 12-month algo. This is a bullish cycle that runs through Friday, February 19th end-of-day. Here is the performance thus far:

VII. QUOTE OF THE WEEK:

“If there is no struggle, there is no progress.” – Frederick Douglass

Trade simple, challenge your research

If you enjoy the content at iBankCoin, please follow us on Twitter