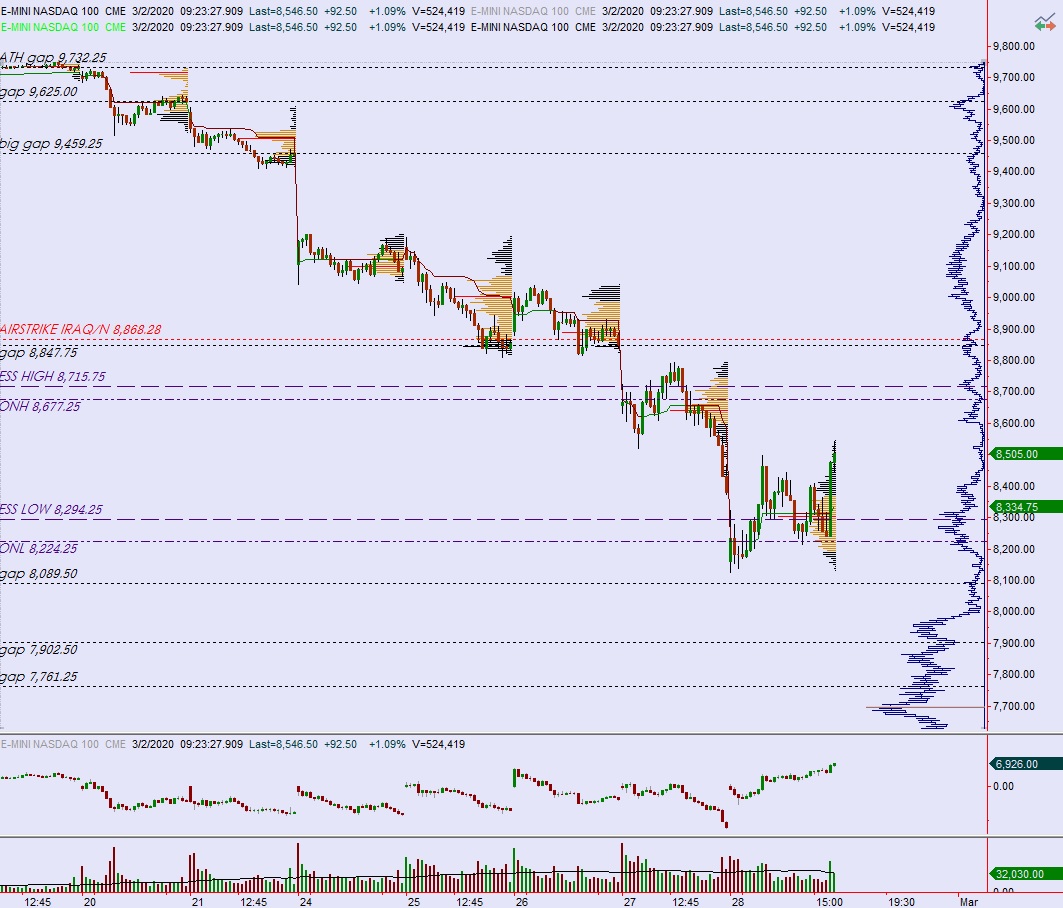

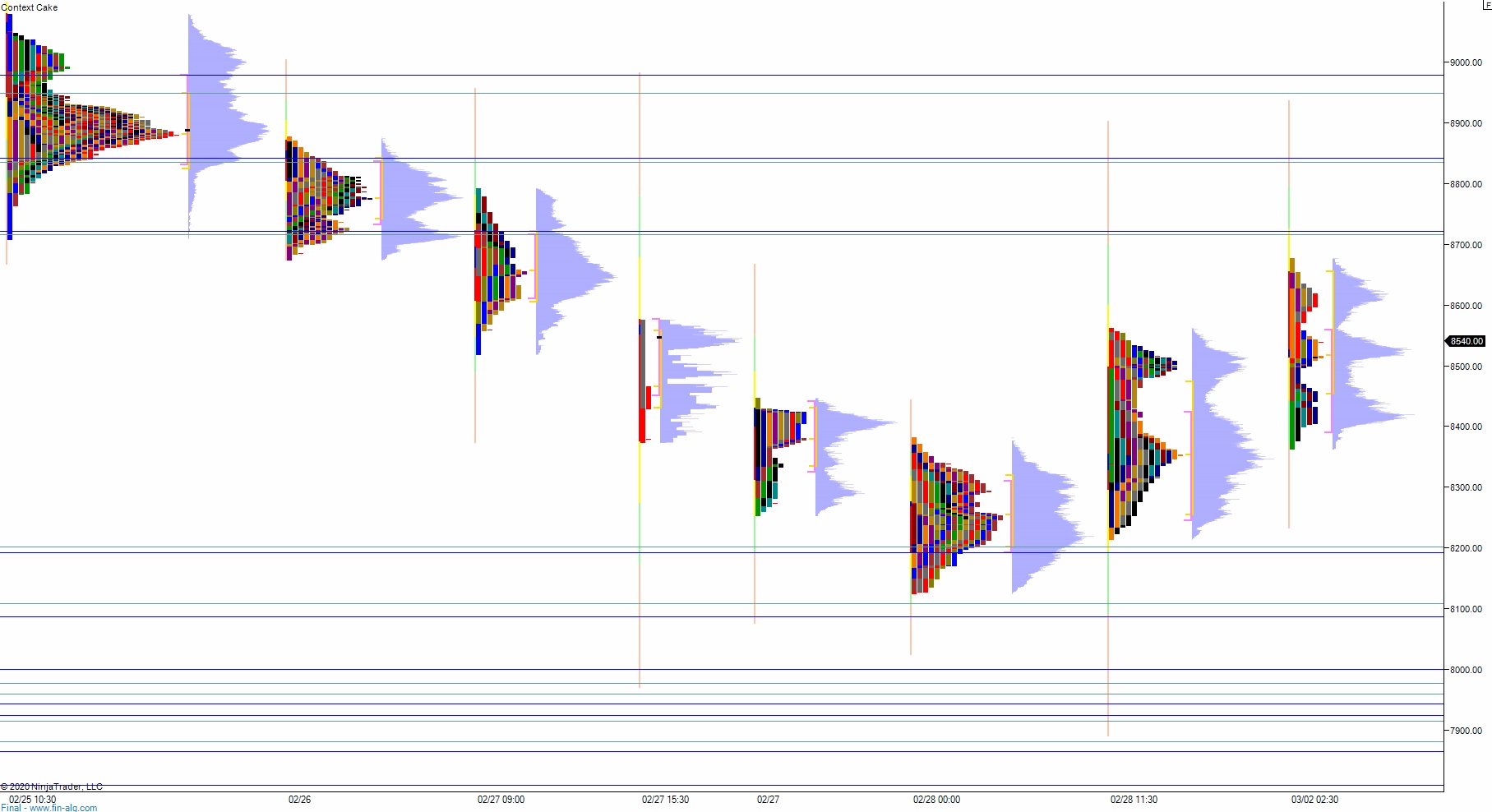

NASDAQ futures are coming into Monday flat after an overnight session featuring extreme (off the charts) range and volume. The globex session began with a gap down that had price near Friday’s midpoint. From there sellers worked a touch lower before discovering a strong responsive bid. This formed an excess low before buyers went to work resolving the Sunday gap. Price then continued higher, trading up through the Friday high and more, eventually working up beyond the Thursday midpoint before finding sellers. Said sellers erased the gains back to the Friday close (unchanged). As we approach cash open, price is about 90 points higher than the Friday close and moving fast.

On the economic calendar today we have ISM employment at 10am, 13- and 26-week T-bill auctions at 11:30am. Also be aware that Berkshire Hathaway reports earnings after the bell. These earnings could move the whole market.

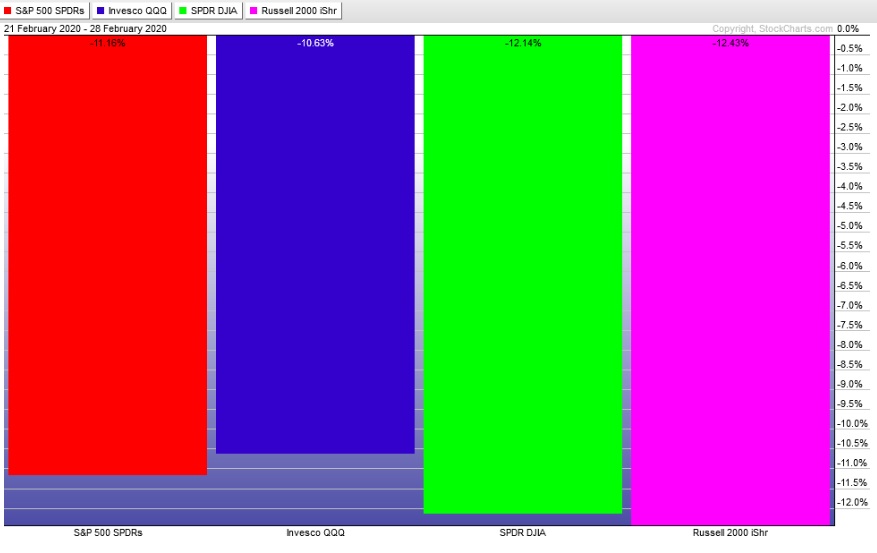

Last week began with a gap down and saw selling all week. Full on risk off, with investors rotating away from equities. Friday morning markets caught a bid and went into the weekend with a choppy balance, off the lows. The last week performance of each major index is shown below:

On Friday the NASDAQ printed a normal variation up. The day began with a gap down and two way auction, with price trading down to levels unseen since November 1st. Sellers could not however take out the November first low before buyers stepped in. Buyers then became initiative (initiative relative to Friday open, responsive relative to Thursday close) closing the overnight gap and trading up into Thursday’s lower quadrant before settling into a big chop along the daily midpoint. Late int he session price ramped to a new high of day and closed there.

Heading into today my primary expectation is for buyers to gap and go higher, trading up through overnight high 8677.25. Look for sellers up at 8715.75 and two way trade to ensue.

Hypo 2 stronger buyers trade up to the open gap at 8847.75 before two way trade ensues.

Hypo 3 sellers press into the overnight inventory and close the gap down to 8505. From here sellers continue lower, down through overnight low 8224.25. Look for buyers down at 8089.50 and two way trade to ensue.

Levels:

Volume profiles, gaps, and measured moves: