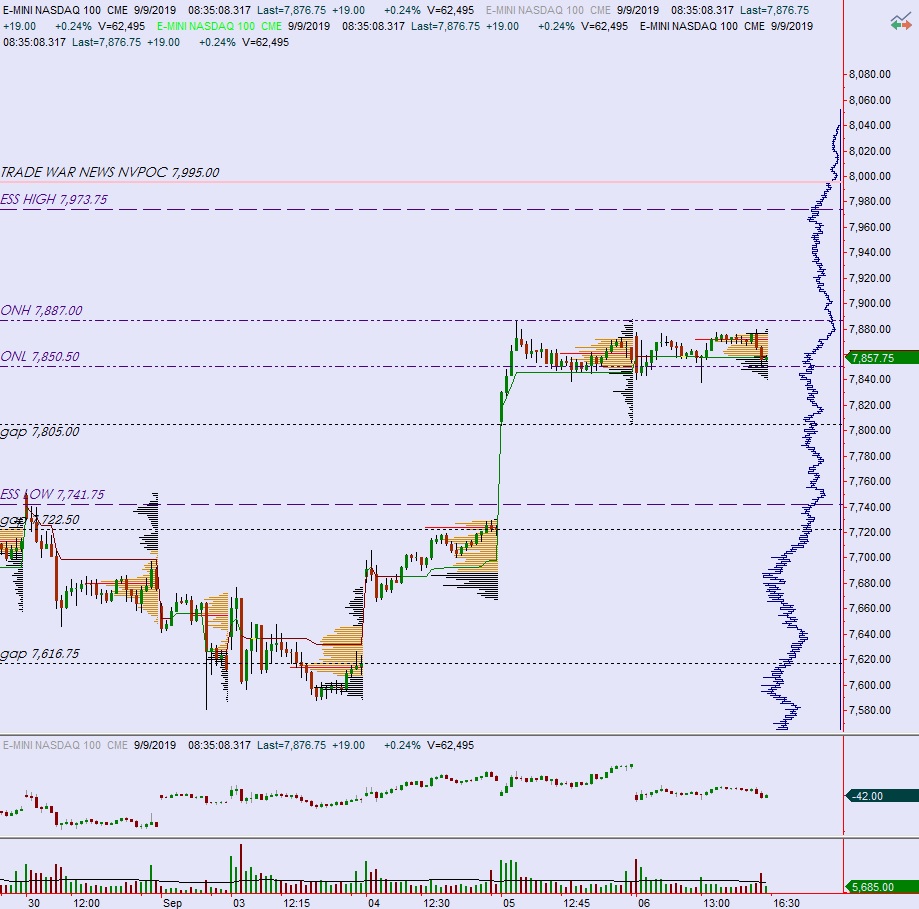

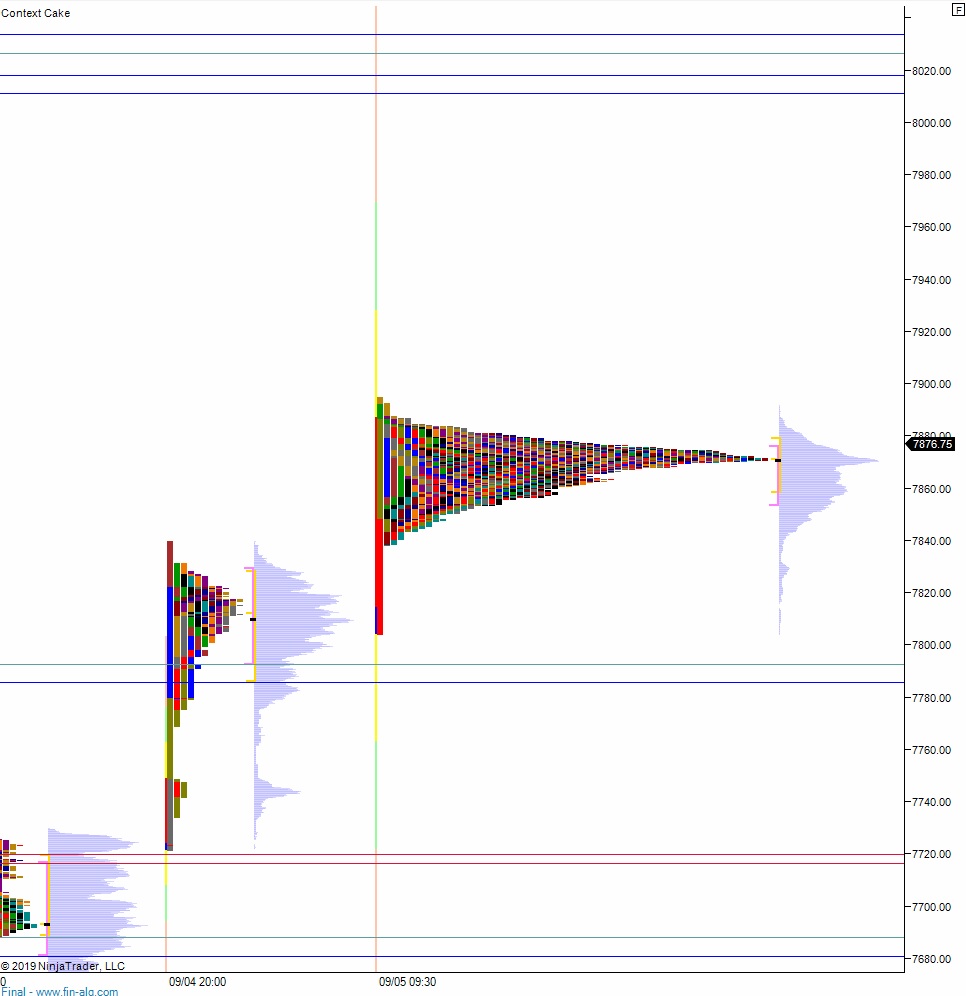

NASDAQ futures are coming into Monday with a slight gap up after an overnight session featuring normal range on extreme volume. Price worked slightly higher overnight in a balanced manner, slowly working up through the Thursday/Friday high before settling into balance. As we approach cash open, price is hovering right at Friday’s high.

On the economic calendar today we have 3- and 6-month T-bill auctions at 11:30am and consumer credit at 3pm.

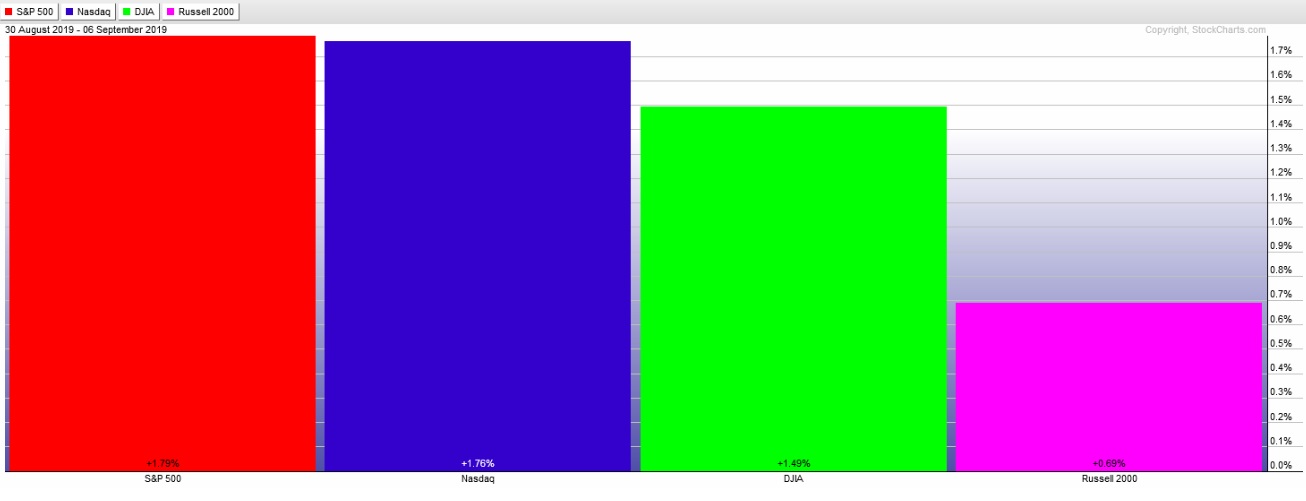

Last week was shortened Monday, with U.S. markets closed in observation of Labor Day. We came into Tuesday with a gap down and saw selling pressure through late Tuesday when responsive bidders began to show up. We went gap up into Wednesday and Thursday before finding responsive sellers, then we consolidated along these highs into the weekend. The last week performance of each major index is shown below:

On Friday the NASDAQ printed a neutral day. The day began with a slight gap up that sellers worked into then continued pressing lower until about the Thursday midpoint. Then we came into balance before a spike lower down off the daily midpoint around 1pm pushed us range extension down. This move formed a sharp excess low, and eventually, late in the session price worked range extension up, putting us into a neutral print. The day ended with a fade back down to the midpoint.

Super clean neutral day.

Heading into today my primary expectation is for buyers to gap-and-go higher, trading up through overnight high 7887 setting up a move to tag 7900 before two way trade ensues.

Hypo 2 sellers press into the overnight inventory and close the gap down to 7857.75 before continuing lower, down through overnight low 7850.50 before two way trade ensues.

Hypo 3 stronger sellers press down through overnight low 7850.50 and sustain trade below here, setting up a move to target 7800 before two way trade ensues.

Levels:

Volume profiles, gaps, and measured moves: