NASDAQ futures are coming into the last full week of July (the week after OPEX) gap up after an overnight session featuring extreme range and volume. Price worked higher overnight, and as we approach cash open prices are hanging around in the lower quadrant of Friday’s range.

The economic calendar is light today. Later this week we will hear earnings from Facebook, Google and Amazon. Today we have Bank of Japan’s Kuroda speaking to the IMF in Washington at 11am.

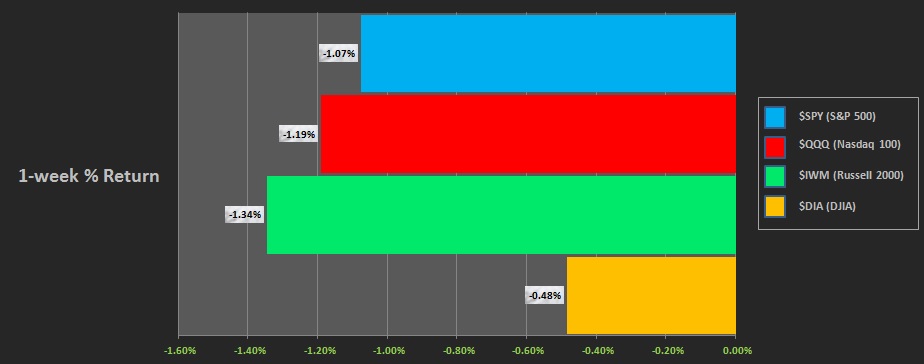

Last week began slow, with a drift through the early part of the week, with indices marking time near record highs before seeing sellers step in during the second half of the week. There were signs of strong responsive buying Thursday and Friday morning before sellers pressed prices back down to weekly lows on Friday. The last week performance of each major index is shown below:

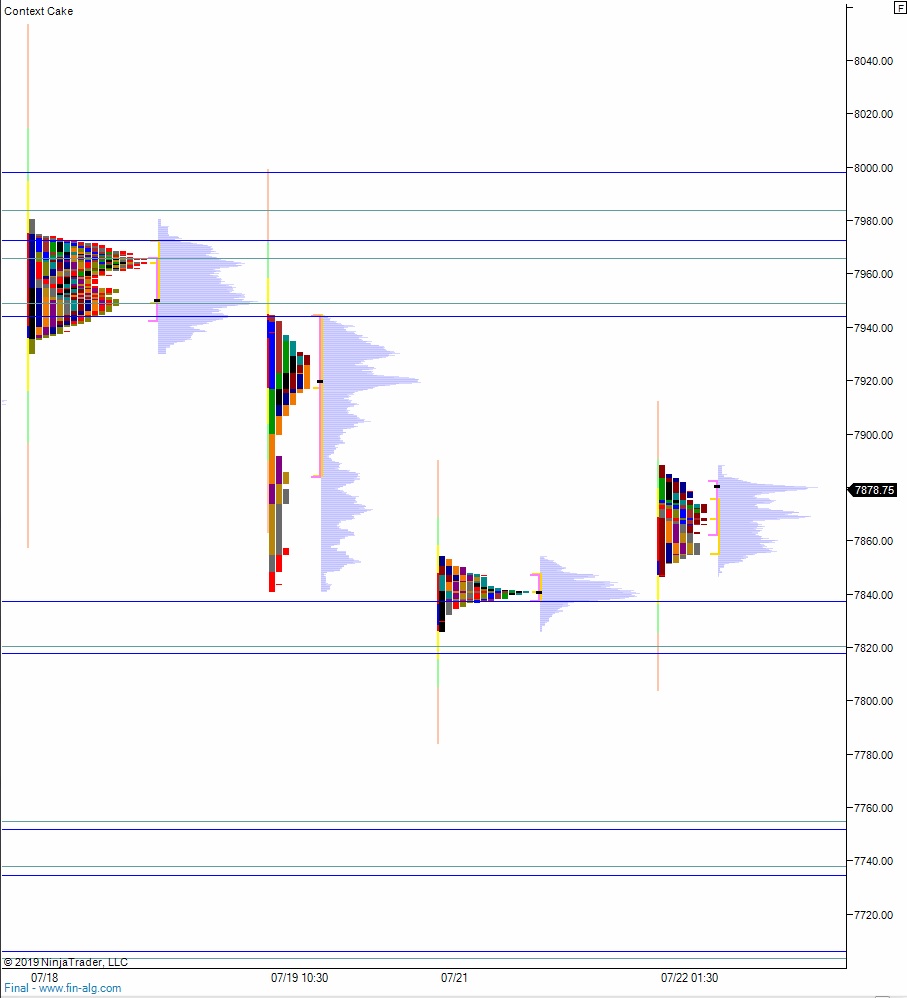

On Friday the NASDAQ printed a trend down. The day began with a gap up into Tuesday’s range. Sellers drove down at the open, closing the overnight gap up in short order then continuing lower throughout the morning. A bit of responsive buying took price back up to the daily midpoint. Sellers stepped in and defended then mid which triggered a liquidation down to a new low of the week. We ended the day at the lows, down inside the 07/09 range.

Heading into today my primary expectation is for sellers to be active ahead of 7900 to set up a move to close the overnight gap down to 7843.75. From here we continue lower, down through overnight low 7826.25. Look for buyers down at 7820.25 and two way trade to ensue.

Hypo 2 buyers gap-and-go higher, sustaining trade above 7900 and trapping Friday afternoon sellers. This trigger a trend reversal, with price trading up to tag the Friday naked VPOC at 7919.75 before two way trade ensues.

Hypo 3 choppy conditions, with price staying in a range between 7900 and 7840.

Levels:

Volume profiles, gaps, and measured moves: