NASDAQ futures are coming into Thursday gap down after an overnight session featuring extreme range and volume. Price worked lower overnight, trading down into levels unseen since 04/04. As we approach cash open, price is hovering near the 4/4 highs.

On the economic calendar today we have Fed Chairmen Powell delivering opening remarks at a community development conference in DC along with initial/continuing jobless claims data at 8:30am. There are 4- and 8-week T-bill auctions at 11:30am followed by a 30 year bond auction at 1pm.

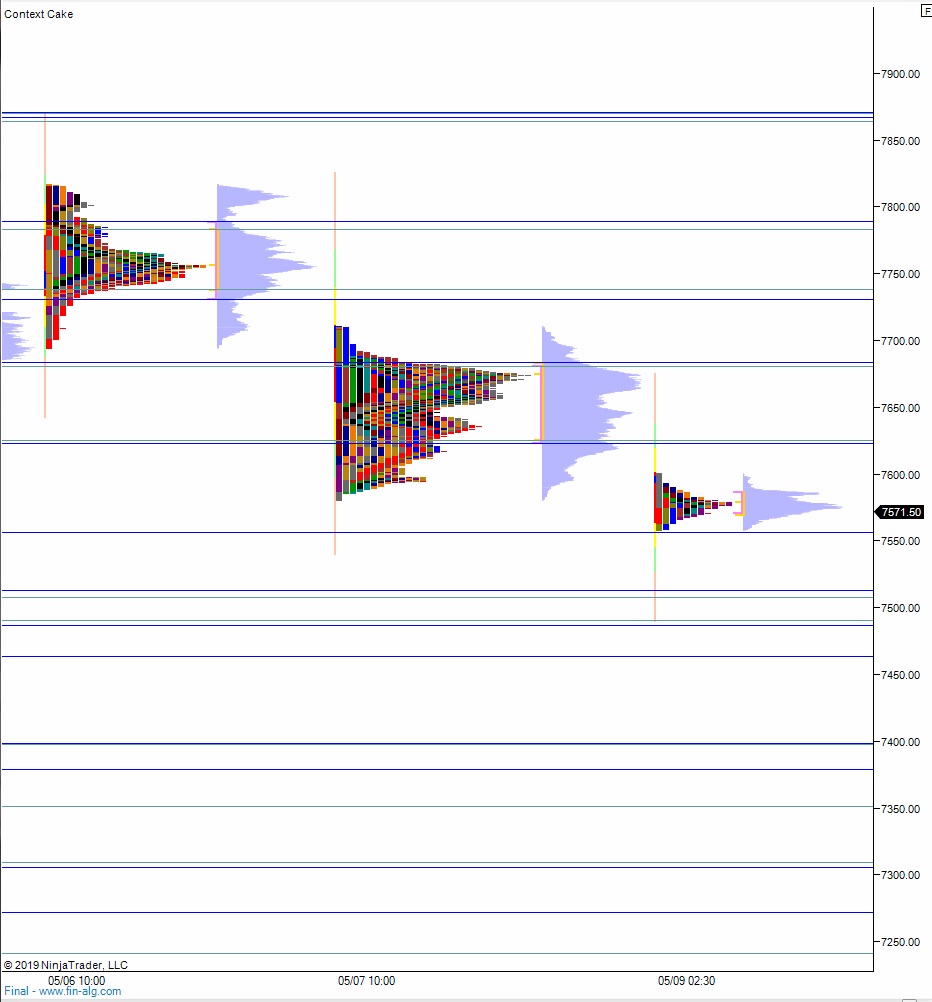

Yesterday we printed a normal variation up. The day began with a gap down and two-way auction. Chop eventually gave way to buyers working a full gap fill before we balanced in a tight range above the midpoint for most of the day. Then, late in the afternoon sellers drove price lower, ending the day just below session mid.

Heading into today my primary expectation is for sellers to gap-and-go lower, trading down to close the open gap at 7518.75. Look for buyers down at 7513 and two way trade to ensue.

Hypo 2 buyers work into the overnight inventory and reclaim the Wednesday low 7600 setting up a move to target 7622.50 before two way trade ensues.

Hypo 3 stronger sellers trigger a liquidation. Look for price to slash down through 7500. Look for buyers down at 7643.75 and two way trade to ensue.

Levels:

Volume profiles, gaps, and measured moves: