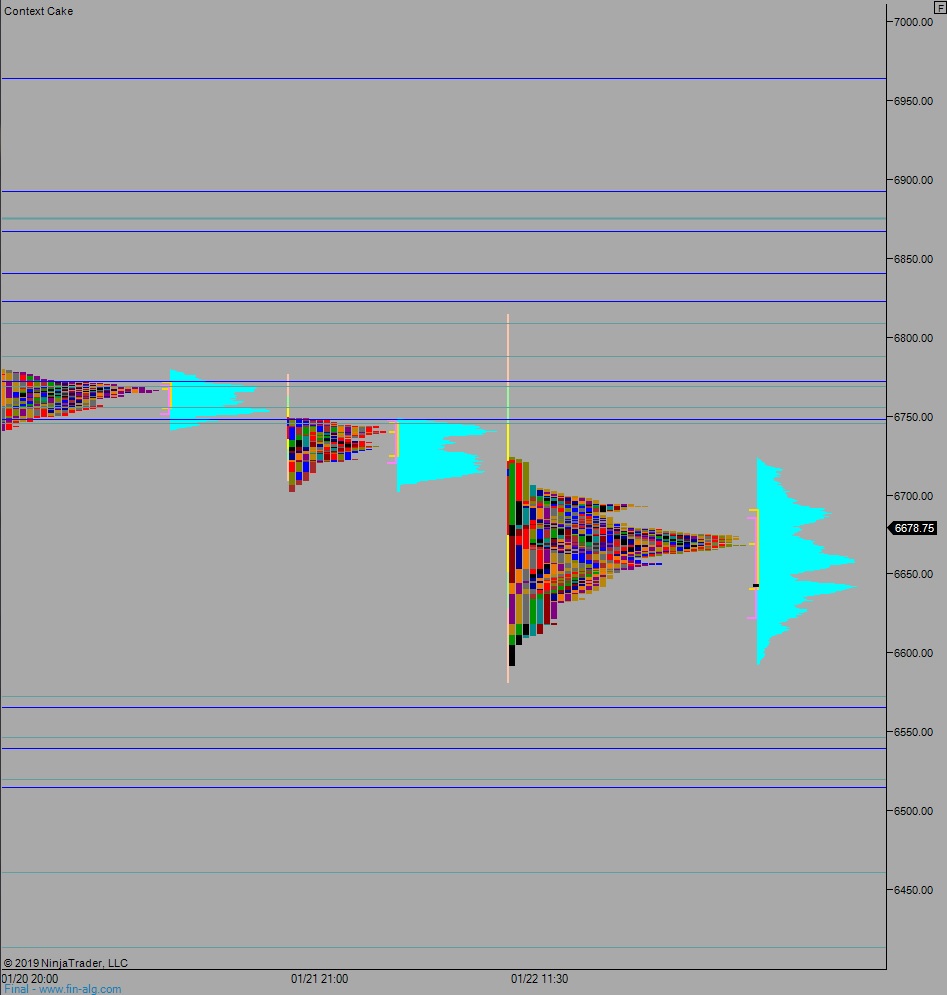

NASDAQ futures are coming into Thursday gap down after an overnight session featuring extreme volume on elevated volume. Price worked sideways overnight, trading inside of the Wednesday cash range. As we approach the open, price is hovering along the daily midpoint. At 8:30am Initial/Continuing jobless claims data came out stronger than expected.

Also on the economic agenda today we have markit composite/manufacturing/service PMI at 9:45am, Leading Index at 10am, Crude Oil inventories at 11am, and 4- and 8-week T-bill auctions at 11:30am.

Yesterday we printed a normal variation down. The day began with gap up. An early attempt higher found responsive sellers ahead of the upper distribution of Tuesday’s doulbe distribution trend down. Sellers took control of the tape, closing the overnight gap and continuing down through the Tuesday low before a bid stepped in. We ended the day near session mid.

Heading into today my primary expectation is for sellers to work into the overnight inventory and close the gap down to 6663.25. From here we continue lower, down through overnight low 6653. Look for buyers down at 6572.25 and two way trade to ensue.

Hypo 2 buyers work up through overnight high 6706.50 setting up a move to target 6745 before two way trade ensues.

Hypo 3 stronger buyers trade us up to 6768 before two way trade ensues.

Levels:

Volume profiles, gaps, and measured moves: