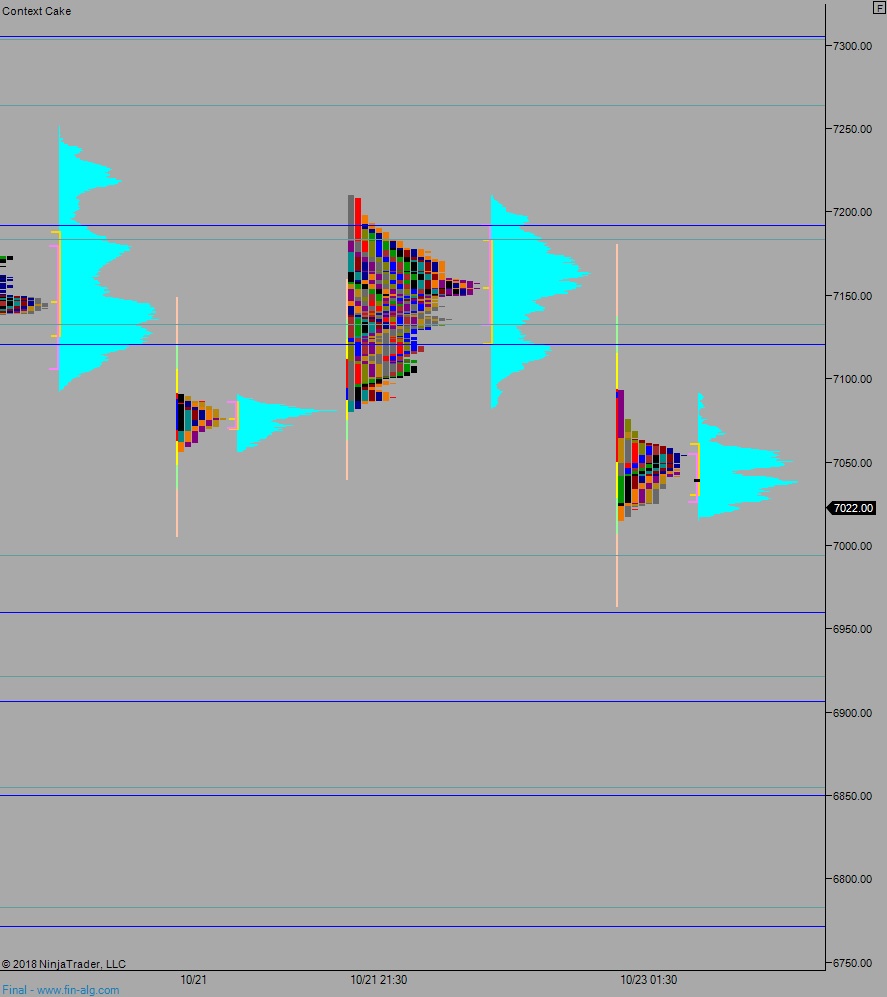

NASDAQ futures are coming into Tuesday pro gap down after an overnight session featuring extreme range and volume. Price worked lower overnight, uni-directionally working down into the 10/11 range, which is the day that we recently made a swing low. As we approach cash open, prices are hovering near the midpoint of the 10/11 range.

On the economic calendar today we have a 4- and 8-week T-bill auction at 11:30am and a 2-year Note auction at 1pm.

Yesterday we printed a normal variation up. The day began with a gap up that sellers quickly resolved in the first 30 minutes of trade. Sellers were unable to take out the Friday low, instead discovering a responsive bid (responsive relative to Monday open, initiative relative to Friday close) which came in and worked higher, eventually taking us range extension up but ultimately settling into a choppy balance, with the rest of the day spent trading above the midpoint. It was an inside day.

Heading into today we are way out of balance, and I expect the open to be violent. Look for buyers to work into the overnight inventory and work up towards 7100. Then look for sellers to reject a move back into the Monday low 7100.50 and two way trade to ensue.

Hypo 2 buyers regain Monday low 7100.50 and continue working higher to close the gap up to 7154.75 setting up a move through overnight high 7160.25. Look for sellers up at 7184 and two way trade to ensue.

Hypo 3 gap-and-go lower, down to 7000 before two way trade ensues.

Hypo 4 full-on liquidation, look for buyers down at 6933.50. Stretch targets to the downside are 6921.25, 6906, 6900, then 6854.75.

Levels:

Volume profiles, gaps, and measured moves: