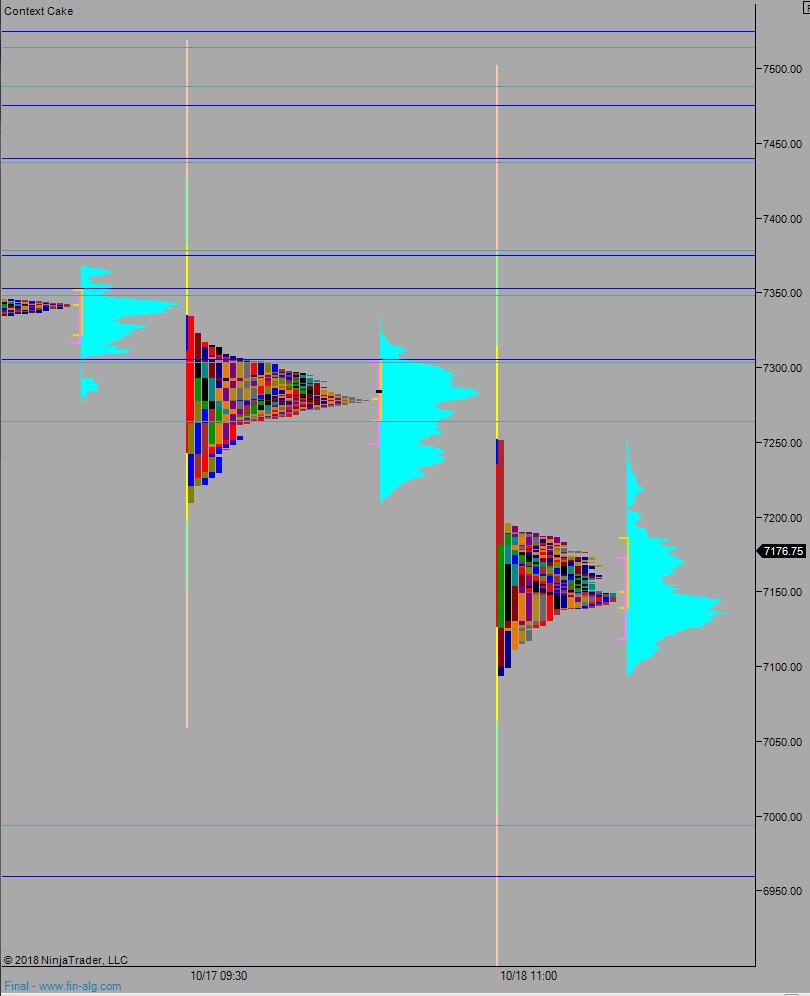

NASDAQ futures are coming into Friday gap up after an overnight session featuring extreme range and volume. Price worked sideways overnight, bouncing around below the midpoint of Thursday’s trade. As we approach cash open price is hovering along the midpoint of Thursday.

On the economic calendar today we have existing home sales at 10am.

Yesterday we printed a double distribution trend down. The day began with a gap down and drive lower. Initially, the price level high lighted in hypo 3 of the morning report [7207] was defended by buyers, but a second move into it saw sellers overtaking the level which triggered a liquidation. Price continued rotate lower until tagging the 7100 century mark where two-way trade ensued.

Heading into today my primary expectation is for buyers to gap-and-go higher, trading up through overnight high 7196. Look for sellers up at 7200 and two way trade to ensue.

Hypo 2 sellers work into the overnight inventory and close the gap down to 7139.25 setting up a move to take out overnight low 7135.50. Look for sellers to accelerate the action down, working to fill the open gap at 7076.25 before two way trade ensues.

Hypo 3 stronger buyers sustain trade above 7200 setting up a move to target 7263 before two way trade ensues.

Levels:

Volume profiles, gaps, and measured moves: