NASDAQ futures are coming into Monday gap up after an overnight session featuring elevated range on normal volume. Price worked higher overnight, briefly trading above all-time highs. As we approach cash open, price is hovering right at record highs.

On the economic calendar today we have 3- and 6-month T-bill auctions at 11:30am followed by a 2-year note auction at 1pm.

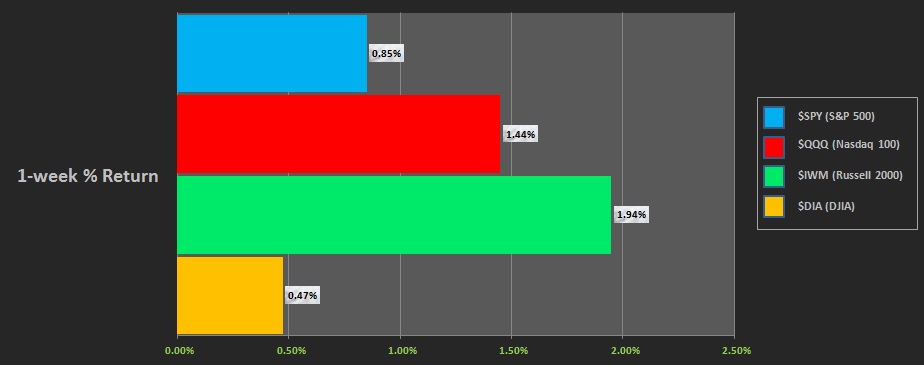

Last week we saw all major US indices slowly trend higher. Many days started strong then ended weak, but come Friday the markets rallied and held the gains into the weekend. The last week performance of each major index is shown below:

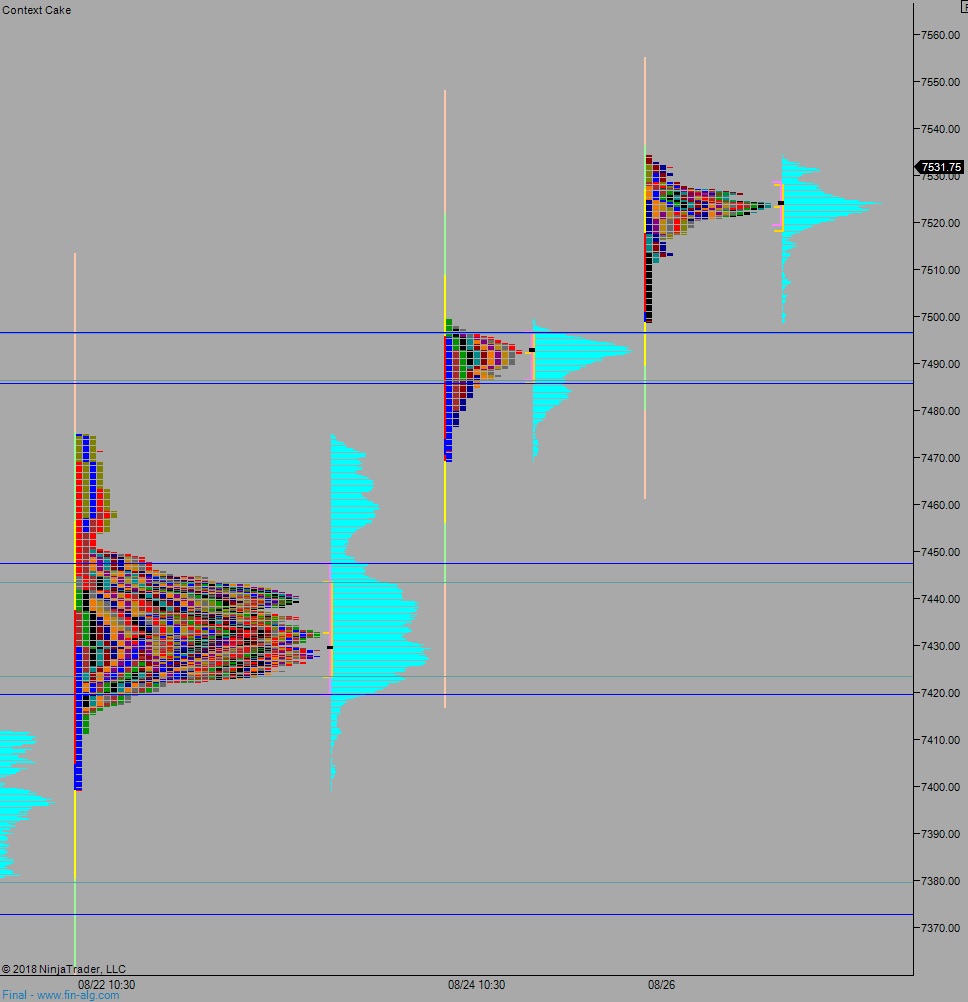

On Friday the NASDAQ printed a normal variation up. The day began with a gap up and drive higher. Then buyers sustained the prices through the afternoon to close out the week near the highs.

Heading into today my primary expectation is for sellers to work into the overnight inventory and trade down to 7500. Buyers reject a move back into the Friday range and we work higher, up through overnight high 7534.25 before two way trade ensues.

Hypo 2 buyers gap-and-go higher. Open air. Look for sellers at the measured move target 7565.25.

Hypo 3 sellers reclaim Friday range 7500 and sustain trade below it setting up a move to take out overnight low 7486.75 before two way trade ensues.

Levels:

Volume profiles, gaps, and measured moves: