Last week was exceptional. The NASDAQ futures traded methodically, telling a simple story about the auction that was easy to follow and trade. The playbook repeated from the prior three weeks—drift rally through Wednesday. Weakness Thursday morning. Strong responsive bid Thursday afternoon that rallies out through the weekend.

You cannot make this stuff up. It has been like a record on repeat. And through it all IndexModel, the quantitative system built to predict five days into the future, kept generating the same results—we call it extreme Rose Colored Sunglasses, or e(RCS) for short. The name comes from the fact that the markets are painting a beautiful picture on the surface. The major indices are healthy looking charts. Extremely healthy charts mean we expect more of the same, a drift, perhaps upward, but certainly no downward.

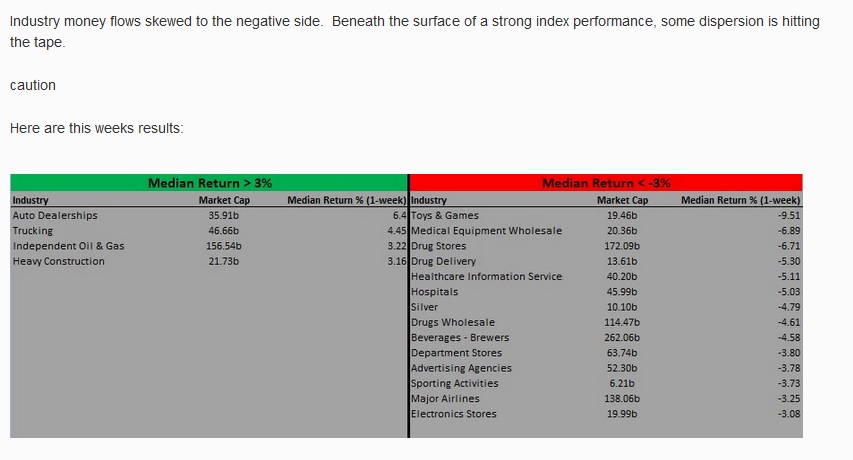

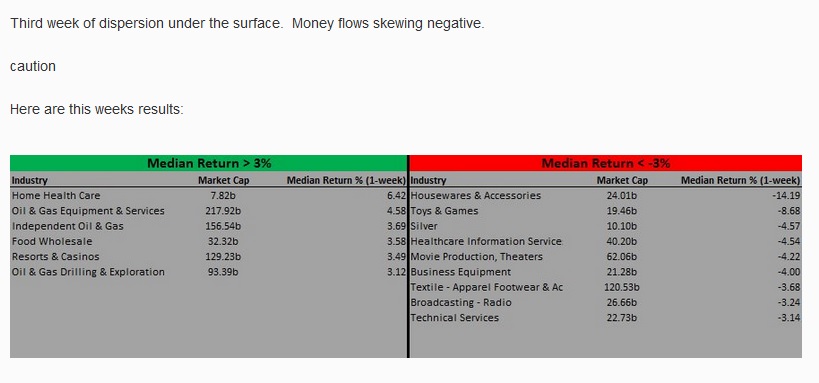

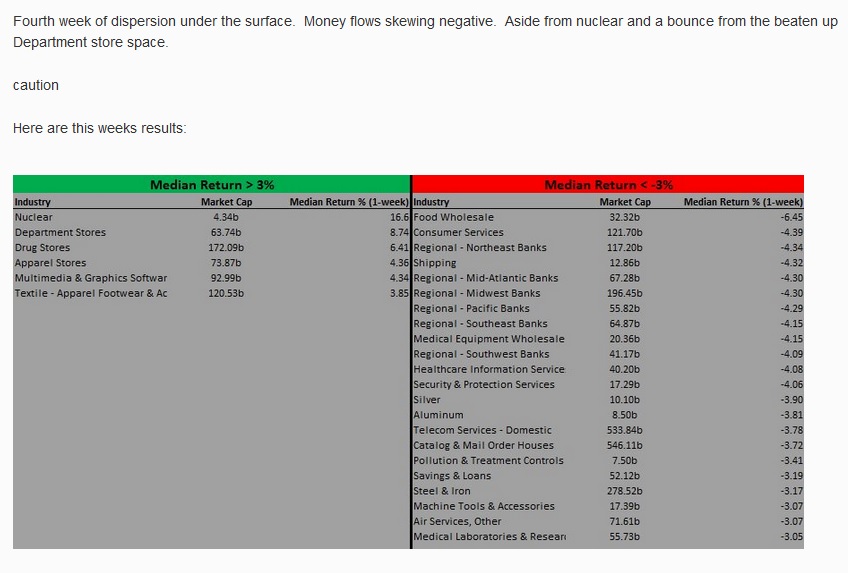

However, we began noting what we term ‘dispersion’ on the industrial, money-flow level. Look:

10/29/2017:

11/05/2017:

And on the Strategy Session from today, more of the same:

The industrial weakness shown above is also what the term Rose Colored Sunglasses implies because listen, if you put on a pair of rose colored sunglasses, even a junkyard in Detroit looks like a pleasant place to spend a Saturday afternoon with your kids. Everything is better with rose colored sunglasses.

But the lenses tint our perspective of the world.

It is important to remember these sort of things when you go about life. Like that you may be seeing a false representation of the world because you are looking at it through the lenses of bias or assumption.

When we strip it all away, only then can be objectively see the world. And even then, you occasionally have to step outside of the fish tank you inhabit to see whether the water is cloudy. Or clear.

Philosophy aside, IndexModel just went on a record streak of e(RCS) readings, six consecutive weeks. The model finally flipped back to neutral. Therefore we have zero guidance going into next week.

And as humble market practitioners, we know it is best to step aside when we have no defined edge in the marketplace. Humans are in control, and humans can be emotional. They operate on feel, which can be helpful once you have a solid foundation of logic. But without the foundation, all those feelings are like quicksand circling around a vortex of failure.

Last week was also special because I had the opportunity to catch up with Downtown Josh Brown. I walked away from his presentation realizing many of his strongly held beliefs about the marketplace are congruent with mine. It is also enjoyable to see how someone from a different part of the world views my dystopian paradise.

Soon my anarchic stomping grounds will change into something a bit more suburban and safe. But for now, it truly is the best city in the world to cavort around like an apex wolf man.

In summary, models are neutral. Without an edge we see little reason for our head trader, RAUL SANTOS, to engage the NASDAQ. Life is about perspective. Detroit has perhaps two good years of anarchy left before coastal elites make it into a clean and proper metropolis.

Distinguished members of Exodus Market Intelligence, the 156th edition of Strategy Session is live. Go check it out!

If you enjoy the content at iBankCoin, please follow us on Twitter