NASDAQ futures are coming into Wednesday gap down after an overnight session featuring extreme volume on elevated range. All the upside achieved Monday/Tuesday was reversed during extended trade before two way trade ensued. At 7am the MBA Mortgage applications data was worse than last week.

Also on the economic agenda today we have crude oil inventories at 10:30am. Also, at 11am the New York Fed will release its Household Debt and Credit report. This report will likely contain major implications of a June rate hike.

Investors are currently pricing in a 69.2% probability of a rate hike on June 14th, according the CME’s Fed Fund futures.

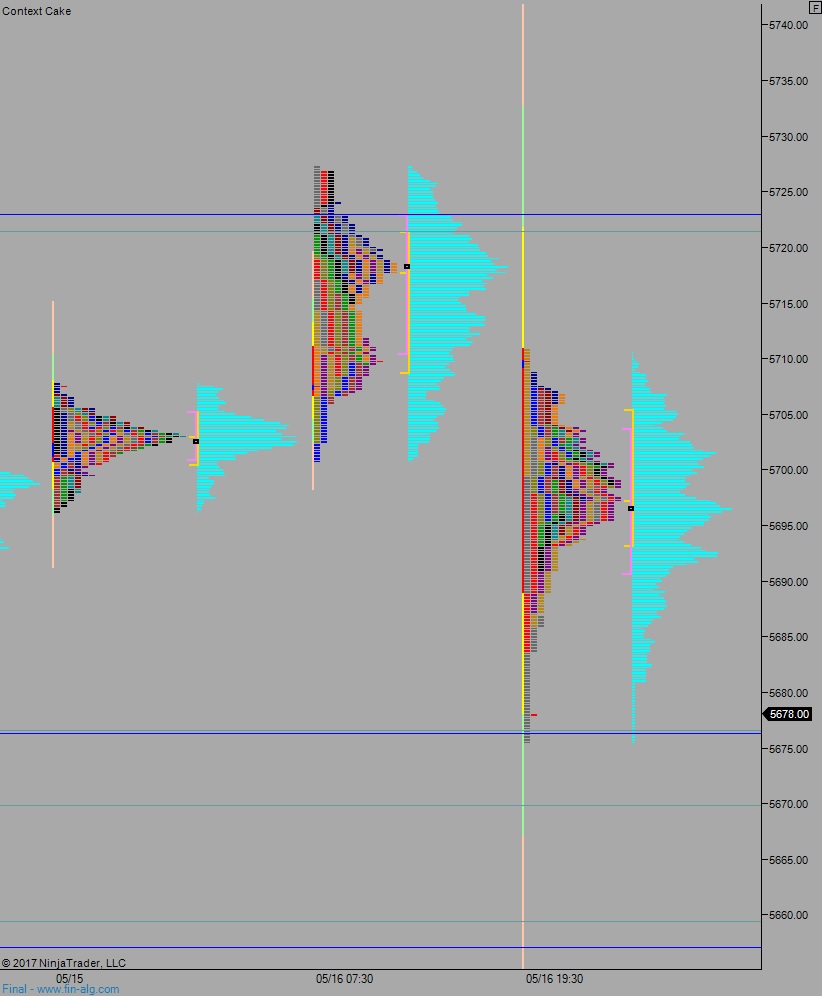

Yesterday we printed a neutral extreme up. Price worked lower early on, closing the overnight gap reversing and traversing the entire daily range and going range extension up. Buyers then added a bit more near the end of the day.

Heading into today my primary expectation is for a gap-and-go lower, down to 5676 before two way trade ensues.

Hypo 2 strong selling pushes down through 5670, setting up a move to 5659.50 before two way trade ensues.

Hypo 3 buyers work into the overnight inventory and close the gap up to 5724.75 before two way trade ensues.

Levels:

Volume profiles, gaps, and measured moves: