NASDAQ futures are coming into Thursday gap down after an overnight session featuring normal range and volume. Price worked lower overnight, in a one-way auction lower, trading down to the open gap from Monday’s close before turning higher. At 8:30am Initial/Continuing jobless claims data was better than expected.

Initial jobless claims are at their lowest levels in 28 years. https://t.co/DO6dYvviTj

— Joe Weisenthal (@TheStalwart) May 11, 2017

There are no other economic events scheduled for today.

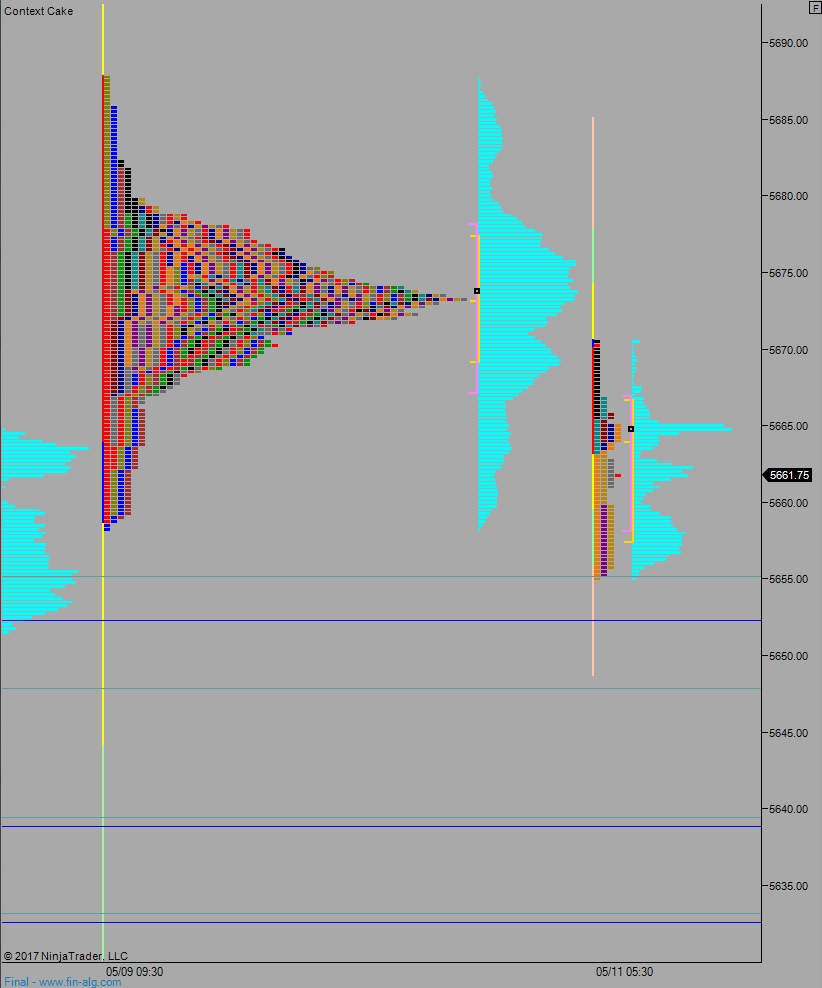

Yesterday we printed a neutral day. A neutral day the day after a normal day, interesting. Price opened gap up and sellers pushed off the open, ultimately stalling before filling the gap down at 5655 which was the primary hypothesis from Wednesday morning’s trading report. Price then traversed the entire daily range to make a new high of day, going neutral, before settling into two-way trade.

Heading into today my primary expectation is for buyers to work into the overnight inventory and close the gap up to 5675. Action gets choppy from here, but we manage to take out overnight high 5676.50 before it is all said and done.

Hypo 2 we push down through overnight low 5655 and find a bid just below, at 5652.25 before two way trade ensues.

Hypo 3 strong sellers press down to 5639.50 before two way trade ensues.

Levels:

Volume profiles, gaps, and measured moved: