NASDAQ futures are coming into Tuesday gap up after an overnight session featuring normal range and volume. Price held the progress made during Globex on Monday which means we are coming into the first real trading day of the week gap up.

The economic calendar is interesting today. At 9:45am we’ll hear from Markit and their reading of Manufacturing and Service PMI. Then, at 11:30am lots of short duration debt is being auctioned off. The 4-week, 3-month, and 6-month T-bills will be auctioned by the US Treasury—$34B, $28B, and $35B respectively. Then at 1pm a 2-year Note auction. There’s some Fed speak today, but not from anyone important.

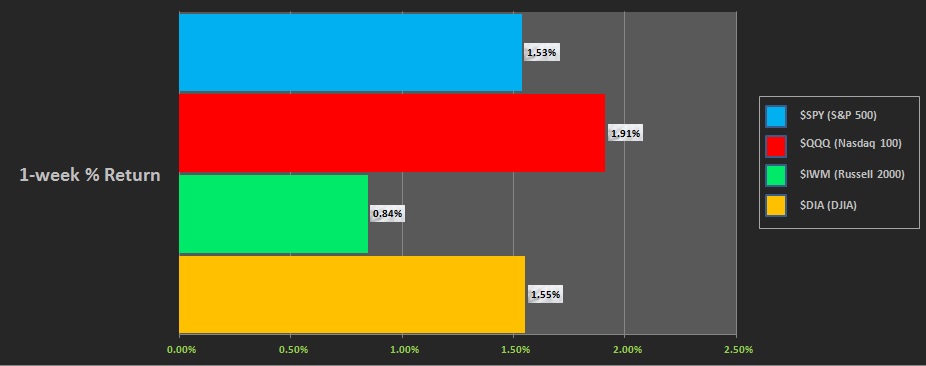

Last week US markets worked higher for the second consecutive strong week. Nearly uninterrupted, see below:

On Friday, the NASDAQ printed a double distribution trend up. Price opened gap down and the morning featured a buying drive. Then buying continued all day long, right up to the end of the week.

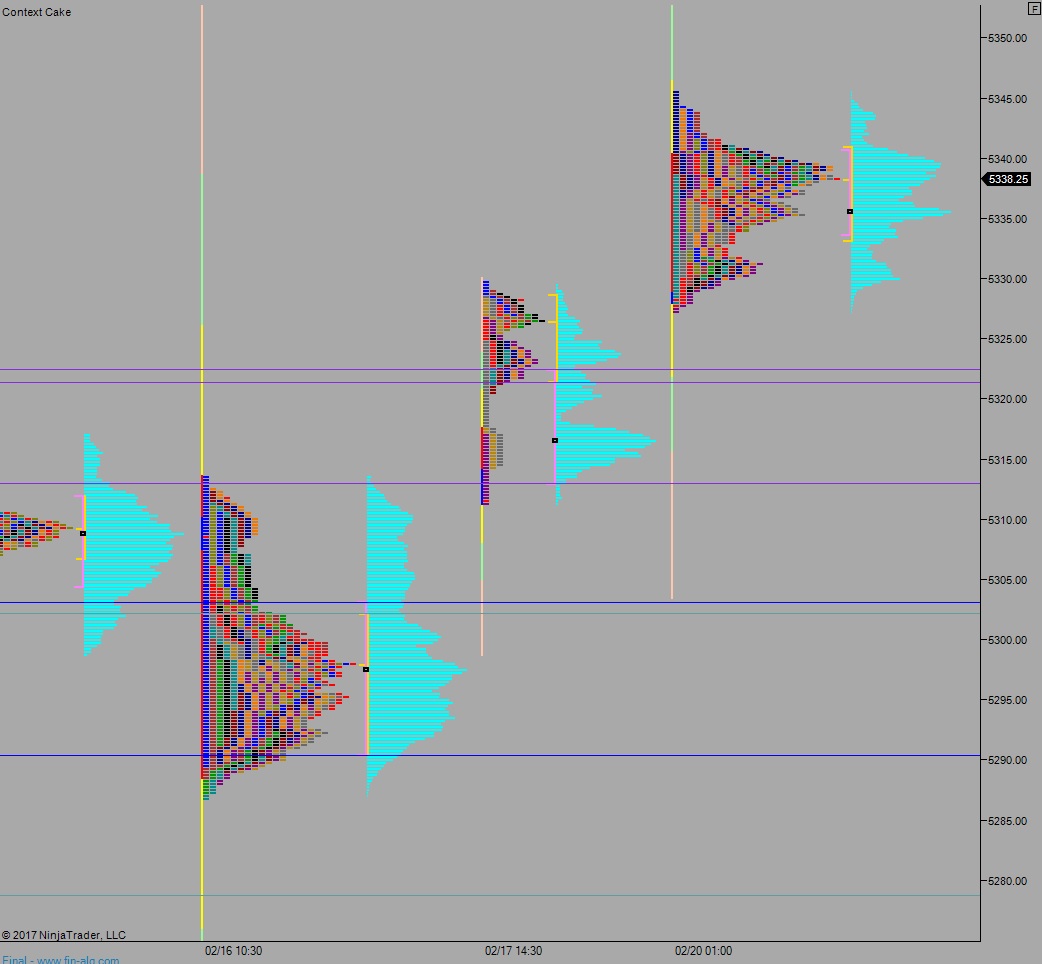

Heading into today my primary expectation is for sellers to work into the overnight inventory and take out overnight low 5331.75. From here look for a move to close the weekly gap down at 5325.25. Look for buyers down at 5322.50 and two way trade to ensue.

Hypo 2 buyers press off the open, take out overnight high 5341.50 then probe above President’s Day high 5345.50 and into open air briefly before two way trade ensues.

Hypo 3 rally continues, stretch target up at 5358.25.

Levels:

Volume profiles, gaps, and measured moves: