September 2016 is a month with 5 Thursdays and Fridays. Yesterday at 9:30am the majority of active traders rolled forward to the December futures contracts. I will continue to report and trade based off the September contract until next week.

NASDAQ futures are coming into Friday gap down after an overnight session featuring normal range and volume. Sellers pressed down near last week’s lows after breaking the market loose around 7am.

On the economic calendar today we have the Baker Hughes rig count at 1pm.

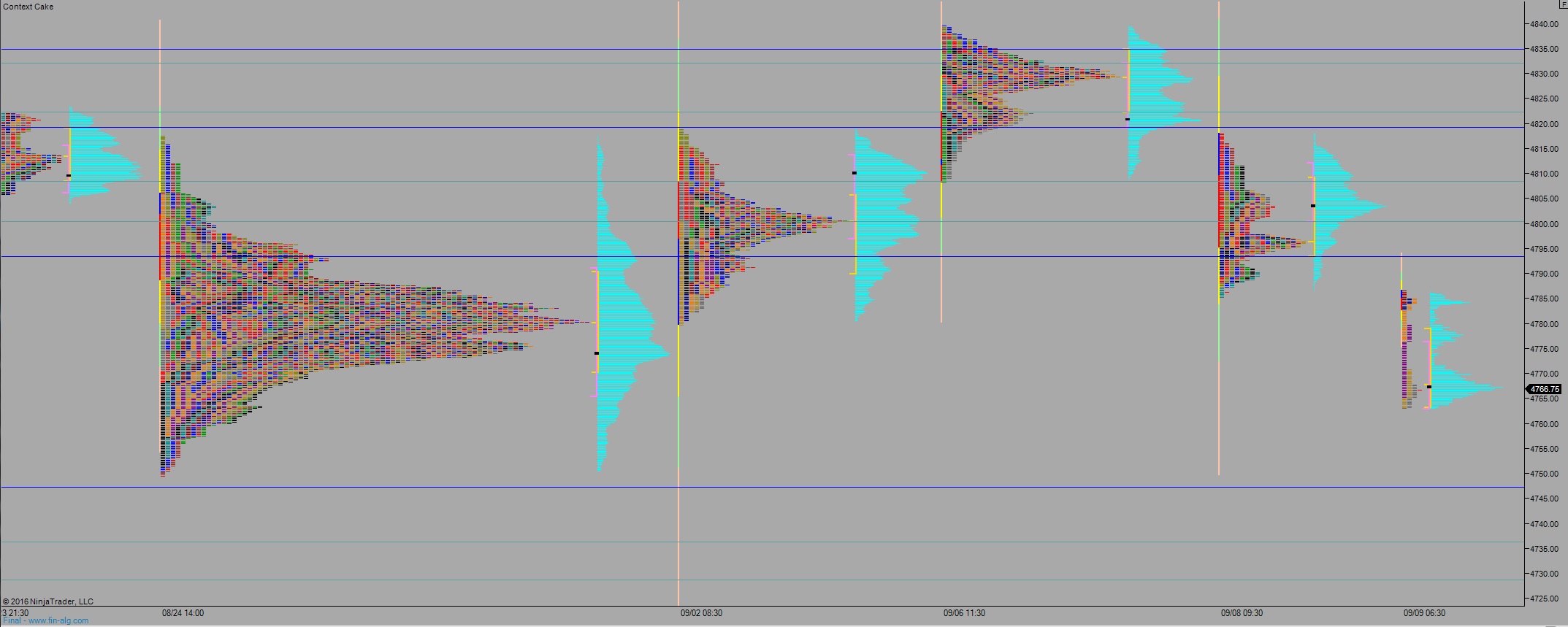

Yesterday we formed a normal variation down. Price opened down below Wednesday’s range and buyers could not retake the range. Instead sellers became initiative on the session, extending price lower.

Heading into today my primary expectation is for buyers to push into the overnight inventory up to 4780. Look for sellers to reemerge here and take out overnight low 4763.25. Buyers show up around 4760 and two way trade ensues.

Hypo 2 sellers gap-and-go, take out 4760 and work lower to target the open gap down at 4743.50 before two way trade.

Hypo 3 buyers firm up and close the overnight gap up to 4792.25 then set their sights on overnight high 4798. This could trigger continued buying to close Wednesday’s gap up at 4829.

Levels:

Volume profiles, gaps, and measured moves: