NASDAQ futures are coming into Friday gap up after a session featuring extreme range on elevated volume. Price managed to hold above Thursday’s mid before spending the rest of globex trade working higher. The market stalled out just below the weekly high print from Wednesday. At 8:30am Advance Retail Sales data came out slightly better than expected. The initial reaction is buying.

Also on the economic calendar today we have the preliminary February read of U. of Michigan Confidence at 10am and the Baker Hughes Rig Count at 1pm.

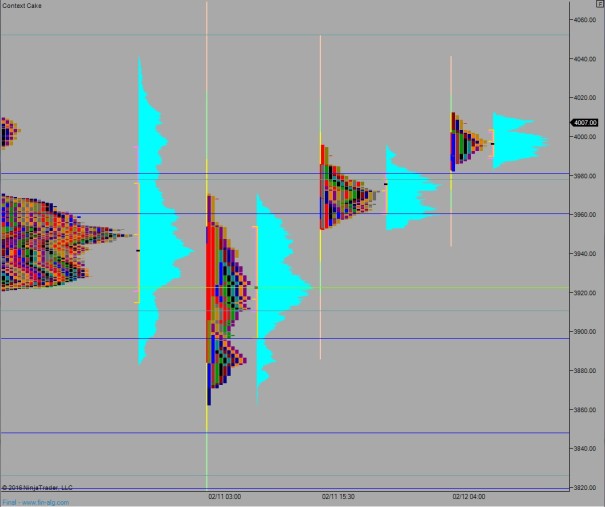

Yesterday we printed a neutral extreme up. Price opened gap down and after briefly going range extension down buyers responded. A second attempt was made to go lower but buyers defended again, pushing us through the range and neutral, then closing us in the upper quadrant to earn a neutral extreme day.

Heading into today my primary expectation is for sellers work into the market and test the 3980 handle. Responsive buyers defend here and work to take out overnight high 4012.50. Price rallies up to 4050 before two way trade ensues.

Hypo 2 buyers gap and go higher, push up through 4012.50 and push to target 4050 before two way trade ensues.

Hypo 3 full gap fill down to 3963. Look for responsive buyers down at 3960 and two way trade ensues below 3980.

Hypo 4 gap fill down to 3963, responsive buyers at 3960 are overrun and we work to take out overnight low 3953. Liquidation takes hold and we continue lower. Stretch targets are 3922.50 then 3910, and 3896.50.

Levels: