The logic behind a false move can be a bit complicated. The market breaks out higher after a period of consolidation and spends several periods facilitating trade well in the direction of the breakout. The auction is going well and the expected effect is for higher prices to entice new buyers into the marketplace and to continue probing higher to incentivize sellers to come in. Once sellers have become incentivized, there is a reasonable expectation that we might see trapped shorts begin to cover on the pullback thus creating demand. There is also a likelihood for participants who missed the move to eagerly participate on the pullback. That was not the case yesterday which is why we use words like “might” and “likely” and “probable” and “could” avoiding absolutes and accepting that anything can and will happen in the marketplace.

Instead we reversed the entire move and price was thrown back to the scene of the breakout only a few short hours later. This is not normal and can produce some unexpected effects. Longs initiated during the rally are negative, some longs initiated during the consolidating building up to the rally are negative while others are flat, and shorts initiated on the way down have the confidence of a bearish candle print. Sellers might take this opportunity to press into the vulnerability of the longs thus producing a liquidation, and there is profile context which will signal to us where this will occur.

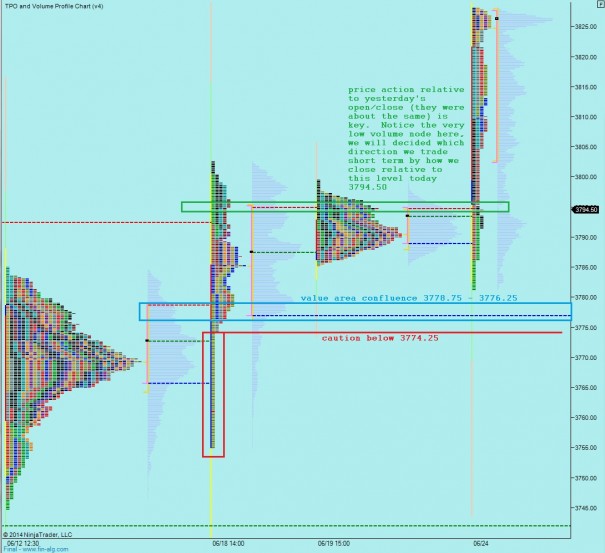

I will only present the regular trading hour market profile for the Nasdaq this morning because I want you to actually enlarge this file and think about why and where it makes sense to expect liquidation to take hold. These are the levels I will be observing today:

If you enjoy the content at iBankCoin, please follow us on Twitter