The NASDAQ Composite was quiet overnight and printed a narrow range which essentially marked time. The resulting profile is very much of the bell curve variety with a slight imbalance to the downside.

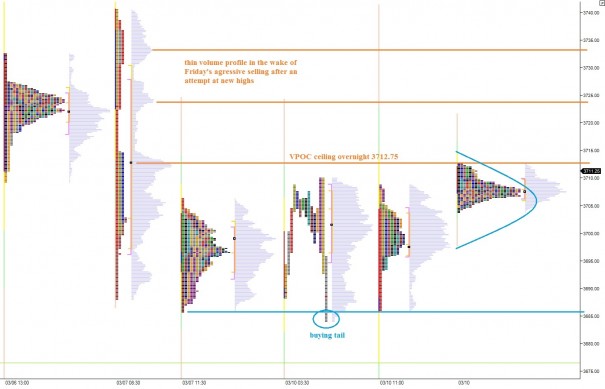

Yesterday we traded in a very balanced manner, only very briefly could we see signs of responsive buyers on the tape. They left footprints in the form of buying tails. This action occurred when price briefly broke last Friday’s low. It was at this moment we saw responsive buying overwhelm the sell flow and a new auction ensued. The short term timeframe is thus balanced with a slight edge given to the seller.

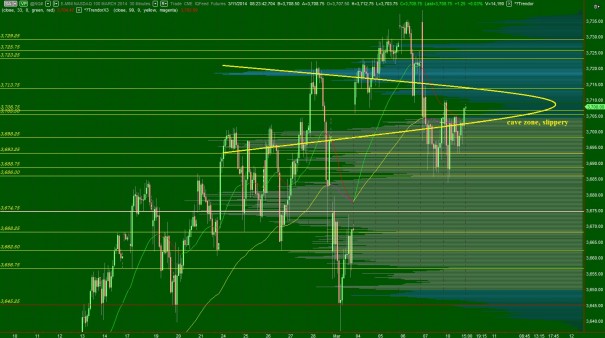

This is interesting, because early on Monday it appeared the sellers were putting together a win. They were able to range extend lower in the morning which made me hesitant to buy any new longs until I saw the responsive buying. Overall the intermediate term is balanced however, and we are set to open inside the “PTD” volume cave we broke down through on Friday. Thus today’s treatment of this low volume slip zone could set the tone for the rest of the week. Do sellers reject us out of this low volume zone? Do we fill the cave with volume, further aging intermediate term balance? Or do sellers launch us up and through? I will be assessing these three scenarios all day.

The long term auction is still firmly in the hands of the buyers. This can be seen as a series of higher highs and lows on the daily and weekly charts of the COMPQ. I have highlighted the volume cave we are set to open inside and also today’s market profile on the following two charts:

If you enjoy the content at iBankCoin, please follow us on Twitter