The markets engaged a one directional drift this week after news of a The Fed tapering on December 18th reignited the spirit of the long term directional control—the bull. As the [Santa] rally has progressed we start to see the marketplace working into equilibrium. This process can be seen as overlapping price action. As our balance establishes further it will be seen as overlapping value areas.

These prints are the result of sell orders entering the market with a force equal to and at times greater than the force applied by buy orders. As the rally ages, we eventually reach balance or see a sharp rejection lower by selling.

This has not occurred yet. However, we may see profit taking start to kick in today ahead of the weekend. This does not mean you should automatically take profit in your own portfolio, only that your plans should be assessed on individual stocks and consider taking profit or selling if your desired target has been achieved.

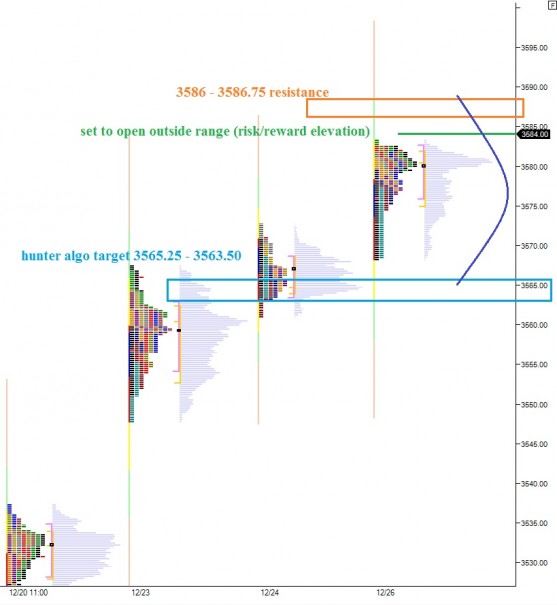

We also want to measure any downward move and whether it makes logical sense in the auction process, or whether we are seeing a shift in control away from the long term trend. Should we see selling enter the market, my expectation is for algorithms to begin hunting stop orders. This action could take price in the NASDAQ futures down to the support zone from 3565.25 – 3563.50.

I have highlighted this zone as well as a few other market profile thoughts on the following chart:

If you enjoy the content at iBankCoin, please follow us on Twitter