Yesterday’s liquidation break took out nine days worth of auctions. Going into 9am, we are set to open lower, suggesting a rejection of the entire upper range. The globex session appears to have put in its lows after selling off sharply during the European market. Asian markets were weak too, thus I expect my Japan stocks to gap lower.

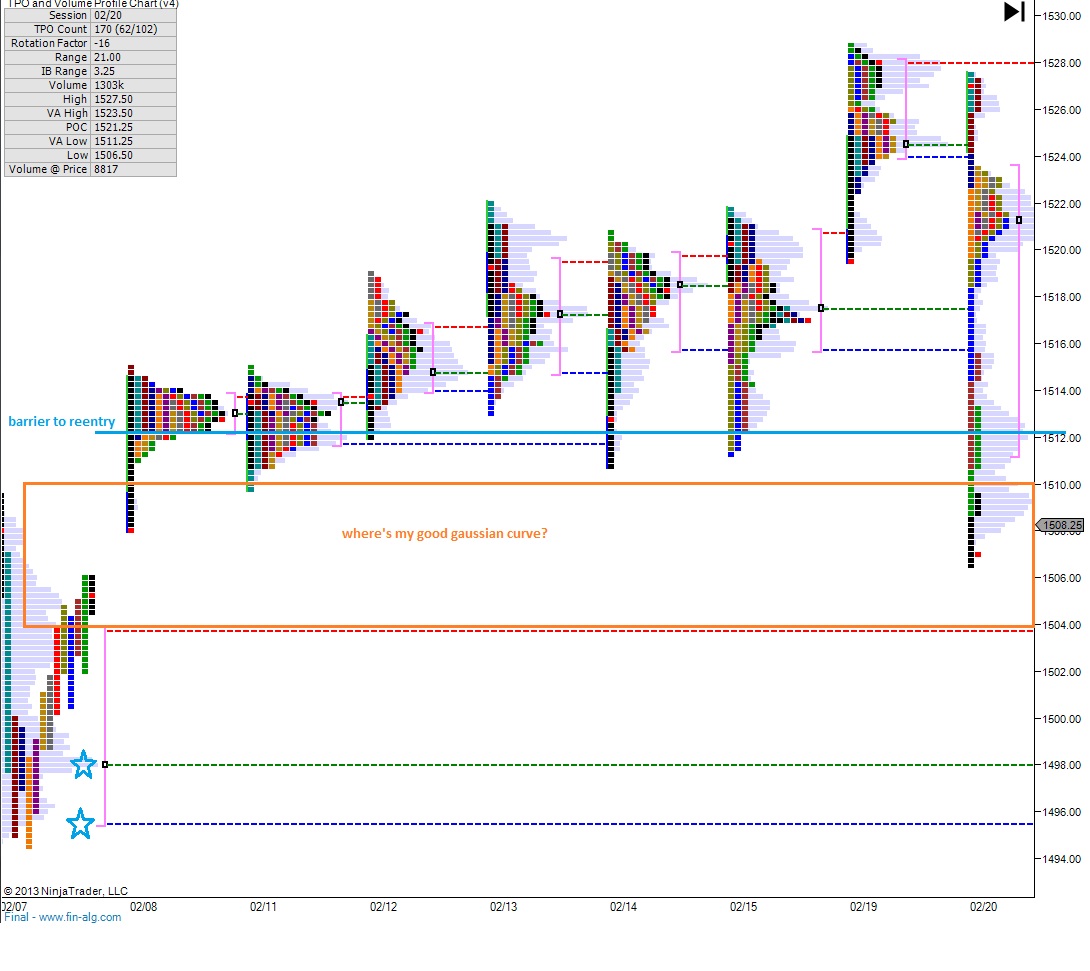

Overnight, the market found buyers around 1501.50. I had to stretch my profile chart back to 02/07 (two Thursday’s back) to find reference points. The first thing that catches my eye is the naked VPOC from 02/07 at 1498. Since we’re down here, there’s a strong proclivity for sellers to target this level. Should the selling continue through the value area, I’m going to be looking for buyers at the value area low of 1495.75. If they decide not to show up at these levels, I will drastically reduce exposure.

Talking upside and near-term range, there hasn’t been a health auction between the 1510 – 1504 region. We’re set to open near these levels. If I see balanced trade occurring (a nice, Gaussian bell) within these levels, I consider that constructive. I’m looking for a balanced session and a compressed range before I get back my “buy the dip” mentality.

The market has certainly been worse to bulls than this. But respect the action and get out of the way if everyone starts running for the door. Should we stabilize, keep your head clear, look for signs of buyers initiating trades, and go and do likewise where quality chart setups present themselves.

If you enjoy the content at iBankCoin, please follow us on Twitter