[youtube://http://www.youtube.com/watch?v=5pxp61tYJcw 450 300]

Comments »“Pretty Soon We Will Own the Fucking Air That You Breathe”

“Giant bank holding companies now own airports, toll roads, and ports; control power plants; and store and hoard vast quantities of commodities of all sorts. They are systematically buying up or gaining control of the essential lifelines of the economy. How have they pulled this off, and where have they gotten the money?

In a letter to Federal Reserve Chairman Ben Bernanke dated June 27, 2013, US Representative Alan Grayson and three co-signers expressed concern about the expansion of large banks into what have traditionally been non-financial commercial spheres. Specifically:

[W]e are concerned about how large banks have recently expanded their businesses into such fields as electric power production, oil refining and distribution, owning and operating of public assets such as ports and airports, and even uranium mining.

After listing some disturbing examples, they observed:

According to legal scholar Saule Omarova, over the past five years, there has been a “quiet transformation of U.S. financial holding companies.” These financial services companies have become global merchants that seek to extract rent from any commercial or financial business activity within their reach. They have used legal authority in Graham-Leach-Bliley to subvert the “foundational principle of separation of banking from commerce”. . . .

It seems like there is a significant macro-economic risk in having a massive entity like, say JP Morgan, both issuing credit cards and mortgages, managing municipal bond offerings, selling gasoline and electric power, running large oil tankers, trading derivatives, and owning and operating airports, in multiple countries.

A “macro” risk indeed – not just to our economy but to our democracy and our individual and national sovereignty. Giant banks are buying up our country’s infrastructure – the power and supply chains that are vital to the economy. Aren’t there rules against that? And where are the banks getting the money?

How Banks Launder Money Through the Repo Market

In an illuminating series of articles on Seeking Alpha titled “Repoed!”, Colin Lokey argues that the investment arms of large Wall Street banks are using their “excess” deposits – the excess of deposits over loans – as collateral for borrowing in the repo market. Repos, or “repurchase agreements,” are used to raise short-term capital. Securities are sold to investors overnight and repurchased the next day, usually day after day.

The deposit-to-loan gap for all US banks is now about $2 trillion, and nearly half of this gap is in Bank of America, JP Morgan Chase, and Wells Fargo alone. It seems that the largest banks are using the majority of their deposits (along with the Federal Reserve’s quantitative easing dollars) not to back loans to individuals and businesses but to borrow for their own trading. Acquiring a company or a portion of a company mostly with borrowed money is called a “leveraged buyout.” The banks are leveraging our money to buy up ports, airports, toll roads, power, and massive stores of commodities.

Using these excess deposits directly for their own speculative trading would be blatantly illegal, but the banks have been able to avoid the appearance of impropriety by borrowing from the repo market. (See my earlier article here.) The banks’ excess deposits are first used to purchase Treasury bonds, agency securities, and other highly liquid, “safe” securities. These liquid assets are then pledged as collateral in repo transactions, allowing the banks to get “clean” cash to invest as they please. They can channel this laundered money into risky assets such as derivatives, corporate bonds, and equities (stock).

That means they can buy up companies. Lokey writes, “It is common knowledge that prop [proprietary] trading desks at banks can and do invest in a variety of assets, including stocks.” Prop trading desks invest for the banks’ own accounts. This was something that depository banks were forbidden to do by the New Deal-era Glass-Steagall Act but that was allowed in 1999 by the Gramm-Leach-Bliley Act, which repealed those portions of Glass-Steagall.

The result has been a massively risky $700-plus trillion speculative derivatives bubble. Lokey quotes from an article by Bill Frezza in the January 2013 Huffington Post titled “Too-Big-To-Fail Banks Gamble With Bernanke Bucks“:

If you think [the cash cushion from excess deposits] makes the banks less vulnerable to shock, think again. Much of this balance sheet cash has been hypothecated in the repo market, laundered through the off-the-books shadow banking system. This allows the proprietary trading desks at these “banks” to use that cash as collateral to take out loans to gamble with. In a process called hyper-hypothecation this pledged collateral gets pyramided, creating a ticking time bomb ready to go kablooey when the next panic comes around.

That Explains the Mountain of Excess Reserves….”

[youtube://http://www.youtube.com/watch?v=la8wY-R_fqU 450 300] Comments »

Hindenburg Omen Reaches Highest Levels Since 2008 Crash

“Are we heading for a major stock market decline? Warnings about a crash of the financial markets are quite common these days, and usually they don’t materialize. But this time may be different. A number of top analysts are pointing out the fact that the biggest cluster of “Hindenburg Omens” has appeared since the last stock market crash. And those that have studied this insist that the more “Hindenburg Omens” there are in a cluster, the stronger the signal is. Meanwhile, another very disturbing sign is the fact that the yield on 10 year U.S. Treasuries is starting to soar again. On Tuesday it shot up from 2.62% to 2.727%. As I have written about previously, the yield on 10 year U.S. Treasuries is the most important number in the U.S. economy right now. If that number continues to rise, it is going to be very, very bad news for the financial system.

But before I discuss rising interest rates any further, I want to talk about this unusual cluster of Hindenburg Omens that we have just witnessed. In a previous article, I shared a list of the criteria that are commonly used to determine whether a Hindenburg Omen has appeared or not…

1. The daily number of NYSE new 52 Week Highs and the daily number of new 52 Week Lows must both be greater than 2.2 percent of total NYSE issues traded that day.

2. The smaller of these numbers is greater than or equal to 69 (68.772 is 2.2% of 3126). This is not a rule but more like a checksum. This condition is a function of the 2.2% of the total issues.

3. That the NYSE 10 Week moving average is rising.

4. That the McClellan Oscillator ( a market breadth indicator used to evaluate the rate of money entering or leaving the market and interpretively indicate overbought or oversold conditions of the market)is negative on that same day.

5. That new 52 Week Highs cannot be more than twice the new 52 Week Lows (however it is fine for new 52 Week Lows to be more than double new 52 Week Highs).

When the Hindenburg Omen makes an appearance, it is supposedly a signal that the U.S. stock market will likely experience a significant decline within the next 40 days.

But of course this has not always happened when a Hindenburg Omen has appeared. However, what we are seeing right now is a highly concentrated cluster of Hindenburg Omens. According toSentimenTrader’s Jason Goepfert, the last time such a cluster appeared was before the last stock market crash…

Sometimes a topic in the market takes hold and it’s hard to shake it off. One of those is the technical “market crash” signal called the Hindenburg Omen.

It has its boosters and its detractors, and we’re not going to get caught up in debating its merits. We’ve discussed it for 12 years, always with the same arguments.

On June 10th, we outlined the market’s historical performance after suffering at least 5 signals from the Hindenburg Omen within a two-week period. Stocks were consistently weak afterward, and proved to be so again, at least for a while.

With the latest market rally, the Omens are flaring up again.There have been 5 Omens triggered out of the past 8 trading sessions (your data may vary—we’re using the same sources we’ve always used for historical data). That’s actually the closest-grouped cluster since early November 2007.

It’s extremely rare to see as many Omens occurring together as we’ve seen over the past 50 days. The last time was prior to the bear market in 2007.

The time before that was prior to the bear market in 2000.

Will the pattern hold up this time?

We’ll see.

But without a doubt we have been witnessing some very unusual activity in the markets over the past couple of weeks. In fact, according to Tyler Durden of Zero Hedge, we have now seen a Hindenburg Omen occur five times in the last seven trading days…

For the 5th time in the last 7 days, equity market internals have triggered an anxiety-implying Hindenburg Omen. Based on our data, this is the most concentrated cluster of new highs, new lows, advancing/declining based confusion on record. The last few occurrences have not ended well (though obviously not disastrously) but as the creator of the ‘Omen’ notes, the more occurrences that cluster, the stronger the signal.

But the Hindenburg Omen is not the only sign that a stock market crash may be coming. Marc Faber, the publisher of the Gloom, Boom & Doom Report, says that the markets are repeating the exact same patternthat we saw just before the stock market crash of 1987…

“In 1987, we had a very powerful rally, but also earnings were no longer rising substantially, and the market became very overbought,” Faber said on Thursday’s “Futures Now.” “The final rally into Aug. 25 occurred with a diminishing number of stocks hitting 52-week highs. In other words, the new-high list was contracting, and we have several breaks in different stocks.”

Faber says that’s exactly where we find ourselves this August.

Faber is projecting a stock market decline of “20 percent, maybe more” in the month ahead.

Meanwhile, as I mentioned at the top of the article, the yield on 10 year U.S. Treasuries shot up to 2.727% today. The Federal Reserve is starting to lose control of long-term interest rates, and the only way that Fed officials are going to be able to get control back is to substantially raise the level of quantitative easing that they are doing, but of course that would create a whole bunch of other problems.

For now, the Fed keeps dropping hints that “tapering” is coming. But if the Fed does “taper”, there might not be any support for bond prices from the private sector. BAML credit strategist Hans Mikkelsenrecently detailed why this is the case…

Since the financial crisis, Treasuries have been supported by numerous types of investors, including mutual funds/ETFs, banks, [emerging market] central banks and the foreign official sector (in addition to the Fed of course). However, these four sources of Treasury demand are unlikely to support the market in the short term going forward.

First, with continued outflows from non-short term high grade bond funds, money managers are unlikely to provide support for Treasuries any time soon.

Second, with increasing loan demand reducing the need for banks to support profitability by buying Treasuries, as well as significant mark-to-market losses in [available-for-sale] portfolios that in the future will count against capital, banks are unlikely to add long-duration assets in a rising interest rate environment.

Third, in light of continued depreciation of [emerging market] currencies, it appears unlikely that [emerging market] countries are experiencing inflows that need to be reinvested in Treasuries.

Finally, custody holdings of Treasuries continue to decline, suggesting foreign official sales of Treasuries.

If the yield on 10 year U.S. Treasuries continues to rise sharply over the coming months, that could potentially cause the 441 trillion dollar interest rate derivatives bubble to implode. As John Embry recently told King World News, that would be “disastrous” for the global financial system…”

Comments »Shrinking Trade Deficit; Good or Bad ?

“All those counting on a weaker dollar and rising U.S. corporate profits will be doubly surprised.

That the U.S. trade deficit shrank to $34 billion in June is being presented as good news all around (no surprise there, as all news is presented as good news). The petroleum boom in the U.S. has pushed oil imports down by over $2 billion a month to $10 billion/month, and non-petroleum trade generated a deficit of $37 billion/month, down $5 billion.

Slowing imports and modestly higher exports are being presented as reasons for stronger GDP growth going forward. Oil Boom Helps to Shrink U.S. Trade Deficit by 22%.

Nice, except nobody is talking about the negative consequences of a shrinking trade deficit on U.S. corporate profits. The financial media doesn’t talk about this because it doesn’t understand the connection, which is based on Triffin’s Paradox, a dynamic I have discussed in depth a number of times:

The basic idea here is that the world’s reserve currency must expand to meet the needs of global trade. Most commentators view the U.S. dollar through the prism of the domestic economy: Federal Reserve money-printing increases the supply of dollars, depreciating its value, and this policy is intended to competitively devalue the dollar to increase U.S. exports.

Here’s the heart of Triffin’s Paradox: Triffin’s Paradox: when one nation’s fiat currency is used as the world’s reserve currency, the needs of the global trading community are different from the needs of domestic policy makers.

Understood in this light, rising U.S. trade deficits in the 1990s and 2000s were required to provide enough dollars to lubricate rising global trade:

Trading nations need dollars to lubricate trading and as foreign exchange reserves that bolster the value of their own currency and provide the asset base for the expansion of credit within their own nation.

What does a declining trade deficit mean? …”

Comments »A Message From Nigel Farage

[youtube://http://www.youtube.com/watch?v=IB8lJR63Oxw 450 300] Comments »

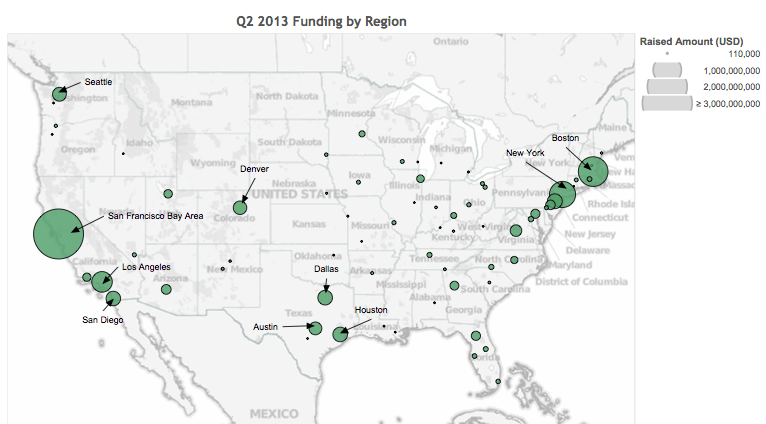

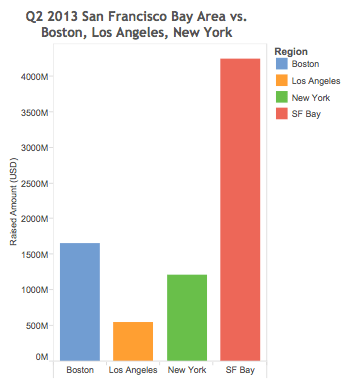

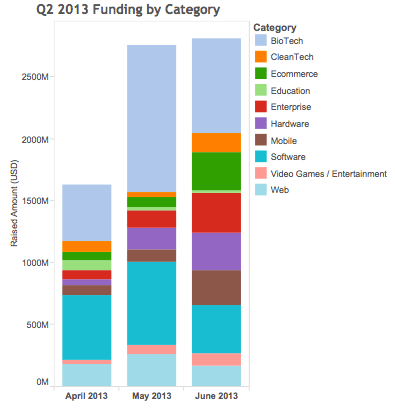

Venture Capital Investments Double in Q2

“Total new capital invested in the United States tech industry rose from $1.9 billion in April to $3.8 billion in June, a 100 percent increase in two months, according to quarterly data from CrunchBase. The data, which is specific to the United States, breaks down new venture capital raised by round type, investor, company, geography and more.

In the second quarter of 2013, $9.2 billion was invested in over 1,347 rounds. The rounds break down to 500 angel rounds, 306 Series A, 109 Series B, 102 Series C and later, and 330 unattributed rounds. This data set doesn’t include some investments, such as private equity and post-IPO investments, and thus is lower than the total funding for the quarter.

The San Francisco Bay Area still dominates other regions, as companies in the Bay Area raised more capital in Q2 than Boston, New York, and Los Angeles, the next three regions in total capital raised, combined.

Bay Area companies raised $3.2 billion in 316 rounds, while Boston companies raised $1 billion in 84 rounds and New York startups raised $800 million in 142 rounds. Los Angeles companies raised a bit under $500 million in 81 rounds.

Biotech companies led the way in amount of money raised, followed by software startups. On average, Biotech companies captured 30 percent of total funding per month, followed by software at 19 percent.

The most active investors, in terms of number of rounds they participated in, were….”

Comments »Are Bank Reserves Held at the Fed the ‘Largest Scam in History’ ?

“Banks’ excess reserves at FED is one of the biggest scam by the FED and there is a conspiracy of silence as to its actual implications. Economists and financial analysts spewing nonsense to mislead and divert attention to non-issues so that the public is kept in the dark.

The issue of banks’ reserves at the FED and other central banks in the world is a complex subject with much technical jargons that confuses a lot of people. Besides, don’t be surprised that your bank branch manager on Main Street as well as lecturers in finance and economics are also ignorant on this issue. In the case of the latter, this subject is hardly taught in universities. And this is the reason why the scam has not been exposed till today.

But, for those who have a basic idea of bank reserves and how this huge amount of “excess reserves” have been created by the FED, have you asked yourself, “Why have I not spotted this scam earlier?”

Many have been taken in by the propaganda that “excess reserves” is the means to encourage banks to extend credit (give out loans) to desperate borrowers who needed urgent funds to survive and to jump-start their businesses. This propaganda is grounded on the assumption that there is insufficient liquidity in the market.

This assumption is misleading.

What are Excess Reserves

The latest figures obtained from the H.3 release from the Board of Governors of the Federal Reserve System (the FED) shows excess reserves of about $1.794 trillion (data as of April 17, 2013), This level of excess reserves is unprecedented and is the highest since reserves were legislated as a requirement.

Please read the below paragraph carefully, ponder deeply before proceeding further. Don’t rush. It is important that you understand this simple fact as otherwise you would not appreciate the audacity of this financial scam!

Excess reserves are the surplus of reserves against deposits and certain other liabilities that depository institutions (collectively referred to as “banks”) hold above the statutory amounts that the FED requires in accordance with the law. The general requirement is that banks maintain reserves at least equal to ten percent of liabilities payable on demand. There is now data to show that as much as 50% of these “excess reserves” are held for United States banking offices of foreign banks.

Let me elaborate. Banks receives deposits from their customers which are inter-alia placed in current accounts (checking accounts) or time deposits (fixed deposit accounts) and which the customer can at any time withdraw from the bank. But, banking practice shows that at any one time, only a small fraction of customers would withdraw their deposits in full. So, there was no need for banks to keep all the deposits in their vaults to meet such a demand for payment. Laws were enacted to allow banks to keep in reserve a small amount of monies to meet such demands.

That being the case – if only 10% reserves is all that is required according to banking regulations to meet repayment demands, why should there be such a huge amount of reserves, beyond the legal requirement of 10%?

Keep this question at the back of your mind to understand the huge scam by the FED.

A Slight Digression

In a previous article, I had exposed the fact that when a customer deposits monies in a bank, he is in law a “creditor” (he has loaned the monies to the bank) and the bank is a “debtor” (and he can use the money in any way at his absolute discretion, even to speculate).

This is because the ownership of the money has been transferred to the bank. The money is no longer the money of the customer. It now belongs to the bank. And as long as the bank is solvent, and there is a demand for repayment of the deposit, the law of contract stipulates that the bank must repay together with the agreed interest that has accrued.

However, if at the time when demand for repayment is made, the bank is bankrupt (i.e. in a liquidation) then the depositor/customer in law is deemed an “unsecured creditor” and must join the queue of all unsecured creditors to share the proceeds of any remaining assets after all secured creditors have been paid. If there are no remaining assets, the depositors get zilch! Ouch!!!!!!

That is why and as illustrated in the bank confiscation of deposits in Cyprus banks acting in concert with central banks can expropriate all customers’ deposits to pay their secured creditors.

I will elaborate on this issue later.

Let’s return to the issue of excess reserves.

How Did The Excess Reserves Balloon To A Massive US$1.794 Trillion? A Simple Summary

The Fed’s overall balance sheet has expanded from about $909 billion before the crisis (i.e. before 2008) to about $3.3 trillion in 2013. Of the $2.4 trillion increase, approximately $1.8 trillion is excess reserves.

Banks were up to their eyeballs in toxic assets (financial sewage) and they are drowning in this cesspool but for the rescue efforts of the FED and other central banks they would have sunk to the bottom of the cesspool.

First Stage of Excess Reserves Scam

From the diagram below, you will see that the FED created trillions of money out of thin air by a digital entry in its books to purchase the toxic assets (financial sewage) in batches from the banks. The objective of QEs is to save the banks and to save the US Treasury from bankruptcy and not Joe Six-Packs. However, in this article we are focusing on the banks…..”

Comments »The Fed’s Williams Discusses QE Uncertainties

“Federal Reserve Bank of San Francisco President John Williams, who has never dissented from a Fed decision, said critics of the central bank including Nobel Prize-winning economist Paul Krugman disregard how bond buying by the Fed is an untested tool with an ambiguous impact.

“The claim that the Fed is responding insufficiently to the shocks hitting the economy rests on the assumption that policy is made with complete certainty about the effects of policy on the economy,” Williams said in a paper posted Tuesday on the San Francisco Fed’s website. “Nothing could be further from the truth.”

The 29-page paper by Williams is an academic response to critics such as Krugman who have said high unemployment and low inflation show the Fed hasn’t done enough to fuel economic growth. The central bank is currently considering reducing its $85 billion in monthly bond purchases even with unemployment at 7.6 percent and the Fed’s preferred inflation index showing prices rising 1 percent from a year earlier, below the central bank’s 2 percent goal.

“Policymakers are unsure of the future course of the economy and uncertain about the effects of their policy actions,” Williams said. “Uncertainty about the effects of policies is especially acute in the case of unconventional policy instruments such as using the Fed’s balance sheet to influence financial and economic conditions.”

Williams cited Krugman, a Princeton University economist, by name in his paper. Krugman didn’t immediately respond to a request for comment in a phone message and an e-mail.

Moderation ‘Defense’

Williams, who titled his paper “A Defense of Moderation in Monetary Policy,” told reporters on June 28 that he supported the timetable for winding down purchases that Fed Chairman Ben S. Bernanke outlined in his June 19 press conference. Bernanke said the Fed could start shrinking the pace of purchases later this year and end them around mid-2014 if the economy performs in line with the central bank’s forecast….”

Comments »Perma Bear Rosenberg Sings a Bulls Song

“….since Friday’s jobs report, Rosenberg’s tone has turned decidedly bullish.

Indeed, he has already published his “Ten Reasons To Love The U.S. Employment Report.”

In his latest Breakfast With Dave note, Rosenberg goes even further:

JOBS DATA A GAME CHANGER

First came the healing in the credit markets in 2009-2010.

Then came the healing in the housing market from 2011 to now.

And now we have the third act in full swing, which is the healing of the labour market….”

Comments »Gapping Up and Down This Morning

Heads Up on This Week’s Fed Speak

“The big show this week will be a speech on Wednesday from Fed Chair Ben Bernanke.

It’s titled: “The First 100 Years of the Federal Reserve: The Policy Record, Lessons Learned, and Prospects for the Future” and there’s going to be a Q&A.

So he could really talk about anything, including, perhaps, his own future (fingers crossed).

Fedspeak is always a market obsession, but lately that obsession has been turned to 11, given all of the concern about slowing the pace of QE, and how far we are from the first rate hike. Lately the “ZIRP4EVA” crowd has gone pretty silent, and markets are pricing in the possibility of a rate hike sometime in late 2014, in part due to shifts in the Fed’s language, and in part because the pace of job creation has accelerated. In recent months, the economy has been averaging nearly 200K jobs created, which is a nice step up from the approximately 150K pace from months’ previous.

So Bernanke’s speech on Wednesday will be watched ultra-closely.

What will he say?…”

Comments »Quebec Rail Crash to Bring Scrutiny Over Oil Transport

“(Reuters) – The deadly train derailment in Quebec this weekend is set to bring intense scrutiny to the dramatic growth in North America of shipping crude oil by rail, a century-old practice unexpectedly revived by the surge in shale oil production.

At least five people were killed, and another 40 are missing, after a train carrying 73 tank cars of North Dakota crude rolled driverless down a hill into the heart of Lac-Megantic, Quebec, where it derailed and exploded, leveling the town center.

It was the latest and most deadly in a series of high-profile accidents involving crude oil shipments on North America’s rail network. Oil by rail – at least until now – has widely been expected to continue growing as shale oil output races ahead far faster than new pipelines can be built.

Hauling some 50,000 barrels of crude, the train was one of around 10 such shipments a month now crossing Maine, a route that allows oil producers in North Dakota to get cheaper domestic crude to coastal refiners. Across North America, oil by rail traffic has more than doubled since 2011; in Maine, such shipments were unheard of two years ago.

“The frequency of the number of incidents that have occurred raises legitimate questions that the industry and government need to look at,” said Jim Hall, managing partner of consultants Hall & Associates LLC, and a former chairman of the U.S. National Transportation Safety Board….”

Comments »Rookie Pilot at the Helm of $BA Plane Crash in San Fran

“(Reuters) – The pilot of the crashed Asiana plane at San Francisco airport was still “in training” for theBoeing 777 when he attempted to land the aircraft under supervision on Saturday, the South Korean airline said.

Lee Kang-kuk, whose anglicized name was released for the first time on Monday and differed slightly from earlier usage, was the second most junior pilot of four on board the Asiana Airlines aircraft. He had 43 hours of experience flying the long-range jet, the airline said on Monday.

The plane’s crew tried to abort the descent less than two seconds before it hit a seawall on the landing approach to the airport, bounced along the tarmac and burst into flames.

It was Lee’s first attempt to land a 777 at San Francisco airport, although he had flown there 29 times previously on other types of aircraft, said South Korean transport ministry official Choi Seung-youn. Earlier, the ministry said he had accumulated almost 10,000 flying hours, including 43 at the controls of the 777….”

Comments »Thompson Reuters Will Stop Disseminating Information Early to Selected Clients

“Thomson Reuters said it would suspend its early provision to a small group of clients of the widely watched Thomson Reuters/University of Michigan consumer sentiment data at the request of the New York Attorney General.

The news and information company has an agreement with the University of Michigan to allow some of its clients to receive the data 2 seconds before its other clients.

But the arrangement is the subject of a review by the office of New York Attorney General Eric Schneiderman, Thomson Reuters said in a statement on Sunday.

The review follows a series of media reports about the early release of the twice-monthly data and a lawsuit by a former Thomson Reuters employee, who says he was fired for whistle-blowing activity.

Thomson Reuters did not disclose how much clients paid for the data or how much it payed the University of Michigan.

The New York Times said on Sunday that some clients paid more than $6,000 a month for the 2-second advantage….”

Comments »Got Solar ?

“I love this chart

The chart encapsulates a long, steady decline that actually dates back to early 2011. The 50-day MA (blue line) more or less served as resistance during this protracted downtrend. Price bottomed last November at around $12 and has since more than doubled before the recent pullback.

So many bullish things in the chart, I don’t know where to start….”

Are U.S. Stocks at Risk Due to NSA Security Deals?

“Whatever you think about Edward Snowden, the National Security Agency (NSA) data collection he unveiled is more than a privacy issue. Investors should pay attention, too. The company whose shares you own may be lying to you — while Uncle Sam looks the other way.

Let’s step through this. I think you will see the problem.

Fact 1: U.S. financial markets are the envy of the world because we have fair disclosure requirements, accounting standards and impartial courts. This is the foundation of shareholder value. The company may lose money, but they at least told you the truth.

Fact 2: We now know multiple public companies, including Microsoft (MSFT), Google (GOOG), Facebook (FB) and other, gave their user information to NSA. Forget the privacy implications for a minute. Assume for the sake of argument that everything complies with U.S. law. Even if true, the businesses may still be at risk.

Fact 3: All these companies operate globally. They get revenue from China, Japan, Russia, Germany, France and everywhere else. Did those governments consent to have their citizens monitored by the NSA? I think we can safely say no.

Politicians in Europe are especially outraged. Citizens are angry with the United States and losing faith in American brand names. Foreign companies are already using their non-American status as a competitive advantage. Some plan to redesign networks specifically to bypass U.S. companies.

By yielding to the NSA, U.S. companies likely broke laws elsewhere. They could face penalties and lose significant revenue. Right or wrong, their decisions could well have damaged the business.

Securities lawyers call this “materially adverse information” and companies are required to disclose it. But they are not. Only chief executives and a handful of technical people know when companies cooperate with the NSA. If the CEO can’t even tell his own board members he has placed the company at risk, you can bet it won’t be in the annual report.

The government also gives some executives immunity documents, according to Bloomberg. Immunity is unnecessary unless someone thinks they are breaking the law. So apparently, the regulators who ostensibly protect the public are actively helping the violators.

This is a new and different investment landscape. Public companies are hiding important facts that place their investors at risk. If you somehow find out, you will have no recourse because regulators gave the offender a “get out of jail free” card. The regulatory structure that theoretically protects you knowingly facilitates deception that may hurt you, and then silences any witnesses….”

Comments »Gapping Up and Down This Morning

European Crisis Part Deux

“The news today is that the Euro crisis has returned to the Eurozone.

Portugal is crashing to the tune of 6% on the resignation of the Finance Minister, who says he can no longer support such harsh austerity.

Other markets are getting clubbed in the fallout. Spain is off nearly 3%. Italy nearly 2%.

The reality of Europe is that it’s a gigantic economic and political mess, where unemployment in the common currency area has hit a record of 12.1%.

On the other hand, it’s not like there aren’t signs of life in the economy, which appears to be coming out of recession.

Monday’s manufacturing PMI figures showed broad improvement across the Eurozone.

But although these numbers are encouraging from a cyclical standpoint, these tiny greenshoots barely begin to make a dent in the gigantic economic problem, which will likely cause reverberations for whole generations….”

Comments »The Fed Raises Capital Requirements for Large Banks

“The Federal Reserve Board has ratcheted up the amount of capital U.S. banks will need to hold. In the new rules approved by a vote in an open meeting today in Washington, the minimum capital U.S. banks will need to hold is higher than that set out in Basel III. Most banks are already in compliance with the rule, according to the Fed. Still, about 100 banks will end up raising $4.5 billion by 2019 to catch up to the rules.

Chairman Ben Bernanke complimented Fed staff for their work on the rule, which synthesized the positions of various agencies as well comments from the financial services industry. The Fed struck a “delicate balance” when it came to the needs of small banks, according to Bernanke, and he noted that between the stress test, capital reviews, and the new rules, regulation of large banks was coming together. He went on to say Fed examiners would have to keep a close eye on risk management.

The key elements of the new rule are the same for all banks, regardless of size. They include a new ratio—Tier 1 Common/risk weighted assets of 4.5 percent also known as the capital conservation buffer. (This would be 2.5 percent higher for the big internationally-active banks.) In addition, banks will have to have Tier 1 Capital of 6 percent of assets, vs. 4 percent under Basel III rules. They will have to keep total capital of 8 percent against risk-weighted assets, which is unchanged from the current Basel III rules.

One piece of the rules that has had banks and the markets worried is the leverage ratio, the amount banks can borrow to fund their activities, which can have a big impact on how much banks lend. There was talk the Fed would impose a higher leverage ratio than Basel III. Instead, the Fed stuck with a leverage ratio of 4 percent common equity to assets. Big banks would have to add a 3 percent cushion to that, with off balance sheet items being added to assets. This is the same treatment that Basel III proposed…..”

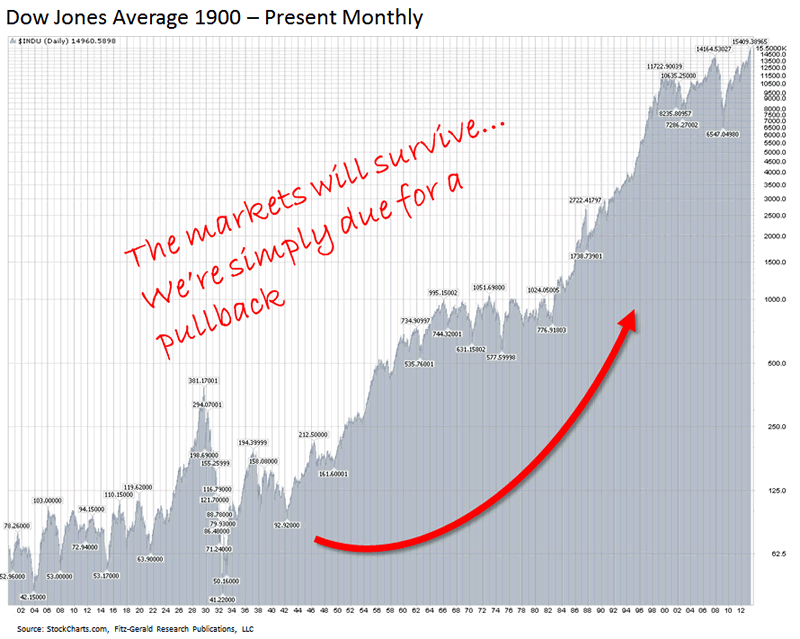

Comments »Don’t Time the Market, Your Chances of Success 50% of the Time are 0.0000000…

“Keith Fitz-Gerald writes: Many investors are understandably nervous when it comes to what the markets will do this week. Some are downright agitated.

My take? Keep calm.

The markets are doing what they need to be doing right now. The big swings we’re experiencing lately are not a sign that the markets are broken. Far from it.

On the heels of a 137.43% run off March 2009 lows, the pullback we experienced last week was absolutely normal. Long overdue, in fact.

I’m actually glad to see the volatility because it means the markets are working normally. A little give and take is absolutely essential when it comes to bigger gains and better returns.

Hard to stomach with everything that’s going on? Yup…which is why It’s worth noting that the markets have posted positive second half gains 26 of 26 times since WWII when the S&P 500 has turned in positive January and February returns. Those aren’t bad odds.

So now on with the show…what is the biggest mistake you can make right now?

Let me put it this way – it’s something locked in our brains. And it loses investors more money than every other investment “problem” combined. Let me show you something:

The probability of correctly timing the stock market just 50% of the time is a mere:

0.000000000000000000000000000000000000000000000000

000000000000000000000000000000000000000000000000

000000000000000000000000000000000000000000000000

000000000000000000000000000000000000000000000000

000000000000000000000000000000000000000000000000

000000000000000000000000000000000000000000000000

00000022883557%.

Jamie Dimon has higher odds of being the next Fed Chairman.

Why are we so incredibly bad at something that seems so basic? Like I said, it’s a “brain thing.” Let me explain…

The Volatile Mind

You hear a lot about the term volatility when the markets jump like this. But most people don’t really understand what it means. Volatility is simply a measure of the variation in price of any financial instrument over time. Unfortunately, the news has preconditioned investors to understand it as a negative influence because volatility rises when the markets drop.

In fact, quite the opposite is true. Volatility is really an expression of both up and down market movement. The key is in learning how to manage it so that your portfolio is not disproportionately impacted by either big down days or lost opportunity that comes from massive upswings.

Take the DOW, for instance. Over the past 110 years we’ve experienced two World Wars, multiple currency defaults, the Korean Conflict, Vietnam, the Gulf Wars, terrorism, presidential assassination, inflation, deflation, the Financial Crisis…and the index still rose 35,174%.

The markets have endured plenty of “volatility” over the years. In fact, if you look far enough back, you find that the markets actually do a pretty good job under conditions that should have killed them.

What makes short-term volatility so dangerous is the impact it has on your mind and specifically on your decision making.

I’ve written about this before but it bears repeating:Investors systematically deviate from otherwise rational decision making when the markets drop.

Scientists think this is because of decisions that get made under duress when the primary concern is losing money are made using reactionary segments of the brain rather than those that are anticipatory.

Whether Bernanke cuts QE has nothing to do with it. He and his central banking buddies are sideshow inputs at best. So is the notion of a Chinese credit crunch, a European meltdown or any of half a dozen other things investors are worried about at the moment.

The Good the Bad and…”

Comments »