“Keith Fitz-Gerald writes: Many investors are understandably nervous when it comes to what the markets will do this week. Some are downright agitated.

My take? Keep calm.

The markets are doing what they need to be doing right now. The big swings we’re experiencing lately are not a sign that the markets are broken. Far from it.

On the heels of a 137.43% run off March 2009 lows, the pullback we experienced last week was absolutely normal. Long overdue, in fact.

I’m actually glad to see the volatility because it means the markets are working normally. A little give and take is absolutely essential when it comes to bigger gains and better returns.

Hard to stomach with everything that’s going on? Yup…which is why It’s worth noting that the markets have posted positive second half gains 26 of 26 times since WWII when the S&P 500 has turned in positive January and February returns. Those aren’t bad odds.

So now on with the show…what is the biggest mistake you can make right now?

Let me put it this way – it’s something locked in our brains. And it loses investors more money than every other investment “problem” combined. Let me show you something:

The probability of correctly timing the stock market just 50% of the time is a mere:

0.000000000000000000000000000000000000000000000000

000000000000000000000000000000000000000000000000

000000000000000000000000000000000000000000000000

000000000000000000000000000000000000000000000000

000000000000000000000000000000000000000000000000

000000000000000000000000000000000000000000000000

00000022883557%.

Jamie Dimon has higher odds of being the next Fed Chairman.

Why are we so incredibly bad at something that seems so basic? Like I said, it’s a “brain thing.” Let me explain…

The Volatile Mind

You hear a lot about the term volatility when the markets jump like this. But most people don’t really understand what it means. Volatility is simply a measure of the variation in price of any financial instrument over time. Unfortunately, the news has preconditioned investors to understand it as a negative influence because volatility rises when the markets drop.

In fact, quite the opposite is true. Volatility is really an expression of both up and down market movement. The key is in learning how to manage it so that your portfolio is not disproportionately impacted by either big down days or lost opportunity that comes from massive upswings.

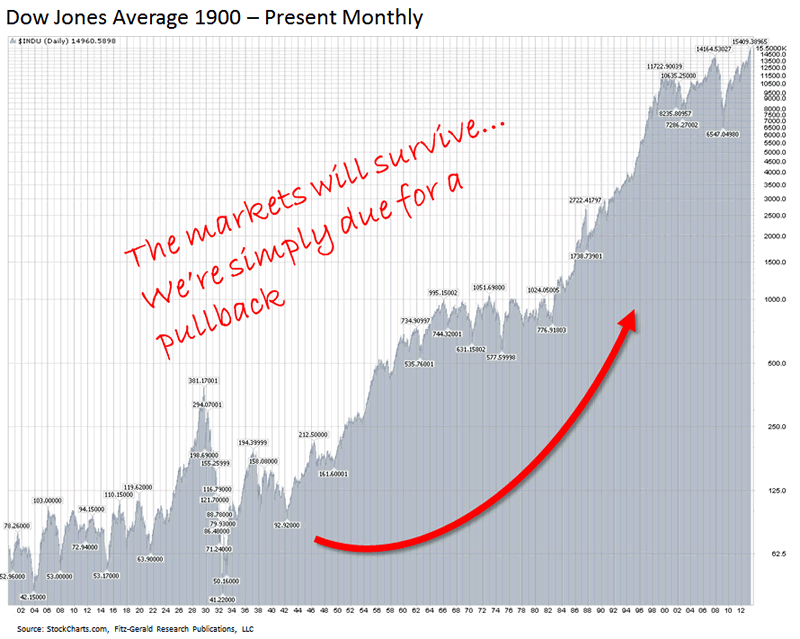

Take the DOW, for instance. Over the past 110 years we’ve experienced two World Wars, multiple currency defaults, the Korean Conflict, Vietnam, the Gulf Wars, terrorism, presidential assassination, inflation, deflation, the Financial Crisis…and the index still rose 35,174%.

The markets have endured plenty of “volatility” over the years. In fact, if you look far enough back, you find that the markets actually do a pretty good job under conditions that should have killed them.

What makes short-term volatility so dangerous is the impact it has on your mind and specifically on your decision making.

I’ve written about this before but it bears repeating:Investors systematically deviate from otherwise rational decision making when the markets drop.

Scientists think this is because of decisions that get made under duress when the primary concern is losing money are made using reactionary segments of the brain rather than those that are anticipatory.

Whether Bernanke cuts QE has nothing to do with it. He and his central banking buddies are sideshow inputs at best. So is the notion of a Chinese credit crunch, a European meltdown or any of half a dozen other things investors are worried about at the moment.

The Good the Bad and…”

If you enjoy the content at iBankCoin, please follow us on Twitter