“Americans – living in a huge country which has never really been invaded, and as the sole superpower – are famous for being out-of-touch with how the rest of the world thinks.

So my fellow Americans will probably be surprised to learn that the U.S. is more or less the only country in the world which has a favorable view of Israel.

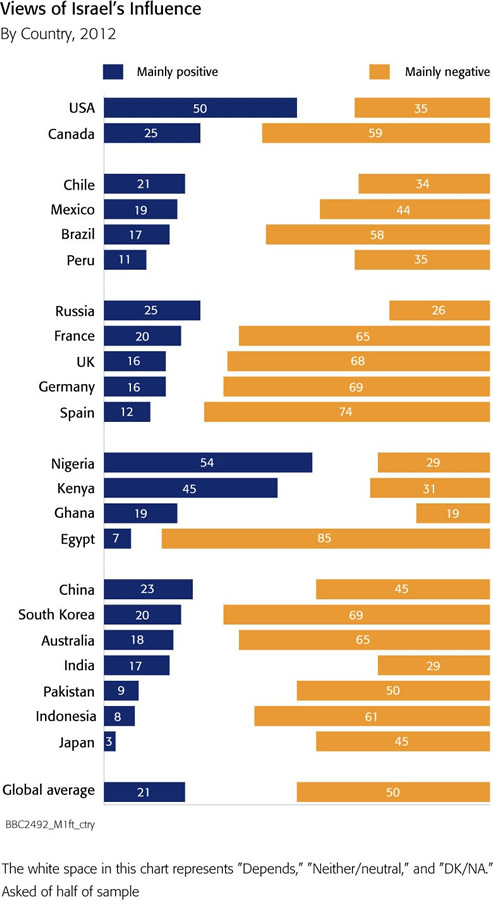

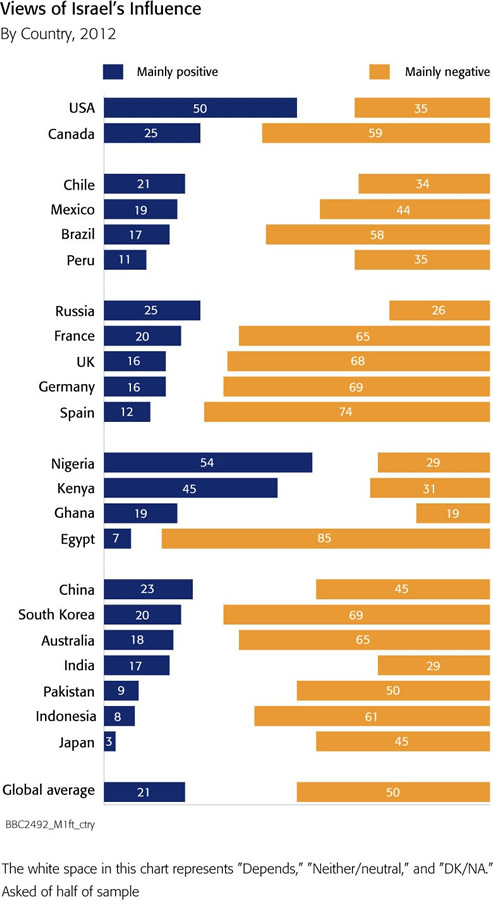

Specifically, a 2012 BBC poll found that the U.S. and Nigeria were the only countries of those polled in which the majority of people had favorable views of Israel:

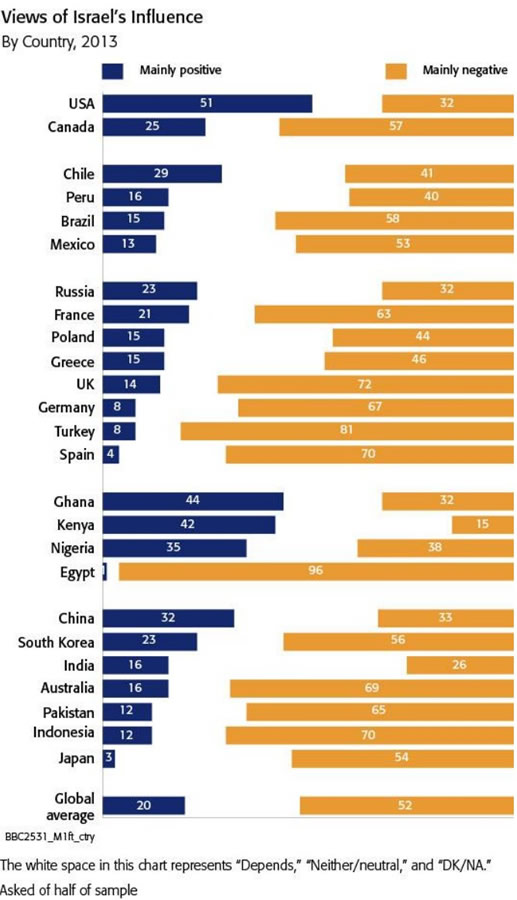

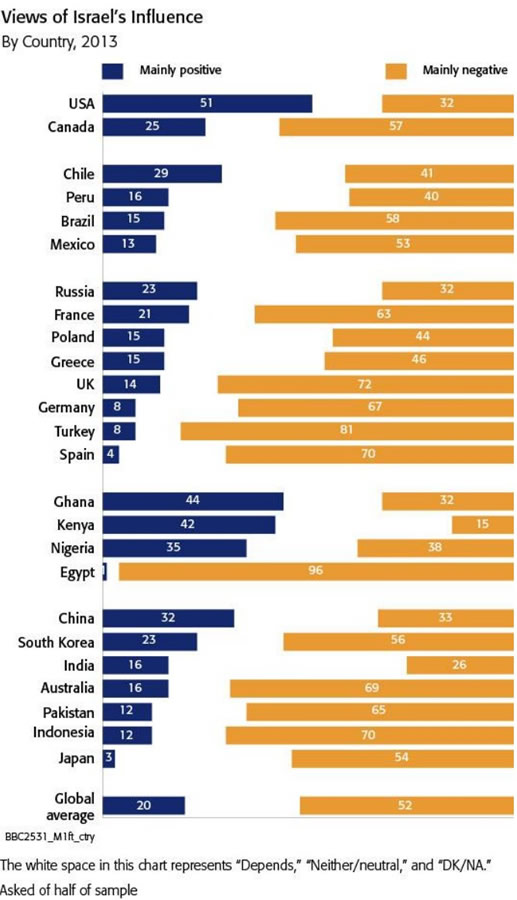

But Nigeria swung negative in the 2013 BBC poll, leaving the U.S. alone of all countries polled:

Indeed, the 2013 poll shows that Israel is the fourth least popular country in the world, trailing only Iran, Pakistan and North Korea:

Iran is once again the most negatively viewed country, with negative ratings climbing four points to 59%. Most people also give negative ratings to Pakistan (56%, up five points), North Korea (55%, up three points) and Israel (52%, up one point).

Israel Has Violated United Nations Resolutions More than Any Country In the World

Another measure of world opinion on Israel is that the United Nations has condemned Israel’s violence towards its neighbors again and again.

Haaretz noted in 2002:

Israel holds the record for ignoring United Nations Security Council resolutions, according to a study by San Francisco University political science professor Steven Zunes.

***

Israel leads the list. Since 1968, Israel has violated 32 resolutions that included condemnation or criticism of the governments’ policies and actions.

***

Zunes specifically avoided counting resolutions that are vague or unclear so that governments could claim different interpretations to the meaning of the resolutions. Thus, the famous UN Security Council resolutions 242 and 338 are not included in his study. He also did not count resolutions that only included condemnations. Instead, he focused on those that included specific calls for changes in the subject governments’ policies.

The resolutions Israel violated were either about its annexation of East Jerusalem or settlements in the territories. Israel also ignored UN Security Council resolutions that called for Israel to cease using harsh measures against the Palestinian population and to cease expelling Palestinians.

Pulitzer prize winning journalist Chris Hedges points out that Israel has broken nearly a hundred UN Security Council resolutions regarding Gaza alone.

Here is a brief sampling of UN Security Council resolutions against Israel:

Resolution 106: The Palestine Question (March 29, 1955) ‘condemns’ Israel for Gaza raid

Resolution 111: The Palestine Question (January 19, 1956) ” … ‘condemns’ Israel for raid on Syria that killed fifty-six people”

Resolution 127: The Palestine Question (January 22, 1958) ” … ‘recommends’ Israel suspends its ‘no-man’s zone’ in Jerusalem”.

Resolution 162: The Palestine Question (April 11, 1961) ” … ‘urges’ Israel to comply with UN decisions”

Resolution 171: The Palestine Question (April 9, 1962) ” … determines flagrant violations’ by Israel in its attack on Syria”

Resolution 228: The Palestine Question (November 25, 1966) ” … ‘censures’ Israel for its attack onSamu in the West Bank, then under Jordanian control”

Resolution 237: Six Day War (June 14, 1967) ” … ‘urges’ Israel to allow return of new 1967 Palestinian refugees”. and called on Israel to ensure the safety and welfare of inhabitants of areas where fighting had taken place

Resolution 248: (March 24, 1968) ” … ‘condemns’ Israel for its massive attack on Karameh in Jordan”

Resolution 256: (August 16, 1968) ” … ‘condemns’ Israeli raids on Jordan as ‘flagrant violation”

Resolution 258: (September 18, 1968) … expressed ‘concern’ with the welfare of the inhabitants of the Israeli-occupied territories, and requested a special representative to be sent to report on the implementation of Resolution 237, and that Israel cooperate

Resolution 259: (September 27, 1968) ” … ‘deplores’ Israel’s refusal to accept UN mission to probe occupation”

Resolution 262: (December 31, 1968) ” … ‘condemns’ Israel for attack on Beirut airport“

Resolution 265: (April 1, 1969) ” … ‘condemns’ Israel for air attacks on Salt“

Resolution 270: (August 26, 1969) ” … ‘condemns’ Israel for air attacks on villages in southern Lebanon”

Resolution 279: (May 12, 1970) “Demands the immediate withdrawal of all Israeli armed forces from Lebanese territory”

Resolution 280: (May 19, 1970) ” … ‘condemns’ Israeli’s attacks against Lebanon”

Resolution 285: (September 5, 1970) ” … ‘demands’ immediate Israeli withdrawal from Lebanon”

Resolution 298: (September 25, 1971) ” … ‘deplores’ Israel’s changing of the status of Jerusalem”

Resolution 316: (June 26, 1972) ” … ‘condemns’ Israel for repeated attacks on Lebanon”

Resolution 317: (July 21, 1972) ” … ‘deplores’ Israel’s refusal to release Arabs abducted in Lebanon”

Resolution 332: (April 21, 1973) ” … ‘condemns’ Israel’s repeated attacks against Lebanon”

Resolution 337: (August 15, 1973) ” … ‘condemns’ Israel for violating Lebanon’s sovereignty and territorial integrity and for the forcible diversion and seizure of a Lebanese airliner from Lebanon’s air space”

Resolution 347: (April 24, 1974)” … ‘condemns’ Israeli attacks on Lebanon”

Resolution 444: (January 19, 1979) ” … ‘deplores’ Israel’s lack of cooperation with UN peacekeeping forces”

Resolution 446 (March 22, 1979): ‘determines’ that Israeli settlements are a ‘serious obstruction’ to peace and calls on Israel to abide by the Fourth Geneva Convention”

Resolution 450: (June 14, 1979) ” … ‘calls’ on Israel to stop attacking Lebanon”.

Resolution 452: (July 20, 1979) … ‘calls’ on Israel to cease building settlements in occupied territories”

Resolution 465: (March 1, 1980) ” … ‘deplores’ Israel’s settlements and asks all member states not to assist Israel’s settlements program”

Resolution 467: (April 24, 1980) ” … ‘strongly deplores’ Israel’s military intervention in Lebanon”

Resolution 468: (May 8, 1980) ” … ‘calls’ on Israel to rescind illegal expulsions of two Palestinian mayors and a judge and to facilitate their return”

Resolution 469: (May 20, 1980) ” … ‘strongly deplores’ Israel’s failure to observe the council’s order not to deport Palestinians”

Resolution 471: (June 5, 1980) ” … ‘expresses deep concern’ at Israel’s failure to abide by the Fourth Geneva Convention”

Resolution 478 (August 20, 1980): ‘censures (Israel) in the strongest terms’ for its claim to Jerusalemin its ‘Basic Law’

Resolution 487: (June 19, 1981) ” … ‘strongly condemns’ Israel for its attack on Iraq’s nuclear facility”

Resolution 497 (December 17, 1981), decides that Israel’s annexation of Syria’s Golan Heights is ‘null and void’ and demands that Israel rescinds its decision forthwith

Resolution 501: (February 25, 1982) ” … ‘calls’ on Israel to stop attacks against Lebanon and withdraw its troops”.

Resolution 515: (July 29, 1982) ” … ‘demands’ that Israel lift its siege of Beirut and allow food supplies to be brought in”

Resolution 516 (August 1, 1982) demanded an immediate cessation of military activities in Lebanon, noting violations of the cease-fire in Beirut

Resolution 517: (August 4, 1982) ” … ‘censures’ Israel for failing to obey UN resolutions and demands that Israel withdraw its forces from Lebanon”.

Resolution 520: (September 17, 1982) ” … ‘condemns’ Israel’s attack into West Beirut”.

Resolution 573: (October 4, 1985) ” … ‘condemns’ Israel ‘vigorously’ for bombing Tunisia in attack on PLO headquarters

Resolution 592: (December 8, 1986) ” … ‘strongly deplores’ the killing of Palestinian students atBirzeit University by Israeli troops”

Resolution 605: (December 22, 1987) ” … ‘strongly deplores’ Israel’s policies and practices denying the human rights of Palestinians

Resolution 607: (January 5, 1988) ” … ‘calls’ on Israel not to deport Palestinians and strongly requests it to abide by the Fourth Geneva Convention

Resolution 608: (January 14, 1988) ” … ‘deeply regrets’ that Israel has defied the United Nations and deported Palestinian civilians”

Resolution 611: (April 25, 1988) “… condemned Israel’s assassination of Khalil al-Wazir as a ‘flagrant violation of the Charter

Resolution 636: (July 16, 989) ” … ‘deeply regrets’ Israeli deportation of Palestinian civilians

Resolution 641 (August 30, 1989): ” … ‘deplores’ Israel’s continuing deportation of Palestinians

Resolution 672 (October 12, 1990): ” … ‘condemns’ Israel for “violence against Palestinians” at the Haram al-Sharif/Temple Mount

Resolution 673 (October 24, 1990): ” … ‘deplores’ Israel’s refusal to cooperate with the United Nations

Resolution 681 (December 20, 1990): ” … ‘deplores’ Israel’s resumption of the deportation of Palestinians

Resolution 694 (May 24, 1991): ” … ‘deplores’ Israel’s deportation of Palestinians and calls on it to ensure their safe and immediate return

Resolution 726 (January 6. 1992): ” … ‘strongly condemns’ Israel’s deportation of Palestinians

Resolution 799 (December 18 , 1992): “. . . ‘strongly condemns’ Israel’s deportation of 413 Palestinians and calls for their immediate return

Resolution 904 (March 18, 1994): Cave of the Patriarchs massacre

Resolution 1322 (October 7, 2000) deplored Ariel Sharon‘s visit to the Temple Mount and the violence that followed

Resolution 1435 (September 24, 2002) demanded an end to Israeli measures in and aroundRamallah, and an Israeli withdrawal to positions held before September 2000

Resolution 1544 (May 19, 2004) “…‘calls on’ Israel to respect its obligations under international humanitarian law, and insists, in particular, on its obligation not to undertake demolition of homes contrary to that law”

Resolution 1860 (January 8, 2009) “…‘calls for’ an immediate, durable and fully respected ceasefire, leading to the full withdrawal of Israeli forces from Gaza; ‘calls for‘ the unimpeded provision and distribution throughout Gaza of humanitarian assistance, including of food, fuel and medical treatment”

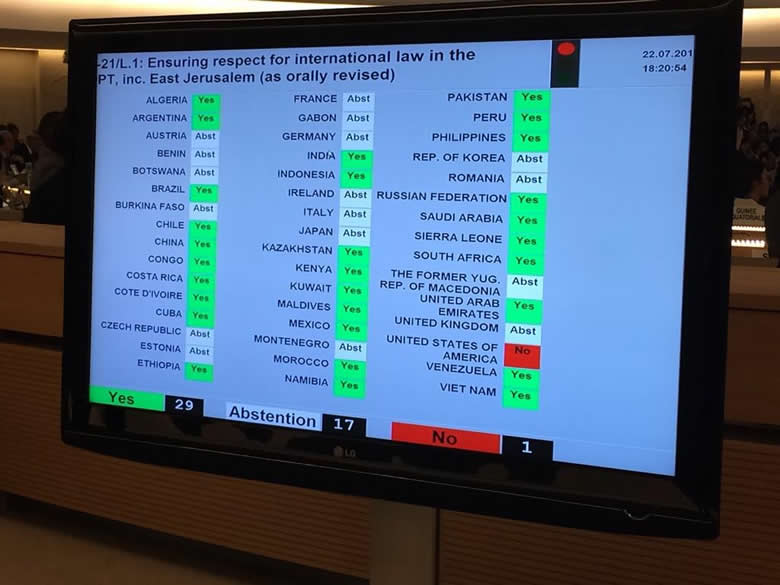

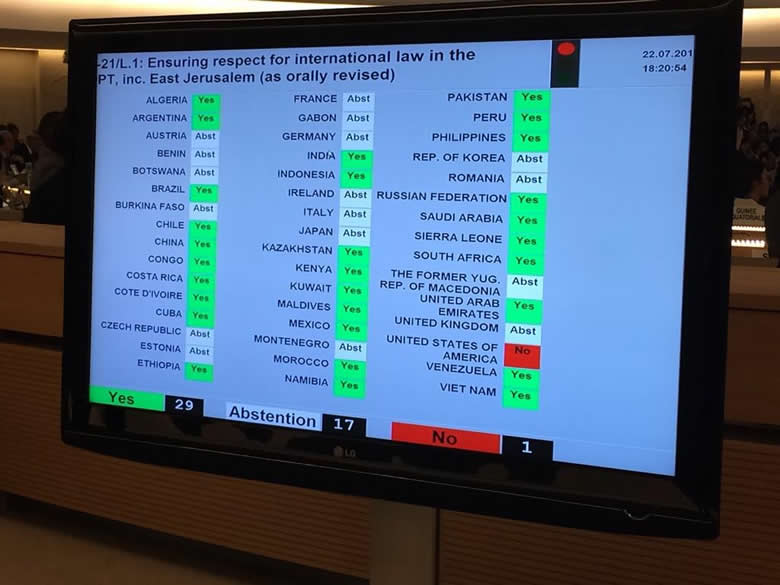

Of course, America is the only country which consistently votes against such resolutions:

Older, White American Males Are Virtually the Only People In the World Who Unconditionally Support Israel

Even with the United States, there are only certain groups which support Israel.

A new poll by Pew this month shows that it is mainly Americans 50 years or older, males, conservatives and evangelicals who support Israel….”

Full article

Comments »