[youtube://http://www.youtube.com/watch?v=DyV0OfU3-FU 450 300]

Comments »Monthly Archives: September 2013

On the Verge of a Government Shutdown: Prepare to Rejoice

“Barring some last-minute miracle, it looks like the government is going to shut down at midnight tonight.

The crux of the matter is that the House GOP is not inclined to pass a budget that doesn’t include some kind of delay or defunding to Obamacare. And obviously Democrats won’t agree to that. So, impasse.

Markets are already falling, it would seem, on the news.

But there are reasons to think this would be good.

Goldman explained why this could be helpful in a note to clients last Friday:

It would be a mistake to interpret a shutdown as implying a greater risk of a debt limit crisis, in our view. It would not be surprising to see a more negative market reaction to a shutdown than would be warranted by the modest macroeconomic effect it would have. We suspect that many market participants would interpret a shutdown as implying a greater risk of problems in raising the debt limit. This is not unreasonable, but we would see it differently. If a shutdown is avoided, it is likely to be because congressional Republicans have opted to wait and push for policy concessions on the debt limit instead. By contrast, if a shutdown occurs, we would be surprised if congressional Republicans would want to risk another difficult situation only a couple of weeks later. The upshot is that while a shutdown would be unnecessarily disruptive, it might actually ease passage of a debt limit increase.

This seems kind of vague, but there are three distinct reasons it could be a positive.

- The market is reacting now….”

Heart Based Wisdom

[youtube://http://www.youtube.com/watch?v=aKsfuHt1EXg 450 300]

Comments »Documentary: Four Horseman

[youtube://http://www.youtube.com/watch?v=5fbvquHSPJU 450 300] [youtube://http://www.youtube.com/watch?v=9QtZsJg2ZxE 450 300]

Comments »A Preview for the Upcoming Earnings Season

“For Q3, analysts expect both the financials and consumer discretionary sectors to show strong earnings growth. Earnings for the materials and energy sectors are expected to decline overall in Q3.

Throughout 2013, analyst estimates called for slow growth in the first half of the year, balanced out by strong growth in the second half. As the third-quarter earnings reporting season approaches, growth estimates have declined to a more modest 4.8%, down from the 8.5% projection from the beginning of the quarter, as seen below in Exhibit 1. Looking ahead to the fourth quarter, the current estimate is for 11.1% earnings growth, which appears optimistic, given projections for only 1.3% revenue growth.

Exhibit 1. S&P 500: Q3 2013 Earnings Growth Estimates, Current and Beginning of Quarter

Similar to the second quarter, analysts expect the financials sector to lead the way in third-quarter earnings growth, with a 10.4% increase expected. Within the sector, the big banks look to be driving earnings, as they benefit from gains in financial markets. Furthermore, many of these companies’ results will be flattered by weak results from a year ago. This is especially true in the investment banking & brokerage sub-industry, which is expected to report 477% earnings growth, primarily as a result of losses in the year-ago quarter from Morgan Stanley (MS.N) and E*TRADE Financial Corporation (ETFC.O).

Strength in the housing market has benefitted the financials sector in recent quarters; however, rising interest rates and more difficult comparisons are expected to provide challenges for third-quarter earnings results for companies with significant exposure to mortgages. Analysts estimate that the thrifts & mortgages sub-industry will undergo a 7% earnings decline, while the regional banks sub-industry will see profits fall by 17%, making it the weakest sub-industry within financials.

The other sector expected to be a major driver of earnings growth in the third quarter is consumer discretionary….”

Comments »Obama Addresses UN General Assembly on Syria

“President Barack Obama said recent overtures from Iran may offer a basis for a “meaningful agreement” to resolve the confrontation over the Persian Gulf nation’s nuclear program, one of the primary sources of instability in the Middle East.

The U.S. is “encouraged” that Iranian President Hassan Rohani was given a mandate in his election to pursue a more moderate course, Obama said.

“Conciliatory words will have to be matched by actions that are transparent and verifiable,” Obama told world leaders today at the United Nations in New York. “The roadblocks may prove to be too great, but I firmly believe the diplomatic path must be tested.”

In an address focused on turmoil in the Middle East, including the civil war in Syria and the Israel-Palestinian peace process, Obama vowed the U.S. will use all means necessary, including military force, to protect its “core interests” in the region and ensure the free flow of energy to the world.

He called on the UN to apply meaningful pressure on the regime in Syria to follow through on its promise to surrender its chemical weapons. He said Iran and Russia, Syria’s main allies, must recognize that Syrian President Bashar al-Assad cannot remain in power if the civil war is to be resolved by political means.

The president’s speech comes as Obama has an opening for progress on long-stalled foreign policy issues….”

Comments »Your Tax Dollars at Work

BIS: The Share of “Leveraged Loans” is 10% Higher Than at the Height of the Financial Crisis in 2007

Note : The article was Google translated and may have grammatical inconsistencies.

“The Bank for International Settlements (BIS) is the current situation on the financial markets as worse than before the Lehman bankruptcy. The warning of the BIS could be the reason why the U.S. Federal Reserve decided to continue indefinitely to print money: Central banks have lost control of the debt-tide and give up. The decision by the U.S. Federal Reserve to continue indefinitely to print money ( here ) might have fallen on “orders from above”. Apparently, the central banks dawns that it is tight. Very narrow.

The most powerful bank in the world, the Bank for International Settlements (BIS) has published a few days ago in its quarterly report for the possible end of the flood of money directly addressed – and at the same time described the situation on the debt markets as extremely critical. The “extraordinary measures by central banks” – aka the unrestrained printing – had awakened in the markets the illusion that the massive liquidity pumped into the market could solve the fundamental problems (more on the huge rise in debt – here ).

This clear words may have meant that Ben Bernanke and the Federal Open Market Committee, the Fed got cold feet. Instead, as expected, which is now formally announcing the end of the flood of money, the Fed has decided to just carry on as before.

If one is to the BIS experts believe that no single problem is solved.

All problems are only increasing.

Because the BIS but apparently does not know how they get the genie back in the bottle, it pays to listen to those who were part of the system – but now have no official functions and therefore more able to find clear words.

The former chief economist of the Bank for International Settlements (BIS), William White, was also reported to be parallel to the BIS word.

His statements are nothing more and nothing less than an announcement of the big crash.

White warned in unusually clear form of a huge, global credit bubble.

The share of “leveraged loans” or the extreme form of credit risk by mid-2013 at an all time high of 45 percent. This is ten percentage points higher than at the height of the financial crisis in 2007. A year later, in September 2008, Lehman Brothers went bankrupt.

Thus, the current situation is much more dangerous than before the Lehman bankruptcy….”

Comments »Chaos Computer Club Breaks Apple TouchID

“The biometrics hacking team of the Chaos Computer Club (CCC) has successfully bypassed the biometric security of Apple’s TouchID using easy everyday means. A fingerprint of the phone user, photographed from a glass surface, was enough to create a fake finger that could unlock an iPhone 5s secured with TouchID. This demonstrates – again – that fingerprint biometrics is unsuitable as access control method and should be avoided.

Apple had released the new iPhone with a fingerprint sensor that was supposedly much more secure than previous fingerprint technology. A lot of bogus speculation about the marvels of the new technology and how hard to defeat it supposedly is had dominated the international technology press for days.

“In reality, Apple’s sensor has just a higher resolution compared to the sensors so far. So we only needed to ramp up the resolution of our fake”, said the hacker with the nickname Starbug, who performed the critical experiments that led to the successful circumvention of the fingerprint locking. “As we have said now for more than years, fingerprints should not be used to secure anything. You leave them everywhere, and it is far too easy to make fake fingers out of lifted prints.” [1]

The iPhone TouchID defeat has been documented in a short video…”

Documentary: Wikileaks War, Lies, and Videotape

Canadian Billionaire Predicts The End of the Dollar as the World’s Reserve Currency

[youtube://http://www.youtube.com/watch?v=nX7J8-VTG08 450 300]

Comments »The Fed Puts Tapering to Bed

So a lame congress threatening to shut down government over budget policy along with the jump in interest rates stemming from the last FOMC meeting allows the Bearded clam to put tapering to bed for the moment. Markets rejoice in full retard tape.

Comments »The Saudi Arabia of Lithium

[youtube://http://www.youtube.com/watch?v=U5UoMTjs9Cg 450 300]

Comments »Witch Hunts Always Find Witches

[youtube://http://www.youtube.com/watch?v=fj-zfwWrCok 450 300]

Comments »iPhone 5NSA

[youtube://http://www.youtube.com/watch?v=IQQH_A9qVgs 450 300]

Comments »Two Whistle Blowers Come Forward With “Hard Evidence” That $JPM Manipulates Gold and Silver Markets

“In a stunning development, two JP Morgan whistleblowers have confessed that the bank manipulates the gold and silver markets. This is truly a shocking admission by the courageous JP Morgan whistleblowers. In a blockbuster King World News interview, London metals trader Andrew Maguire told KWN that the two JP Morgan employees came directly to him with hard evidence that the bank was actively manipulating the gold and silver markets.

This is a truly catastrophic event for JP Morgan, which up to now has denied manipulating these markets. Below Maguire takes KWN readers around the world on a trip down the rabbit hole as he discusses how he led the two JP Morgan employees to turn over the evidence to a law firm which specializes in high profile whistleblowers, and also to the CFTC. According to Maguire, the CFTC has virtually buried this information. Is this a cover up, or the next LIBOR scandal about to be exposed? Below is what Maguire had to say in this blockbuster interview.

Thanks to King World News for taking up this story, this news went mainstream. But most importantly, Eric, it caught the attention of some serious Eastern hemisphere buyers who moved in (to these markets) from the sidelines. They were buying it (gold and silver) aggressively. Now, in this case the bullion banks were exposed to be naked short (gold and silver in 2010).”

Eric King: “Andrew, I don’t have to tell you that the price of gold and silver exploded after that (March, 2010 King World News interview) interview.”

Maguire: “Absolutely. And I’m going to go into that in a minute, Eric, because it is quite astounding what happened after that. A lot of people are really concerned about the upcoming 5-year anniversary, and the possibility of the statute of limitations bringing this all-important (CFTC) investigation to a close this month.

Very recently Commissioner Chilton assured me, and I’m going to quote him exactly, “I can’t appropriately express my frustration and disappointment with how we’ve handled the silver investigation….

Bart Chilton continues: “And, as you know, I’m prohibited from actually saying much. That said, I will not let September go by without speaking out if the agency doesn’t do so.”

Now, since the original CFTC Meeting, I’ve provided a very large amount of detailed evidence to the agency. And what isn’t known, however, up until now, is during that time I was also contacted by two JP Morgan employees who told me they had a large amount of documented evidence of market trading abuses in gold and silver by their bank (JP Morgan).

Now, it was my understanding that this covered the same time period of metals abuses that I had prepared in my submissions. And for their own protection I directed them to a law firm specializing in whistle blowers so they could formally provide this evidence under the Dodd-Frank Whistleblower Provision directly to the CFTC.

This would provide them the necessary protections which they would need if they were going to make such a submission. Now, this was actually done in early June, 2012. Not June, 2013, but June of 2012, which is staggering. Now, I didn’t want to hinder any investigation, so I kept this information ‘under wraps,’ until now….”

Senator Lindsey Graham: “Let’s Just Blow Up Iran” (Video)

“Warmongering South Carolina Senator Lindsey Graham has decided to skip straight over Syria and convince Congress to attack the sovereign nation of Iran. Senator Graham must not have gotten the message when Vladimir Putin politely warned Barack Obama hands off of Syria and now Graham believes that the US can launch humanitarian love bombs at Iran’s nuclear facilities, an attack he’d hope would go unanswered. Senator Graham’s office can be reached at 202-224-5972. From Truthstream Media.:

The Republican Senator from South Carolina announced on Saturday that he is going to officially approach Congress to seek military authorization for a strike on Iran to destroy the nation’s nuclear program.

Is this a signal that Iran was the goal of Syrian intervention all along? Senator Graham has been warning that if we don’t bomb Syria, it will lead to war with Iran within six months.

Graham has a long history of warmongering, especially when it comes to Iran.”

[youtube://http://www.youtube.com/watch?v=CLfAdSCSE5M 450 300] Comments »Real Wealth vs Perceived Wealth

“Why is there a fundamental mismatch between stock market performance as reported in financial headlines – and the actual retirement behavior of the many millions of Americans who own those stocks in their portfolios?

Using 15 years of stock market performance data and the type of analysis tools used by sophisticated wealth management professionals, we will solve that mystery in this research-based tutorial. The results may come as a major surprise, even for well read and financially literate investors who have been buying stocks for decades.

On the one hand, stocks have been in a sustained rally, with the markets recovering from the depths of 2008 and 2009 and finally moving on to all new highs. This should have created enormous wealth for tens of millions of long-term retirement investors who have stock-heavy investment portfolios in their retirement accounts.

Yet at the very same time, according to recently released government data as reported in Bloomberg and the Washington Post, the fastest growing group of workers in the United States is older than age 65, up 67% in 10 years, and their average weekly pay has climbed from $502 to $825 over that time.

Over a decade, there has been a three-part change in behavior among those aged 65 and older, with a reduction in the percentage of those retiring, an increase in full time work rather than part time work, and incomes that are higher than those of all workers on average. So people with higher wages than the rest of the population are not only not retiring, they are increasingly not slowing down either, but are continuing full time jobs.

Now where the mystery comes in, is that people who are older than 65 with successful careers and good incomes are the exact same people who would be expected to have substantial stock portfolios in their retirement accounts. So if stocks have in fact been creating so much wealth in recent years, why is it that the same segment of the population that owns the largest amount of those stocks are in practice the same group that is changing their retirement behavior in order to prolong their careers and keep their full income coming in?

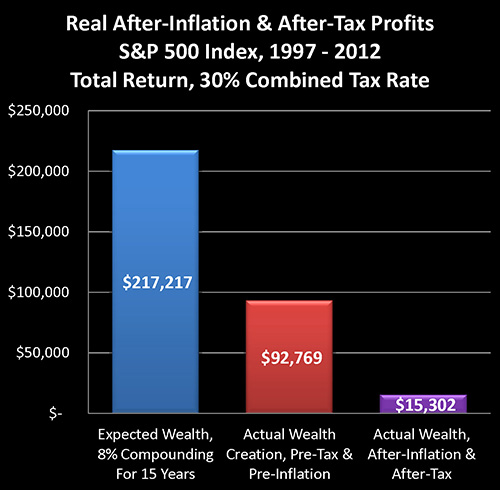

The explanation of the mystery can be found in the graph above, which is based upon historical performance of the Standard & Poor’s 500 index from the end of 1997 through the end of the 2012, as well as official US government inflation statistics for those same 15 years. As such, the graph should act as a reasonable proxy for the real world long term performance results achieved by tens of millions of American investors during those years.

Based on an assumed starting portfolio value of $100,000, the blue bar reflects expectations for the compounding of wealth through stock investment. It assumes an 8% average return – which has been a quite common assumption, particularly 15 years ago.

The red bar shows actual real-world performance on a total return basis, with price movements in the S&P 500 index, dividend payments and the reinvestment of dividend payments. It is much lower than expectations, but still substantially positive.

The purple bar shows what really matters – the purchasing power of average stock market investments on an after-tax and after-inflation basis. As shown above, in the real world for many millions of investors, the purchasing power of long term stock market profits has been virtually non-existent. If we compare what really matters – which is what money will buy for us on an after-tax basis – then real gains are a mere 7% of expected wealth gains.

The purple bar is what reconciles the mystery, and explains the divergence between the headline illusion of major profits and the reality of actual after-tax purchasing power in retirement that is currently driving the behavior of millions of investors.

As we will explore, the ultimate bottom line number of what our investments will buy for us after we’ve paid our taxes has been dominated by something that few average individual investors fully understand, which is the powerful and deceptive relationship between inflation and taxes.

What may come as a particular surprise is that these dramatic results are entirely based upon the officially reported 2.42% average rate of inflation over the 15 years. If our personal experience …..”

Comments »Everything’s Fixed, Everything’s Great!

“A brief summary of everything that’s been fixed.

Much to the amazement of doom-and-gloomers, everything’s been fixed and as a result, everything’s great. The list is impressive: China: fixed. Japan: fixed. Europe: fixed. U.S. healthcare: fixed. Africa: fixed. Mideast: well, not fixed, but no worse than a month ago, and that qualifies as fixed.

Let’s scroll through a brief summary of everything that’s been fixed.

1. China’s economy. It was slowing down, which would have been bad for the global economy. But the recent PMI (preliminary made-up indicator) readings have been the strongest since the Great Leap Forward.

The basic story here is China needs a million more of everything…”

Comments »You Gotta Laugh Every Now and Then

[youtube://http://www.youtube.com/watch?v=kS2TpW7dnPo 450 300]

Comments »