“LOS ANGELES (AP) — The number of U.S. homes repossessed by lenders last month fell to the lowest level in more than five years, the latest evidence that the nation’s foreclosure crisis is abating amid an improving housing market.

While some states still saw increases in homes taken back by banks, nationally home repossessions fell 3 percent in March from the previous month and were down 21 percent from a year earlier,foreclosure listing firm RealtyTrac Inc. said Thursday.

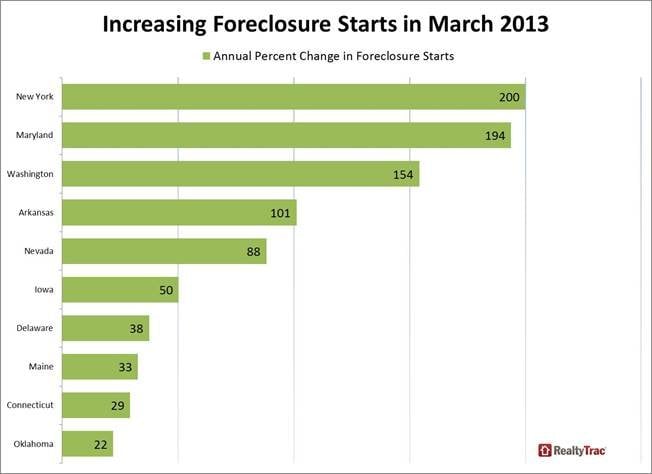

Thirty-four states posted annual declines in completed foreclosures. Among those bucking that trend: Arkansas, Maryland, Washington and Pennsylvania.

All told, lenders repossessed 43,597 homes last month, the lowest level since September 2007.

At the current monthly pace, completed foreclosures will total roughly 550,000 this year, down from 671,000 last year, RealtyTrac said.

An uptick in homes that entered the foreclosure process last month, however, may end up pushing that total to 600,000, said Daren Blomquist, a vice president at RealtyTrac.

Several factors are contributing to the decline in completed foreclosures: Steady job growth and ultra-low mortgage rates are helping the once-battered housing market recover, driving demand for homes and prices upward.

Higher home values help restore equity to homeowners, which can help those at risk of foreclosureby improving their chances of refinancing their mortgage to a lower payment or place them in a better position to sell their home.

Meanwhile, states like California, Nevada and others have passed laws to increase homeowners’ protections from foreclosure. Those laws have effectively delayed the pace of homes entering the foreclosure process, which has helped to thin the pipeline of completed foreclosures in those states.

Even so, the number of foreclosure starts, or homes that entered the foreclosure process, edged higher for the second month in a row in March….”

Full article

Comments »