[youtube://http://www.youtube.com/watch?v=f-sHAwNfoL4 450 300]

Comments »Rising Rates and Derivatives

“Will rapidly rising interest rates rip through the U.S. financial system like a giant lawnmower blade? Yes, the U.S. economy survived much higher interest rates in the past, but at that time there were not hundreds of trillions of dollars worth of interest rate derivatives hanging over our financial system like a Sword of Damocles. This is something that I have been talking about for quite some time, and now a Mexican billionaire has come forward with a similar warning. Hugo Salinas Price was the founder of the Elektra retail chain down in Mexico, and he is extremely concerned that rising interest rates could burst the derivatives bubble and cause “massive bankruptcies around the globe”. Of course there are a whole lot of people out there that would be quite glad to see the “too big to fail” banks go bankrupt, but the truth is that if they go down our entire economy will go down with them. Our situation is similar to a patient with a very advanced stage of cancer. You can try to kill the cancer with drugs, but you will almost certainly kill the patient at the same time. Well, that is essentially what our relationship with the big banks is like. Our entire economic system is based on credit, and just like we saw back in 2008, if the big banks start failing credit freezes up and suddenly nobody can get any money for anything. When the next great credit crunch comes, every important number in our economy will rapidly start getting much worse.

The big banks are going to play a starring role in the next financial crash just like they did in the last one. Only this next crash may be quite a bit worse. Just check out what billionaire Hugo Salinas Price told King World News recently…

I think we are going to see a series of bankruptcies. I think the rise in interest rates is the fatal sign which is going to ignite a derivatives crisis. This is going to bring down the derivatives system (and the financial system).

There are (over) one quadrillion dollars of derivatives and most of them are related to interest rates. The spiking of interest rates in the United States may set that off. What is going to happen in the world is eventually we are going to come to a moment where there is going to be massive bankruptcies around the globe.

What is going to be left after the dust settles is gold, and some people are going to have it and some people are not. Then the problem is going to be to hold on to what you’ve got because it’s not going to be a very pleasant world.

Right now, there are about 441 trillion dollars of interest rate derivatives sitting out there. If interest rates stay about where they are right now and they don’t go much higher, we will be fine. But if they start going much higher, all bets will be off and we could see financial carnage on a scale that we have never seen before.

And at the moment the big banks have got to behave themselves because the government is investigating allegations that they have been cheating pension funds and other investors out of millions of dollars by manipulating the trading of interest rate derivatives. The following is from an article that the Telegraph posted on Friday…

The Commodity Futures Trading Commission (CFTC) is probing 15 banks over allegations that they instructed brokers to carry out trades that would move ISDAfix, the leading benchmark rate for interest rate swaps.

Pension funds and companies who invest in interest rate derivatives often deal with banks to insure against big movements in the ISDAfix rate or to speculate on changes to interest rate swaps

ISDAfix is published each morning after banks submit bids for swaps via Icap, the inter-dealer broker, in a number of currencies. The CFTC has been investigating suggestions that the banks deliberately moved the rate in order to profit on these deals.

Given the hundreds of trillions of dollars worth of interest rate derivatives trades that occur annually, even the slightest manipulation can have a substantial effect. The CFTC, which started to investigate ISDAfix after last summer’s Libor scandal has now been handed emails and phone call recordings that show the rate was deliberately moved, according to Bloomberg.

Essentially they got their hands caught in the cookie jar and so they have got to play it straight (at least for now).

Meanwhile, it looks like the Fed may not be able to keep long-term interest rates down for much longer….”

Comments »How Derivatives Help “To Evade Taxes, Circumvent Accounting Rules and Deceive Clients”

“While Warren Buffett has called derivatives “weapons of mass destruction,” they should be called “weapons of mass deception” since they are often used to evade taxes, circumvent accounting rules and deceive clients, New York Times columnist Floyd Norris writes.

Even national governments may have used the weapons of mass deception.

European newspapers recently revealed that Italy had used derivatives in the 1990s to make its budget deficit seem smaller in order to enter the eurozone, the Financial Times reported.

Those derivatives could now mean a loss of 8 billion euros ($10.4 billion).

The European Union may have known about the financial smoke and mirrors but chose to overlook it, Norris noted, adding that joining the euro was more a political than an economic event at the time.

Companies — or nations it now seems — can use derivative contracts called futures contracts in which banks make large upfront payments in return for larger payments in the future.

Sounds like a loan, right? Except the company — or country — does not report the contract on its balance sheet or can report it in a misleading way in order to make its finances seem stronger. Enron was probably the most famous user of futures contracts, specifically prepaid forward contracts.

In credit default swaps, another type of derivatives, speculators pay a fee in return for a payoff when a company or country defaults.

That sounds like insurance, but if it were regulated as such, the issuing company would have to follow insurance regulations and hold reserves to pay claims.

AIG, probably the most famous user of credit default swaps, needed a government bailout when it couldn’t pay its losing bets on its swaps.

Current accounting rules do an inadequate job of requiring companies to report their derivative contracts, Norris argued.

Companies can net their derivatives positions, that is, offset a position’s gain against another position’s loss even if the two positions have little in common, he explained.

Most other countries require banks to ….”

Comments »Japanese Manufacturers Turn Positive for the First Time Since September 2011

“Big Japanese manufacturers turned optimistic for the first time since September 2011, indicating confidence in Prime Minister Shinzo Abe’s reflationary policies even after stock market volatility.

The quarterly Tankan (JNTSMFG) index for large manufacturers rose to plus four in June from minus eight in March, the Bank of Japan said in Tokyo today. A positive figure means optimists outnumber pessimists. The median estimate of 22 economists surveyed by Bloomberg Newswas for a plus three reading. Large companies from all industries plan to increase capital spending 5.5 percent in this fiscal year as the government looks to promote business investment….”

Comments »“Education, is No Longer the Answer to Rising Inequality”

“Having a higher education won’t help you anymore in your job, writes New York Times columnist Paul Krugman.

Conventional thought holds that technology eliminates jobs for less-skilled workers, but increases demand for more highly educated workers and eventually increases living standards.

But now, highly educated workers are just as likely as are less-educated workers to be displaced. “And pushing for more education may create as many problems as it solves,” Krugman notes.

He points to a recent report from The McKinsey Global Institute that lists a dozen major new technologies that may be “disruptive” for workers and their industries.

“Even a quick scan of the report’s list,” Krugman says, “suggests that some of the victims of disruption will be workers who are currently considered highly skilled, and who invested a lot of time and money in acquiring those skills.”

For instance, watch out for “automation of knowledge work,” he states, where software will do work once done by college graduates, and robots will handle more manufacturing and could also replace some medical professionals.

“Education, then, is no longer the answer to rising inequality, if it ever was (which I doubt).”

We could be facing another industrial revolution, a time when many workers lost their jobs to machines…”

Comments »Home Builder Confidence Melts Up

“For the first time in seven years, most U.S. homebuilders are optimistic about home sales, a sign that construction could help drive stronger economic growth in coming months.

The National Association of Home Builders/Wells Fargo builder sentiment index released Monday leaped to 52 this month from 44 in May. It was the largest monthly increase since 2002.

A reading above 50 indicates more builders view sales conditions as good, rather than poor. The index hasn’t been that high since April 2006, just before the housing market collapsed…”

Comments »PIMCO Estimates a 60% Chance of Recession in 3-5 Years

“High debt levels have raised the chances of a global recession in the next three to five years to more than 60 percent, said Pimco, which manages the world’s largest bond fund.

The world economy goes through a recession about every six years and the frequency of global recessions tends to rise when global indebtedness is high and falling compared with when indebtedness is low and rising, Pacific Investment Management Co (Pimco) said in a note published on its website late Tuesday.

“Given that the last global recession was four years ago, and also given that the global economy is significantly more indebted today than it was four years ago, we believe there is now a greater than 60 percent probability that we will experience another global recession in the next three to five years,” Saumil H. Parikh, a managing director and generalist portfolio manager at Pimco said in the note.

The U.S. had a debt to GDP ratio of about 101.6 in 2012, up from 99.4 in 2011. Japan, the world’s third largest economy after China and the U.S., has a debt to GDP ratio of more than 200 percent….”

Comments »How $GOOG Glass Will Make Us Look in a 100k Years

The NFIB Reports Small Business Sentiment is Up

“JUNE REPORT:

Small Business Optimism Edges Up in May 2013, Reaches May 2012 Level

For the second consecutive month, small-business owner confidence edged up, according to NFIB’s Index of Small Business Optimism, which increased by 2.3 points to a final reading of 94.4 in May.

For the second consecutive month, small-business owner confidence edged up, according to NFIB’s Index of Small Business Optimism, which increased by 2.3 points to a final reading of 94.4 in May.

While May’s reading is the second highest since the recession started December 2007, the Index does not signal strong economic growth for the sector. Eight of 10 Index components gained momentum, showing some moderation in pessimism about the economy and future sales, but planned job creation fell 1 point and reported job creation stalled after five months of gains.

“Small business confidence rising is always a good thing, but it’s tough to be excited by meager growth in an otherwise tepid economy. Washington remains in a state of policy paralysis, and while the stock market sets records, GDP posts mediocre growth. The unemployment rate remains in the mid-7s and it is departures from the labor force —- not job creation — that is contributing to its decline when it does fall. It’s nice to see confidence not shrinking, but there isn’t much to hang your hat on in this report. We are back to where we were in May 2012. Two good months don’t make a trend, but we can’t have a trend without them, so it’s a start.” – NFIB chief economist Bill Dunkelberg….”

Comments »Consensus Among Analysts Expect Tapering to $65B a Month Starting in October

“Economists cut their estimates for how much the Federal Reserve will reduce the amount of its monthly asset purchases, a Bloomberg survey shows.

Policy makers led by Chairman Ben S. Bernanke will trim their so-called quantitative easing program to $65 billion a month at the Oct. 29-30 meeting of the Federal Open Market Committee, from the current level of $85 billion, according to the median estimate in the survey of 59 economists this week. In a similar survey before the Fed’s April 30-May 1 meeting, economists expected the Fed to cut purchases to $50 billion in the fourth quarter.

Debate among central bank policy makers over when and how to dial back their unprecedented easing campaign has shaken financial markets. The Standard & Poor’s 500 Index has dropped 2.8 percent since reaching a record closing high on May 21, and the yield on 10-year Treasuries has risen to 2.08 percent from as low as 1.63 percent last month as investors weighed the timing of a reduction in the central bank’s stimulus.

“Even those who are advocating for tapering are thinking that it could be a pretty small first step to see how it goes,” said Julia Coronado, chief economist for North America at BNP Paribas in New York and a former Fed economist. “That’s one of the few things we’ve learned” from the debate among policy makers.

When the first move comes, officials will split their $65 billion in purchases between $30 billion a month of mortgage bonds and $35 billion a month of Treasuries, a $10 billion reduction in each category, according to the survey, conducted June 4-5.

June Tapering?

Two of the 59 economists surveyed this week expect the pace of purchases to be reduced at the FOMC meetings on June 18-19 or July 30-31. Sixteen say tapering will begin at the Sept. 17-18 meeting, 14 see it happening Oct. 29-30 and 15 forecast the first tapering Dec. 17-18. Twelve see tapering next year or later.

“If jobs growth continues in the 150,000-to-200,000 per month range, that’s probably sufficient to lower the unemployment rateslightly,” said Tom Lam, chief economist at DMG & Partners Securities in Singapore. “Coupled with real GDP growth recovering to 2.5 percent, that would be sufficient for them to consider tapering modestly at the December meeting.”

Stocks, Bonds…”

Comments »High Speed Trading and Unabated Accounting Fraud, What is the Little Guy to Do ?

“WASHINGTON (MarketWatch) — Faced with a rash of insider trading in the markets, federal prosecutors and securities regulators in recent years have stepped up efforts to crack down on violations.

But insider trading and market fraud persist, perhaps at epidemic levels. Even though the Securities and Exchange Commission has brought more insider-trading actions in the past three years than in any three-year period in the agency’s history, and even though the U.S. attorney in New York City has convicted 73 people in insider-trading cases since 2009, the crime remains all too common.

That’s what MarketWatch found in a series of interviews with people convicted of insider trading and fraud. These felons painted a picture of an unfair market driven by widespread cheating that favors those with privileged information and expensive technology. The cheating also hurts individual investors and retirement savers trying to follow the rules of the road and produces a deeply unfair market environment.

MarketWatch reporters conducted a series of in-depth interviews with ex–investment brokers and others who lost their trading licenses and are either in prison serving multiyear sentences or have done their time in the slammer and now advise others on what not to do.

The results were discouraging.

MarketWatch found that insider trading may be one of the most common crimes on Wall Street and one of the least prosecuted. And that was only the beginning. MarketWatch discovered that the problem for retail investors goes far beyond a failure of regulators to identify insider-trading violations.

The financial criminals we spoke with said that not only do many investors routinely skirt insider-trading laws, but the explosion of computerized high-speed trading in recent years has made the situation even more unfair for the retail investor.

Those retail investors should be careful when relying on audited financial statements because accounting fraud continues unabated, according to one interview. Accounting-fraud cases are complex, and regulators don’t have the resources to enforce the law effectively, according to one felon.

As one fraudster put it to MarketWatch, the Securities and Exchange Commission has roughly 4,000 employees to regulate the financial industry while there are 35,000 cops in New York fighting blue-collar crime….”

Comments »$BLK’s Fink: DOW 28k in Five to Six Years

“Stocks are hitting record highs on a seemingly daily basis, and BlackRock CEO Larry Fink thinks the bull market has another five or six years to go.

Investors could experience annual returns of 8 to 10 percent during that period, he tells CNBC. This could put the Dow Jones industrial Average above 28,000 in 2019.

“Sounds pretty good, doesn’t it?” he quips.

That would represent an 83 percent jump from the 15,314 level prevailing Wednesday afternoon. The Dow reached an all-time peak of 15,542 a week ago.

Given corporate earnings strength, stocks offer attractive values, Fink says.

“The S&P [500] is around 15½, 16 times earnings,” he explains. “There’s no question in my mind that equities remain … fairly cheap.” …”

Comments »

French Consumer Confidence Hits 2008 Lows

“French consumer confidence unexpectedly dropped, matching the record low it set in 2008, as President Francois Hollande’s tax increases hurt pruchasing power and the economy returned to recession.

Household sentiment fell to 79 in May from a revised 83 in April….”

Comments »Bill Gross Expects Tapering to Begin in Q3

“The Federal Reserve is likely to taper its quantitative easing in September, says bond-investing legend Bill Gross, co-chief investment officer of Pimco.

The Fed is currently buying $85 billion of Treasurys and mortgage-backed securities a month.

Both Fed Chairman Ben Bernanke and New York Fed President William Dudley have suggested a tapering is coming within the next few meetings of the Fed’s policymaking Federal Open Market Committee, Gross told CNBC.

“I think we’re looking at a potential tapering in the next few months, probably around September,” he said.

Bernanke gave conflicting comments about whether a tapering will come soon in his congressional testimony Wednesday.

“That’s what happens when you approach an inflection point,” Gross said. You talk with uncertainty to alert investors there’s change coming.”

The bond market already is preparing for a tapering, with the 10-year Treasury yield having risen to 2.04 percent from its record low of 1.38 percent in July 2012, Gross says….”

Comments »The Coming Uranium Bull

“In August 1956, the Calder Hall Power Plant in Seascale, England began generating electricity and earned the distinction of being the world’s first commercial nuclear power plant. It was a humble beginning for nuclear power; the plant only had a 50-megawatt (MW) output capacity, whereas the smallest US plant today has a 478 MW capacity. Nonetheless, Calder Hall represented the launch of a new era in energy that promised to bring electricity too cheap to meter.

But early on, the promising power source had its detractors. They objected to the high initial cost of constructing nuclear plants, the problems of radioactive waste disposal, and the risks of nuclear accidents and nuclear proliferation.

The detractors had an impact. The heavy regulation they pushed for and the litigation they initiated extended construction times and drove up construction costs. But despite their efforts, over 100 reactors had been placed in service in the United States by 1974.

Then came 1979 and a landmark event – the nuclear accident at Three Mile Island. In the aftermath, public opinion turned solidly in favor of the anti-nuclear movement, several construction projects were canceled, and no new US building permits for nuclear power plants were issued for the next 33 years.

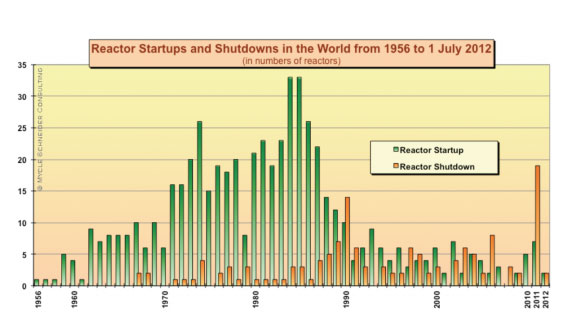

Though the US abandoned nuclear expansion in the 1980s, other countries forged ahead. Worldwide startups peaked in 1984 and 1985, as over 30 plants were brought online in each of those years. However, escalating regulatory and litigation costs and pressure groups were not unique to the US. By the 1980s, it was becoming difficult to cost-justify new projects. On top of all that, the Chernobyl accident occurred in 1986, and the world had its own Three Mile Island moment.

In the 1990s, global startups fell to an annual average of less than six per year; in the first decade of the new century, average annual startups were just over three per year. In fact, since 1990 there have barely been enough startups to offset shutdowns.

The recent flurry of closures was caused to a great extent by yet another accident. After the earthquake and tsunami in Japan on March 11, 2011 and the ensuing catastrophe at the Fukushima Nuclear Power Plant, several countries began to rethink their nuclear energy policies. In May 2011, Germany announced that it would abandon nuclear energy entirely, shutting down all 17 of its plants by 2022. In June 2011, Italian citizens voted overwhelmingly in favor of a referendum to cancel plans for new reactors. The Japanese Cabinet, though unclear about a specific plan, has issued a white paper calling for less reliance on nuclear power.

So is nuclear on its last legs? It would appear so… but before we make the funeral arrangements, let’s take a closer look.

A Nuclear Renaissance….”

Comments »

Global Poll: 71% Feel $AAPL Has Lost its Mojo

Bloomberg Poll: U.S. Recovery Will Continue Slowly Into 2015 Without Recession

“The U.S. economy will continue to recover until at least 2015 without tumbling into a recession, achieving the sustained growth that has eluded it since the last slump ended four years ago, according to a Bloomberg poll.

With the economy creating an average of 208,000 jobs a month since November, 69 percent of those surveyed call the recovery “sustainable” while 27 percent anticipate a new recession within two years, according to the global poll of investors, analysts and traders who are Bloomberg subscribers.

“I expect growth to accelerate,” says respondent Brandon Fitzpatrick, 35, a portfolio manager for D.B. Fitzpatrick in Boise,Idaho. “Consumers’ balance sheets are improving, and consumption is set to pick up.”

The prospect of increasing energy independence, a rise in home values after years of decline and a pause in the partisan budgetary battles in Washington are driving investor sentiment.

Real estate, the epicenter of the 2008 financial crisis, is a big part of the optimism. Even after yesterday’s reported drop in April’s housing starts, homebuilders began work on 853,000 new homes, up 78 percent from the April 2009 low. After watching the housing crash erase more than $7 trillion worth ofwealth, homeowners have recovered about $2 trillion in real estate holdings, according to Federal Reserve data.

In the poll, 71 percent of Bloomberg customers say the recent home-price increase in major U.S. markets is evidence of a genuine recovery in values; 21 percent say it’s a sign that a new bubble is inflating.

Above Average….”

Comments »Small Business Optimism Rises to a Six Month High

“WASHINGTON (Reuters) – A gauge of confidence for small businesses rose in April to its highest in six months, a sign of resilience in an economy beset by Washington’s austerity drive.

The National Federation of Independent Business said on Tuesday its Small Business Optimism Index rose 2.6 points to 92.1, the highest reading since October.

About half the gain was because businesses expect better business conditions over the next six months. Firms also were more optimistic about creating jobs and about sales….”

Comments »The Fed’s QE Exit Will More Than Quadruple Interest Costs For The US

“With the Fed now openly warning that there may actually come a time when the ‘flow’ stops; the most recent Treasury Borrowing Advisory Committee (TBAC) report has some concerning statistics for those change-ridden hopers who see a smooth Fed exit, deficit-reduction, and blue skies ahead. While they are careful not shout ‘sell’ in a crowded bond market; hidden deep in the 126 page presentation are two charts that bear significant attention. The first shows what TBAC expects (given the market’s expectations) to happen to interest rates in the US as the Fed ‘exits’ its QE program (taper, unwind, hold) – the result, the weighted-average cost of financing for the US government will almost triple from around 1.6% to around 4.3% over the next ten years. But more problematic is that even with CBO’s rather conservative estimates of the growth in US debt over the next decade the USD cost of financing will explode from around $205bn (based on TBAC data) to over $855bn. Still convinced the Fed can exit smoothly?

As TBAC warns…”

Comments »SLM Cancels Student Debt Bond Auction, Is the Bubble Bursting ?

“In 2007 a small number of French hedge funds imploded over sudden losses stemming from highly leveraged bets made on the unstoppable subprime mortgage market. At the time, a few saw the writing on the wall; but many simply wrote it off as just another over-levered hedge fund and the subprime mortgage market was ‘fine’. Fast forward six years and as we have discussed numerous times (most recently here and here) there is a bubble, potentially far bigger than subprime, in student loan debt. As one of the last remaining outlets for state-sanction credit creation, this is a big deal; but, of course, the popping of the bubble (or even a slight leak) is eschewed since there is so much ‘reach for yield’ and the Fed’s got your back. That is until this week. As WSJ reports, Sallie Mae (SLM), the nation’s largest non-government student lender just cancelled a $225 million debt offering as investors decided they simply were not getting paid enough for risk – amid rising student loan defaults. Simply put, there’s a limit to what investors will tolerate.

SLM was offering a stunningly low 3.5% interest on the deal and investors snubbed it, “There are certain limits that can’t, or shouldn’t, be crossed if you’re an investor,” adding that, “we’re beginning to see what the tolerances are.” This is a significant shift since SLM and other issuers of debt backed by student loans sold $7.8 billion worth of securities this year through last week, up from $5.7 billion in the same period of 2012. With the portion of student borrowers who are late on their debt payments by 90 days or more climbing to 31% in 2012, from 24% in 2008; we wonder if this is the tipping point for the student debt in 2013 that was generally ignored in subprime in 2007, until it was too late.

Via WSJ….”

Comments »