Remember all those raw land purchase of the bottom of the market ?

Comments »Lateef Fund: “You Can Almost Feel the Rumbling of What They are Calling the “Great Rotation” Into Equities.”

“Stock picking, plain and simple. And successful. That’s what attracts investors — individuals, private-wealth managers, and endowments — to Lateef Investment Management, a $4.5 billion money-management firm in Greenbrae, Calif., a small Marin County town just north of San Francisco. Three portfolio managers, Quoc Tran, James Tarkenton, and Matthew Sauer, scour and sift for underappreciated and mispriced blue-chip companies with strong balance sheets, strong business models, high free-cash flows, and attractive returns on capital. The trio is steeped in the art of value investing, having learned it from some of the best in the business, including Wally Weitz of Weitz Funds and John Rogers of Ariel Investments. Their flagship offering, the Lateef Fund (ticker: LIMAX), celebrated its fifth anniversary at year end by doing what it’s usually done: beating its benchmark.

Barron’s: Are you more bullish or bearish about the U.S. equity market after the run-up in the S&P 500 and Dow Jones industrials?

Sauer: You can almost feel the rumbling of what they are calling the “great rotation” into equities. We’re seeing it in fund flows. Corporate risk spreads are obviously tight. Junk-bond yields are low. That is positive for the market….”

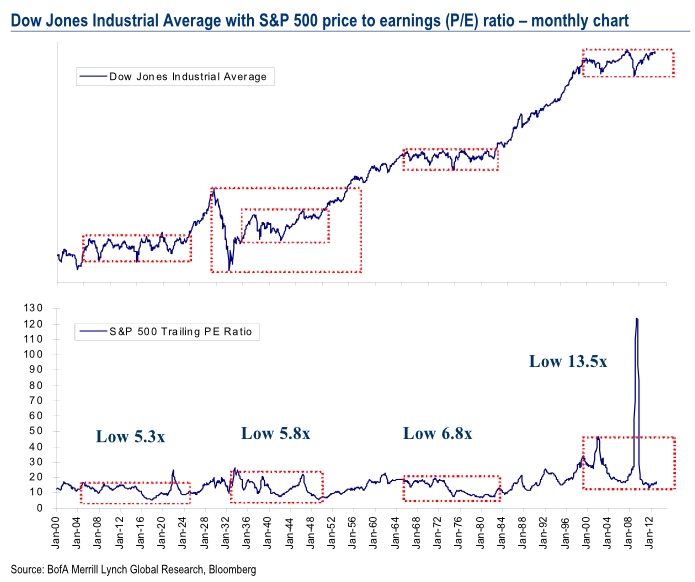

Comments »A Look at P/E For the DOW vs The S&P

Leon Cooperman Kicks Out $AAPL and Buys $FB

“Shares of Facebook (NASDAQ: FB [FREE Stock Trend Analysis]) surged to a session high Wednesday after a 13F filing revealed that Leon Cooperman’s Omega Advisors had purchased 3.16 million shares in the last quarter.

Although Cooperman could’ve exited his stake within the last few weeks, he was in Facebook as of December 31.

Facebook shares traded up nearly three percent after news of Cooperman’s filing broke, trading back above $28 per share.

(c) 2013 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments »The Relationship Between Returns and Volatility

“Do returns dictate volatility or does volatility dictate returns? It might seem like a silly question, but one that is worth spending a bit of time on. If market returns actually followed normal distributions, then we might expect that there are as many up days as down days and upside deviation equals downside deviation. Unfortunately, the distribution of returns is rather non-normal with a larger number of negative returns and a lot of small positive returns. You can read about option pricing and equity return distributions at a popular old post, “Do Black Swans Negate Option Premiums“.

The question for today is whether volatility necessarily means that returns are negative. For this little bit of analysis, we will look at the S&P 500 daily returns going back to 1928. The data is calculated into calendar month statistic sets and then the sets are grouped by realized volatility buckets (see figure 1)….”

Comments »A Look at the Best and Worst Stock Oracles

“(MoneyWatch) The financial media tends to focus most of its attention on stock market forecasts by purported investment gurus. They do so because they know that’s what gets the public’s attention. Investors must believe they have value or they wouldn’t tune in. Nor would they subscribe to investment newsletters, nor publications like Barron’s that claim to provide you with “news before the markets know.”

Unfortunately for investors, there’s a whole body of evidence demonstrating that market forecasts have no value (though they provide me with plenty of fodder for my blog) — the accuracy of forecasts is no better than one would randomly expect. For investors who haven’t learned that forecasts should only be considered as entertainment, or what Jane Bryant Quinn called investment porn, they actually have negative value because forecasts can cause them to stray from well-developed plans.

The latest piece of evidence illustrating the futility of forecasts comes from CXO Advisory Group. The investor research firm set out to determine if stock market experts, whether self-proclaimed or endorsed by others, provide useful guidance on how to time the stock market. To find the answer, from 2005 through 2012 they collected and investigated roughly 6,600 forecasts for the U.S. stock market offered publicly by 68 experts, bulls and bears employing technical, fundamental and sentiment indicators. Their collection included forecasts, all of which were publicly available on the Internet and which went back as far as the end of 1998. They selected experts based on Web searches for public archives with enough forecasts spanning enough market conditions to gauge their broader accuracy.

CXO’s methodology was to compare forecasts for the U.S. stock market to the S&P 500 index returns over the future intervals most relevant to the forecast horizon. They excluded forecasts that were too vague and forecasts that included conditions requiring consideration of data other than stock market returns. They matched the frequency of a guru’s commentaries (such as weekly or monthly) to the forecast horizon, unless the forecast specified some other timing. And importantly, they took into account the long-run empirical behavior of the S&P 500 index. For example, if a guru said investors should be bullish on U.S. stocks over the year, and the S&P 500 index was up by just a few percent, they judged the call incorrect (because the long-term average annual return has been much higher). Finally, they graded complex forecasts with elements proving both correct and incorrect as both right and wrong (not half right and half wrong).

The following is a summary of CXO’s findings….”

Comments »Peter Schiff: US Will Win Currency War; Economy Will ‘Implode’

“The United States will win the global currency war, and the economy will “implode” as a result, says Peter Schiff, CEO of Euro Pacific Capital.

Central banks around the world are easing monetary policy, which often pushes a currency lower.

“There is a currency war going on. The irony of a currency war, which makes it different from other wars, is the object is to kill itself,” Schiff said at a conference Monday, CNBC reports.

“Unfortunately, I think the U.S. is going to win the currency war.”

A currency war kills by sparking inflation in countries that depress their currencies. “Anybody who believes there is no inflation [in the United States] isn’t shopping,” Schiff said.

The consumer price index rose 1.7 percent last year, but official inflation numbers are “a total fraud,” Schiff said. “Consumer prices in the U.S. are moving up much faster than indicated by the CPI. It is manipulated. It is deliberately designed to mask inflation, not report it.”

Schiff has been a consistent critic of the Federal Reserve’s massive easing program.

“The Fed knows that the U.S. economy is not recovering,” he noted. “It simply is being kept from collapse by artificially low interest rates and quantitative easing. As that support goes, the economy will implode.”

Gross domestic product (GDP) shrank 0.1 percent in the fourth quarter….”

Comments »Gapping Up and Down This Morning

ART CASHIN: A Dormant US Inflation Indicator Just Spiked, And It’s Got Me Thinking Of Weimar And Zimbabwe

“Veteran trader Art Cashin has been more concerned about the threat of inflation in the U.S. than most.

In a recent interview with Eric King of King World News, he notes that the once dormant threat of inflation could be waking up.

From King World News:

…That having been said, the Federal Reserve Bank of St. Louis puts out what is called the ‘Monetary Stock.’ It is the ‘raw material’ of the money supply, and it has been dormant throughout the year.

The report for the first part of this year suddenly spiked higher, and it’s something that I’m going to keep a very close look at. It may be, and there is some seasonality, but I think people need to begin watching the money supply, particularly the M2, and see if that starts to accelerate…”

Comments »BoE Expects to Battle Another Round of Inflation and Weak Growth

“Bank of England Governor Mervyn King said Britain faces a further bout of inflation and a muted economic recovery, and pledged officials will look through the volatility in prices to keep nurturing growth where they can.

“Inflation is likely to rise further in the near term and may remain above the 2 percent target for the next two years,” King said as he presented the central bank’s Inflation Report in London today. “The MPC’s remit is to deliver price stability in the medium term in a way that avoids undesirable volatility in output in the short run. The prospect of a further prolonged period of above-target inflation must therefore be considered alongside the weakness of the real economy.”

The pound fell as King spoke on the dilemma of a weak recovery and above-target inflation that has plagued the Monetary Policy Committee for more than three years and is set to overshadow the last few months of his tenure. The BOE said today it sees inflation at about 2.3 percent at the end of its two-year forecast period, and a “slow and sustained” recovery.

“If necessary, we will do more,” King told reporters today. “We must recognize, however, that there are limits to what can be achieved via general monetary stimulus — in any form — on its own.”

The pound was down almost 0.6 percent against the dollar at $1.5570 as of 12:02 p.m. in London.

Inflation Outlook

In its Inflation Report, the BOE said the outlook for consumer-price growth is higher than forecast in November because of the weaker pound and increases in energy bills. It also warned that weak productivity is boosting domestic cost pressures….”

Comments »Lloyd Blankfein: Markets Are on the Threshold of a New Bull Market

“Goldman Sachs CEO Lloyd Blankfein gave his state of union on CNBC’s “Street Signs” Tuesday, saying the political environment remains difficult as Washington grapples with the sequester but the “economic underpinnings are actually better than they have been for some time.”

“We could be on the threshold of a bull market,” Blankfein said.

The Goldman executive listed extremely low interest rates, a “terrific” energy situation which can drive manufacturing and create jobs, and an ongoing turnaround in housing. But he cautioned that the U.S. needs policies to make sure it can benefit from those advantages.

(Read More: What Is Goldman Sachs?)

“A million things that can go wrong but what people under-assess is things could go right,” Blankfein said. With the U.S. stock market flirting with all-time highs, he added, “The equity market could very have it right.”

(Read More: Goldman Sachs Downgrades Global Stocks as Rally Stalls)

Blankfein’s comments come hours ahead of President Barack Obama’s State of the Union address Tuesday evening.

The U.S. has also made significant progress on dealing with its debt and deficits, Blankfein said, but there is more work to be done. He noted that with sequestration, tax increases and other measures, politicians have cut nearly $2.6 trillion — still far below the $4 trillion needed.

“When you look through it, come hell or high water, we’re going to have $2.6 trillion” in cuts, he said. “It’s not where we should be but it’s not nothing.”

He also expects a pickup in merger activity. “My expectation generally would be for where we are in the economic cycle, given the level of interest rates — which are very, very low — and equity market values which are high and moving higher — we think there should be more activity now generally than we’re seeing,” Blankfein said….”

Comments »RAY DALIO: Borrow Cash And Buy Almost Anything With It

“Ray Dalio who runs the world’s biggest hedge fund at Bridgewater Associates, said a few weeks ago at Davos that 2013 would be the year when large amounts of cash moved into markets, and that investors should position for price appreciation in risky assets.

Today, Bloomberg’s Kelly Bit has details from one of the secretive firm’s recent client conference calls, which fleshes out the firm’s bullish thesis in a bit more detail.

Bit says that on the call, Bridgewater co-CIO Bob Prince told clients, “You want to be borrowing cash and hold almost anything against it.” …”

Comments »$BAC: The Fed May Have to Step on the QE Gas Pedal

” “This is not a fluke: almost all of the underlying determinants of inflation point to weakness,” writes BofA Merrill Lynch economist Ethan Harris in a note to clients today.

For all of the talk of rising government bond yields and predictions for when the Federal Reserve will taper back its bond buying, Harris says, deflation is still a bigger risk than higher inflation – and disinflation could cause the Fed to actually ramp up QE if it continues.

Several key measures of inflation are actually headed lower, and have yet to bottom out, according to Harris.

“This, along with the fiscal shock, is a good reason to fade the bond market sell-off,” he writes.

The chart below shows Core CPI, Core PPI, Median CPI (calculated by the Cleveland Fed), Core PCE, and Trimmed PCE (calculated by the Dallas Fed).

Harris cites six forces weighing on inflation, summarized below:

- Spare capacity: Official estimates for the U.S. output gap, the difference between potential GDP and actual GDP, range from 3.6 to 5.6 percent – the widest since the 1982 recession. Moreover, the unemployment rate, at 7.9 percent, is still well above BofA’s estimate for the inflation-neutral rate (6.3 percent).

- Labor costs: High unemployment is keeping downward pressure on wages and salaries. Harris says that excepting for a distorted number in Q4, unit labor costs have been “essentially flat” over the past year.

Short Interest Rises in Some of the Most Actively Trade Stocks

“We have tracked the key short interest changes as of January 31 in the following large cap stocks: General Electric Co. (NYSE: GE), Nokia Corp. (NYSE: NOK), Bank of America Corp. (NYSE: BAC), Verizon Communications Inc. (NYSE: VZ), Alpha Natural Resources Inc. (NYSE: ANR), McDonald’s Corp. (NYSE: MCD), Apple Inc. (NASDAQ: AAPL), Research In Motion Ltd., Microsoft Corp. (NASDAQ: MSFT), Dell Inc. (NASDAQ: DELL), Green Mountain Coffee Roasters Inc. (NASDAQ: GMCR) and Cisco Systems Inc. (NASDAQ: CSCO)………

BlackBerry remains the most heavily shorted of these active stocks, name change notwithstanding. Dell’s short interest fell dramatically in the days leading up to the buyout offer from Michael Dell and his partners. GE’s rise in short interest is likely due to investors’ belief that the company will not repeat its strong fourth-quarter showing. Finally, McDonald’s has been having trouble meeting expectations for monthly sales, and shorts are taking advantage of that.”

Comments »Fed’s Yellen: Aggressive Easing Needed to Bolster Labor Market

“The Federal Reserve’s aggressive easing of monetary policy is warranted given the still-battered state of the U.S. labor market, Fed Vice Chairwoman Janet Yellen said on Monday.

In an address to the politically influential AFL-CIO, the largest U.S. labor group, Yellen, a potential successor to Fed Chairman Ben Bernanke next year, focused on the unusually weak nature of the economic expansion.

“The gulf between maximum employment and the very difficult conditions workers face today helps explain the urgency behind the Federal Reserve’s ongoing efforts to strengthen the recovery,” Yellen said.

“We have taken, and are continuing to take, forceful action to increase the pace of economic growth and job creation.” …”

Comments »Gapping Up and Down This Morning

NYSE

NASDAQ

AMEX

LOSERS

NASDAQ – Pre-Market Ten Most Active Share Volume

As of 2/12/2013 8:43:48 AM

| Symbol | Company | Last Sale* | Change Net / % | Share Volume | |

|---|---|---|---|---|---|

| Facebook, Inc. | $ 27.53 | 0.73 |

783,927 | ||

| Zynga Inc. | $ 3.75 | 0.08 |

666,628 | ||

| Gulfport Energy Corporation | $ 38.52 | 0.16 |

257,180 | ||

| PowerShares QQQ Trust, Series 1 | $ 67.98 | 0.03 |

222,490 | ||

| Research In Motion Limited | $ 15.77 | 0.04 |

214,076 | ||

| Ericsson | $ 12.30 | 0.13 |

190,100 | ||

| Fossil, Inc. | $ 107.95 | 0.49 |

185,205 | ||

| American Capital Mortgage Investment Corp. | $ 25.86 | 0.71 |

170,435 | ||

| NetApp, Inc. | $ 35.65 | 0.29 |

94,000 | ||

| The Goodyear Tire & Rubber Company | $ 13.37 | 0.54 |

81,317 | ||

What’s Moving Pre-Market

| S&P 500 Gainers & Losers | Price | Pre-Market % Change |

Volume |

|---|---|---|---|

| MASMasco Corp | 19.00 | +6.80% | 65,455 |

| AVPAvon Products Inc | 18.05 | +4.46% | 11,992 |

| WYNNWynn Resorts Ltd | 123.85 | +3.01% | 300 |

| AIVApartment Investment… | 28.92 | +2.57% | 777 |

| AMZNAmazon.com Inc | 260.30 | +2.32% | 25,587 |

| FSLRFirst Solar Inc | 32.52 | -5.59% | 4,535 |

| FOSLFossil Inc | 108.66 | -4.06% | 144,472 |

| NDAQNASDAQ OMX Group Inc… | 31.00 | -3.72% | 7,050 |

| YHOOYahoo! Inc | 20.90 | -2.11% | 2,750 |

| BKBank of New York Mel… | 27.35 | -2.08% | 925 |

The Greatest Story Never Told: Swaps and the Risks Involved

Once in a while i have to smack my self for falling into a false sense of security. This post is one of those external reminders to help me not forget.

So we had a balance sheet recession and in response the fed and the taxpayer bailed out the system.

The cause of this balance sheet recession was due to an enormous amount of on and off balance sheet liability tied to the housing market.

Now, that we have forgotten about off balance sheet talk it is business as usual for the crooks.

Nobody went to jail, the banks get a free ride off of the taxpayers back, and the only ones who benefit from this environment are large corporations and the banking system.

The large corporations have refinanced mostly all outstanding debt down to historically low rates while the banks get to use the free money to speculate.

This speculation has some effect upon CPI. It is inflationary no matter how statistics are jiggered.

Now in a truly capitalistic society the banks would have gone bankrupt. But the bankruptcies would have been so wide spread that there would be no financial system left. We had to act plain and simple.

We in effect nationalized the banks without having any of the transparency or controls that would have come from nationalization.

The question remains; why are we still keeping a ZIRP policy going? Why would we take such high risks?

There is only one answer. The black hole that caused the crash is largely still present.

There is no other answer. If it were not there then the banks would lend money to the private sector at a rate similar too or better than it was before the crash of the system.

While this seems plainly obvious, the boob tube is doing a good job of moving the American people further away from worry over the entire topic.

Here is a great video on balance sheets and gimmickry;(8 minutes for ADD readers.)

Notional value on SWAPS is something to be concerned over. Not having disclosure or transparency is something to be concerned over. Not insisting upon said disclosure and regulation thereof will cause another melt down in the system.

The question is when will the glass menagerie fall again?

[youtube://http://www.youtube.com/watch?v=UmNV8_VBGX0 450 300]

Comments »

Nassim Taleb: Beware the Big Errors of ‘Big Data’

“We’re more fooled by noise than ever before, and it’s because of a nasty phenomenon called “big data.” With big data, researchers have brought cherry-picking to an industrial level.

Modernity provides too many variables, but too little data per variable. So the spurious relationships grow much, much faster than real information.

In other words: Big data may mean more information, but it also means more false information.

Just like bankers who own a free option — where they make the profits and transfer losses to others – researchers have the ability to pick whatever statistics confirm their beliefs (or show good results) … and then ditch the rest.

Big-data researchers have the option to stop doing their research once they have the right result. In options language: The researcher gets the “upside” and truth gets the “downside.” It makes him antifragile, that is, capable of benefiting from complexity and uncertainty — and at the expense of others.

But beyond that, big data means anyone can find fake statistical relationships, since the spurious rises to the surface. This is because in large data sets, large deviations are vastly more attributable to variance (or noise) than to information (or signal). It’s a property of sampling: In real life there is no cherry-picking, but on the researcher’s computer, there is. Large deviations are likely to be bogus.

We used to have protections in place for this kind of thing, but big data makes spurious claims even more tempting. And fewer and fewer papers today have results that replicate: Not only is it hard to get funding for repeat studies, but this kind of research doesn’t make anyone a hero. Despite claims to advance knowledge, you can hardly trust statistically oriented sciences or empirical studies these days.

This is not all bad news though: If such studies cannot be used to confirm, they can be effectively used to debunk — to tell us what’s wrong with a theory, not whether a theory is right.

Another issue with big data is the distinction between real life and libraries. Because of excess data as compared to real signals, someone looking at history from the vantage point of a library will necessarily find many more spurious relationships than one who sees matters in the making; he will be duped by more epiphenomena. Even experiments can be marred with bias, especially when researchers hide failed attempts or formulate a hypothesis after the results — thus fitting the hypothesis to the experiment (though the bias is smaller there).

This is the tragedy of big data: The more variables, the more correlations that can show significance. Falsity also grows faster than information; it is nonlinear (convex) with respect to data (this convexity in fact resembles that of a financial option payoff). Noise is antifragile. Source: N.N. Taleb

The problem with big data, in fact, is not unlike the problem with observational studies in medical research. In observational studies, statistical relationships are examined on the researcher’s computer. In double-blind cohort experiments, however, information is extracted in a way that mimics real life. The former produces all manner of results that tend to be spurious (as last computed by John Ioannidis) more than eight times out of 10….”

Comments »Barron’s: Five Reasons To Stay Away From Gold

“Humphrey Neill, the father of contrarian analysis, famously wrote that “when everyone thinks alike, everyone is likely to be wrong.”

That’s a sobering thought when it comes to gold, since the belief in gold’s investment virtues seems to be almost universal.

For this column I am taking Neill’s advice to heart, with help from a new study published by the National Bureau of Economic Research in Cambridge, Mass. “The Golden Dilemma,” by Claude Erb, a former commodities portfolio manager for Trust Company of the West, and Campbell Harvey, a finance professor at Duke University, calls the conventional wisdom into question.

I should stress that the study’s authors are not predisposed against gold. For example, Erb told me, he frequently bought and held gold for the commodities portfolio he used to manage. Here’s a summary of the study’s findings:

Gold as inflation hedge

This is perhaps the most widely held belief about gold, and the one that the study’s authors devote the most energy to analyzing. They found that gold does not live up to the widely held belief that gold’s price in real terms remains more or less constant.

Over any of the time periods assumed by investors — from the short term to as long as 20 years — gold’s real price has fluctuated wildly. Interestingly, Erb and Prof. Harvey told me in separate interviews that this finding holds regardless of how inflation is defined — whether it’s based on government data, or the shadow statistics some think are more accurate, or monetary inflation as measured by money supply….”

Comments »Reaganomics VS Obamanomics

“In February, 2009, I wrote for theWall Street Journal an article entitled Reaganomics versus Obamanomics. The article explained that the emerging Obamanomics was pursuing exactly the opposite of every policy of the enormously successful Reaganomics, and predicted that it would produce exactly the opposite results.

Well, the results are in, and under President Obama the American people have now suffered the worst 5 years since the Great Depression, as first explained by Steve McCann of the American Thinker on January 25. McCann writes….”

Comments »