[youtube://http://www.youtube.com/watch?v=Ouo7Q6Cf_yc#t=25 450 300]

Comments »Monthly Archives: October 2013

Israeli Planes Strike Syrian Military Base

“(CNN) — Israeli warplanes struck a military base near the Syrian port city of Latakia this week, an Obama administration official told CNN on Thursday.

An explosion at a missile storage site in the area was reported in the Middle Eastern press, but an attack has not been confirmed by the Israeli government.

The target, according to the Obama administration official, was missiles and related equipment the Israelis felt might be transferred to the Lebanon-based militant group Hezbollah. The official declined to be identified because of the sensitive nature of the information.

There was some confusion about the timing of the attack, with some reports saying it happened Wednesday, and others saying Thursday.

When asked for comment, an Israel Defense Forces spokeswoman told CNN: “We don’t refer to foreign reports.”

Israel has been accused several other times this year of launching airstrikes inside Syria, including once in January. In the January incident, a U.S. official said Israeli fighter jets bombed a Syrian convoy suspected of moving weapons to Hezbollah.

Syrian rebels warn against talks with regime

Israel’s military did not comment on any of the allegations at the time, but has long said it would target any transfer of weapons to Hezbollah or other groups designated as terrorists, as well as any effort to smuggle Syrian weapons into Lebanon that could threaten Israel.

Thursday’s reports of a blast come amid a Syrian civil war in which Hezbollah, a Shiite Muslim militant group….”

Comments »Don’t Get Hosed !

There are many ways to hose the taxpayer; let’s make sure this will not be one of them. Don’t get *^#*!$ in the @$$

“Statement by Francisco Enriquez, U.S. Public Interest Research Group Tax and Budget Associate, in response to recent news reports that JPMorgan will admit fault as part of its $100 million settlement with the Commodity Futures Trading Commission for the $6 billion “London Whale” trading fiasco.

“On Wednesday, reports emerged that JPMorgan Chase will agree to admit to wrongdoing and pay a $100 million penalty for improper market manipulation that led to a multibillion dollar trading loss. Yet unless the Commodity Futures Trading Commission (CFTC) explicitly forbids it, the bank could write off the settlement as a tax deduction, forcing taxpayers to shoulder some of the cost of JPMorgan’s admitted reckless behavior.

“JPMorgan’s admission of wrongdoing will only benefit the public if investors can be made whole through ensuing civil litigation, and if taxpayers are protected from bearing the cost of tax windfalls to the bank.

“Federal law forbids companies from deducting public fines and penalties from their taxes, but payments made as part of a settlement can be treated differently. Companies that cut deals with an agency to resolve charges through a legal settlement typically manage to deduct the penalties as a tax write-off unless specifically forbidden from doing so. In essence, companies are allowed to receive a tax subsidy for their wrongdoing, forcing ordinary taxpayers to shoulder the budgetary burden.

“Despite an admission of wrongdoing….”

If you would like to voice your opinion click here

Comments »

State of the Union

“Did you know that the number of Americans on welfare is higher than the number of Americans that have full-time jobs? Did you know that 1.2 million public school students in the U.S. are currently homeless? Anyone that uses the term “economic recovery” to describe what is happening in the United States today is being deeply insulting to the nearly 150 million Americans that are considered to be either “poor” or “low income” at this point. Yes, things are great in New York City, Washington D.C. and San Francisco, but almost everywhere else economic conditions continue to steadily get worse.

The gap between the wealthy and the poor is at a level that America has never seen before, and this is beginning to create a “Robin Hood mentality” that could cause a tremendous amount of social chaos in the years ahead. Anger at the “haves” in America continues to rise at a very alarming pace, and the “have nots” are becoming increasingly desperate. At some point all of this anger is going to boil over, and you won’t want to be anywhere around major population centers when that happens.

Despite unprecedented borrowing by the federal government in recent years, and despite unprecedented money printing by the Federal Reserve, poverty in the United States keeps getting worse with each passing year. The following are 29 incredible facts which prove that poverty in America is absolutely exploding…

1. What can you say about a nation that has more people getting handouts from the federal government than working full-time? According to the latest numbers from the U.S. Census Bureau, the number of people receiving means-tested welfare benefits is greater than the number of full-time workers in the United States.

2. New numbers have just been released, and they show that the number of public school students in this country that are homeless is at an all-time record high. It is hard to believe, but right now 1.2 million students that attend public schools in America are homeless. That number has risen by 72 percent since the start of the last recession.

3. When I was growing up, it seemed like almost everyone was from a middle class home. But now that has all changed. One recent study discovered that nearly half of all public students in the United States come from low income homes.

4. How can anyone deny that we are a socialist nation when half the people are getting money from the federal government each month? According to the most recent numbers from the U.S. Census Bureau, 49.2 percent of all Americans are receiving benefits from at least one government program.

5. Signs of increasing poverty are even showing up in the wealthiest areas of the nation. According to the New York Post, New York subways are being “overrun with homeless“.

6. According to the U.S. Census Bureau, approximately one out of every six Americans is now living in poverty. The number of Americans living in poverty is now at a level not seen since the 1960s.

7. The gap between the rich and the poor in the United States is at an all-time record high. The wealthy may not consider this to be much of a problem, but those at the other end of the spectrum are very aware of this…..”

Comments »Are Puerto Rico’s Bonds a Canary in the Coal Mine ?

“Despite the fact that Puerto Rican (PR) municipal bonds are triple-tax-exempt (no federal, state, or local income taxes apply on their interest), their interest rates have skyrocketed since the Detroit bankruptcy first disrupted the complacency among municipal bond investors in July. High quality municipal bonds are paying little more than 1 percent annually, but PR bonds, even though they remain investment grade (barely), have spiked to paying between 8 and 10 percent, with some predicting that even higher rates will be necessary in order to attract new investors.

Comparisons to Detroit are tempting, but a careful look at the headwinds facing Puerto Rico makes Detroit’s problems seem almost not worth mentioning. Detroit’s bankruptcy filing in July was for $18 billion. Puerto Rico’s debt is nearly four times larger.

A partial listing of those headwinds include:

• Moody’s downgrade of PR debt on October 3 to just above junk, with its outlook changed from stable to negative;

• The recent settlement by UBS bank’s Puerto Rican branch with the Securities and Exchange Commission over hiding the country’s faltering financial condition and artificially supporting bond prices;

• The necessity by Puerto Rico treasury officials to borrow in the private market because the bond market is essentially closed to them;

• The U.S.-enforced minimum wage in Puerto Rico, which makes it too expensive for business owners to hire workers, impacting the island’s already high unemployment rate — a rate that is nearly twice that in the United States;

• National debt that is greater than any American state, except California (population of 38 million) and New York (population of 20 million) — Puerto Rico has a population of just 3.6 million;

• A ratio of debt to personal income (which in the United States averages 3.4 percent) is an eye-popping 89 percent;

• A labor force participation rate of just 41 percent, compared to 63 percent in the United States;

• The sharp increase in income taxes by President Alejandro Padilla in his attempt to balance the government’s budget by 2016;

• Overly generous welfare and disability income programs, which discourage employment and encourage dependency;

• Bloated government, where one in five workers are employed by the government;

• The country’s pension plan, which is only 7 percent funded;

• The government’s cash flow, which has been negative for the past 13 years, and

• Its 2012 Comprehensive Annual Financial Statement, due months ago, has yet to be filed.

As a territory of the United States (more accurately, the relationship between the United States and Puerto Rico is that of asuzerainty), Puerto Rico therefore suffers from the welfare state mentality of its northern neighbor. The country has subsisted on handouts, special incentives (such as a tax code that, until 2006, allowed U.S. corporations with offices in Puerto Rico to send their earnings to their parent without paying corporate income tax), and triple tax exemptions that allowed the government to continue to borrow at artificially attractive rates from American investors who assumed that their investments were safe. For those investors it was the best of all worlds: In a low interest-rate environment, they were able to generate excellent real rates of return without risk to their capital.

Until now.

Most of Puerto Rico’s borrowings have been absorbed by municipal bond funds run by big names such as Franklin, Fidelity, and Oppenheimer. According to MorningStar, the mutual fund tracking service, 180 mutual funds in the United States hold at least five percent of their portfolios in PR municipal bonds. Some of them, such as the Franklin Double Tax-Free Income fund, has a 60 percent exposure to Puerto Rico and has seen its value drop a harrowing 15.7 percent in just the last five months. In other words, investors in that fund have seen their capital shrink by three percent per month just since May, losing one-sixth of their initial investment.

One mutual fund manager, affiliated with UBS bank, has seen its two primary Puerto Rico funds — the UBS Puerto Rico Tax-Free Target Maturity Fund and the UBS Puerto Rico Tax-Free Target Maturity Fund II — lose an astounding 88.9 percent and 83.5 percent of their value, respectively.

The impact on borrowing costs ripple out far beyond that of a small island in the Caribbean. It is estimated that the entire municipal bond market in the United States exceeds $4 trillion. If the situation in Puerto Rico continues to unravel, interest rates are likely to rise significantly across the board, raising borrowing costs for every municipality from Dubuque to Portland….”

Comments »The First Bitcoin ATM Opens in Canada

“The world’s first bitcoin ATM opened Tuesday in Vancouver, Canada, dispensing hard money in exchange for the anonymous crypto-currency through a palm-scan security system.

The automated teller is set up in downtown Vancouver at Waves Coffee House, making it the first of five ATMs bought by Canadian firm Bitcoiniacs from Nevada-based producer Robocoin.

“I think [bitcoins have] the potential to be revolutionary,” Mitchell Demeter, founder of Bitcoiniacs and co-owner of Robocoin, told RT.

The machines will exchange bitcoins for Canadian dollars via Canada’s VirtEx exchange. The transactions themselves will be anonymous, the vendor says, but clients will have to identify themselves via a palm scanner first.

Demeter said the anonymous nature of bitcoins should not scare those reticent to trust the currency’s validity.

A user is instructed on how to scan his palm using scanning identification to ensure that a single user cannot exchange more than $1,000 in a single day day on the world’s first bitcoin ATM at Waves Coffee House on October 29, 2013 in Vancouver, British Columbia (AFP Photo / David Ryder)

A user is instructed on how to scan his palm using scanning identification to ensure that a single user cannot exchange more than $1,000 in a single day day on the world’s first bitcoin ATM at Waves Coffee House on October 29, 2013 in Vancouver, British Columbia (AFP Photo / David Ryder)

“It’s said to be anonymous, but it isn’t really,” he explained. “Every transaction you make is recorded on a public ledger. Your name isn’t attached to it, but if somebody wants to find out who is making that transaction, it can be done.”

This is done to enforce Canadian anti-money laundering laws……”

Comments »The Djinn is Out

“Argentina’s agricultural industry was dramatically transformed by the introduction of genetically modified plants in 1996. A country once known for its grass-fed beef is now dominated by genetically engineered soy, corn and cotton. Farmers in the Latin American country use twice as much pesticide per acre as farmers in the US, and those agrotoxins are applied by many farmers not wearing any protective gear and then drift into homes and schools. Since the introduction of these practices in Argentina by agrichemical companies such as Monsanto, cancer rates have skyrocketed and the number of birth defects has quadrupled.

Argentina was an early adopter of GMO technology when it was billed as the silver bullet to solve world hunger with increased crop productivity, and improved human and environmental health resulting from decreased pesticide use. The most widely used GMO crops, such as Monsanto’s Roundup Ready line of corn and soybeans, allow farmers to apply the herbicide glyphosate during and after seed plantings in order to kill weeds without risk of the main crop dying off. Today, almost all the corn, soy, and cottonproduced in the country are GMO.

Both the United States and Argentina produce almost exclusively GM soybeans. In these countries, GM soybeans are approved without restrictions and are treated just like conventional soybeans. Producers and government officials in the US and Argentina do not see a reason to keep GM and conventionally bred cultivars separate — whether during harvest, shipment, storage or processing. Soybean imports from these countries generally contain a high amount of GM content.

No Official Concern

Doctors warn that the rise in cancer and birth defects in Argentina may be attributable to the growing use of these pesticides.

Doctors warn that the rise in cancer and birth defects in Argentina may be attributable to the growing use of these pesticides.

This summer the non-profit organization GRAIN highlighted the “neocolonialist fervor” with which transnational agribusinesses were transforming parts of Latin America, including Argentina, into “The United Republic of Soybeans,” pushing genetically modified crops and sparking “a social and environmental catastrophe settling like a plague over the entire region.”

| There has been no official concern about the problems caused by the widespread planting of transgenic soybeans and the high levels of agrotoxins this requires On the contrary, this model continues to be consolidated and defended by all of the region’s governments, which have adopted it as government policy in every case. At best — and only when societal pressure becomes too great — they have given slapdash consideration to the problems of agrotoxin poisoning, displacement of peasants and first peoples, land concentration, and loss of local production. But these are considered “collateral impacts.” |

GRAIN wrote:

Researchers in the U.S. have corroborated, GMO technology only decreases pesticide use for a short period of time. After the brief decline in Argentina, pesticide use soared from 9 million gallons in 1990 to 84 million gallons today as weed resistance developed to glyphosate. In response, agrichemical companies have encouraged the use of more hazardous and toxic chemicals to kill weeds. Argentinian farmers are now mixing in and applying herbicides such as 2,4-D, a chlorophenoxy herbicide that made up half of Agent Orange, the chemical mixture used to defoliate forests and croplands in the Vietnam War. 2,4-D has also been linked to kidney/liver damage, neurotoxicity, and birth defects. Earlier this year the U.S. Department of Agriculture (USDA) delayed the introduction of a new generation of GMO crops resistant to 2,4-D.

Widespread Health Problems

Aixa Cano, a shy 5-year-old who lives in Chaco, Argentina’s poorest province, was born with hairy moles all over her body. Her mother believes the skin condition was caused by contaminated water. Her neighbour, 2-year-old Camila Veron, was born with multiple organ problems and is severely disabled. Doctors told their mothers that agrochemicals may be to blame.

“They told me that the water made this happen because they spray a lot of poison here,” said Camila’s mother, Silvia Achaval.

“People who say spraying poison has no effect, I don’t know what sense that has because here you have the proof,” she added, pointing at her daughter.

Fabian Tomasi, 47, never wore any protective gear in the years he spent pumping poisons into crop-dusting planes. Today, he is near death from polyneuropathy, a neurological disorder that has left him emaciated.

“I prepared millions of liters of poison without any kind of protection, no gloves, masks or special clothing. I didn’t know anything. I only learned later what it did to me, after contacting scientists,” he said.

Now, at 47, he’s a living skeleton, so weak he can hardly swallow or go to the bathroom on his own.

Schoolteacher Andrea Druetta lives in Santa Fe Province, the heart of Argentina’s soy country, where agrochemical spraying is banned within 500 meters (550 yards) of populated areas. But soy is planted just 30 meters (33 yards) from her back door. Her boys were showered in chemicals recently while swimming in the backyard pool.

After Sofia Gatica lost her newborn to kidney failure, she filed a complaint that led to Argentina’s first criminal convictions for illegal spraying….”

Comments ».com Bubble 2.0 ?

” “It’s gotten pretty frothy,” is how one portfolio manager describes the behavior in internet-based companies currently as signs of pre-2000 exuberance can be seen in Silicon Valley and the nearby area. As WSJ reports, home prices in San Francisco and surrounding counties rose more than 15% in the past year. Office rents in San Francisco are 23% above their 2008 peak. As SnapChat, Pinterest, and Twitter are set to join such illustrious names as RocketFuel; asset managers are careful to remind suckers investors that it’s not at all like 1999 – companies going public are more mature, the leadership teams more seasoned, the business models more proven – but the “reach for growth” at all costs echoes Kyle Bass’ remarks that “financial memory is no longer than two years,” with even younger and more revenue-deprived companies come to market at massively elevated multiples.

Via WSJ,

Comments »“It’s gotten pretty frothy,” says Daniel Cole, a senior portfolio manager at Manulife Asset Management who has invested in highflying IPOs, including for Rocket Fuel Inc. The Redwood City, Calif., online-advertising company sold shares to the public last month at $29 each. They traded at $61.72 a share Friday, giving Rocket Fuel a market valuation of $2 billion, without having recorded a profit.

… Technology and finance veterans say this time is different—and it is. Companies going public are more mature, the leadership teams more seasoned, the business models more proven. Social networks such as Twitter and Pinterest are drafting off the success of Facebook Inc., which sports a market value of $126.5 billion, or about 70 times next year’s expected earnings.

But the current surge is accelerating, aided by some little-appreciated factors. Big companies are scarcely growing, and interest rates remain near zero, boosting zeal for investment opportunities in companies with high-growth potential….”

Destroying National Sovereignty and Usurping the Democratic Process With the TPP

“New reports on leaked draft versions of the Trans-Pacific Partnership (TPP) agreement indicate threats to the rights of news organizations to publish information critical of large corporations. The multinational trade pact will require member states to surrender sovereign control over domestic copyright laws, as well.

In a story published by the Electronic Frontier Foundation(EFF), the agreement being hammered out by the 12 Pacific rim countries will:

give private corporations new tools to undermine national sovereignty and democratic processes. Specifically, TPP would give multinational companies the power to sue countries over laws that might diminish the value of their company or cut into their expected future profits.

EFF reports that a seemingly benign provision of the TPP agreement called the “investor-state dispute settlement” (ISDS) will revoke the right of domestic courts to settle legal disputes between participating countries and corporations with investments in that country.

In a nutshell, if a corporation feels that its ability to turn a profit on an investment made in a member country is being stymied by the country’s regulatory scheme, then that corporation may bring the dispute to the TPP bureaucracy, completely bypassing the nation’s domestic judicial system.

The EFF story summed up this TPP provision’s assault on national sovereignty:

Apparently a country’s own courts can’t be trusted to administer this kind of lawsuit, so investor-state also requires the creation of a new court. It would be comprised of three private-sector attorneys who take turns being judge and/or corporate advocate.

Even if this kangaroo court ruled in favor of the defendant nation, court costs alone would scare countries from adopting (or enforcing) pro-user policies where they might potentially inhibit investor profits. The investor-state tribunal bills its time by the day and decides for itself how many days to work, so it can rack up as many days of work they want. Given this system, it’s then no surprise that current investor-state court costs average about 8 million dollars per case. So even if it wins, the country has to pay those court fees, the lawyer fees, plus compound interest. That’s money that would doubtless be better spent elsewhere.

The process is absurd as well. Once a decision has been issued, there is no way to appeal it. That’s right, if this court rules that the nation is at fault and has to pay huge fees that could even bankrupt a government, there’s no other way for the country to overturn that decision.

The ISDS section of the chapter on intellectual property in the leaked TPP draft agreement is nearly as “absurd,” however, as the agreement’s mandate forces member nations to enact regulations that require Internet Service Providers (ISPs) to privately enforce copyright protection laws.

These private companies — many of which are very small — would be forced to take upon themselves the responsibility of patrolling for and punishing any violation of the copyright laws by its subscribers.

Current U.S. law, specifically the Digital Millennium Copyright Act (DMCA), would be supplanted by TPP Article 16.3. This provision in the TPP draft document paves the way for a new copyright enforcement scheme that extends far beyond the limits currently imposed by DMCA. In fact, it contains mandates more expansive than even those proposed in the Anti-Counterfeiting Trade Agreement (ACTA).

ACTA is widely regarded as a threat to Internet freedom, as well as to the legislative power of the Congress. If ACTA is a threat than TPP is an all-out frontal assault.

Regardless of any flaws of the DMCA, it is U.S. law and should not be subject to de facto appeal by the work of a body of internationalists who are not accountable to citizens of the United States.

Apart from the issues of sovereignty, putting such pressure on service providers is a threat not only to the owners of these small business, but also to Internet freedom, as well.

It is the good work of these ISPs that has created the Internet we know today. Were it not for the typically low-cost access these companies provide, the pool of readily accessible viewpoints, opinions, and news resources would be significantly shallower…..”

Comments »A Word From Ron Paul

[youtube://http://www.youtube.com/watch?v=ePqDNePGFfg 450 300]

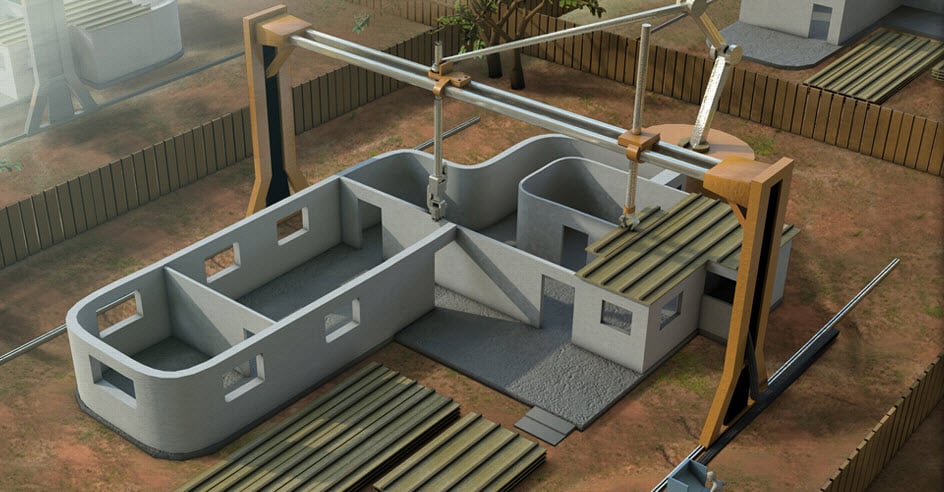

Comments »3D Printing Gets Homey

Holy Cow, WTF: “I Saw Joseph Ratzinger Murder a Little Girl”…in a Ritual Child Sacrifice

“Here’s an explosive update from the International Tribunal into Crimes of Church and State [ITCCS]:

A Global Media Advisory from the International Tribunal into Crimes of Church and State (ITCCS) and its Central Directorate, Brussels

“I saw Joseph Ratzinger murder a little girl”:

Eyewitness to a 1987 ritual sacrifice confirms account of Toos Nijenhuis of Holland

New Evidence of Vatican’s guilt prompts Italian politicians to confront Pope Francis as next Common Law court case is announced – The Papacy retaliates with global “black ops” attacks against ITCCS

A Breaking News Summary and Update from ITCCS Central, Brussels

Monday, October 28, 2013

The criminal prosecution of yet another Pope came closer to reality this month as Italian politicians agreed to work with the ITCCS in a common law court action against the papacy for its haboring of a wanted fugitive from justice: deposed Pope Benedict, Joseph Ratzinger.

The agreement came after a new eyewitness confirmed the involvement of Ratzinger in a ritual child sacrifice in Holland in August of 1987.

“I saw Joseph Ratzinger murder a little girl at a French chateau in the fall of 1987″ stated the witness, who was a regular participant in the cult ritual torture and killing of children.

“It was ugly and horrible, and it didn’t happen just once. Ratzinger often took part. He and (Dutch Catholic Cardinal) Alfrink and (Bilderberger founder) Prince Bernhard were some of the more prominent men who took part.”

This new witness confirms the account of Toos Nijenhuis, a Dutch woman who went public on May 8 with her eyewitness account of similar crimes involving Ratzinger, Alfrink and Bernhard. (see: http://youtu.be/-A1o1Egi20c)

Soon after his historic resignation from office last February 11, Joseph Ratzinger was convicted of Crimes against Humanity on February 25, 2013 by the Brussels-based International Common Law Court of Justice…..”

Comments »The IMF Proposes Confiscation of Wealth to Solve Debt Problems

“A controversial report released this month by the International Monetary Fund outlines schemes to have big-spending governments with out-of-control debts plunder humanity’s wealth using a mix of much higher taxes and outright confiscation. The goal: Prop up Big Government. Because people and their assets are generally mobile, the radical IMF document, dubbed “Taxing Times,” also proposes measures to prevent them from escaping before they can be fleeced. Of course, the real problems — debt-based fiat currency, lawless bank bailouts, and a cartel-run monetary system — are virtually ignored.

Pointing to absurd and rising levels of government debt, as well as increasing income inequality, the IMF document suggests there are few remaining options for desperate policymakers to explore. Two that are mentioned include “repudiating public debt” — in other words, defaulting on government bonds — or “inflating it away” by having privately owned central banks conjure even more gargantuan amounts of fiat currency into existence at interest. Both of those plots, of course, would still represent a massive transfer of wealth.

However, even though it hides behind the passive voice, the IMF preference for dealing with the debt problems appears to be simply confiscating the wealth more directly. “The sharp deterioration of the public finances in many countries has revived interest in a capital levy, a one-off tax on private wealth, as an exceptional measure to restore debt sustainability,” the report claims. “The appeal is that such a tax, if it is implemented before avoidance is possible, and there is a belief that it will never be repeated, does not distort behavior (and may be seen by some as fair).”

Reducing government debt ratios to “pre-crisis levels” seen at the end of 2007 — before the multi-trillion-dollar banker bailouts and ramping up of the lawless currency printing at central banks — will require “sizeable” tax rates, the IMF continues. Citing a sample of 15 euro-area nations, the report claims that all households with positive net wealth — anyone with more assets than debt, in essence — would have to surrender about 10 percent of it. Because many people who lived responsibly and saved would try to avoid the looting of their wealth, drastic measures must be considered to stop them.

“There is a surprisingly large amount of experience to draw on, as such levies were widely adopted in Europe after World War I and in Germany and Japan after World War II,” the IMF report notes. “This experience suggests that more notable than any loss of credibility was a simple failure to achieve debt reduction, largely because the delay in introduction gave space for extensive avoidance and capital flight, in turn spurring inflation [sic].”

By proposing the outright confiscation of middle-class wealth, analysts say the IMF is essentially acknowledging that simply looting “the rich” will not be enough to even restore government debt to “sustainable” levels. Still, the non-establishment “rich” would face by far the most ferocious assaults on their assets under the schemes outlined in the radical IMF report, which was promptly celebrated by Big Government-supporting politicians.

Noting that financial wealth and people are mobile, the document suggests that there “may be a case” for confiscating varying amounts of wealth using various means — all depending on how easy it would be for people to protect the assets in question from legalized looting. “Substantial progress likely requires enhanced international cooperation to make it harder for the very well-off to evade taxation by placing funds elsewhere,” the report says matter-of-factly.

Taxes on the “rich” of around 60 percent to 70 percent, according to the IMF, would likely be the rate at which the most plunder could be extracted for desperate governments. “A revenue-maximizing approach to taxing the rich effectively puts a weight of zero on their well-being,” the report explains, calling that notion “contentious.” “If one attaches less weight to those with the highest incomes, the vote would be to increase the top marginal rate.”

Private companies that try to reduce their already-crushing tax burdens using “tax planning schemes,” as the report calls them, are also in the IMF crosshairs for increased wealth confiscation. In a section headlined “Tricks of the Trade,” for example, the document blasts business efforts to provide services directly from “low-tax jurisdictions” as “abusive.”

In essence, the IMF and other taxpayer-funded international institutions hope to see a stronger global regulatory regime to ensure maximum wealth extraction via corporate taxation, too. “The chance to review international tax architecture seems to come about once a century; the fundamental issues should not be ducked,” the report argues.

The devastating consequences of squandering ever-greater amounts of productive capital on government programs, of course, are largely overlooked. Meanwhile, the unspoken assumption underpinning the radical ideas is essentially that companies exist to produce wealth for governments to spend — rather than value for shareholders and consumers as has traditionally been the case.

Looking past the bureaucratic language, the IMF caveats, its effort to hide behind the passive voice, and the thinly disguised attempt to make the heist sound palatable to the public because not everyone would be fleeced just yet…..”

Comments »What Could Happen With Derivatives?

[youtube://http://www.youtube.com/watch?v=C4BEDc16dd0 450 300]

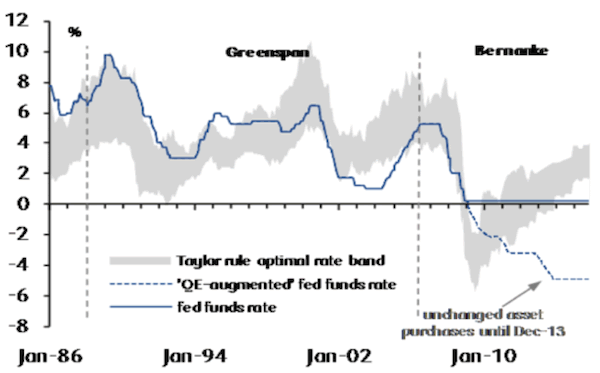

Comments »Code Red for the Fed: The Taylor Rate Is Now 2%

“I wasn’t the only person coming out with a book this week (much more on that at the end of the letter). Alan Greenspan hit the street with The Map and the Territory. Greenspan left Bernanke and Yellen a map, all right, but in many ways the Fed (along with central banks worldwide) proceeded to throw the map away and march off into totally unexplored territory. Under pressure since the Great Recession hit in 2007, they abandoned traditional monetary policy principles in favor of a new direction: print, buy, and hope that growth will follow. If aggressive asset purchases fail to promote growth, Chairman Bernanke and his disciples (soon to be Janet Yellen and the boys) respond by upping the pace. That was appropriate in 2008 and 2009 and maybe even in 2010, but not today.

Consider the Taylor Rule, for example – a key metric used to project the appropriate federal funds rate based on changes in growth, inflation, other economic activity, and expectations around those variables. At the worst point of the 2007-2009 financial crisis, with the target federal funds rate already set at the 0.00% – 0.25% range, the Taylor Rule suggested that the appropriate target rate was about -6%. To achieve a negative rate was the whole point of QE; and while a central bank cannot achieve a negative interest-rate target through traditional open-market operations, it can print and buy large amounts of assets on the open market – and the Fed proceeded to do so. By contrast, the Taylor Rule is now projecting an appropriate target interest rate around 2%, but the Fed is goes on pursuing a QE-adjusted rate of around -5%.

Also, growth in NYSE margin debt is showing the kind of rapid acceleration that often signals a drawdown in the S&P 500. Are we there yet? Maybe not, as the level of investor complacency is just so (insert your favorite expletive) high.

The potential for bubbles building atop the monetary largesse being poured into our collective glasses is growing. As an example, the “high-yield” bond market is now huge. A study by Russell, a consultancy, estimated its total size at $1.7 trillion. These are supposed to be bonds, the sort of thing that produces safe income for retirees, yet almost half of all the corporate bonds rated by Standard & Poor’s are once again classed as speculative, a polite term for junk.

Central Bankers Gone Wild

But there is a resounding call for even more rounds of monetary spirits coming from emerging-market central banks and from local participants, as well. And the new bartender promises to be even more liberal with her libations. This week my friend David Zervos sent out a love letter to Janet Yellen, professing an undying love for the prospect of a Yellen-led Fed and quoting a song from the “Rocky Horror Picture Show,” whose refrain was “Dammit, Janet, I love you.” In his unrequited passion I find an unsettling analysis, if he is even close to the mark. Let’s drop in on his enthusiastic note:

I am truly looking forward to 4 years of “salty” Janet Yellen at the helm of the Fed. And it’s not just the prolonged stream of Jello shots that’s on tap. The most exciting part about having Janet in the seat is her inherent mistrust of market prices and her belief in irrational behaviour processes. There is nothing more valuable to the investment community than a central banker who discounts the value of market expectations. In many ways the extra-dovish surprise in September was a prelude of so much more of what’s to come.

I can imagine a day in 2016 when the unemployment rate is still well above Janet’s NAIRU estimate and the headline inflation rate is above 4 percent. Of course the Fed “models” will still show a big output gap and lots of slack, so Janet will be talking down inflation risks. Markets will be getting nervous about Fed credibility, but her two-year-ahead projection of inflation will have a 2 handle, or who knows, maybe even a 1 handle. Hence, even with house prices up another 10 percent and spoos well above 2100, the “model” will call for continued accommodation!! Bond markets may crack, but Janet will stay the course. BEAUTIFUL!!

Janet will not be bogged down by pesky worries about bubbles or misplaced expectations about inflation. She has a job to do – FILL THE OUTPUT GAP! And if a few asset price jumps or some temporary increases in inflation expectations arise, so be it. For her, these are natural occurrences in “irrational” markets, and they are simply not relevant for “rational” monetary policy makers equipped with the latest saltwater optimal control models.

The antidote to such a boundless love of stimulus is of course Joan McCullough, with her own salty prose:

And the more I see of the destruction of our growth potential … the more convinced I am that it’s gonna’ backfire in spades. Do I still think that we remain good-to-go into year end? At the moment, sporadic envelope testing notwithstanding, the answer is yes. But…..”

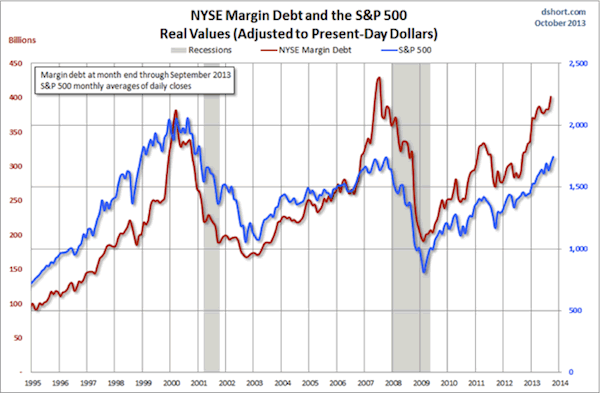

Comments »U.S. Margin Debt Approaches Breakout Territory

“Note from dshort: The NYSE has released new data for margin debt, now available through September. I’ve updated the charts in this commentary to include the new numbers.

The New York Stock Exchange publishes end-of-month data for margin debt on the NYXdata website, where we can also find historical data back to 1959. Let’s examine the numbers and study the relationship between margin debt and the market, using the S&P 500 as the surrogate for the latter.

The first chart shows the two series in real terms — adjusted for inflation to today’s dollar using the Consumer Price Index as the deflator. I picked 1995 as an arbitrary start date. We were well into the Boomer Bull Market that began in 1982 and approaching the start of the Tech Bubble that shaped investor sentiment during the second half of the decade. The astonishing surge in leverage in late 1999 peaked in March 2000, the same month that the S&P 500 hit its all-time daily high, although the highest monthly close for that year was five months later in August. A similar surge began in 2006, peaking in July, 2007, three months before the market peak.

The next chart shows the percentage growth of the two data series from the same 1995 starting date, again based on real (inflation-adjusted) data. I’ve added markers to show the precise monthly values and added callouts to show the month. Margin debt grew at a rate comparable to the market from 1995 to late summer of 2000 before soaring into the stratosphere. The two synchronized in their rate of contraction in early 2001. But with recovery after the Tech Crash, margin debt gradually returned to a growth rate closer to its former self in the second half of the 1990s rather than the more restrained real growth of the S&P 500. But by September of 2006, margin again went ballistic. It finally peaked in the summer of 2007, about three months before the market.

After the market low of 2009, margin debt again went on a tear until the contraction….”

Comments »McResource Line

[youtube://http://www.youtube.com/watch?v=olUsgn-Ubh0 450 300]

Comments »Elizabeth Warren Implores the Bearded Clam, The SEC, & The Comptroller of Currency to Send Bank CEOs to Jail

“Senator Elizabeth Warren has really hit the ground running since being sworn in back in January. Hot on the heels of JPMorgan’s record $13 billion settlement for their role in the fiscal meltdown, the Massachusetts Senator penned a letter to the heads of the Securities and Exchange Commission, the Officer of the Comptroller of Currency, and the Federal Reserve imploring them not to stop at fines and settlements, but to throw the entire weight of the United States justice system at those whose fiscal malfeasance nearly destroyed our economy for good.

We thought we’d share Senator Warren’s letter with you”

[youtube://http://www.youtube.com/watch?v=-F62B6BX0xs 450 300]Documentary: Shade

Let’s just say the rabbit hole runs deep in this documentary….so don’t shrug this off as tinfoil hat wearing tard opinion; Edward Snowden has given us corroborating evidence beyond the documentation presented in this film.

Cheers on your weekend!

[youtube://http://www.youtube.com/watch?v=V4VFYRaltcc 450 300]

[youtube://http://watch?v=CH3HnokBh8g 450 300] Comments »

The Future of Manufacturing…

“A former high-ranking official from the Department of State claims that the mass loss of civilian life caused by American-launched drone strikes in Yemen are creating dozens of new militants with each attack.

Nabeel Khoury, the deputy chief of mission in Yemen for the State Department from 2004 to 2007, writes in the Cairo Review this week that the use of unmanned aerial vehicles against alleged Al-Qaeda operatives is breeding anti-American sentiment overseas.

The editorial, published Wednesday, comes as the United States’ use of drones is dominating discussions in Washington and around the world. Two leading human rights organizations condemned drones in a pair of reports released earlier this week, and on Wednesday the prime minister of Pakistanurged US President Barack Obama to cease drone strikes in his country and essentially halt an operation that has involved hundreds of attacks since 2004.

According to Khoury, similar attacks conducted in Yemen during the last few years have spawned a hatred that could immensely hurt America’s efforts.

“Drone strikes take out a few bad guys to be sure, but they also kill a large number of innocent civilians. Given Yemen’s tribal structure, the US generates roughly forty to sixty new enemies for every AQAP operative killed by drones,” Khoury wrote, referring to Al-Qaeda in the Arabian Peninsula.

“In war, unmanned aircraft may be a necessary part of a comprehensive military strategy. In a country where we are not at war, however, drones become part of our foreign policy, dominating it altogether, to the detriment of both our security and political goals,” he added.

Khoury is currently a senior fellow for Middle East and national security at the Chicago Council on Global Affairs, a Windy City-based nonpartisan, independent think tank described on its website as “committed to influencing the discourse on global issues through contributions to opinion and policy formation, leadership dialogue and public learning.” His “40-60 new enemies” estimate was not scientifically drawn, but instead relied on his intimate knowledge of Yemeni society. ….”

Comments »