“WASHINGTON (Reuters) – A drop in government spending dragged more on the U.S. economy than initially thought in the first three months of the year, although consumer spending looked relatively resilient to Washington’s austerity drive.

Other reports on Thursday showed the number of new jobless claims rose modestly last week while contracts on previously owned homes climbed to a three-year high in April.

Together, the reports pointed to an economy that has held up reasonably well despite government constraints, but nevertheless faced headwinds severe enough to dissuade the U.S. Federal Reservefrom trimming its monetary stimulus in the immediate future.

“(The reports) paint the picture of an economy with strengthening fundamentals that is facing significant fiscal drag,” said Ellen Zentner, an economist at Nomura in New York.

Gross domestic product, a measure of the country’s total economic output, expanded at a 2.4 percent annual rate during the first quarter, down a tenth of a point from an initial estimate, the Commerce Department said.

Analysts had forecast a 2.5 percent gain.

Government spending tumbled at a 4.9 percent annual rate, which was faster than the 4.1 percent rate initially estimated. Also holding back growth during the quarter, businesses outside the farm sector stocked their shelves at a slower pace.

Washington has been tightening its belt for several years but ramped up austerity measures in 2013, hiking taxes in January and slashing the federal budget in March.

“We are dramatically under-spending in Washington,” said Michael Strauss, a market strategist at Commonfund in Wilton, Connecticut.

U.S. stocks rose and the dollar weakened as some investors bet the data could dissuade the Fed from rushing to taper a bond buying program that has acted as a bulwark against government belt tightening. Prices for U.S. government debt pared losses.

Despite the signs of a substantial fiscal drag, the GDP report also highlighted a resilience that has surprised many economists.

Consumer spending, which accounts for more than two-thirds of U.S. economic activity. rose at a 3.4 percent annual rate, up two tenths of a point from the government’s previous estimate.

Excluding the volatile inventories component, GDP rose at an upwardly revised 1.8 percent rate, slightly higher than analysts had forecast. This suggests that an improvement in hiring and incomes over the last year has helped keep economic momentum intact.

“(It’s) steady as she goes,” said Stephen Stanley, an economist at Pierpont Securities in Stamford, Connecticut

HOUSING RECOVERY….”

Full article

Comments »

FORTUNE — Like the recent bull market? How about taking a home renovation to go with it? That apparently is what some investors have been doing with their stock gains.

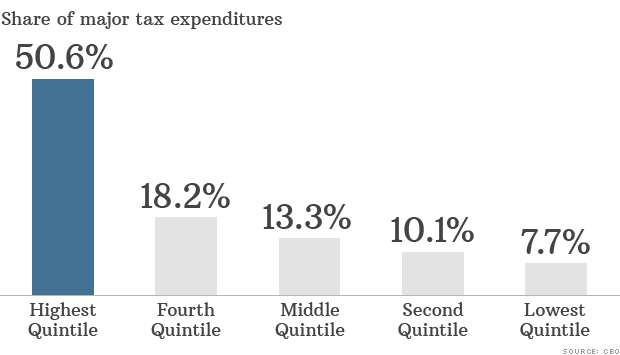

FORTUNE — Like the recent bull market? How about taking a home renovation to go with it? That apparently is what some investors have been doing with their stock gains. Income ranges for family of four: Highest quintile ($163K and up); fourth quintile ($110K to $163K); middle quintile ($77K to $110K); second quintile ($50K to $77K); lowest quintile (less than $50K).

Income ranges for family of four: Highest quintile ($163K and up); fourth quintile ($110K to $163K); middle quintile ($77K to $110K); second quintile ($50K to $77K); lowest quintile (less than $50K).