“All those counting on a weaker dollar and rising U.S. corporate profits will be doubly surprised.

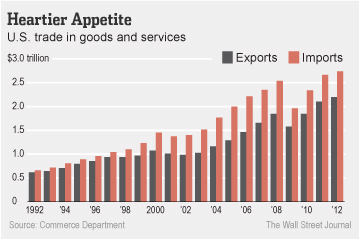

That the U.S. trade deficit shrank to $34 billion in June is being presented as good news all around (no surprise there, as all news is presented as good news). The petroleum boom in the U.S. has pushed oil imports down by over $2 billion a month to $10 billion/month, and non-petroleum trade generated a deficit of $37 billion/month, down $5 billion.

Slowing imports and modestly higher exports are being presented as reasons for stronger GDP growth going forward. Oil Boom Helps to Shrink U.S. Trade Deficit by 22%.

Nice, except nobody is talking about the negative consequences of a shrinking trade deficit on U.S. corporate profits. The financial media doesn’t talk about this because it doesn’t understand the connection, which is based on Triffin’s Paradox, a dynamic I have discussed in depth a number of times:

The basic idea here is that the world’s reserve currency must expand to meet the needs of global trade. Most commentators view the U.S. dollar through the prism of the domestic economy: Federal Reserve money-printing increases the supply of dollars, depreciating its value, and this policy is intended to competitively devalue the dollar to increase U.S. exports.

Here’s the heart of Triffin’s Paradox: Triffin’s Paradox: when one nation’s fiat currency is used as the world’s reserve currency, the needs of the global trading community are different from the needs of domestic policy makers.

Understood in this light, rising U.S. trade deficits in the 1990s and 2000s were required to provide enough dollars to lubricate rising global trade:

Trading nations need dollars to lubricate trading and as foreign exchange reserves that bolster the value of their own currency and provide the asset base for the expansion of credit within their own nation.

What does a declining trade deficit mean? …”

If you enjoy the content at iBankCoin, please follow us on Twitter