I’m often regaled with comments such as “you just said this Fly — and now you’re saying that! How dare you!” Whilst the sum total of what you’re trying to say, at least on the surface, makes sense. After all, how could a person who proclaims himself in the highest esteem be so changeable? You think that any person with an iota of integrity in what he believes in would be obstinate and more robust in his convictions.

But I am not such a man as this.

I am merely a weathervane in the big scheme of things — a person who is swayed easily with market whims and bases his decisions on real time information and not news that is stale and dated — a flippe flopper if you will.

For example.

The day before last I was bullish and in “excellent health” in both mind and spirit. And then the inflation data came out and I changed my mind. Now why in bloody hell would I do that? But the real question is this: If you need me to explain this to you, you, Sir, aren’t in the lease capable of managing your own money and should cease trying to do so at once.

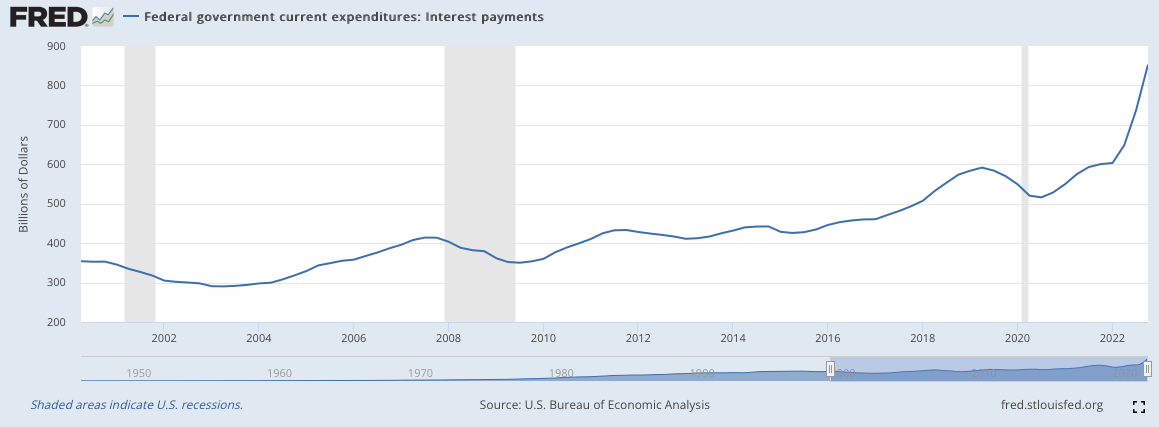

I want you to take a gander at this chart I am about to post and look at the trend and tell me where it’s going next.

TLT

Before we gameplan the potential bullish scenarios for the market, let’s see what Larry Summers has to say about all this. I know it’s Lawrence Fucking Summers, liberal POS. But he is also known for speaking his mind when it comes to economics and really, when it comes down to it, knows more about this stuff than 99.9% of people walking around in these halls.

To summarize:

“We do not have historical examples of when unemployment is below 4% and the inflation is above 4%.”

In other words, if we were to have a soft landing — it would be unprecedented. There isn’t a base case for NOT barreling into recession. You understand, prole? Hard landing means zero bid trading and worse than expected economic data and unemployment. This will establish fear into markets and fear means we trade lower.

My entire bull case was predicated on the idea of a pivot, amazing soft landing, and homosexual giraffes serving iced cream outside of the White House for all of its visitors.

The current bull case is the next CPI number will come in softer than expected, led by a sudden collapse in commodity prices and/or substantial gains in Ukraine by NATO.

Can we trade up on Monday?

NO.

Good day.

Comments »