Listen to me. You can weave as many boolish stories as you want. You can dress up your homes with gilted brocade and adorn it with the finest mahagonay furniture and maple trim. But if said house itself is crumbling from years of mismanagement, all of the finest upholstery in the world, decadent millwork and state of the art electronics, the house will fall.

Let’s go over the Federal balance sheet for a moment.

Expenditures:

Social Security $1.2t – they tried to kill off granny with COVID but largely flopped, so the expense increases.

Health: $915b

Welfare: $850b

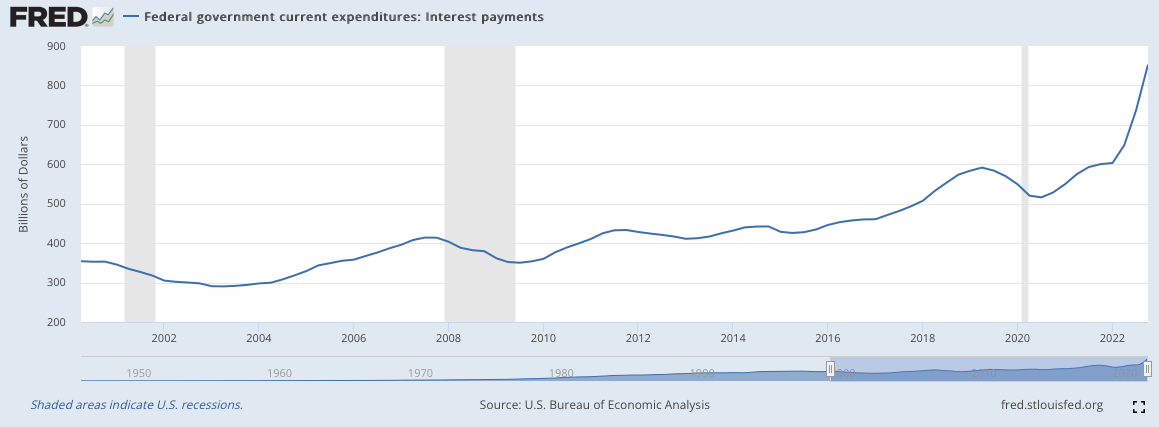

DEBT ON NATIONAL DEBT: $865b (14% OF ANNUAL BUDGET)

Defense/Ukraine: $800-$1t

Medicare: $755b

Entitlements, entitlements. It’s over. Not only is it over — but also cooked. With rates climbing daily, the interest expense on the $31t in debt we owe increases daily. On top of that, we run deficits of $1 to $3 trillion per annum, so every year the balloon gets bigger and bigger as the people inside of the crumbling home get greedier and greedier, adorning it with the finest flooring and chandeliers money can buy.

If you enjoy the content at iBankCoin, please follow us on Twitter

Not sure if I can post here anymore but… Truth

Fiscal irresponsibility and or inflation in the US has led to buyer revolt of treasuries in the past. A while ago now, I’ll have to dig for the details. But that forces the hand in any case, end of discussion and somewhat refreshing.

The first post-war bubble they blew in the 1960’s resulted in a sell-off in the $US and treasuries. Various controls were attempted which failed leading to the complete disconnect from gold and Bretton-Woods in 1971. The biggest historical drop in US living standards ensued with traumatic inflation. However, reserve currency status has allowed continual over spending and deficits since then. Both sides of the aisle, few politicians could resist the temptation with an eye always to the next election.