No one likes all of this prosperity. Man craves danger and bloodshed and death. There is nothing better than the death of stocks that imposes panic unto a deserving public. The people of America have earned a market crash and more than that — wanton unemployment.

The suffering to come will be unlimited in its scope and the individualism that has ball and chained society will swing back to the individual and take off his/her/they/thems face.

Perhaps this is wishful thinking from a man who simply grows weary of it all. I suppose this is how most men feeeeeeel as society changes around their archaic way of thinking. Nevertheless, one can always dream and perhaps dreams can come true.

I read my horoscope today and it read the following:

“If you are not yet on the move it won’t be long before you are off on your travels again and having the time of your life. You will be super popular too, so don’t turn down invitations unless you absolutely have to. Get out there and shine!”

INDEUD.

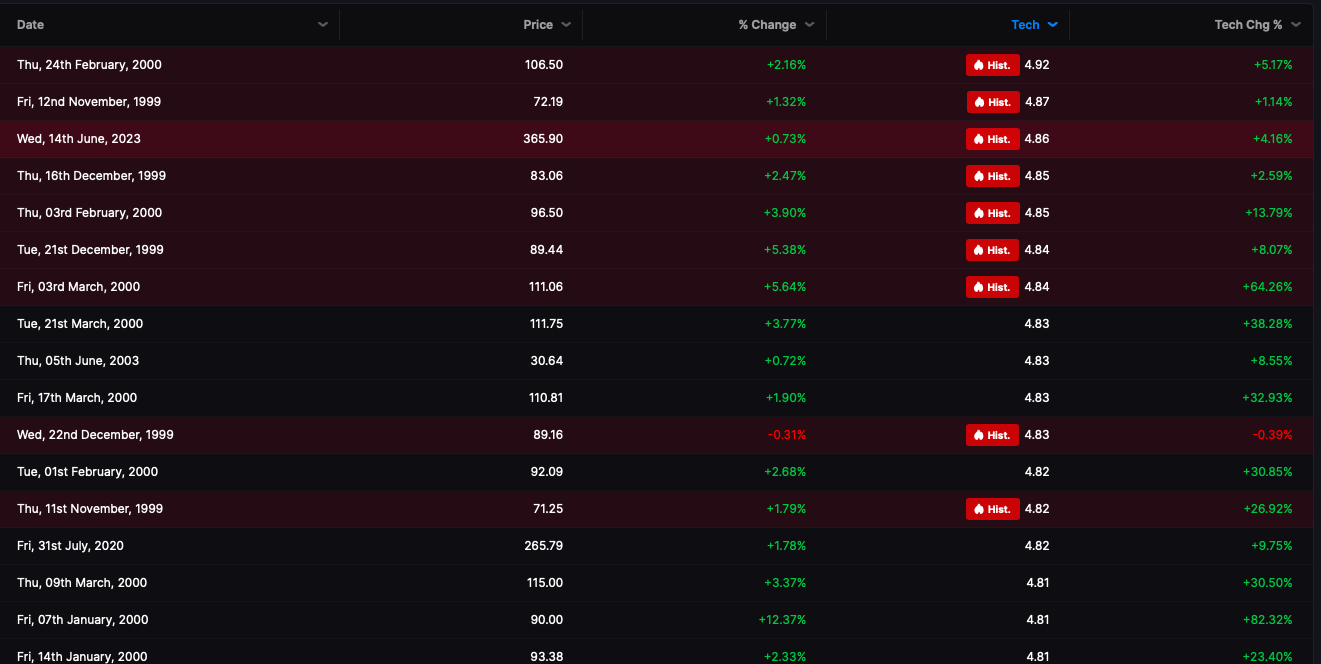

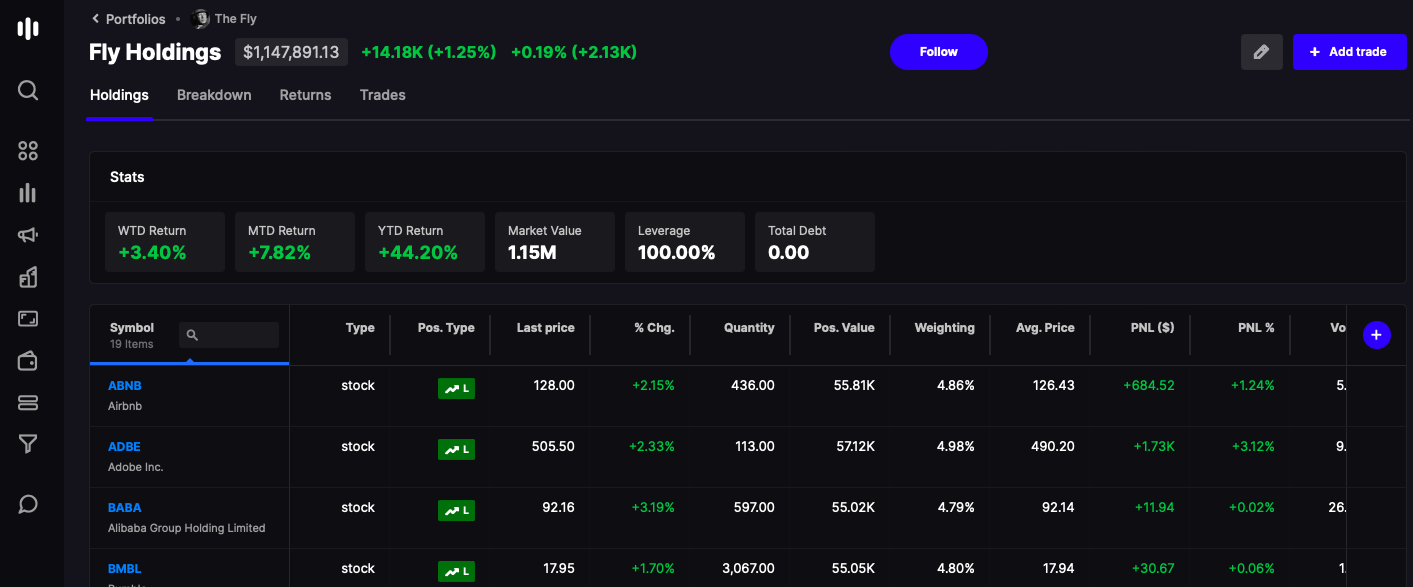

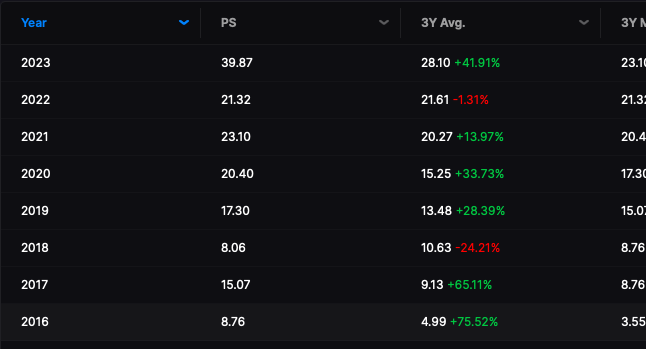

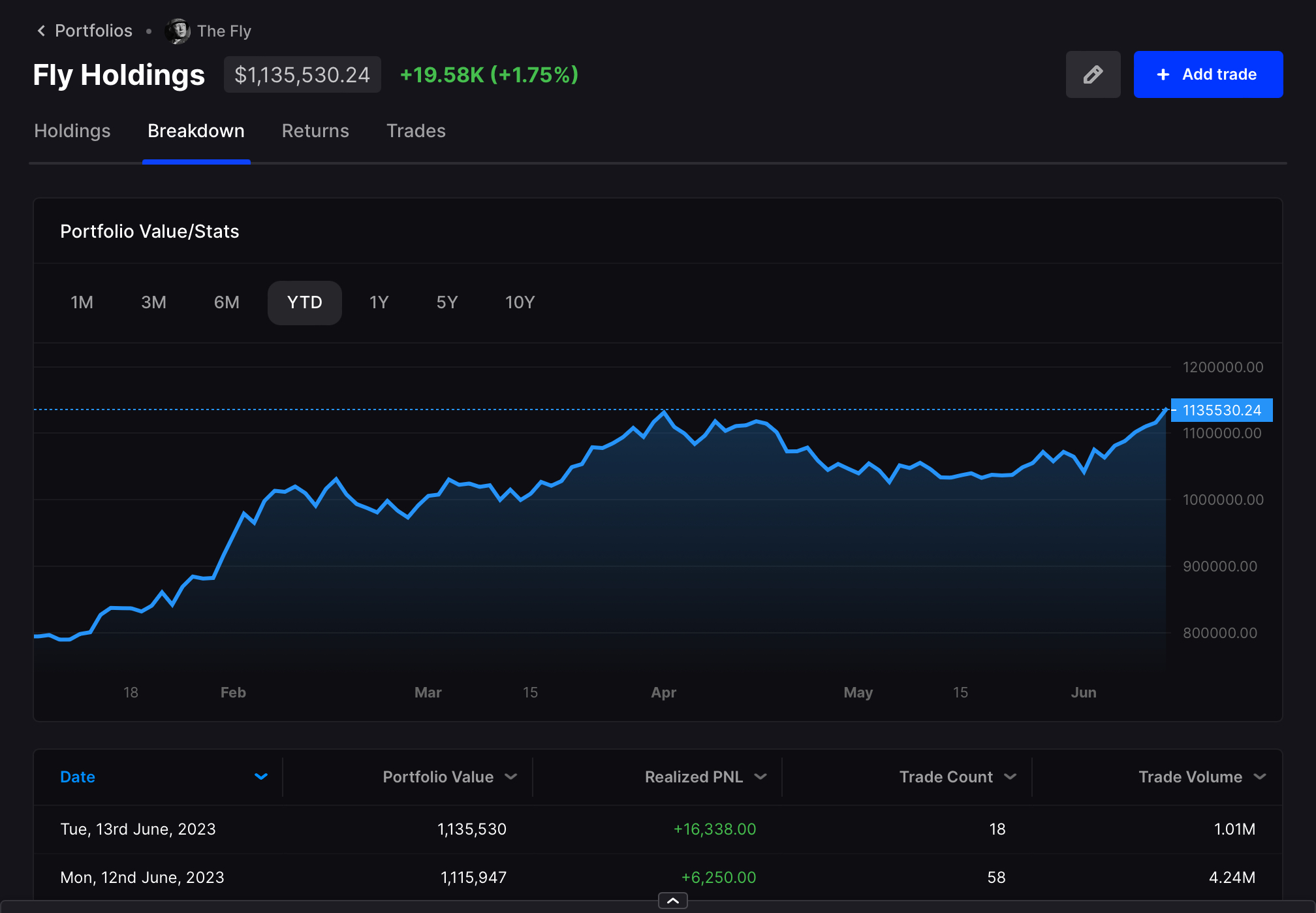

What I need to do is become “super popular” and travel more — perhaps shine a bit. I do believe, as I have said here numerous times — that I am a very good person — powerful even. I also believe, due to thoughts in my head, that I have much to offer. For example, I am very very good at trading stocks, investing for long term, intuitively feeeeeeeling market directions. I should get out there and share my ideas more often — perhaps create a chatroom where I can offer advice to people and maybe inside of that room I can have TOOLZ for the market — you know build stuff that I use to find stocks that allow me to have success. I could name it something, like Stocklabs, and invite people to join it and maybe, just maybe, they too can enjoy success and be at RECOURD HIGHS.

On the issue of market collapse, I do believe there are shoes in the balance of the dropping varietal. From what I have gathered, via my astrological reading, the droppings shall commence in about 1 week and 7 days hence, a fortnight or one half of one month — common parlance for two weeks.

Comments »