One of the chief criticisms of following my trades is that I do too many. This new rapid style trading is somewhat new for me and I never did it until COVID hit. In the past I was a swing trader and built positions over convictions for longer durations. But after COVID and the speed of markets coupled with the speed of the tools I created inside Stocklabs, I found I could achieve far greater returns being autistic.

Because most of you are retarded submentals and cannot figure out how to use the tools in your trading, I am doing this post to offer advice.

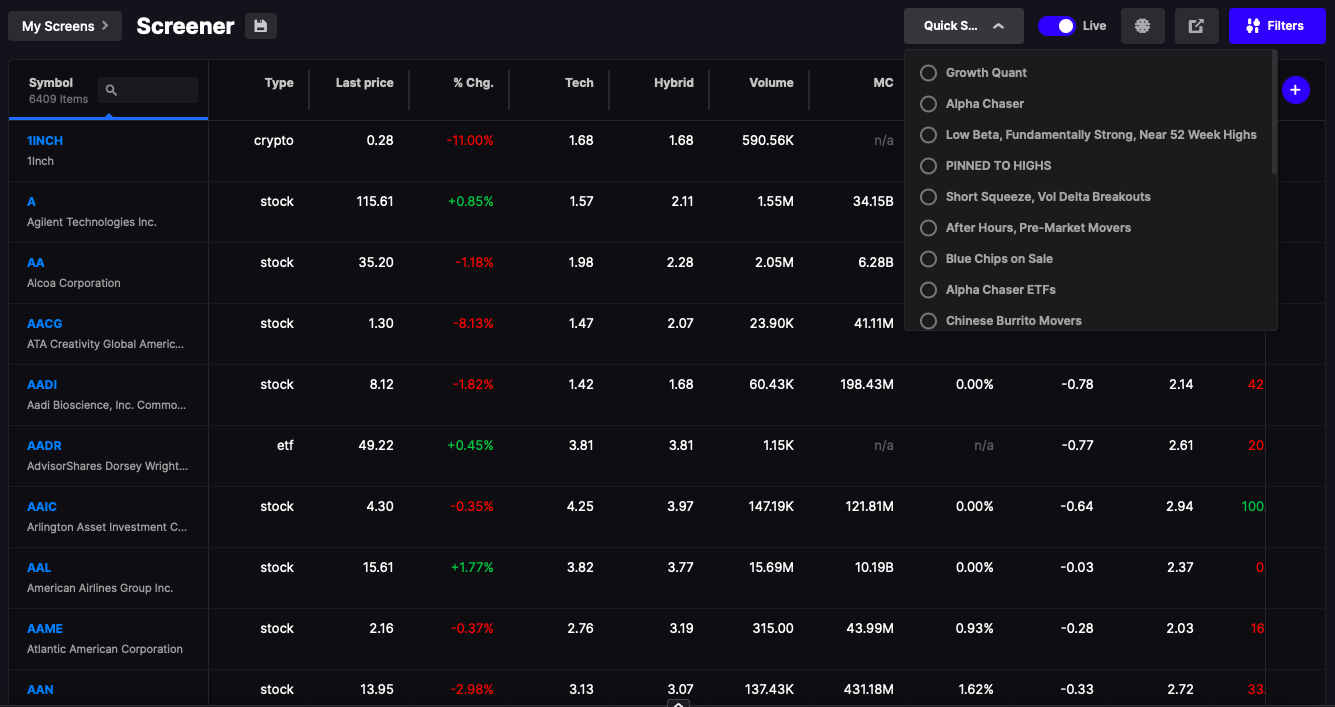

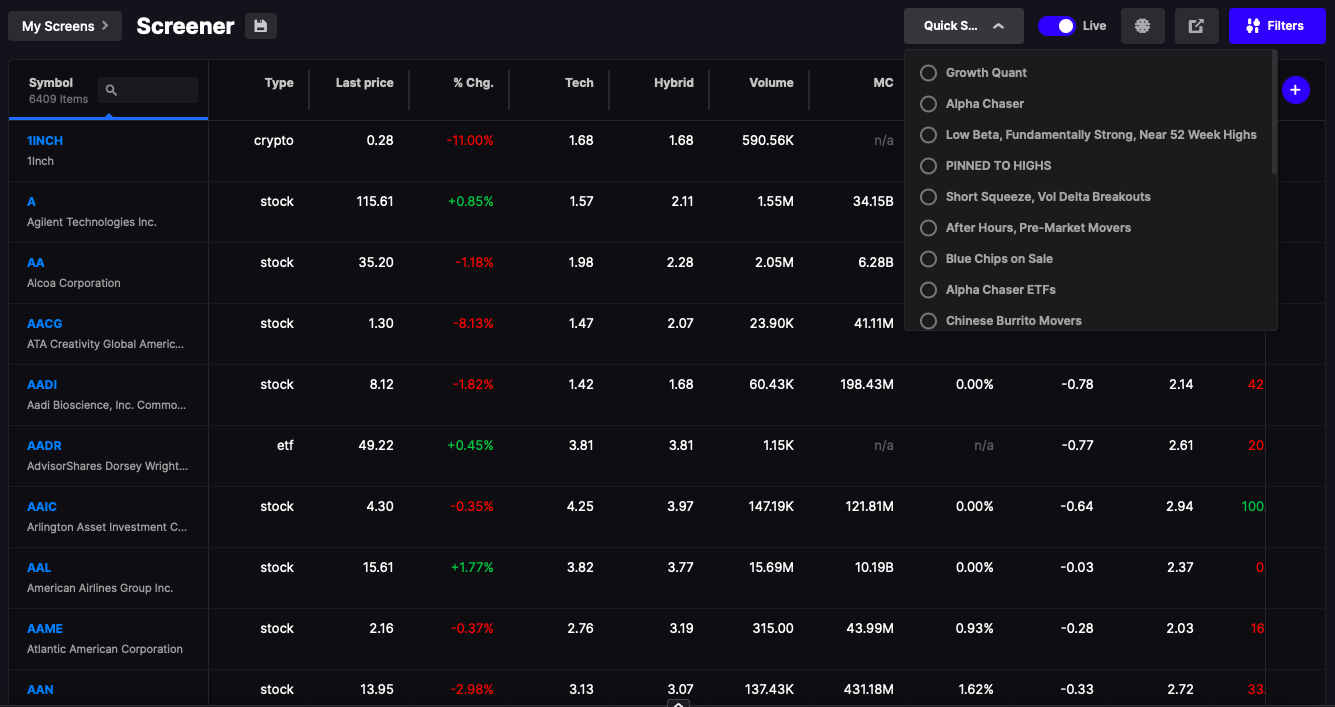

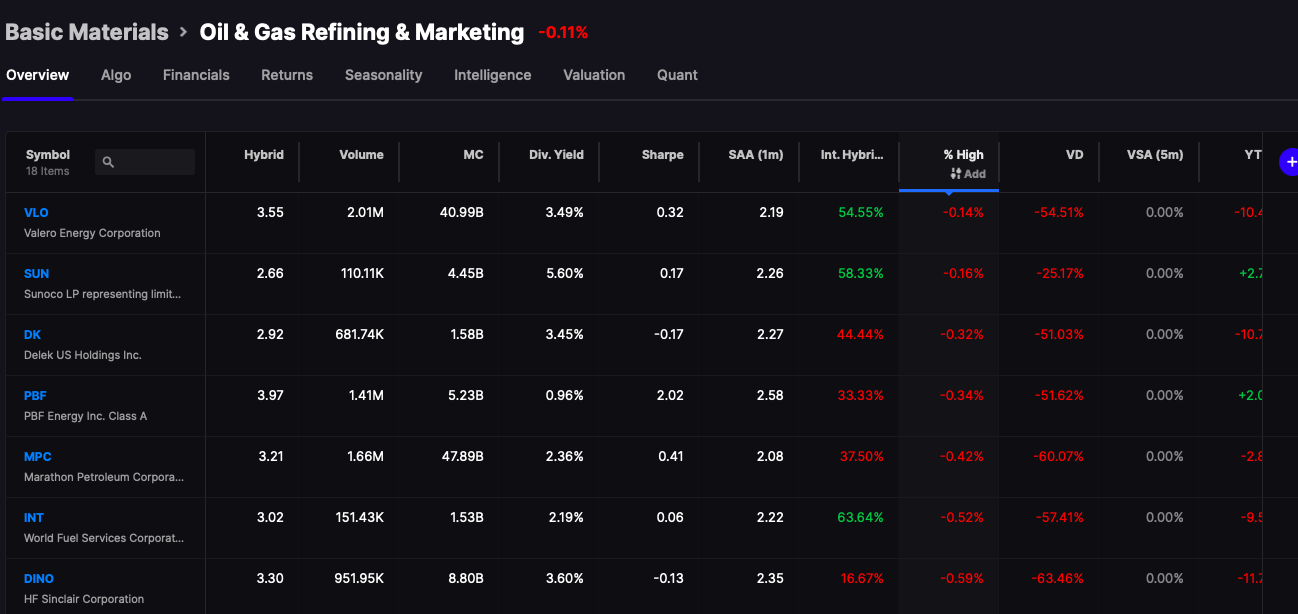

On the screener page, I have a series of pre set screens populated. I hand picked them myself and curate them when needed.

I will now pose to you a philosophical question.

Is it smarter to buy stocks you think will move next or stocks that are already moving? This is the essence of investing and you can have it both ways, contrary to moronic beliefs.

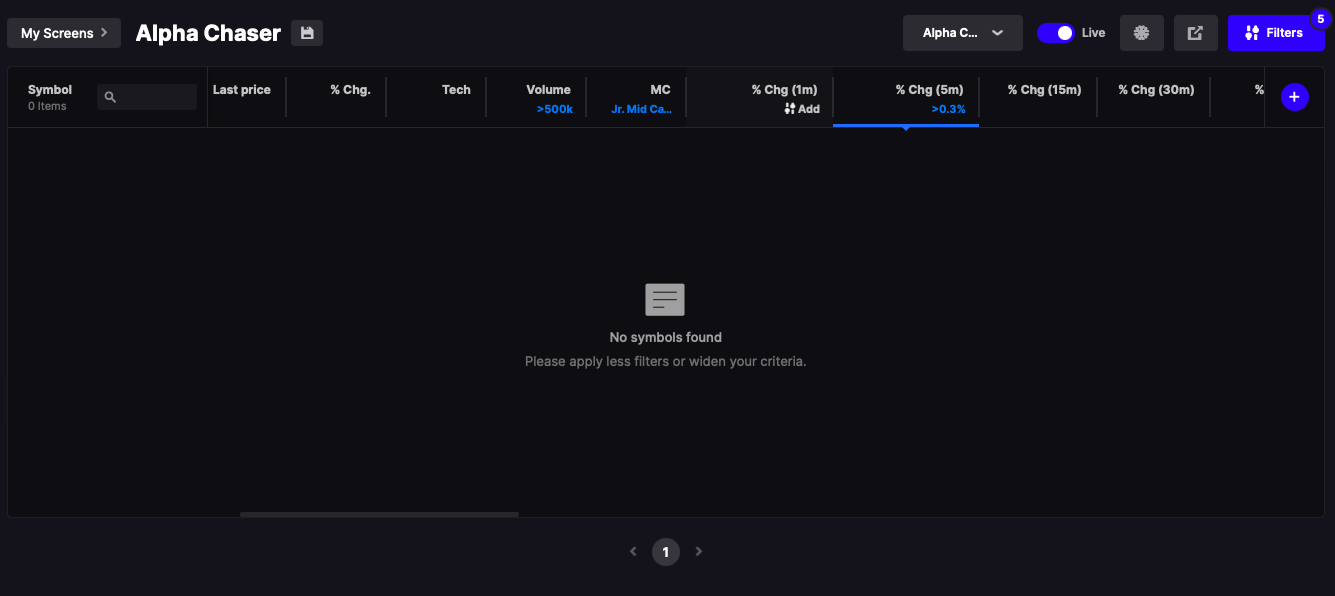

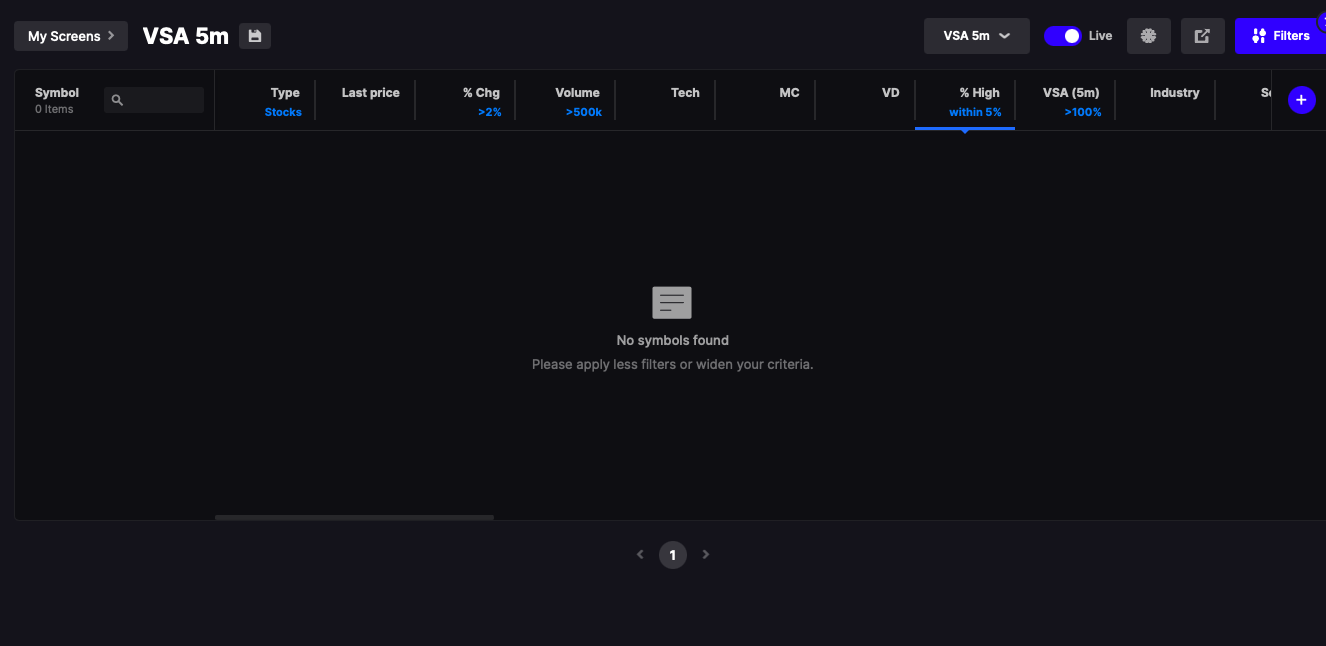

Introducing my Alpha Chaser screener.

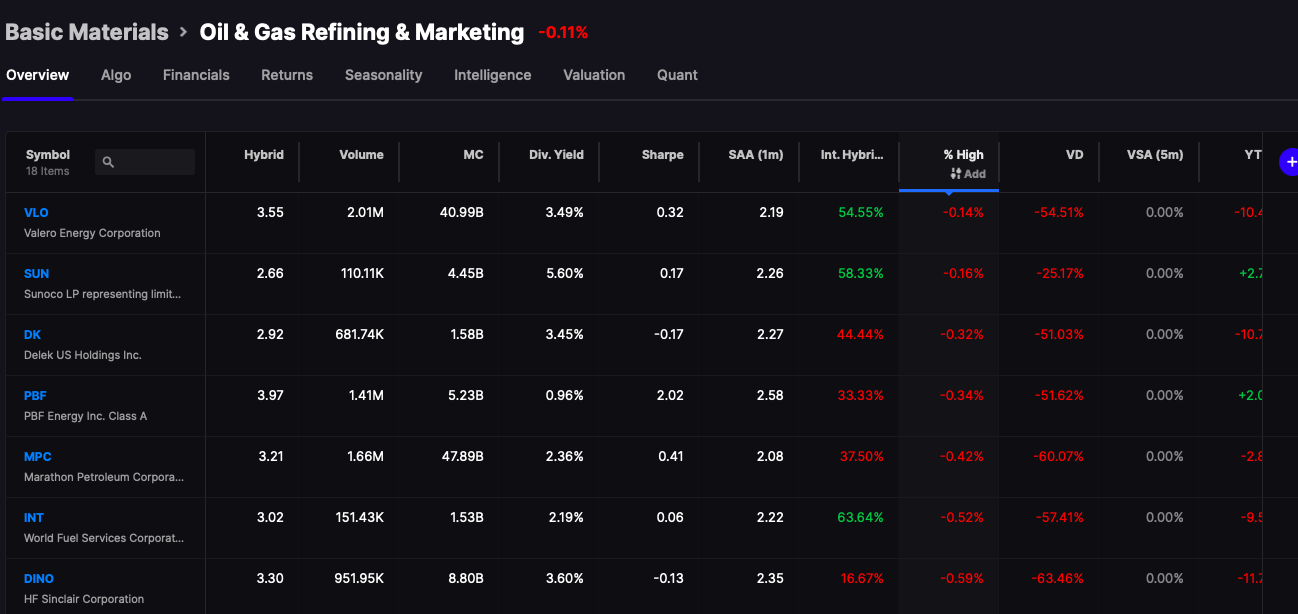

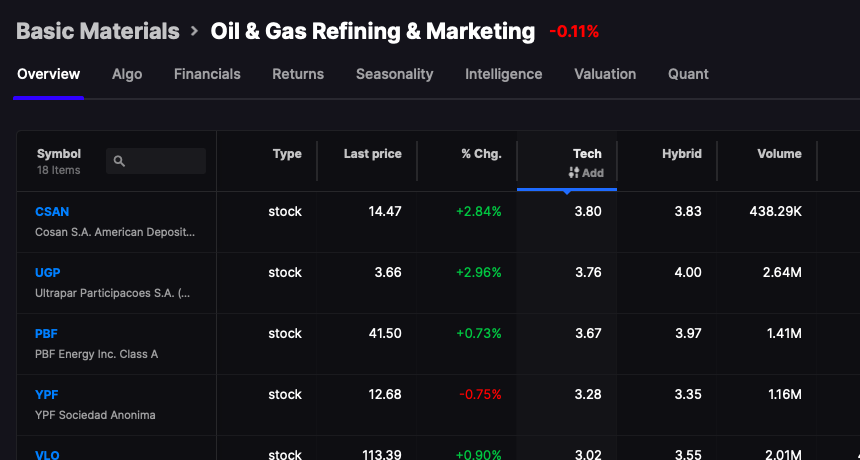

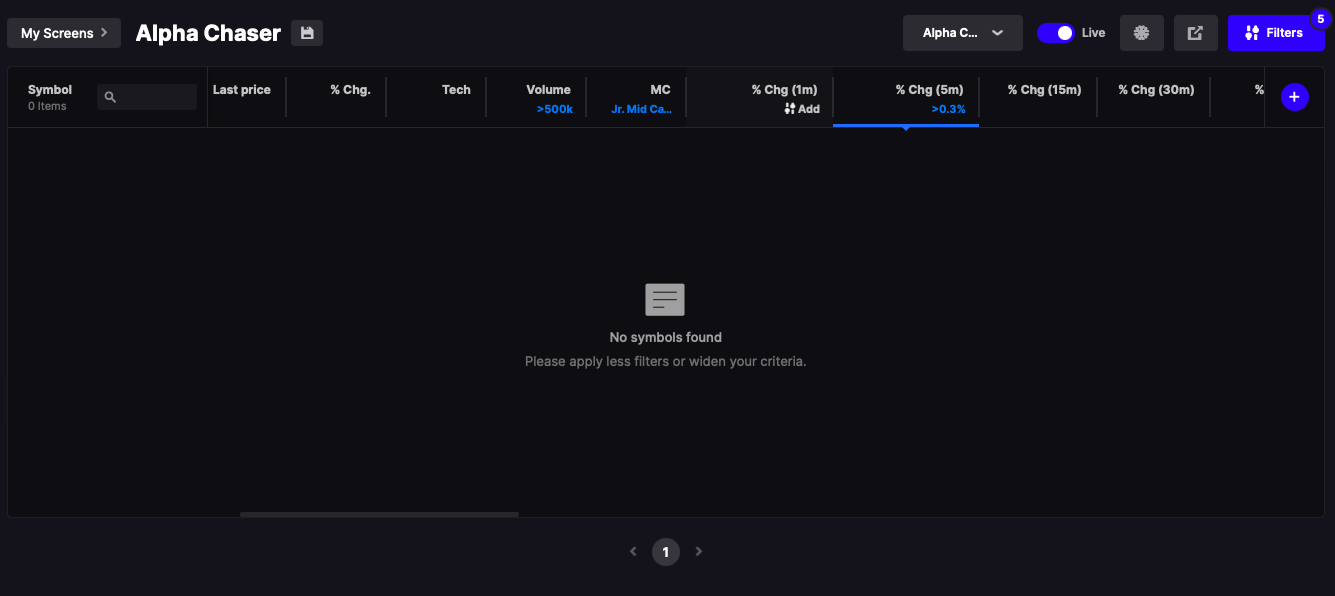

This screen will populate all stocks that meet a minimum volume threshold of 500k that have moved higher by 0.3% over a 5 min time frame. When day trading, I sort by 1 min and sometimes 30 seconds. This screen will capture every single stock movement as it happens. Nothing can escape its grasp. The idea here, buy stocks moving now. You would do this because you’re not stupid and want to trend follow. But while doing this, you can spy areas of the market moving and perhaps attempt to front run a future move. For example, if you see a flurry of Chinese stocks or Alt Energy or Refiner stocks moving on a 1 min scale — you can then click into the industry and fish for stocks at session highs.

How can you do this?

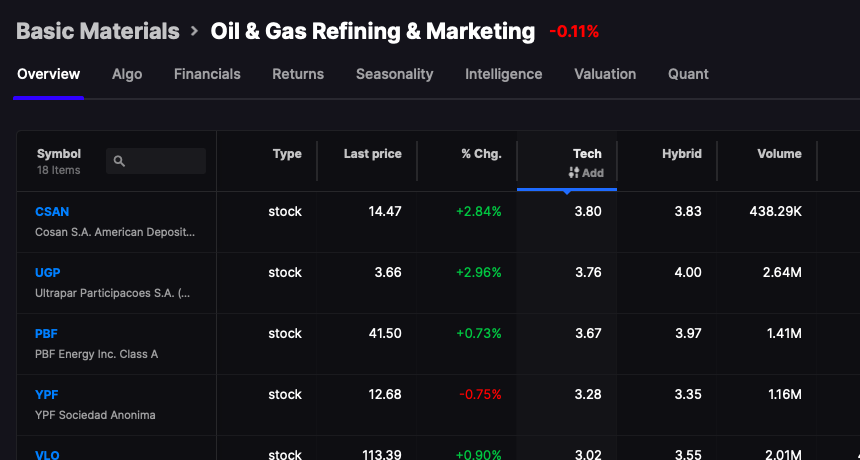

Click on industry and sort for it.

Confused which one to pick? No need to look at charts. We do not have time for that shit. Apply the technical score algorithm and sort for the strongest.

In very bullish tapes, I gravitate towards short squeezes. The logic behind these ideas is natural buyers compiled on top of short covering. If short, you do not want to get caught inside a short squeeze. Look at the recent action in CVNA, UPST and AFRM.

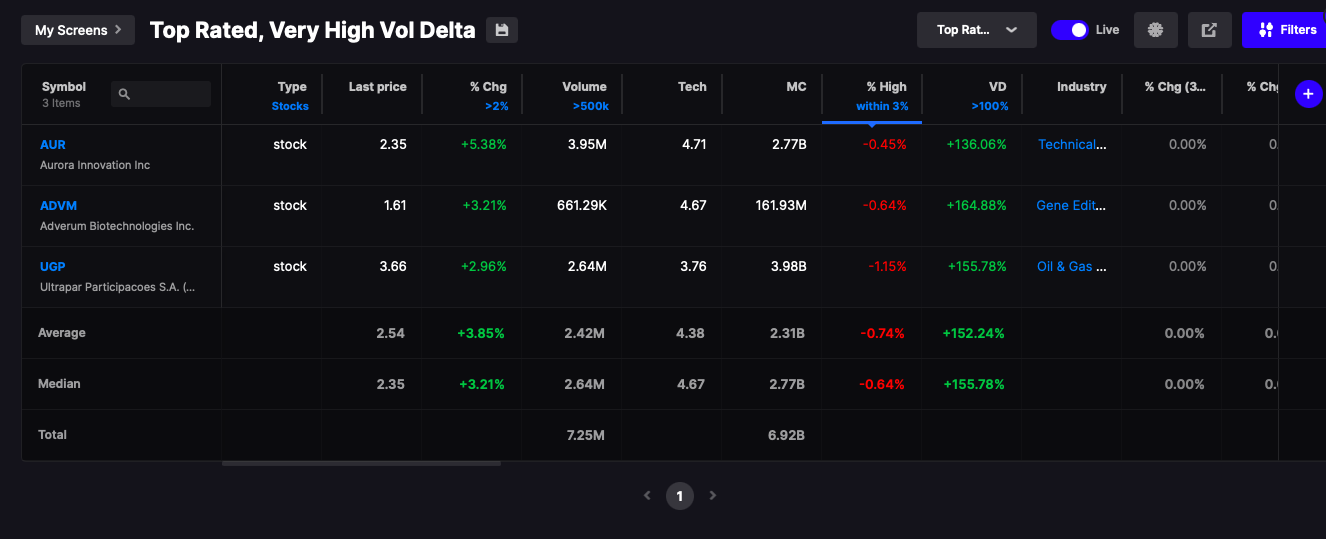

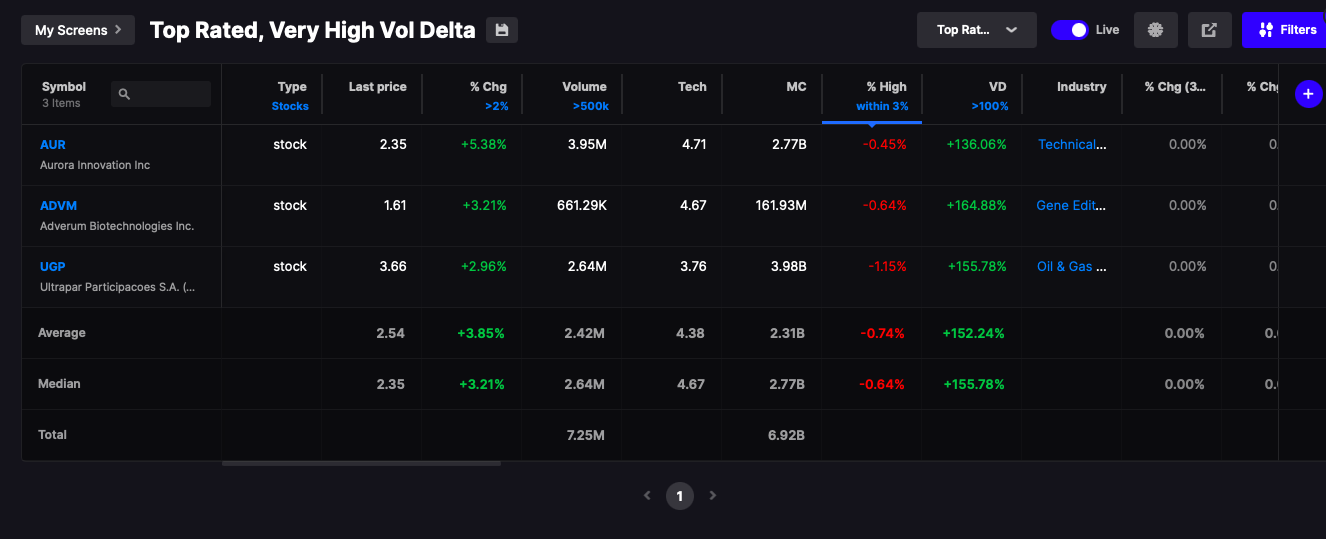

That screen is preset to look for squeezes with stocks already up 3%. But I will adjust that when looking for a future winner. I simply remove the % change filter and sort by heaviest shorted and see what looks good.

Another must use screen deploys our volume tools. Again, this is basic sense translated into my bespoke trading tools that many of you ignore. A stock doesn’t breakout without a volume increase. We can show you which stocks are volume spiking in real time. The delta tools measures the volume pro-rated over a 1 min scale against the 30 day average. So if Apple usually trades 10,000 shares per min and is blasting off 20,000 shares per min — we will see it and report it at 100% spike.

We also do this on an intra day 1 min over 1 min or 5 min over 5 min or 15 min over 15 min etc. If XYZ releases some news and buyers come in — if this screen is up you will see the spike immediately register.

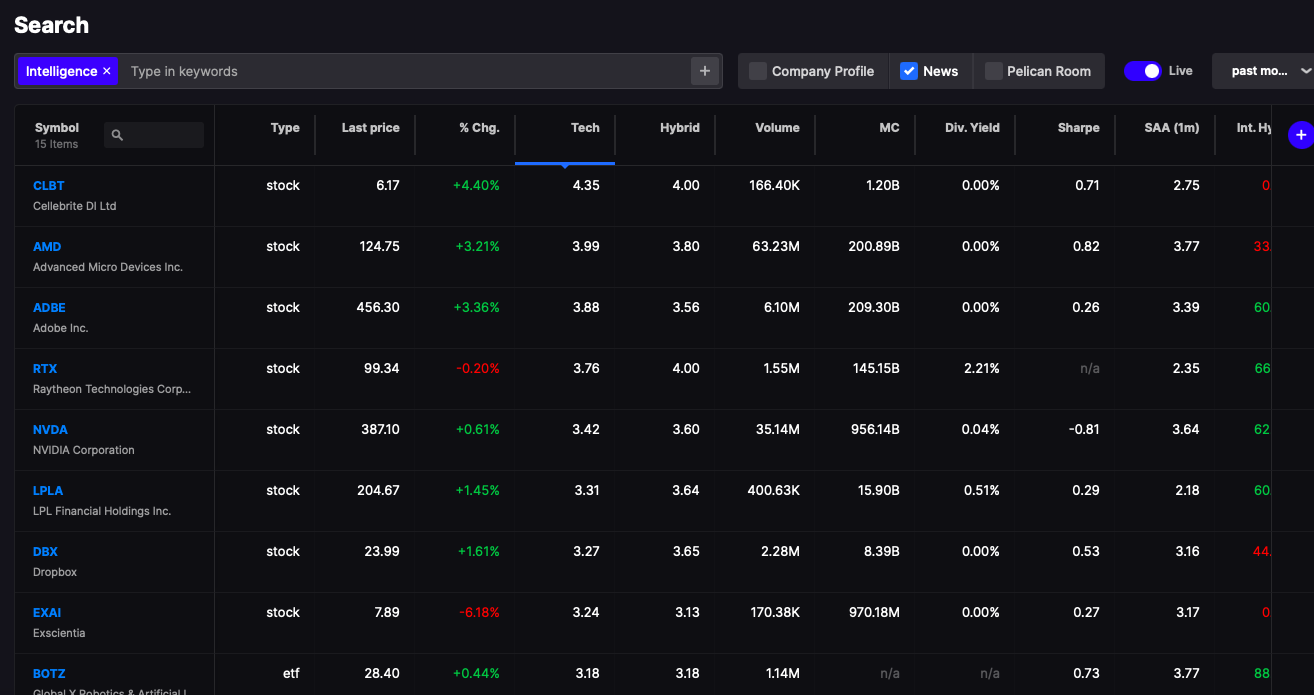

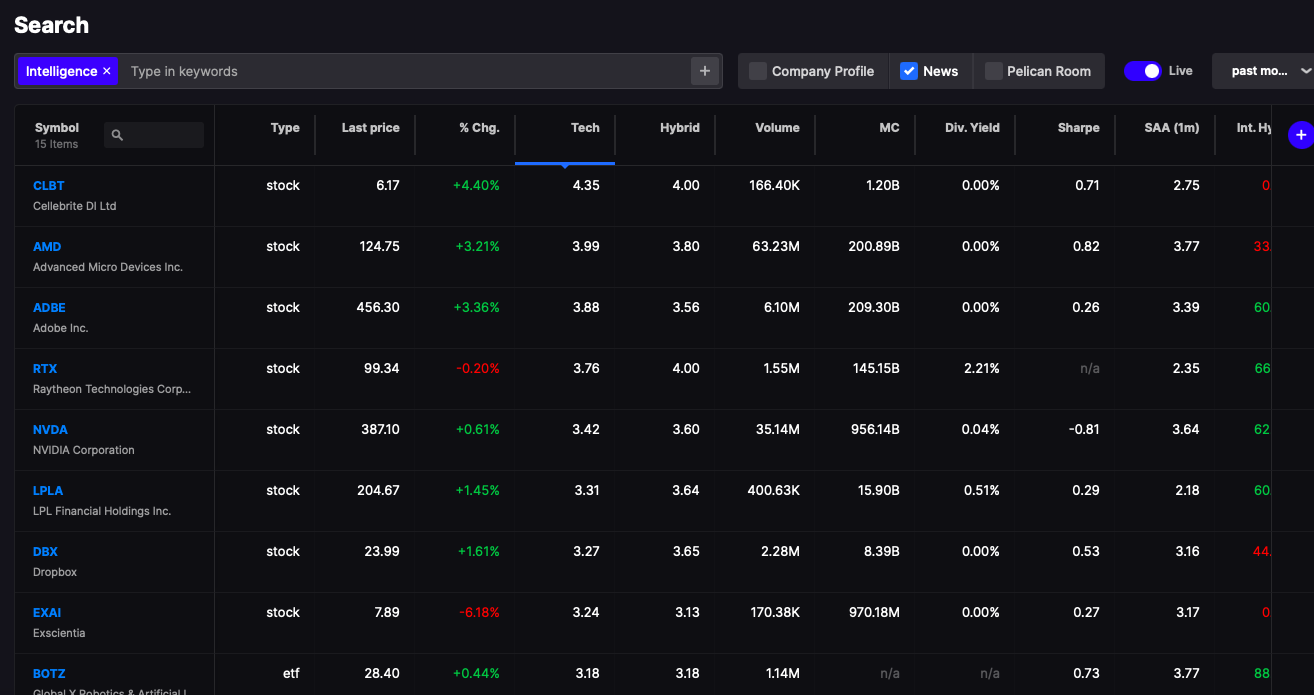

On the issue of news, as you know we have a news wire powered by Twitter. We use this news wire to build a database from which users can search from and also apply in real time screeners.

If at the pro version, you can use the “live” features — which makes everything dynamic. Under this search feature set on news, if any press release hits the SL tape using the keyword “intelligence” under an associated ticker symbol, it will register here inside 3 seconds. You can set time frame ranging from 24hrs to past 12 month. You can also use this to search company profiles and the Pelican Room, which is our chatroom.

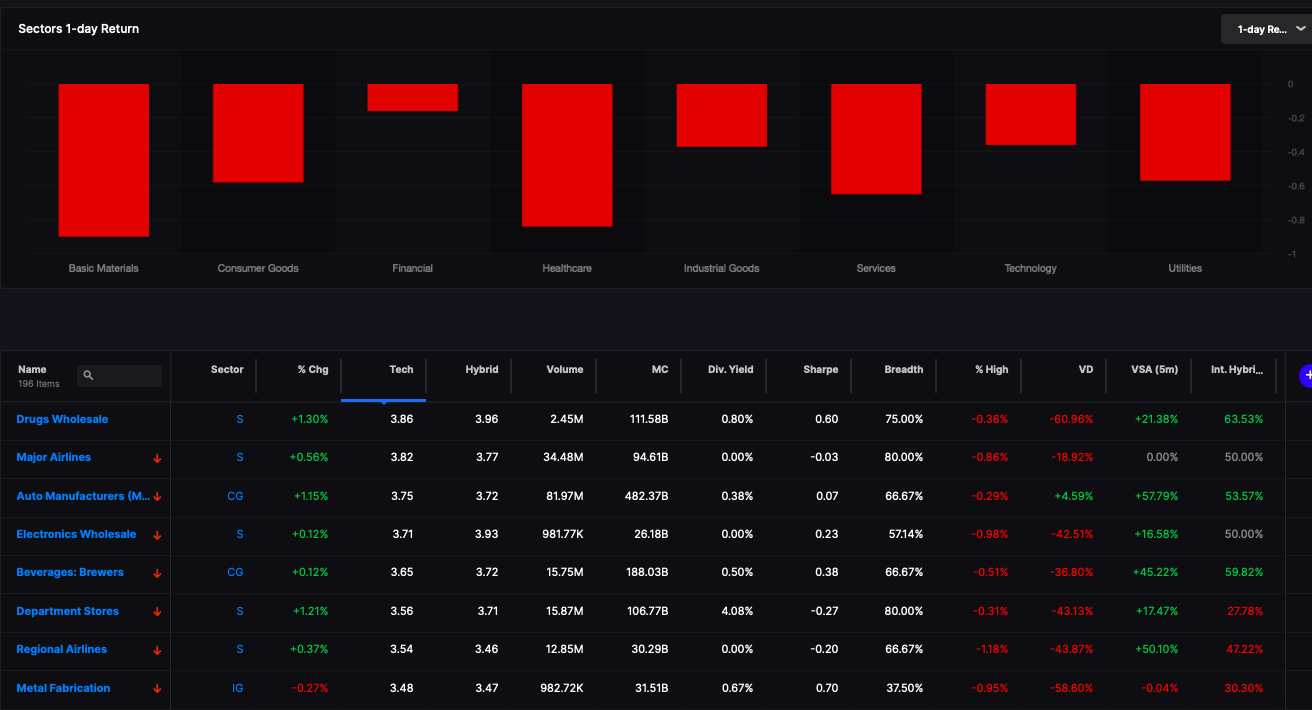

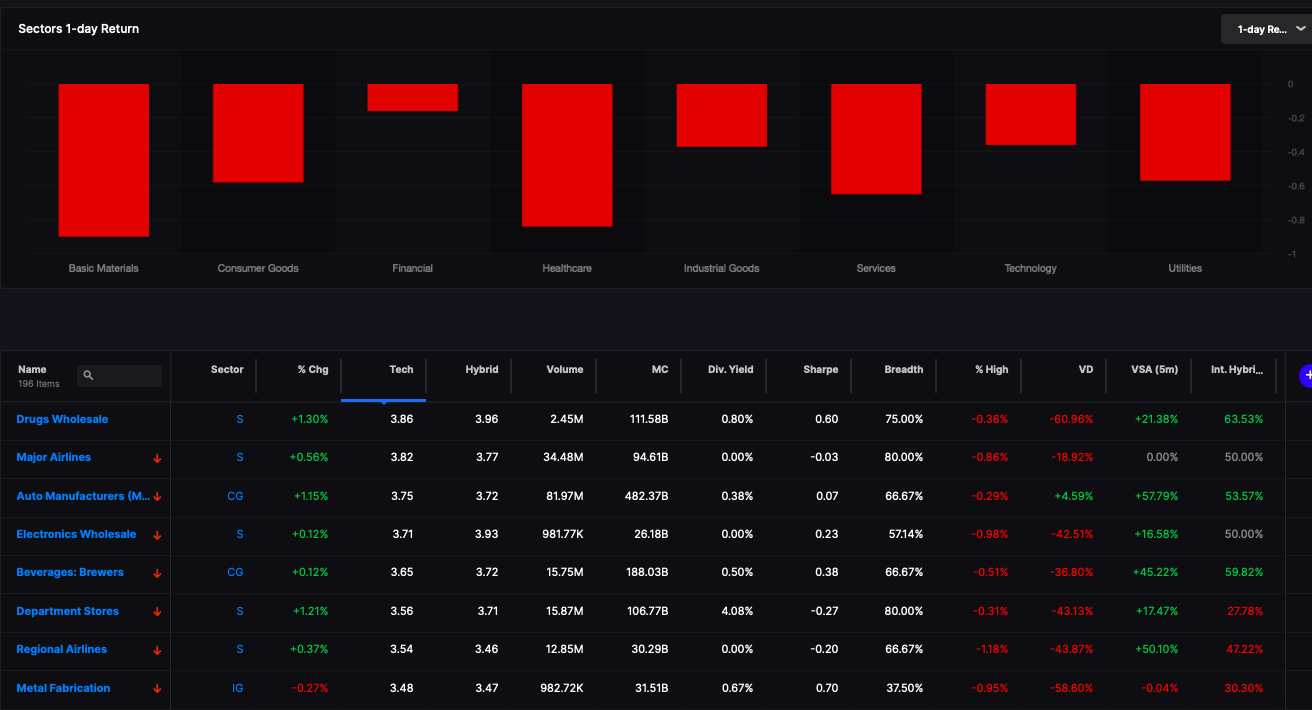

Our industry page can do many things. The lowest hanging fruit is finding the most technically strong areas of the market.

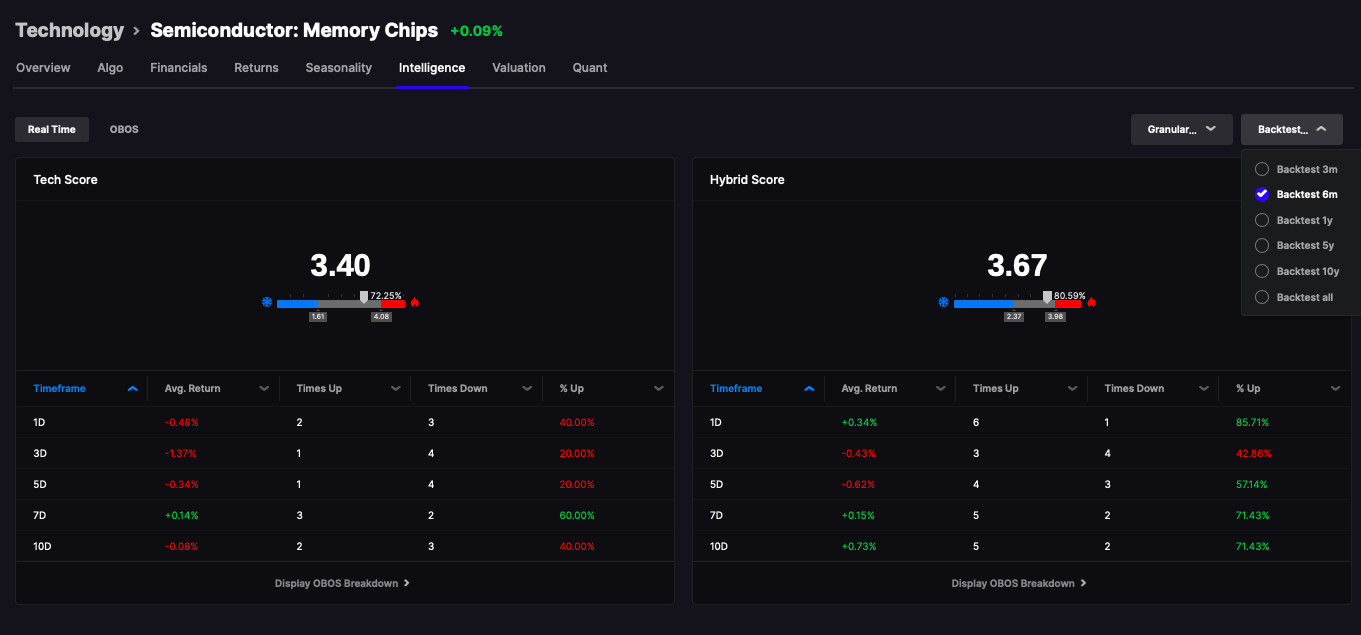

But it can also apply our volume tools and alpha tools to see what is moving over a determined intra day time frame and what is volume spiking. It can also show backtest data using our intelligence algorithms.

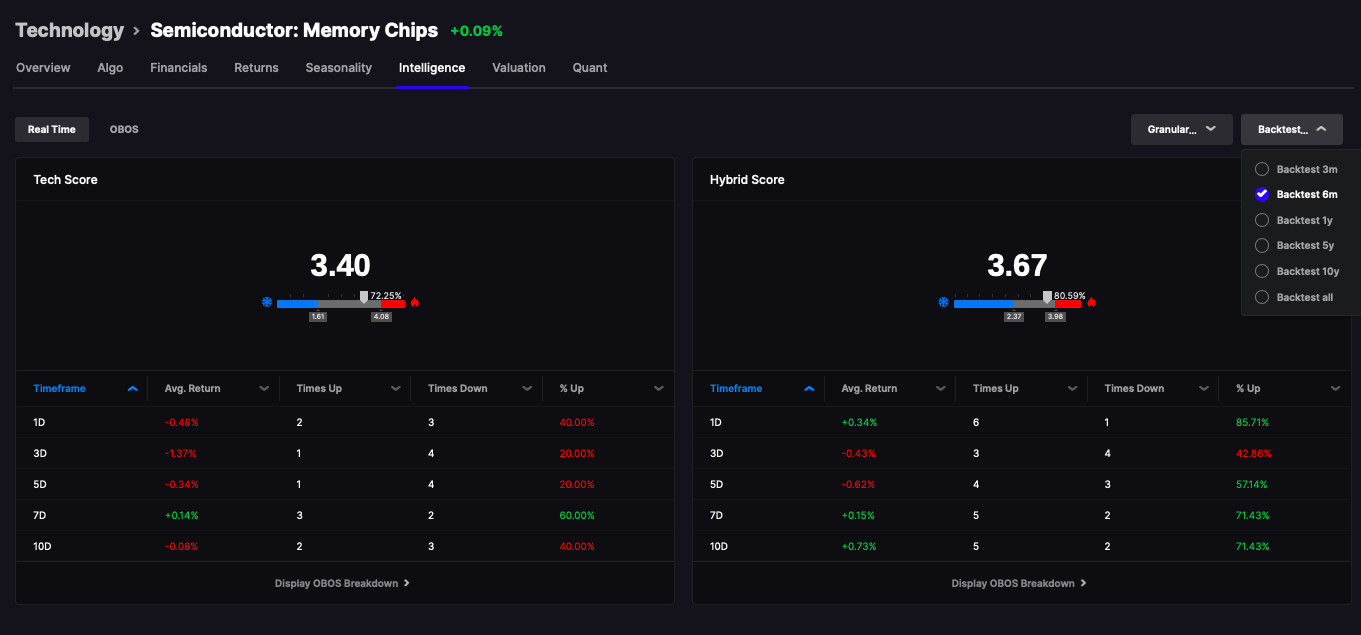

Every stock, sector and industry is accompanied by multiple sets of predictive algorithms. The intelligence algos uses current technical or hybrid (fundamental and technicals combined) and crosses it against a selected time frame to show you how said security performed in the past.

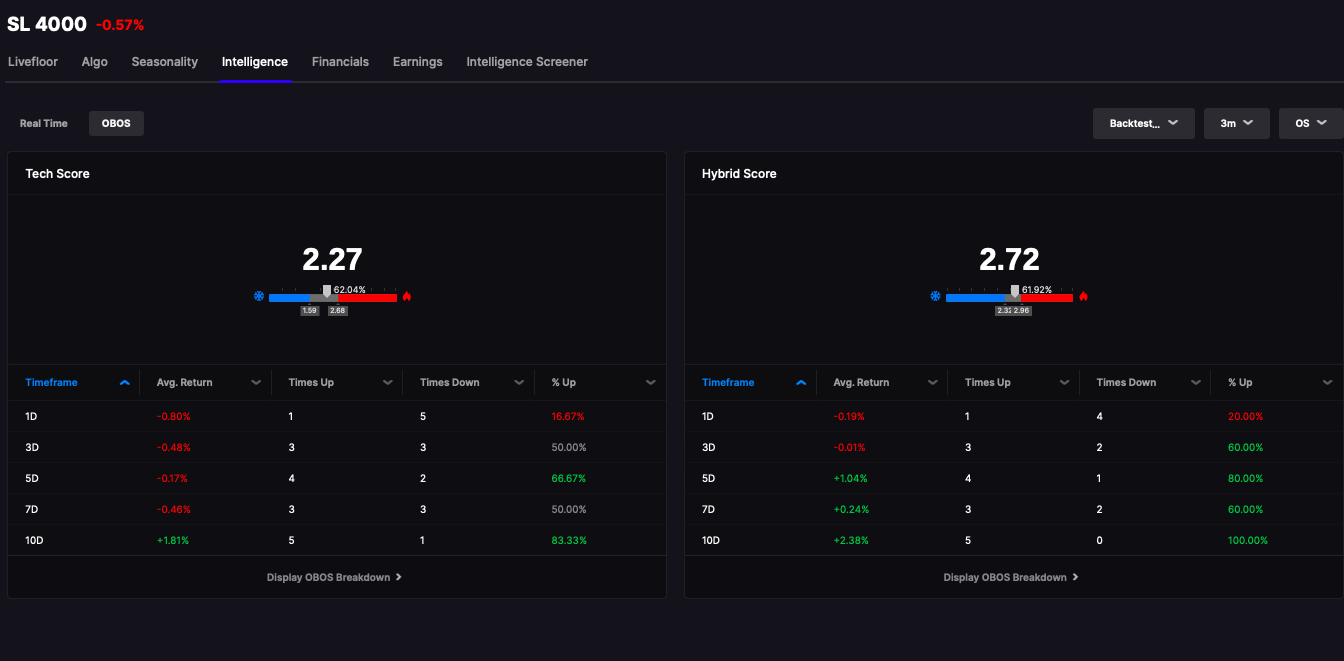

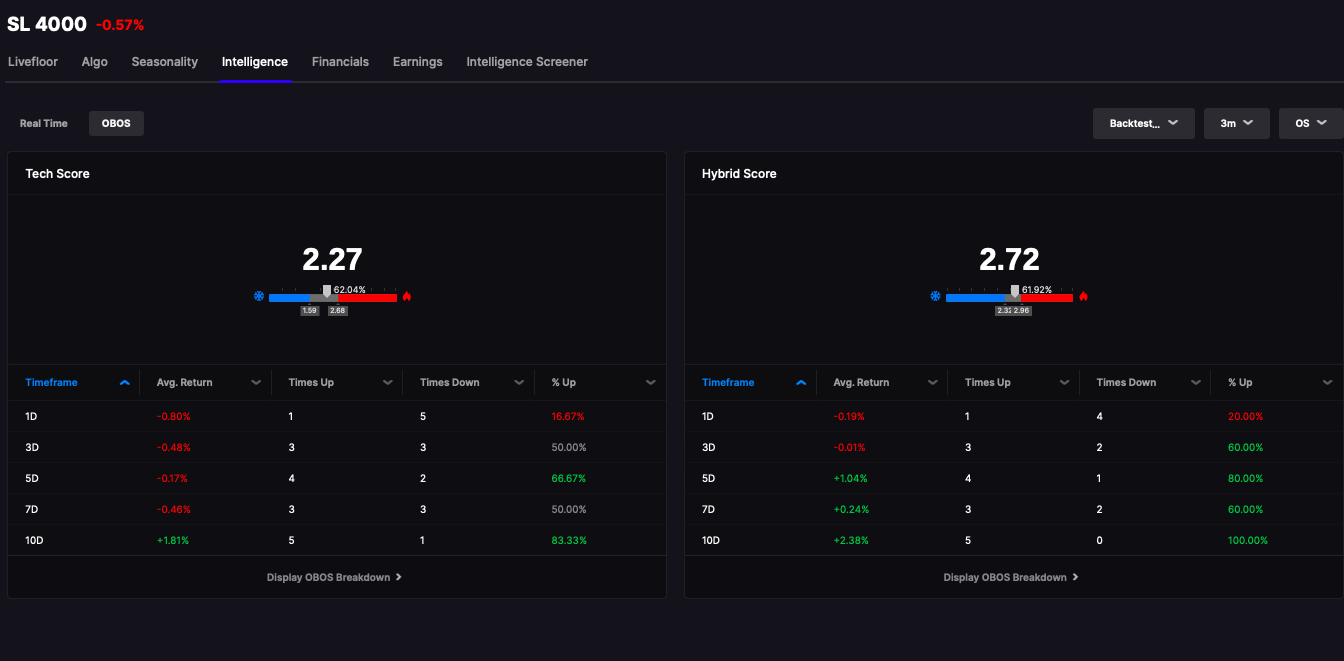

Our overbought and oversold algos are merely the extreme ranges of the algorithms, which are then documented and tracked for a 10 day holding period.

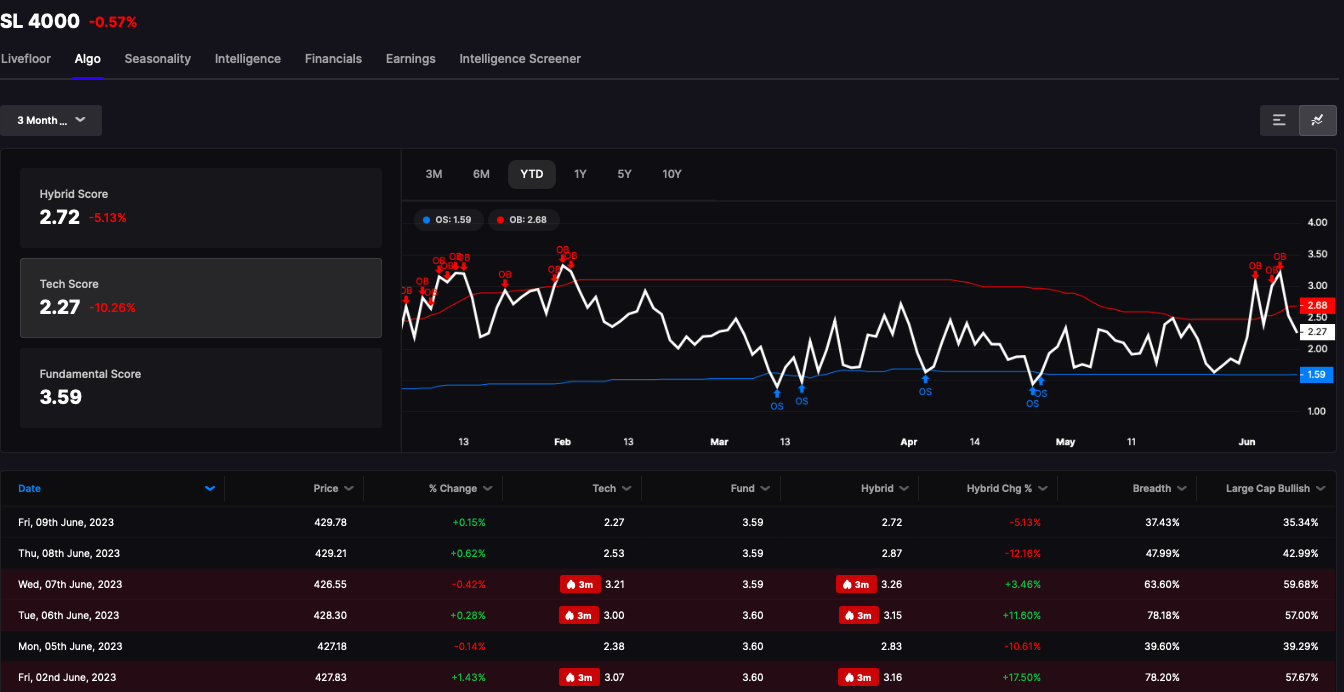

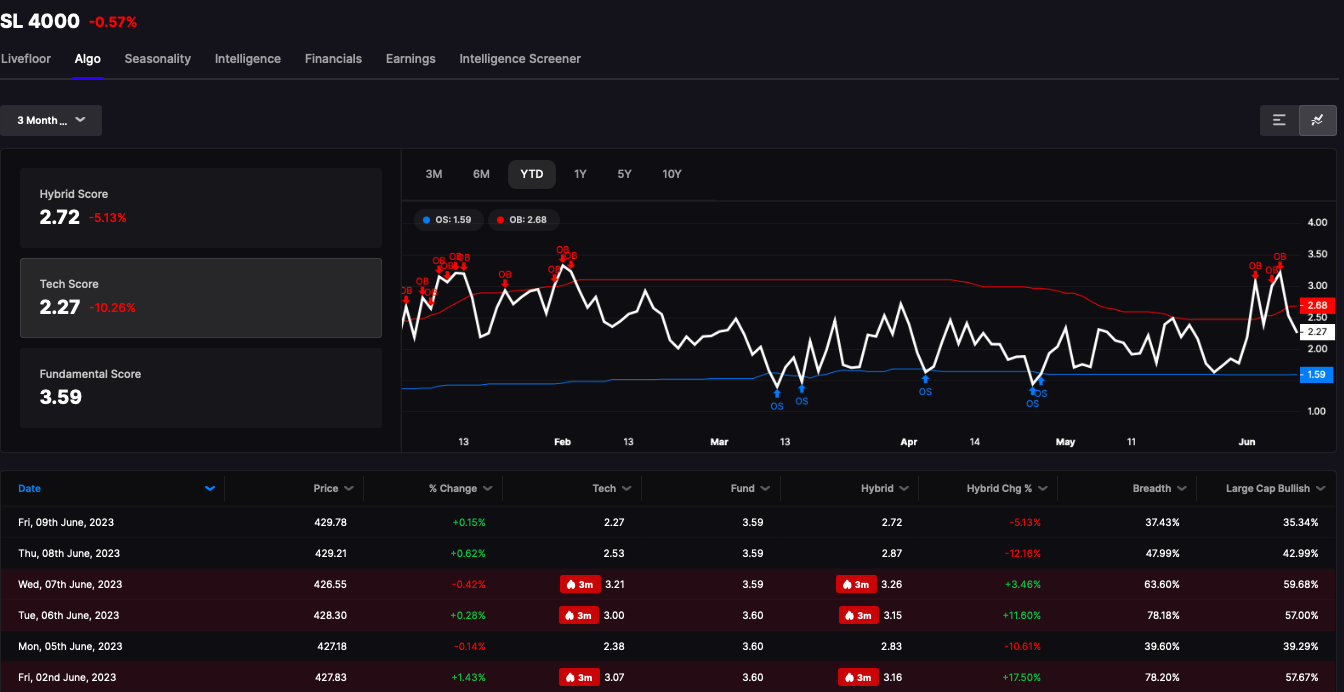

This is our systemwide aggregate oversold signal the past year, flawless data under the hybrid score.

We also visualize it.

Ok, this post is already too long and I need to fuck off. What else can Stocklabs do?

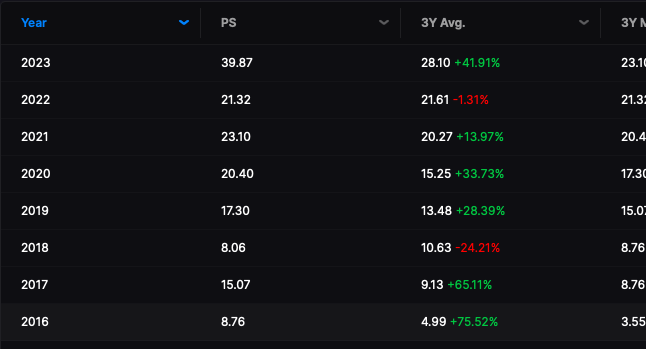

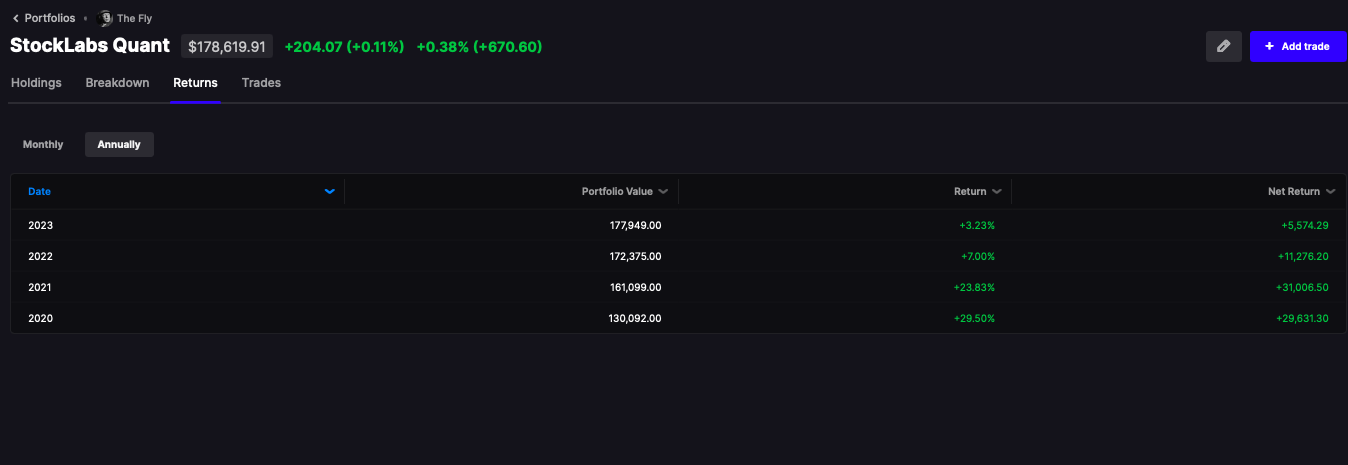

Grade balance sheets and fundamentals, show valuation data going back to 1993. You can go back to 1970 to see our algorithms scores per stock. You can view seasonality data on a daily, monthly and even hourly basis. Curious to see what QQQ has done between 2-4pm the past month? We can show you that. We also take the valuation data and cross it against traditional PE and PS ratios to produce price targets. Yes, we use FPE and FPS. We also aggregate all financial data, show share buybacks, and I use fundamental data to produce a quant portfolio.

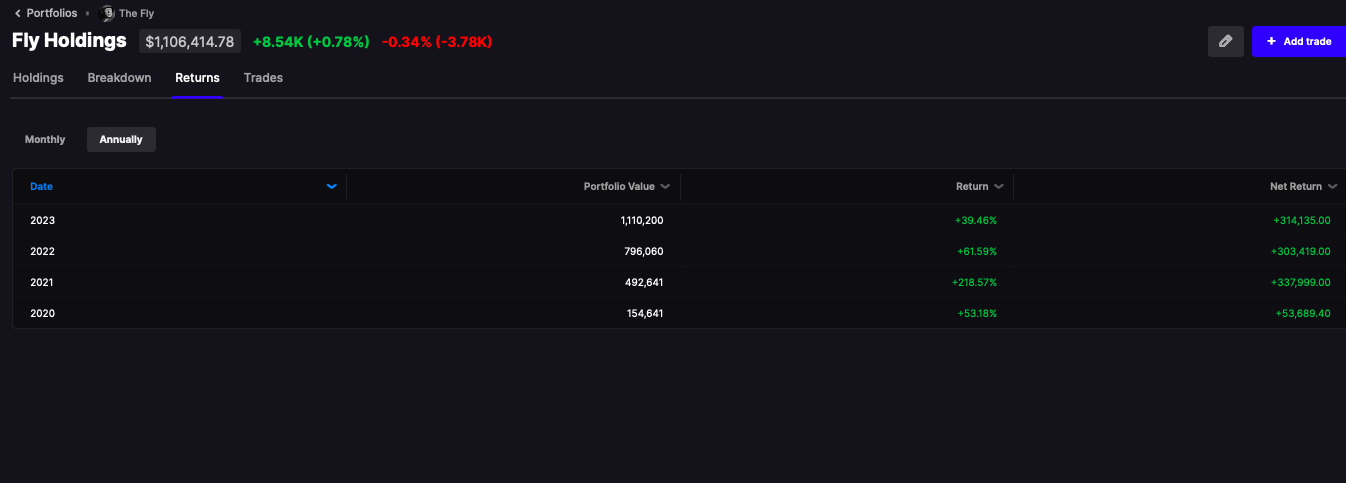

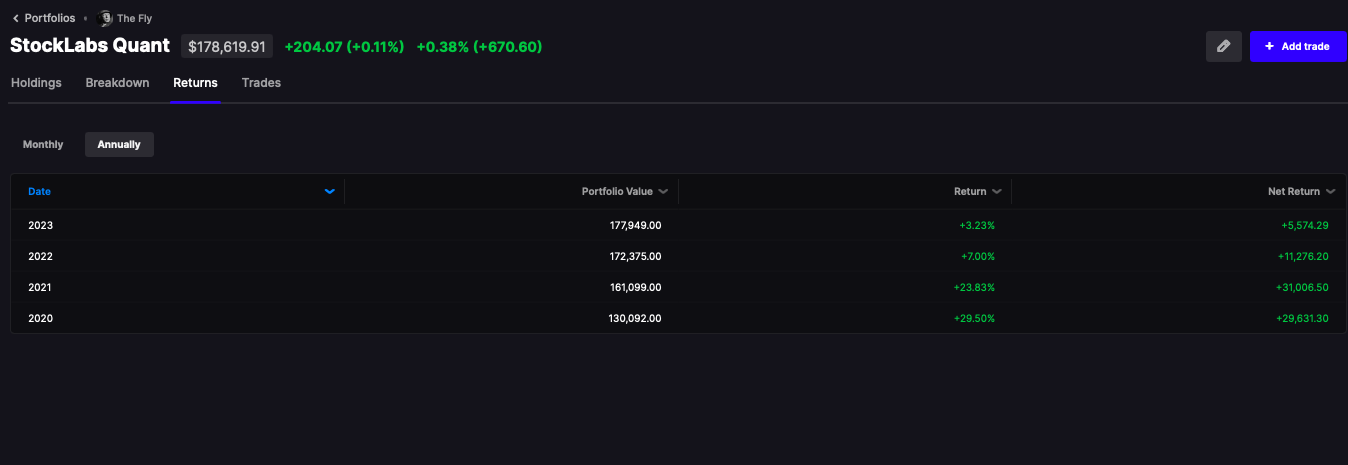

Here are the returns for this static monthly allocated model.

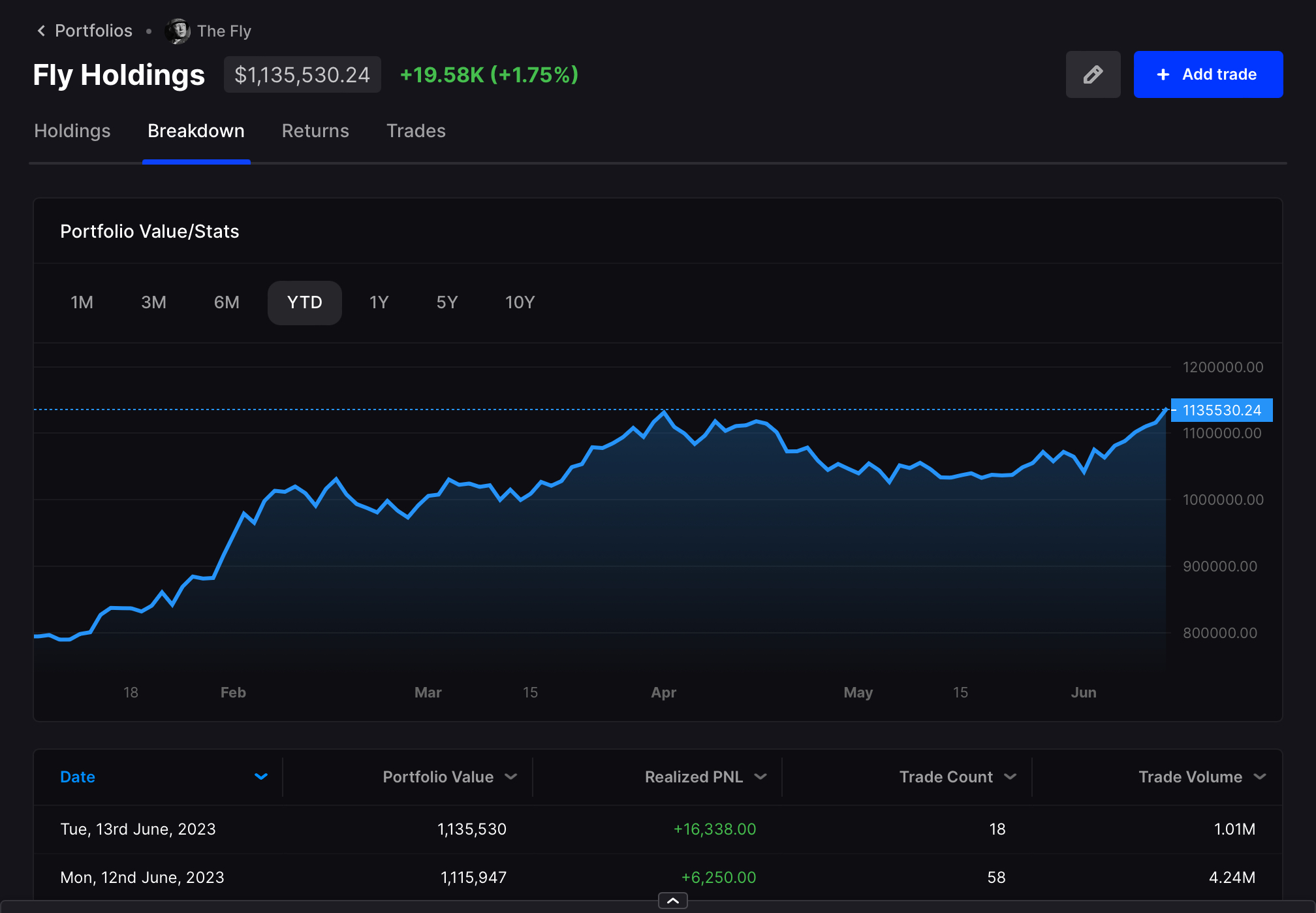

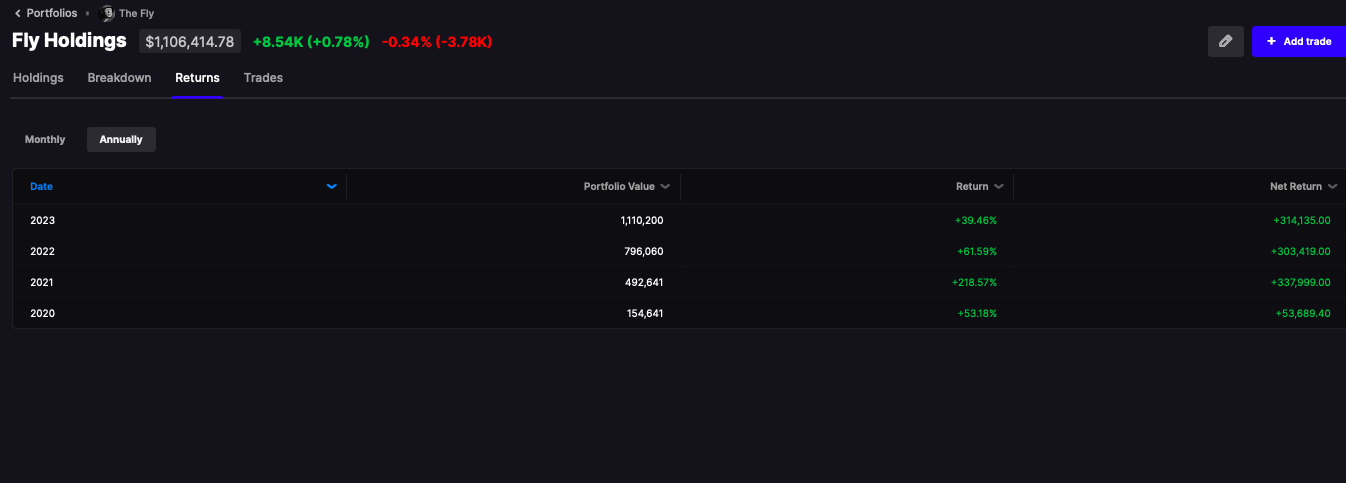

If that’s not good enough, you can always hang out with the degenerates in the Pelican Room and wait for my picks. Here are my returns.

There’s actually a lot more to the platform than what I mentioned. If you want a free trial, you’ll have to wait until we offer them again. But if you’re a serious trader and want to see it now, try it for a month and cancel at any time. If you’re confused due to low IQ after joining, we can help with demos and educational videos and emails.

Ciao

Comments »