Hello plebs —

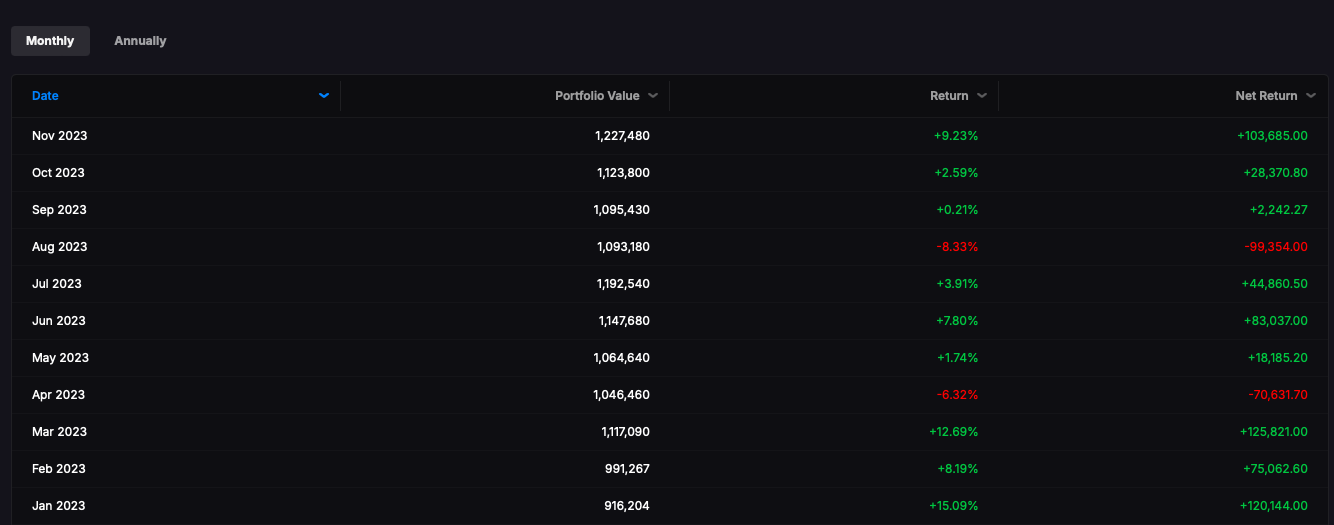

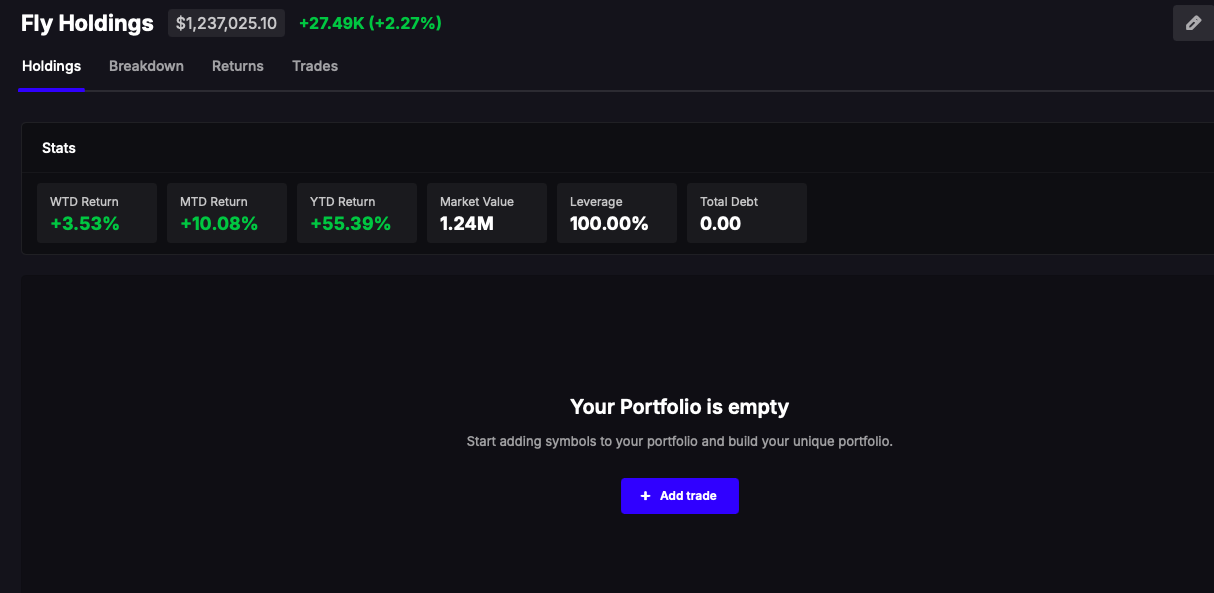

I had a great day, highlighted by the fact that I was right every single minute of the week, sashaying into the weekend +209bps, made nearly 5% for the week — uplifting gains to nearly +58% for 2023. Things are good and they’re going to stay that way. There is a very specific method to how I am able to perform with such consistency and I’ll never tell you what it is. I’d rather die with it in my head, having known I never told you.

My stated goal is to accumulate as much money as I can and then bury it all somewhere beset by booby traps, killing scores of people from beyond the grave preying on the greed of the living.

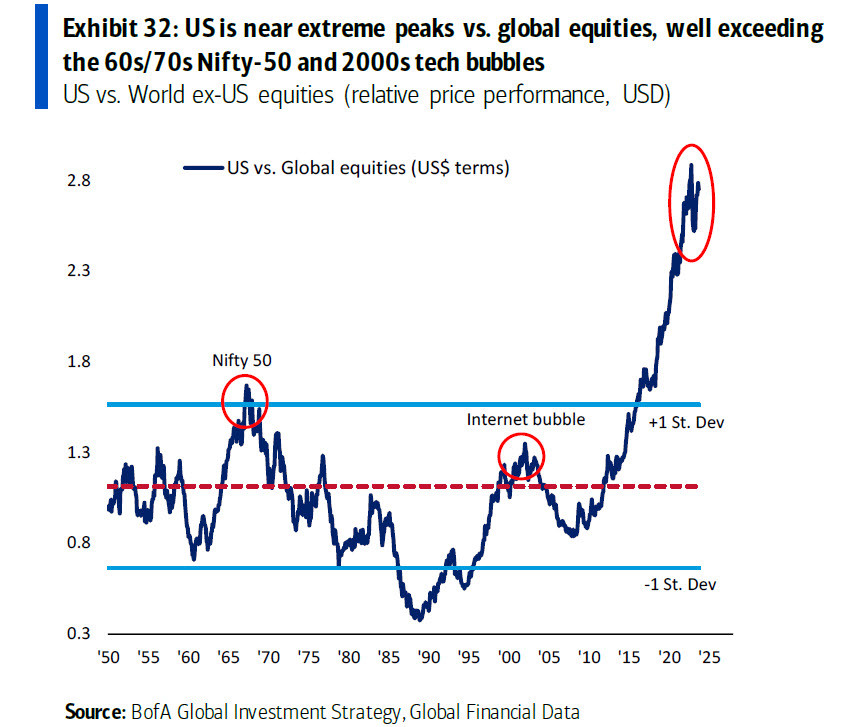

This is where you get in the car and press down on the fucking pedal — FULL FUCKING SPEED, without ever even thinking about the brake. This is the time and place where we mount attacks on the bears, burn their villages down with gelatin gasoline ordinance — and watch them scorch to cinders.

Good Sirs —

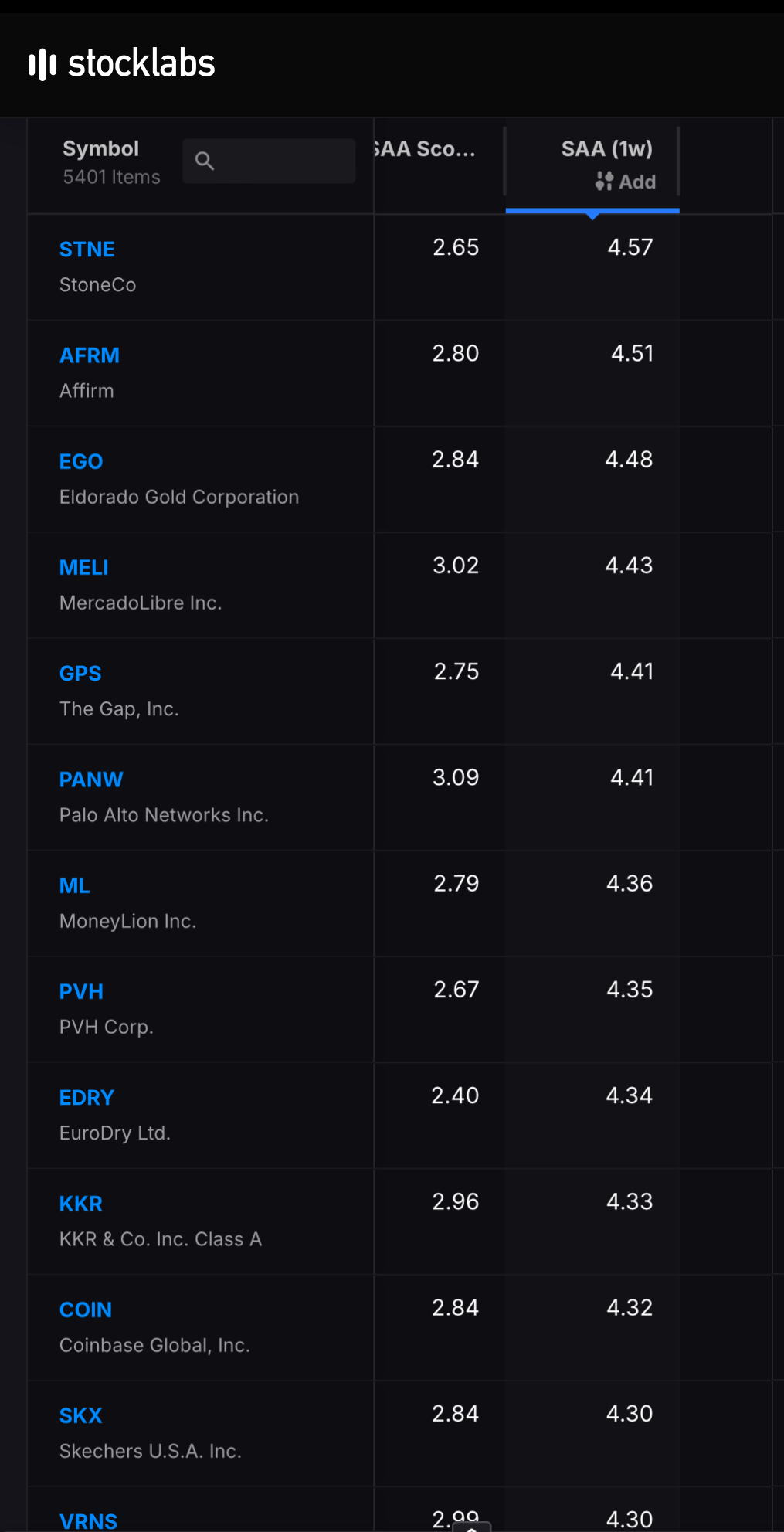

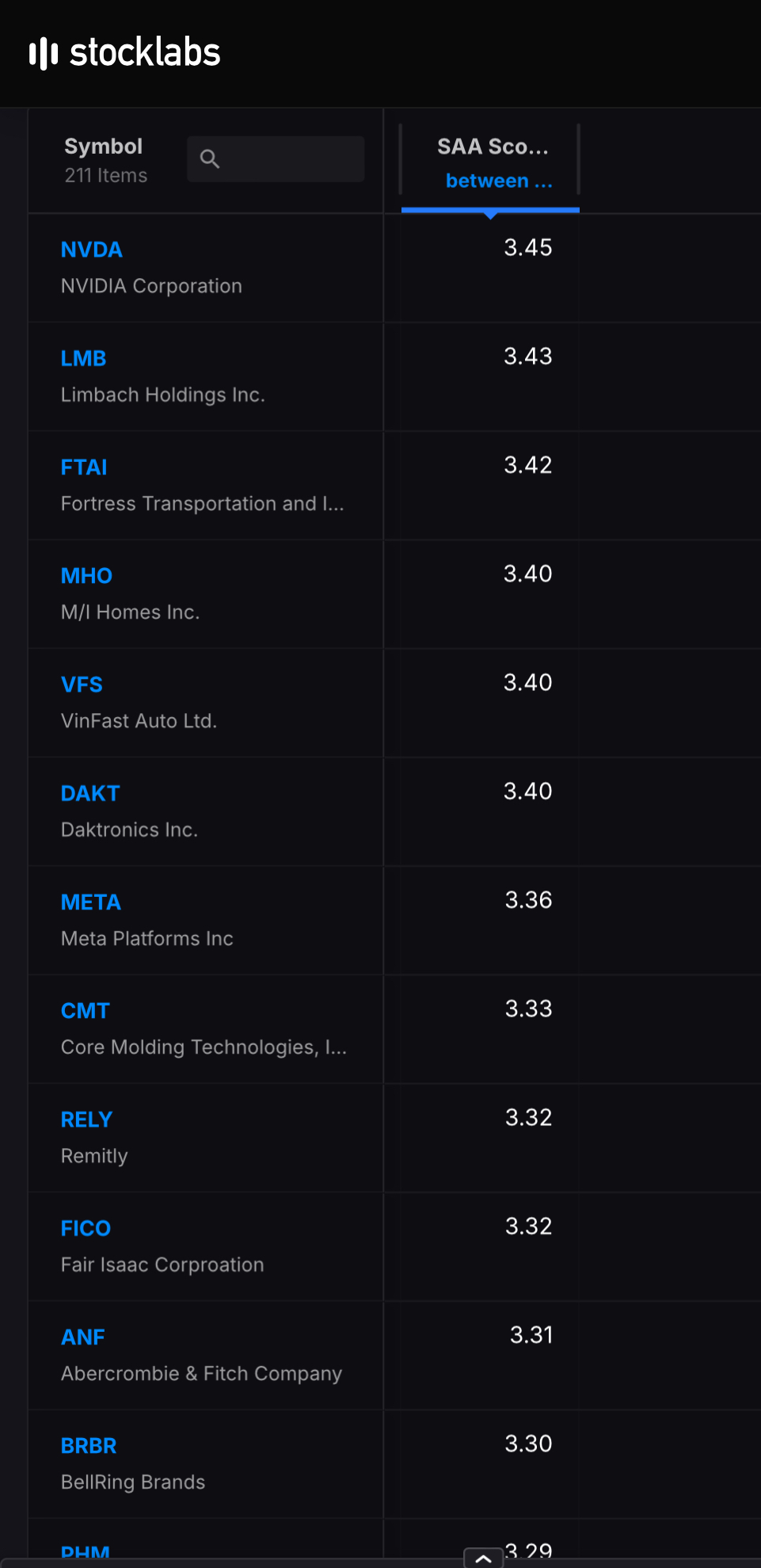

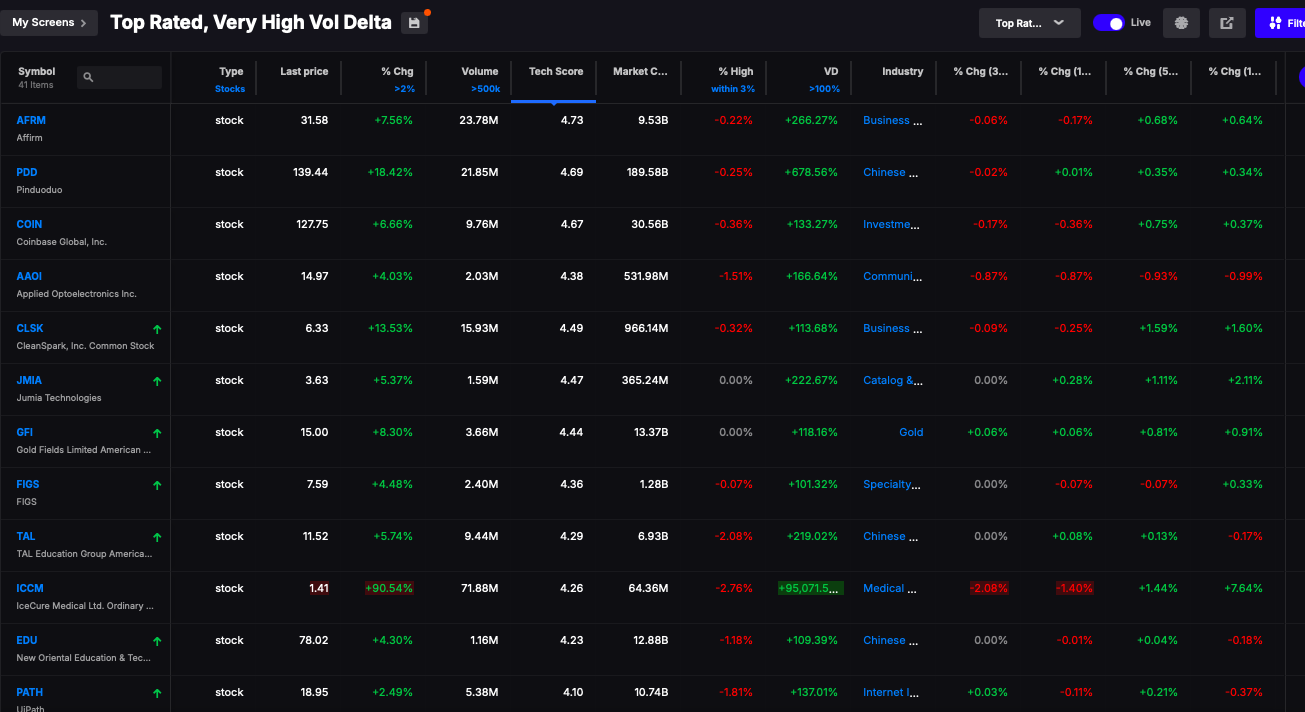

I stand before you at the apex of my game, the very best I’ve ever been in all of the years living. Through the fires and the tumult, I have increased my capacity for peering into the future. HIGH RISK HIGH REWARD stocks were in play. You want to find stocks with beta over 2. Those stocks were up more than 5% today.

I finished the sesh fully long without hedges, captivated by my own prowess — scalps in hand, knife bloody, musket bellowing with smoke.

Comments »