UPDATE: Last night I had a bottle of wine and perhaps my vision was blurred this morning when I read about Biden’s plans for long range missiles. He announced the US would NOT provide Ukraine with weapons that could strike DEEP into Russia. Pardon my gambit at fake news.

This of course didn’t stop the form Ambassador to Russia from war mongering.

Ukraine needs Multiple Launch Rocket System (MLRS) & High Mobility Artillery Rocket System (HIMARS) to stop the Russian army's advance in Ukraine. This decision is a mistake: Biden Rules Out Sending Ukraine Long-Range Rocket Systems That Can Reach Russia https://t.co/zGluGll33p

— Michael McFaul (@McFaul) May 30, 2022

There’s a working theory out there that the government is all knowing omnipresent, with well thought out diabolical schemes to bring all sorts of pain and suffering to the world, rooted in satanism and sacrifice — all for the end goal of world domination. I have long dismissed this absurd theory based on the empirical evidence that the people governing us are incompetent idiots, who are now in the last throes of squandering what they’ve been given — compromised by drugs, sex, and power. These creatures are nothing more than insects — invading homes and families like the pests they are. We are seeing their grande incompetence on the world stage now — via this weak attempt at stopping Russia from winning in Ukraine.

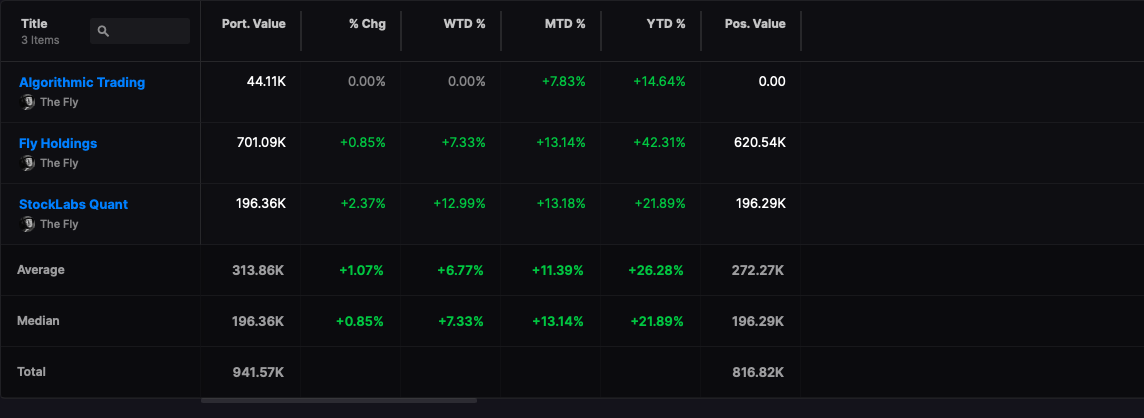

The update goes as follows:

Russia originally went for a wild eyed gambit in an attempt to end the war early and misjudged the fighting ability and will to fight by the Ukrainian army. This was viewed in mocking tones by “the west”, who felt embolden by this and as a result directly intervened in the war via sanctions on Russia and the kitchen sink in weapons supplies to Ukraine. Since then the Russian army, under new command, regrouped and started a more traditional method to wearing down and destroying the Ukrainian army, via artillery, missiles strikes, and air assets. Since then the Russian army has not been mocked as much on Twitter, as nearly all news reports have pointed to their success in the Donbas.

The sanctions the west inflicted on Russia have failed, as evidenced by Russia’s currency, stock market, and trade surplus. Putin just increased pensions by 10%. A failing economy doesn’t give his entire country a pay raise.

So now in the face of all these failures, the west, led by Biden, is doubling down. Today Biden boasted about sending missile systems to Ukraine that can strike deep into Russian territory.

This was the response from Russia.

MEDVEDEV: Otherwise, during the attack on our cities, the Russian Armed Forces would fulfill their threat and strike at the centers for making such criminal decisions.” Some of them are not in Kiev at all. There is no need to explain what would happen after that.”

Biden: “We’re not gonna send to Ukraine rocket systems that can strike into Russia.”

Russia’s Medvedev responds: “Rational decision.”

— The_Real_Fly (@The_Real_Fly) May 30, 2022

This is where we are now — countries like Germany sending 15 tanks to Ukraine, Biden wanting to provoke Russia into attacking a NATO country so he could play FDR, and all of it reeks of wanton incompetence.

Comments »