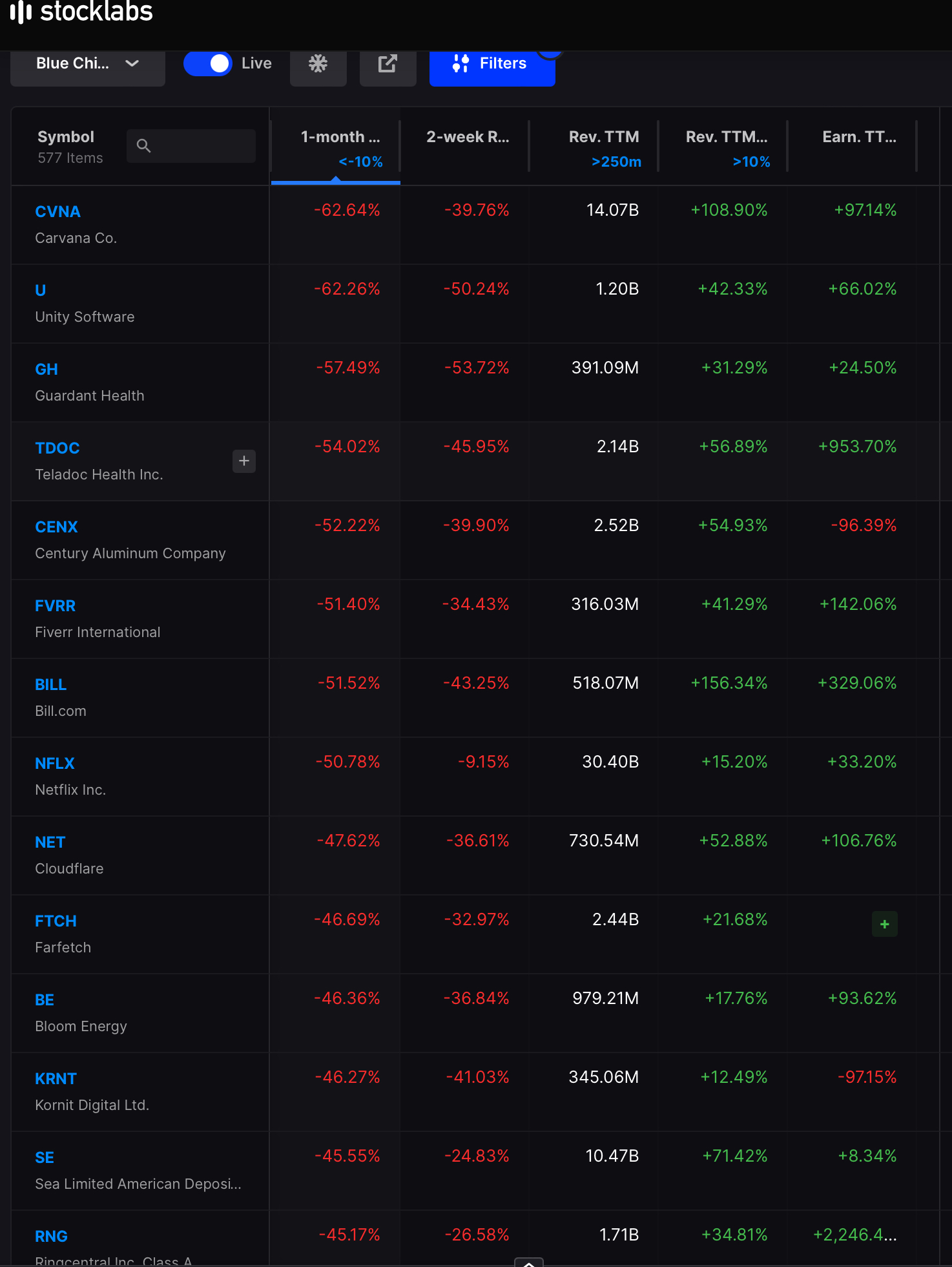

Having said that, we can still run higher from here, even after this big lift. With stocks up 4% for the session and the speculative juices going, we could see a continuation into next week, perhaps a short squeeze or two because fuck you.

Nevertheless, you should be using these rallies to REDUCE your long term exposure, since it’s very likely we are to resume lower at some point soon and then dive back into the crevasse at new lows.

My algo account, which is based solely off the Stocklabs oversold signals, is up 12% today, fully long TQQQ. Just yesterday this looked like a suicide account; now it’s the best thing going. My Quant was also in agony, now +5.3%. In my trading, I went to cash first thing this morning and left a lot of cash on the table in exchange for safety. I am +3% there.

My best guess is a RAMPING of the close. I would not be surprised to see us completely revoke these gains on Monday, as bear markets tend to truly disappoint investors to the point of misery. This is why it’s important you listen to me now: lighten up.

Comments »