Bulk buys in the above names. I am still in the process of allocating into a broad spectrum of names.

Comments »Fly Sales: $TLT, $ETR, $EXC

Where is this Guy Going?

I hate to get political on you; but I will do it anyway. I love the fact the Attorney General Eric Holder resigned–because it gives me all sorts of ideas where to place him next. I was thinking he could head up the IRS and Michelle Obama (MOBAMA) could be new AG. Why not? She’s a lawyer.

As IRS chief, Eric could wield his newly forged powers of middle earth and audit the shit out of the republicans who dare sue him. Then, using his new powers, he could build IRS prisons and mandate that anyone found guilty of tax evasion, of course with the approval of the new AG, be sentenced to a minimum of 15 years. The prisons will be fashioned after the old gulags of Siberia, work camps where men go to die or succumb to frost bite and have their legs sawed off.

Lastly, I propose that President Obama be afforded another term, a curtain call of sorts, in the style of the great FDR, so that we might endure his grandeur and superb basketball skills for another 4 years.

Comments »My Analysis on the Current Situation

Last night I built an extensive buy list of companies whose share prices have been checked over the past month. I was surprised to see how extensive the damage was, considering we’re coming off new highs.

Over 250 stocks, with market caps over $1 billion, are down more than 20% this past month. Entire sectors, like shipping and coal, teeter on the edge of insolvency. The oil and gas space has been rocked to the point of absurdity. And the tech sector hasn’t been much fun either.

Let’s not forget, consumer dominated industries, like retail and restaurants, have been dead money for three years now.

Let’s make one thing abundantly clear: there isn’t a systemic problem in the economy, unless of course mass bankruptices amidst shipping and coal companies causes some sort of disruption. But we haven’t had a real dip in years and what better time than now, post QE, as the world fucks itself with ebola and war, etc., etc.

I need help, trust me I know.

The bottom line: LITB guided up and should run, like a devil chasing a priest, to $10. I like the ethanol space for a bounce, despite ethanol prices at 3 year lows. And, of course, I think energy should bounce, which in turn will help solar run a little. I haven’t sold TLT, ETR or EXC yet–because I am not motivated to do so.

Comments »Bill Gross Fires Himself, Heads On Over To Janus

Super creepy, bond guru, Bill Gross upended himself from PIMCO and moseyed on over to third rate firm, Janus Capital. On that news, shares of JNS are soaring.

Bill leaves PIMCO amidst the SEC throwing meated loaf at his firm for all sorts of irregularities, none of which– I am sure– he had anything to do with. Bill has a long storied career, one of legend–building PIMCO from a piece of shit scrappy dick-licker firm, into the powerhouse it is today. After Mohammed El Arian fired himself, crazy stories started to spread forth the internet about Bill’s eccentric work environment.

But, see here lads, that’s just more corporate bullshit. The ingrates over at PIMCO didn’t appreciate what they had with Bill. They figured they could do it without him, channeling a brand of hubris that pairs rather nicely with success.

At 70 years old, worth over a billion dollars, William H. Gross will now show the catamites at PIMCO who really runs bond-town, albeit from the denizen of a third rate player.

Bill intends to drink their milkshake.

Side note: Bill starts work Monday.

Comments »Am I Supposed to Buy The Dip? Where Does it Say That?

My situation might be different from yours. I am not being dismantled by this drop, off by just 1% for the day. I imagine many of you are down between 2-5%, for this session alone. My trading accounts are down much less. It’s my longer term holdings, the 35 names I’ve alluded to, that are doing damage to me.

I’ve had an amazing run from my May lows and was bestowed a gift from the stock gods in the form of a surging IFON share price, which subsequently allowed me to exit with honor. I accepted the gift and promised to never sin again.

I am balls deep in TLT, ETR and EXC, all conservative positions that serve me in two ways.

1. They don’t tank on days like this.

2. They can be liquidated immediately and the funds can be redeployed into riskier avenues of fun.

But, looking at this market, the question lingers in my head: “why should I buy now?”

We might very well get a bounce tomorrow and everything will surge. But I will make plenty of money in my 35 stocks and my defensive ones will not tank; they’re moribund statues of austerity.

The way I see it, the only way I am to reverse my deficit and post gains for 2014 is by nailing a Hail Mary trade, an outlier event that is missed by most, captured by the best.

With that in mind, I will tell you my honest opinion, without dramatic flair.

We will get a bounce tomorrow, perhaps not at the open, but by the close. If we do not, rest assured, based upon the non-negotiable laws of mathematics, we will get one on Monday. After 5 days time, the rally might fail and we may resume lower again, causing great pain and sorrow for the masses who bedevil me with inane questions.

In summary, there is an easy trade to be made; but I am hoping for something bigger.

Comments »DO I LOOK WORRIED?

Yes the market is careening lower and Ag Holder is stepping down. There is war in the middle east, pestilence in Africa, and downright chicanery in Asia. Has the world really changed?

Small children from the internets: this is seasonal. The market always defecates on itself in September. Every once in awhile we get a crash, or two. The Gatsby-styled parties, starring champagne and colossal shrimp, will have to be postponed due to market conditions.

But remember this: great opportunity presents itself when there are rivers of blood flowing through the streets of Wall. If you buy today, you are resigning yourself to the status quo–mediocrity. The market bounces and you take 7%. But if you wait for something extraordinary, a larger drop, and then nail it; well then, you’re looking at 25-50% returns on a single trade.

Based off recent history, the declines have been shallow and the large opportunity is always evasive. But there is a difference in the matrix now. QE has ended and the previous two QE endings have resulted in -16% and -19% market returns.

Perhaps you should be patient and go whale hunting?

As for me, my largest holdings are TLT, ETR, EXC and SOL. The first three represents almost 50% of my trading dollars, so I’m fairly defensive into this drop.

Comments »Remember When You Said the Collapse Wouldn’t Come?

Well it’s here.

Gentlemen,

Grab a chair and drink your brandy slowly, for this ship, this mammoth enterprise of rot, is going down.

The internals are absolutely dreadful and I couldn’t be happier. Well, technically I could if ETR and EXC went green. I’ve also loaded up on SOL and that’s not doing too well today either. And, let’s not forget the 35 stocks that I am long. Aside from that, the gloom and the doom is a welcomed change of pace for a person, such as myself.

I like lightening with my rain, 100mph winds with my snow and electric shock with my handshakes.

This, gents, is ARMAGEDDON.

Comments »The Wheat Gods Are Hangry

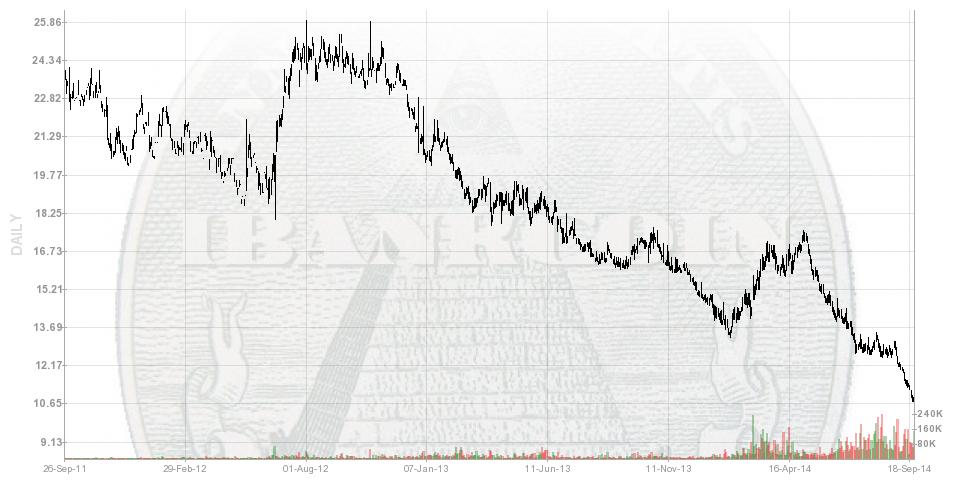

Everyone is talking about gold, silver, oil and corn. But the biggest loser is wheat, down more than 35% over the past 6 months. The decline is due to record yields around the world (bumper crops), specifically in europe and the Ukraine. After you factor in our freight costs to ship there, our wheat simply isn’t competitive.

Couple that with the fact that the US dollar is soaring, up 8% versus the Euro over the past 3 months, and that my friends is a recipe for FARMTASTROPHE.

Like coffee in 2013, I believe wheat will bottom out here and offer 40-70% upside, once the weather Gods even the score in 2015. The ag trade is always an emotional one, with wild gyrations based off the dumbest news clippings. But one thing is for certain, American’s love some bread and the dagos in Italy adore pasta.

The long wheat trade can be taken if you think the run in the dollar will abate, which is another topic up for debate. There appears to be signs of scarcity in the money supply, showing up in surging dollars and depressed yields. If the Fed is going to raise rates, well then, why aren’t rates going up? Perhaps it’s because any semblance of tightening is detrimental and deflationary for this economy, as suggested by recent trends in oil, gold, silver and wheat prices?

Strong dollars means our exports are less attractive. For a country that built its economy around the global trade phenomenon, a strong US dollar doesn’t exactly spell tailwind.

Comments »CLICK HERE FOR FREE GIFTS AND SALUTATIONS

I really didn’t have any gifts in mind, other than the gift of joy from beholding my spam-riddled title. All jokes aside, we are giving you, the people, free access to After Hours with Option Addict tomorrow and Friday:

When inside, feel free to peruse, mind you, his archives– and understand why I view The Option Addict as the best momentum trader I’ve ever met.

Now that fall has begun, I will share with you some of the things to look forward to as regular iBC readers.

1. The fucking dictionary will be unleashed onto your heads. The author of the book, Carl Steinhorn (a completely absurd made up name), insists on having a leather bound version for sale, so that he might place it inside of his high end mahogany library–next to his 1st edition War and Peace. We will also provide a degenerate online version, one that you might share with family and friends about the thanksgiving table.

2. The PPT 2.0. I swear on a stack of holy iBC dictionaries, it shall be done.

3. The fucking 1st ever, and most likely last ever, iBC Investor Conference. Let me tell you something, this thing is a pain in the ass to organize. I should have done it in NYC, like a proper gentleman. Instead, I find myself stuck in the amber of Las Vegas retrograde reprobate. FYI: We have 9 spaces open for VIP. Act soon!!!

4. Orbital Space Cannon (OSC) test run. I will be testing out our space cannon programme on one of your homes.

5. Joint project with StockTwits that may very well crush the faces and jawbones of the homosexuals on CNBC.

Feel free to ask appropriate questions.

Comments »