I sold out of FMSA, +31% one week return.

Comments »GLOBAL GROWTH IS BACK

Two major items to discuss this morning.

1. Saudi Arabia announced they’d cut production by 328,000 barrels in September to a total of 9.36 million barrels.

2. Caterpillar smashed analysts expectations.

Out of all the Dow 30 companies, an index that the venerable DAN NATHAN from Fast Money hates and despises, no company embodies the global growth narrative better than CAT. This earnings beat, this great chant, is an affirmation of the spectacular condition of global trade. Much to the amusement of myself and many others, The House of Saud has cut production, something the wild eyed conspiracy theorists said wouldn’t happen.

So let’s connect the dots, shall we?

Apple, producer of high quality premium products, annihilated estimates, solidifying the notion that money is still out there to be had, for quality products. Caterpillar crushed the skulls of those betting against the China story. Employment data is robust and US GDP is tracking 3% per annum.

But let’s talk about another important factor, something that isn’t being readily discussed.

Cheap oil.

What does it mean?

Well, if you compare today’s prices to those on July 4th, the US consumer is saving $160 million PER DAY. If prices stay at these levels for the next 12 months, it is estimated that US consumers will save an astounding $100 billion.

Now you and I both know people aren’t going to save those dollars. We can very well be setting up for the best holiday shopping season in a decade. Considering the fact that many retail stocks are in the gutter, it might be time to revisit some old names and position for grande eloquence this X-mas season.

Comments »

And Here is Opportunity

I promise you, whenever Morgan Stanley decides to bring The Shake Shack public, I will put 20% of my net worth in it. I will buy the stock every month, after I earn my wage, and dollar cost average into the burger chain until they have 350 stores in the Unites Steaks. At the present, they own a little more than 50.

In the after hours, YELP is down a hard 10 after giving tepid guidance. This is a situation that should be monitored and action should be purposeful, for YELP, ultimately, trades much higher.

But let’s discuss the matter of valuation, shall we?

The stock is trading 17x sales, a tremendous burden for any CEO. Given the growth rate, YELP will trade 11-13x sales next year, providing the stock remains at these levels. There is a strong case to be made for 15x sales, but not 20x. I own a small position and will use any sizable decline to add to it.

The market closed at the lows and a terrorist event took place in Canada today. I’d be shocked if we didn’t trade lower tomorrow.

I sold out of my CYBR and set the proceeds to cash.

My best guess, looking at historical routs and subsequent bounces, we trade lower until Thursday of next week, then bounce the hardest.

Comments »

Here is the Test

The newly minted geniuses are now being tested. Trust in your abilities to navigate these waters and account for another leg lower.

With crude at new lows, it’s very likely that we will begin to descend back down to the lows of last week. The very idea of $70 crude frightens people. It’s funny what a decade of super expensive crude can do to the minds of normal people. We now crave higher gasoline prices, in order to rubber stamp global growth and everything being ‘okay.’

Should the market rally off the lows and momo stocks catch a bid, you should sell them. Everything runs on crude, even America.

As for me, I’ve already thought this through and understand the risks associated with holding stocks in the midst of a maelstrom. The prospective losses are acceptable, providing I am permitted to make them back. I am pleased with most of my holdings and will tweak them whenever necessary.

But it’s important to not act rashly and understand that VIX instrument products are nothing more than a gateway drug to a lifetime’s worth of agony and dishevelment.

Keep your eye on the close for confirmation.

Comments »Things Worth Avoiding

These are guidelines, not rules. Over the years, I’ve picked up a few tricks of the trade, which might come in handy for you punk rookie bastards.

Avoid owning stocks who’ve missed earnings within the past 4 quarters. See DDD and CREE for anecdotal evidence.

If the SEC is investigating your company, it’s best to avoid it.

If your stock went up on merger news, sell it. The deal might fall apart later on. See Shire.

If you bought a stock, it went down, then the volume dried up. That might turn into a roach motel. It’s best to avoid and buy something with greater liquidity.

Avoid companies with debt/equity levels over 4, unless coming out of a recession and the underlying industry is turning the corner. If that’s the case, that debt laden company might soar in price, thus naturally lowering said ratio.

Avoid holding stocks with price/sales ratios over 15 for extended periods of time. More often than not these stocks will correct, severely, at some point.

Avoid biotech stocks with phase 1 drugs, burning through cash, years away from a revenue stream. That company will do dilutive financing at some point, in order to fund their research.

Avoid stocks who have large debt payments due. If XYZ’s bonds are coming due and they don’t have the cash, they will either restructure (with bank’s permission) or do a dilutive secondary.

This one sounds simple, but is sometimes ignored. Avoid stocks that go down all the time. The odds of you catching the bottom on a falling knife is low. Wait for the stock to base out and strengthen before buying.

Winners rarely correct–because the business is great. Sometimes it makes sense to chase growth, even if the multiples are high. Great companies will meet and exceed estimates, rarely giving dip buyers a chance to get in.

If you want out of a stock, quit playing retard games with limit orders. I can’t tell you how many idiots end up stuck in bad stocks because their limits don’t get hit. If a stock is $30×30.05 and you want out, put a limit order of $29.90 and get done. Or, if it’s a very liquid stock, do a market order. The same thing applies when buying. While limit orders can save you money, often times, I find them to be time sinks and a pain in the ass.

Avoid owning Chinese burritos that have come under scrutiny from renowned short sellers. More often than not, they are right.

Feel free to add some of your red flags.

Comments »Let This Be a Lesson to You

Never panic after a big sell off.

Quit betting on crash scenarios, for they are as rare as intelligent Presidents.

Never, ever, short into the hole and do not dare buy VIX instrument ETNs after a sell off.

There are some things that never change in the the market. The seasons change and so do the players; but the rules remains intact. Ultimately, you and I are simply transferring fear and greed back to one another. One of us will be right, the other miserable. Temper your emotions and know that you know nothing (extra Jon Snow). After coming to grips with the fact that you aren’t God’s special creature placed on this planet for the sole purposes of self-aggrandizement, you will become a better investor.

We just had a very sharp oversold bounce. Euphoria is high and greed is trending. Look to raise cash tomorrow and prepare for the possibility that we might retest the lows. At the very least, we will test the hands of the newly minted geniuses to see if they are up to the task of holding during periods of duress. After the next flush out, I believe we might have a straight shot through Thanksgiving.

Look at what you’ve done. Don’t say I didn’t try to warn you.

Comments »Fly Buy: $MU

I added to my MU position.

Comments »SHHHH, IT’S VIX SEASON

Your IRA account is now at zero. That UVXY trade that you kept adding to will now define your headstone.

“HERE LIES THE FUCKHEAD WHO THOUGHT IT WAS A GOOD IDEA TO BUY VIX INSTRUMENT PRODUCTS…INTO THE HOLE.”

For the day, I am up 3.7%. Catch my vapors, son–because you’re never gonna get the chance to touch me again.

Top Picks: TRN, ANET, FMSA, MBLY

Comments »Fly Buy: $ANET

I scaled back on some of my CYBR position and started a new one in ANET–devil endorsed.

Comments »The Life of a Rail Man Isn’t For Everyone

Yesterday, TRN lost a lawsuit at the hands of a scoundrel whistle blower, some guy with an ax to grind trying to recover damages for the purpose of self-aggrandizement. The judgement went against TRN, after 3:30, and the shares got slammed in very illiquid, panic-confused, trading. In the pre-market, the stock is down a little more.

Why?

Apparently, jackasses about the internet enjoy to spread rumors. Mind you, the DOJ didn’t join in this lawsuit and it will most certainly go to appeal. The so called whistle blower will see $500+ million, just as fast as AAPL will pay VHC a gagillion dollars for stealing all of VHC’s precious patents.

Here are some facts to understand, before throwing the baby out with the bathwater.

TRN has a billion dollars in cash.

TRN makes a billion dollars in pre-tax income, per annum.

TRN is a cash flow generating machine.

TRN will NEVER, EVER, pay $500+ million for guardrails that were already approved by the FHWA.

TRN lost $700 million in market cap yesterday, hardly justifiable considering this is going to appeal and judgment will not affect balance sheet in the interim.

TRN has an insurance liability converge of $500 million, potentially insulating them from any damages.

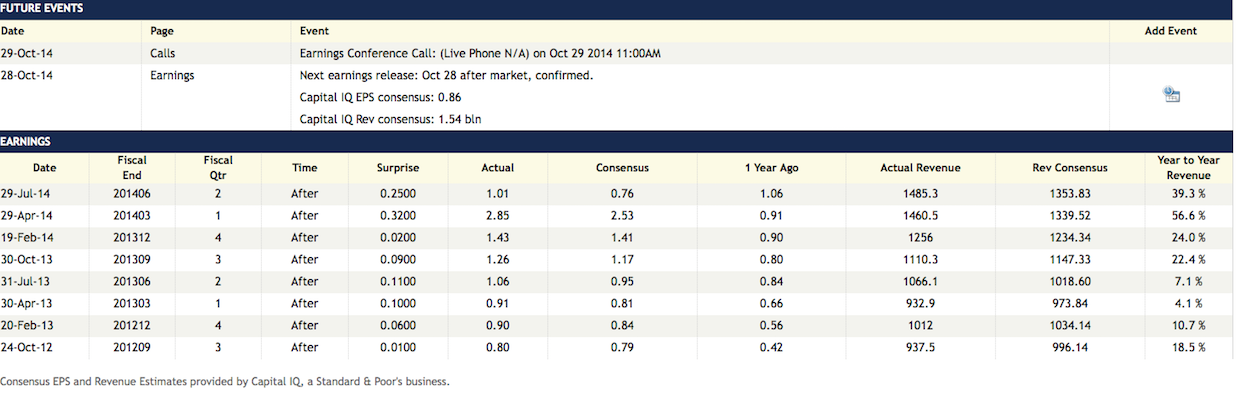

TRN has a long, rich, history of smashing analyst estimate to pieces.

With earnings scheduled to be reported on 10/29 and the stock severely discounted, if short, ask yourself: Am I feeling lucky, punk?

I am a buyer at these levels.

Comments »